Buod ng kumpanya

Note: Ang opisyal na website ng Ando Securities: https://www.ando-sec.co.jp/ ay kasalukuyang hindi ma-access nang normal.

| Pangkalahatang Pagsusuri ng Ando Securities | |

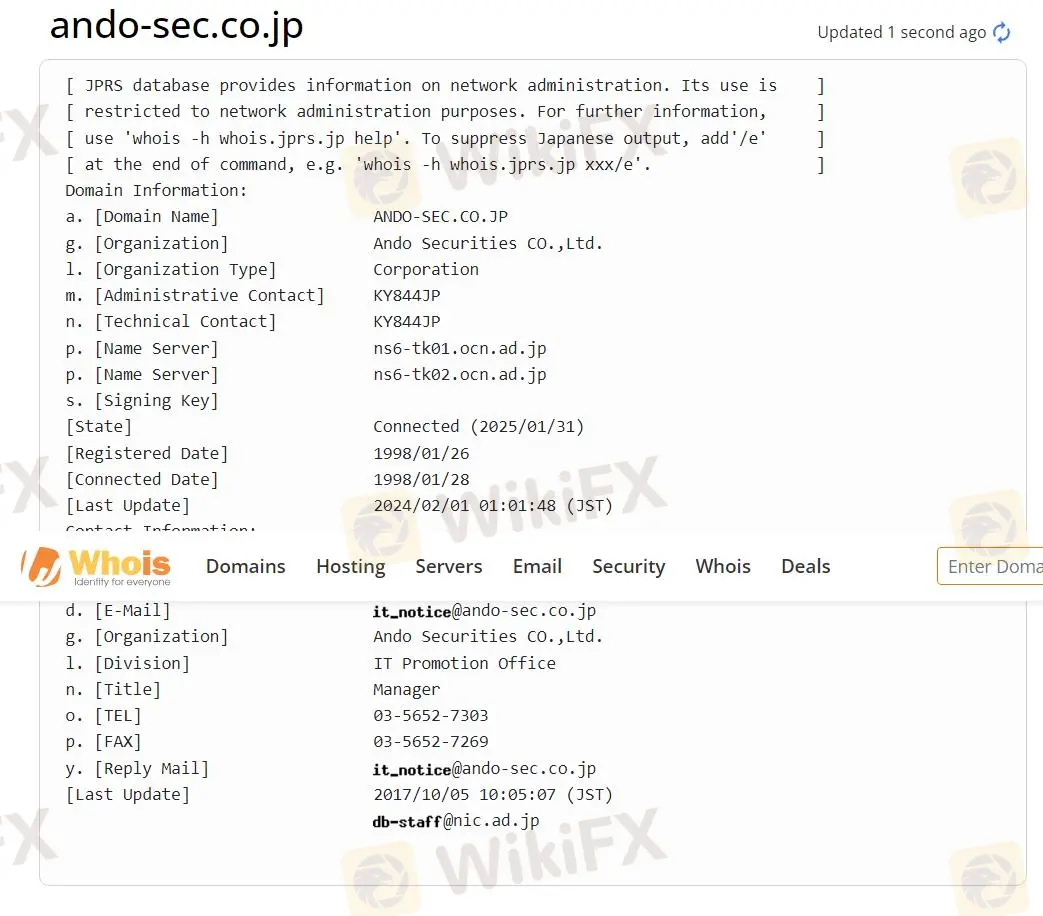

| Itinatag | 1998 |

| Rehistradong Bansa/Rehiyon | Hapon |

| Regulasyon | FSA |

| Mga Produkto sa Pagkalakalan | Mga Stocks, Investment Trusts, Bonds, Futures/Options, Insurance |

| Demo Account | / |

| Plataforma ng Pagkalakalan | Chura Net 24 |

| Minimum na Deposito | 1 milyong yen para sa face-to-face, 300,000 yen para sa internet trading |

| Customer Support | Face-to-face (Lunes hanggang Biyernes, 8:30-17:00) |

| Call center (Lunes hanggang Biyernes, 8:00-17:00), Tel: +81 0120-024-005 | |

| Online (Lunes hanggang Biyernes, 8:00-17:30) | |

Itinatag ang Ando Securities noong 1998 at rehistrado ito sa Hapon. Ito ay regulado ng Financial Services Agency (FSA). Ang kanilang negosyo ay sumasaklaw sa iba't ibang mga instrumento sa merkado tulad ng mga stocks, investment trusts, bonds, futures/options, at mga produkto ng seguro. Ginagamit ng kumpanya ang "Chura Net 24" bilang kanilang internet trading platform para sa mga kliyente na magconduct ng mga transaksyon. Tungkol sa minimum na deposito, ito ay 1 milyong yen para sa face-to-face na mga transaksyon at 300,000 yen para sa mga transaksyon sa internet.

Mga Kalamangan at Disadvantages

| Mga Kalamangan | Mga Disadvantages |

| Regulado ng FSA | Mataas na minimum na deposito |

| Iba't ibang mga produkto sa pagkalakalan | Limitadong mga channel ng komunikasyon at oras ng serbisyo |

| Iba't ibang mga pagpipilian sa transaksyon (face-to-face, call center, internet) |

Tunay ba ang Ando Securities?

Ando Securities, na may license number 東海財務局長(金商)第1号, ay isang reguladong institusyon sa pananalapi na nakabase sa Hapon. Ito ay may Retail Forex License at binabantayan ng Financial Services Agency. Ang institusyon, na kilala bilang Ando Securities株式会社, ay niregula simula noong Setyembre 30, 2007.

| Regulated Country | Regulated Authority | Current Status | Regulated Entity | License Type | License Number |

|---|---|---|---|---|---|

| Financial Services Agency (FSA) | Regulated | Ando Securities株式会社 | Retail Forex License | 東海財務局長(金商)第1号 |

Ano ang Maaari Kong I-trade sa Ando Securities?

| Mga Produkto sa Pag-trade | Supported |

| Mga Stocks | ✔ |

| Investment Trusts | ✔ |

| Mga Bonds | ✔ |

| Mga Futures/Options | ✔ |

| Seguro | ✔ |

| Forex | ❌ |

| Mga Komoditi | ❌ |

| Mga Indeks | ❌ |

| Mga Cryptocurrency | ❌ |

| Mga ETF | ❌ |

Uri ng Account

| Uri ng Account | Min Deposit | Consignment Deposit Rate |

|---|---|---|

| Margin Trading | Face-to-face: 1,000,000 JPY | 40% |

| Online: 300,000 JPY | ||

| Pangkalahatang Securities | 0 | 0 |

Ando Securities Fees

| Item | Standard |

| Domestic stock brokerage commission | 0.63250%-0.085360% ng halaga ng kontrata, min 2,750 yen |

| Purchase interest rate | 2.00% |

| Sale interest rate | 0.00% |

| Stock lending fee | 1.15% |

| Management fee | 11 sen (110 yen, kung hindi naaangkop sa sistema ng unit share) |

| Bayad sa pagbabago ng pangalan | Naapply |

Platform sa Pag-trade

Ando Securities ay nag-aalok ng internet trading platform na tinatawag na "Chura Net 24," isang online trading service na nagbibigay ng access sa pamamagitan ng mga smartphones at PC. Ang mga gumagamit ay maaaring mag-check ng real-time status anumang oras at saanman. Ang platform ay nag-aalok ng makatwirang bayarin at isang simpleng proseso ng pag-oorder, kasama ang pagpipilian na gamitin ang iba't ibang "special orders" para sa mas pinahusay na kapital na kahusayan.

| Plataforma ng Pagkalakalan | Supported | Available Devices | Suitable for |

| Chura Net 24 | ✔ | Web | / |