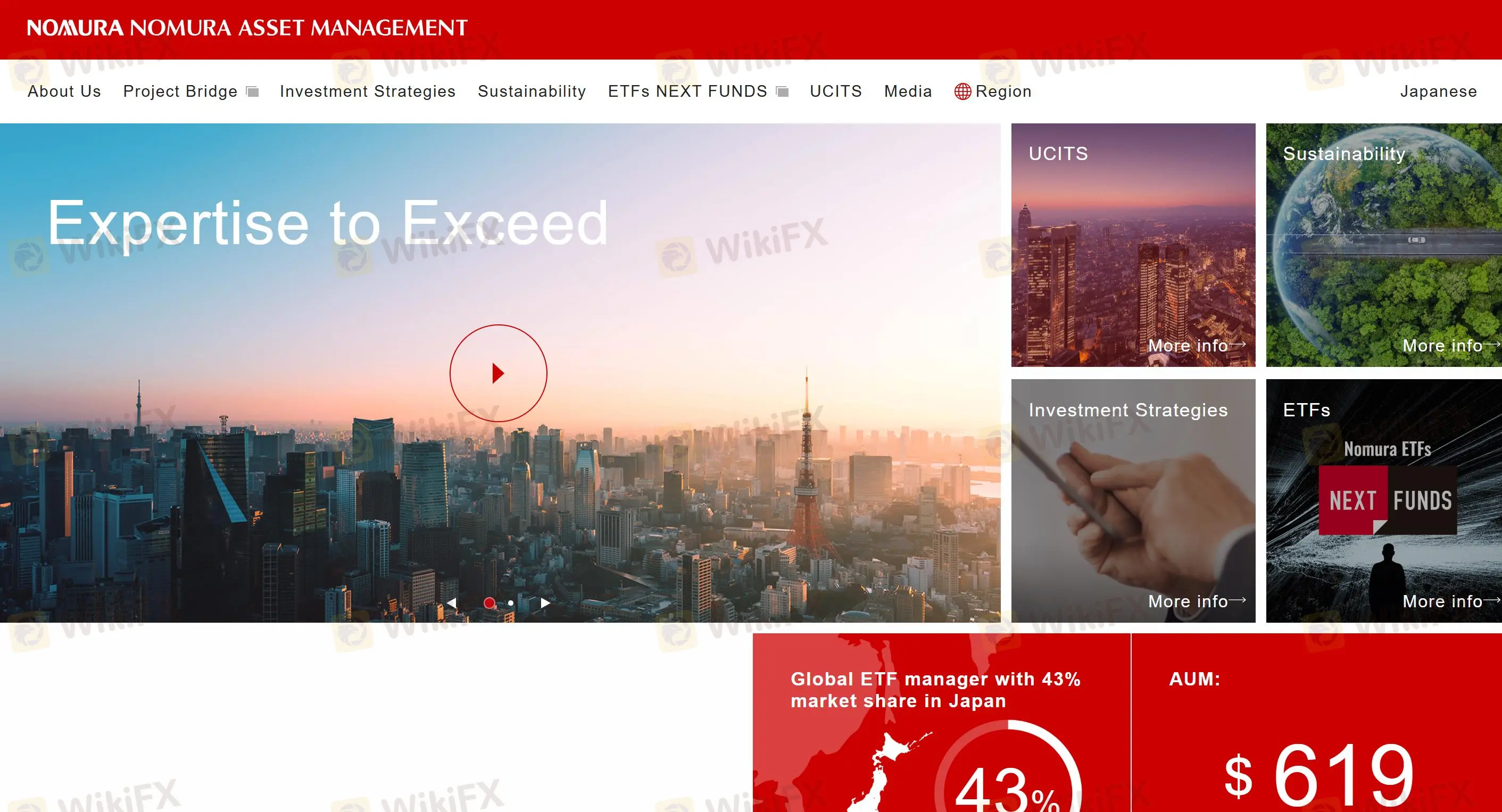

Perfil de la compañía

| Nomura Asset ManagementResumen de la revisión | |

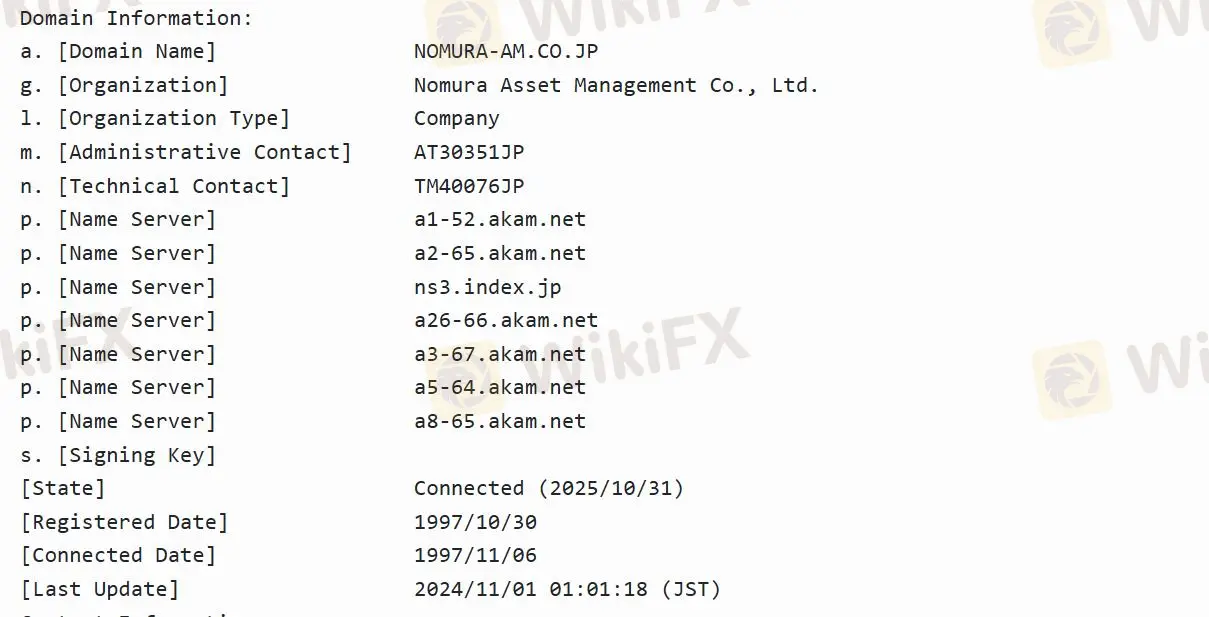

| Fundado | 1997-10-30 |

| País/Región registrado | Japón |

| Regulación | Regulado |

| Sectores empresariales | Negocio de gestión de fondos de inversión/Negocio de gestión de inversiones institucionales |

| Soporte al cliente | / |

Información de Nomura Asset Management

Nomura Asset Management es una subsidiaria de propiedad total de Nomura Holdings, lnc. y es la marca principal dentro de la división de gestión de inversiones del grupo especializada en el negocio de gestión de fondos de inversión y el negocio de gestión de inversiones institucionales. A partir del 31 de diciembre de 2023, es el mayor gestor de fondos de inversión en Japón.

¿Es Nomura Asset Management legítimo?

Nomura Asset Management está regulado por la Agencia de Servicios Financieros (FSA) bajo la licencia No.関東財務局長(金商)第373号 y el tipo de licencia de Forex minorista, lo que lo hace más seguro que los no regulados.

¿Qué estrategias de inversión ofrece Nomura Asset Management?

Renta fija: abarca una amplia gama de estrategias de inversión relacionadas con la renta fija, incluyendo bonos soberanos, bonos corporativos de alto rendimiento, bonos de mercados emergentes, bonos indexados a la inflación y estrategias de renta fija sin restricciones.

Alternativas: gestiona una variedad de inversiones alternativas de rentabilidad absoluta, incluyendo una estrategia de mercado neutral larga/corta y una estrategia de 130/30 extendida a corto plazo dirigida a acciones japonesas.

Multi-activo: Las estrategias multi-activo a largo plazo utilizan un juicio activo para medir el beta del mercado e incluyen activos como renta fija, acciones, REITs, materias primas, oro y bonos de alto rendimiento.

Smart Beta: incluye el Índice Fundamental RAFI®, Volatilidad Mínima y nuestra estrategia de Inversión y Rentabilidad Propietaria (Enfoque en Calidad).