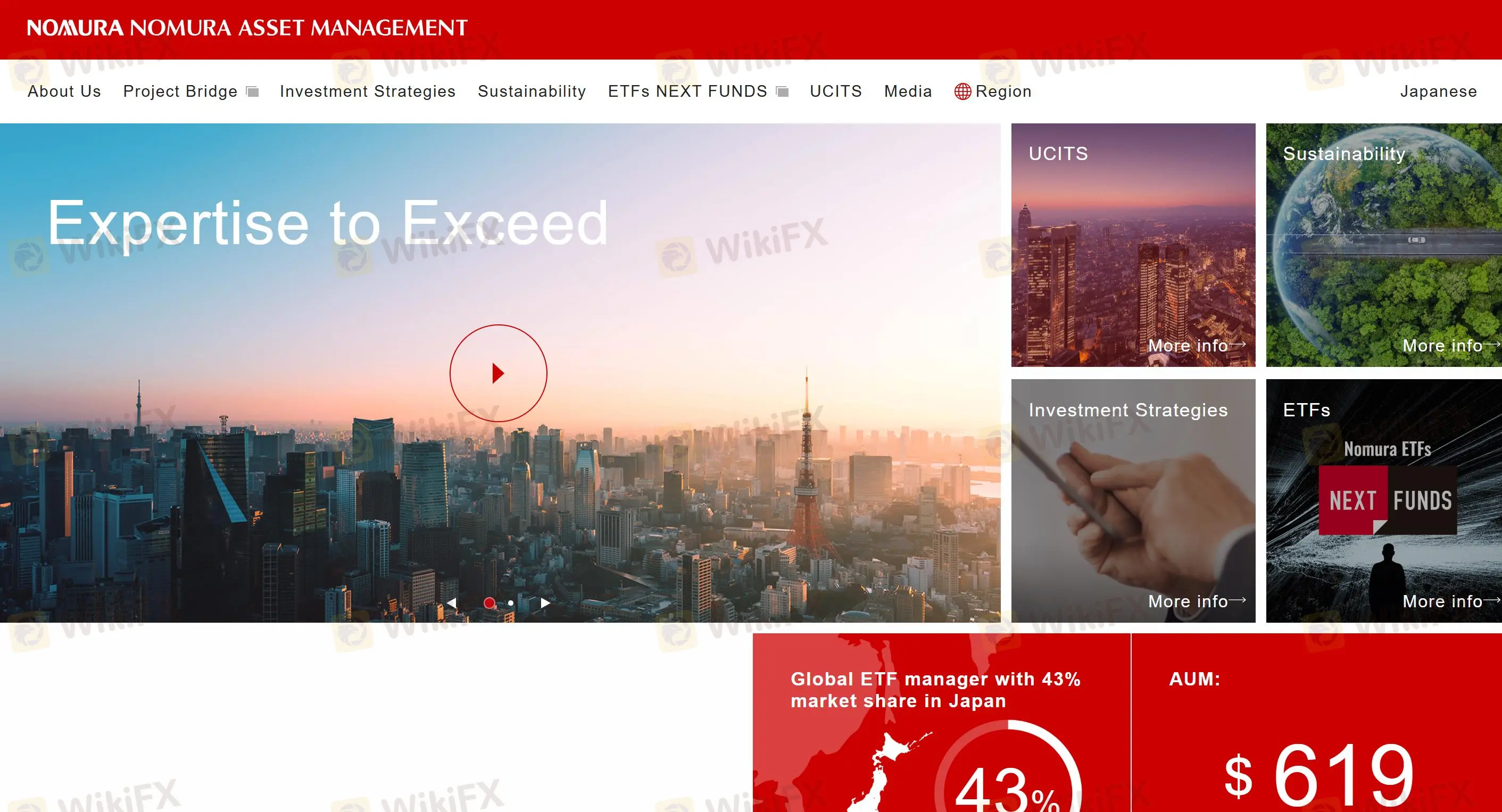

Profil perusahaan

| Nomura Asset ManagementRingkasan Ulasan | |

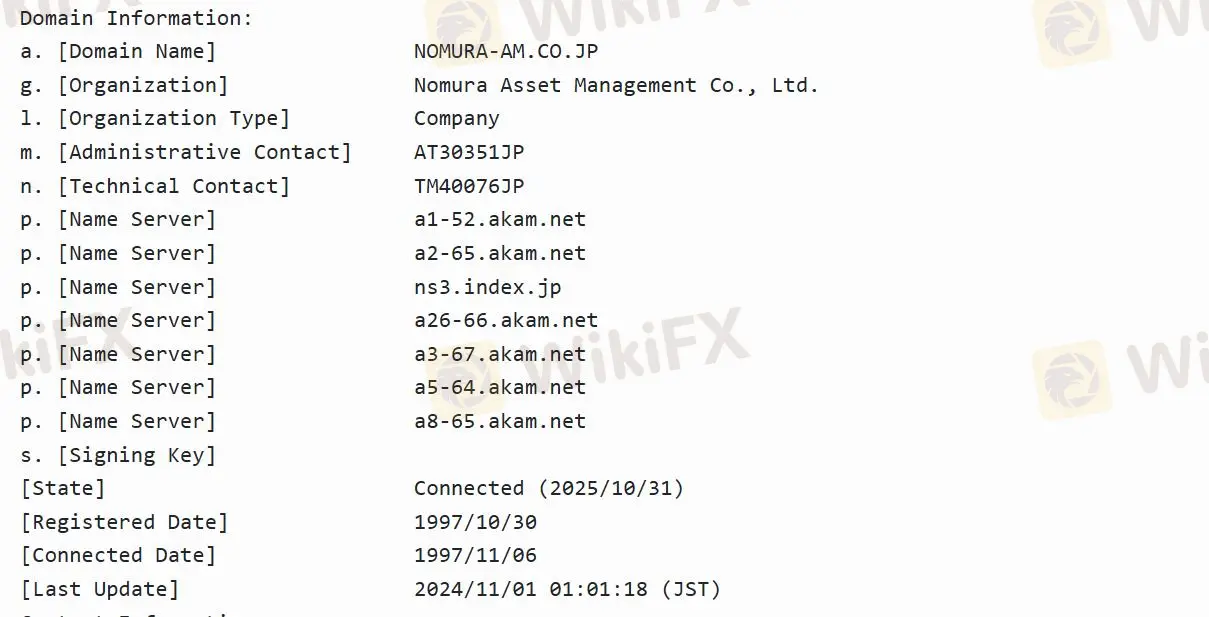

| Dibentuk | 1997-10-30 |

| Negara/Daerah Terdaftar | Jepang |

| Regulasi | Teregulasi |

| Sektor Bisnis | Investment Trust Management Business/Institutional Investment Management Business |

| Dukungan Pelanggan | / |

Informasi Nomura Asset Management

Nomura Asset Management adalah anak perusahaan sepenuhnya milik Nomura Holdings, lnc. dan merupakan merek inti dalam divisi manajemen investasi grup yang mengkhususkan diri dalam bisnis manajemen kepercayaan investasi dan bisnis manajemen investasi institusional. Pada tanggal 31 Desember 2023, ini adalah manajer kepercayaan investasi terbesar di Jepang.

Apakah Nomura Asset Management Legal?

Nomura Asset Management diregulasi oleh Financial Services Agency (FSA) dengan nomor lisensi No.関東財務局長(金商)第373号 dan Tipe Lisensi Retail Forex, sehingga lebih aman daripada yang tidak diatur.

Strategi Investasi Apa yang Ditawarkan oleh Nomura Asset Management?

Pendapatan Tetap: mencakup berbagai strategi investasi terkait pendapatan tetap termasuk obligasi pemerintah, obligasi perusahaan berisiko tinggi, obligasi pasar negara berkembang, obligasi terkait inflasi, dan strategi pendapatan tetap yang tidak terbatas.

Alternatif: mengelola berbagai investasi pengembalian absolut alternatif termasuk strategi pasar netral panjang/pendek dan strategi 130/30 diperpanjang pendek yang menargetkan saham Jepang.

Multi-Aset: Strategi multi-aset jangka panjang menggunakan penilaian aktif untuk mengukur beta pasar dan mencakup aset seperti pendapatan tetap, ekuitas, REIT, komoditas, emas, dan obligasi berisiko tinggi.

Smart Beta: termasuk RAFI® Fundamental Index, Minimum Volatility, dan strategi Investasi dan Profitabilitas (Fokus Kualitas) milik kami.