Buod ng kumpanya

| Mitoyo Buod ng Pagsusuri | |

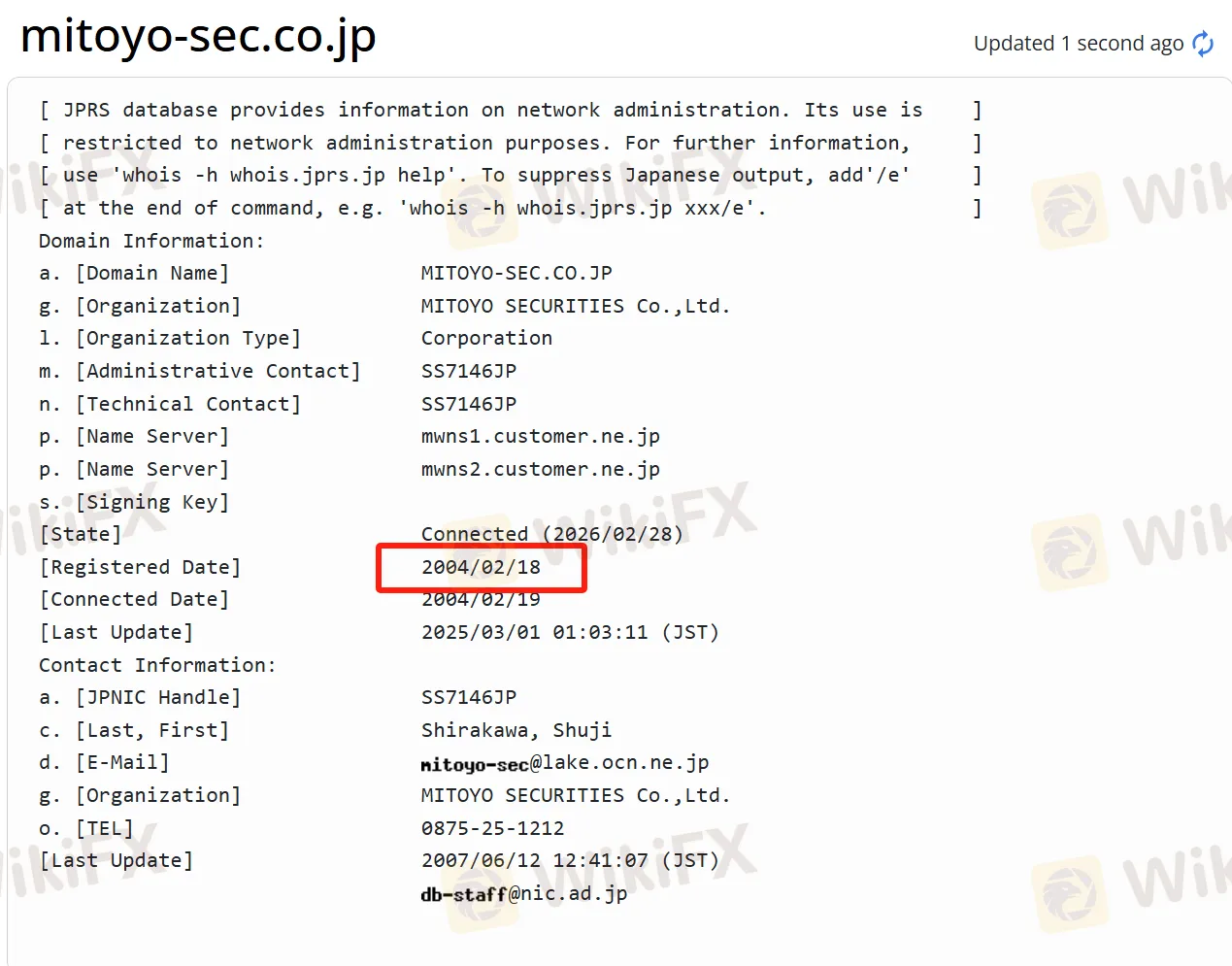

| Itinatag | 2004 |

| Rehistradong Bansa/Rehiyon | Hapon |

| Regulasyon | FSA (Regulated) |

| Mga Kasangkapan sa Merkado | Mga investment trust, Bonds, at Stocks |

| Platform ng Paggawa ng Kalakalan | / |

| Suporta sa Customer | Tel: 0875-25-1212 |

| Fax: 0875-25-1221 | |

Impormasyon Tungkol sa Mitoyo

Ang Mitoyo Securities ay isang kumpanyang pang-seguridad sa Hapon na may mahabang kasaysayan. Mula nang itatag ito, ito ay malalim na nakatanim sa lokal na lugar at isinasagawa ang negosyo nito na may Mitoyo na rehiyon bilang kanilang tanggulan. Nag-aalok ito ng iba't ibang uri ng mga produkto sa pinansyal, saklaw ang mga stocks na naka-lista sa maraming domestic exchanges, iba't ibang investment trusts, at iba't ibang uri ng bonds. Kasabay nito, nagbibigay ito ng mga personalisadong solusyon sa pinansyal at maraming kasangkapan sa kalakalan, na makakatugon sa mga pangangailangan ng iba't ibang mga mamumuhunan. Ang kumpanya ay may magandang sistema ng kaginhawaan at benepisyo, mahalaga ang pagpapahalaga sa lokal na pag-unlad, at aktibong nakikilahok sa lokal na pagpapalakas.

Mga Kalamangan at Disadvantages

| Mga Kalamangan | Mga Disadvantages |

| Regulated | Limitadong internasyonal na negosyo |

| Maraming kasangkapang pangkalakalan | |

| Magandang sistema ng kaginhawaan at benepisyo | |

| Pagbibigay-diin sa lokal na pag-unlad | |

| Mahabang oras ng operasyon |

Tunay ba ang Mitoyo?

Ang Mitoyo ay isang lehitimong kumpanya ng seguridad na sumusunod sa batas. Ang Financial Services Agency (FSA) ay nagregula sa Mitoyo Securities, at ang numero ng lisensya nito ay Shikoku Chief Financial Officer (Financial Merchant) No. 7.

Pagsusuri sa Larangan ng WikiFX

Ang koponan ng pagsusuri sa larangan ng WikiFX ay bumisita sa address ng Mitoyo sa Hapon, at napatunayan namin na may pisikal na opisina ito sa lugar.

Ano ang Maaari Kong Kalakalan sa Mitoyo?

Nagbibigay ang Mitoyo ng domestic stocks na naka-lista sa maraming exchanges, kasama ang Tokyo Stock Exchange, Nagoya Stock Exchange, Sapporo Stock Exchange, at Fukuoka Stock Exchange.

Ang investment trusts ay may iba't ibang uri, kasama ang equity investment trusts, public bond-type investment trusts (MRF, public bond investment trusts), ETFs, J-REITs, at iba pa. Maaaring makamit ng mga mamumuhunan ang iba't ibang uri ng pamumuhunan sa pamamagitan ng mga investment trust.

Maaari ring pumili ang mga mamumuhunan mula sa iba't ibang mga produkto ng bond, tulad ng mga individual-oriented government bonds (kasama ang tatlong uri: variable para sa 10 taon, fixed para sa 5 taon, at fixed para sa 3 taon), new window-selling government bonds, CB (domestic convertible bond-type corporate bonds with new share subscription rights), foreign currency-denominated bonds, at iba pa.

| Mga Tradable na Kasangkapan | Supported |

| Investment trusts | ✔ |

| Bonds | ✔ |

| Stocks | ✔ |

| Forex | ❌ |

| Commodities | ❌ |

| Indices | ❌ |

| Cryptocurrencies | ❌ |

| Options | ❌ |

| ETFs | ❌ |