Présentation de l'entreprise

| Mitoyo Résumé de l'examen | |

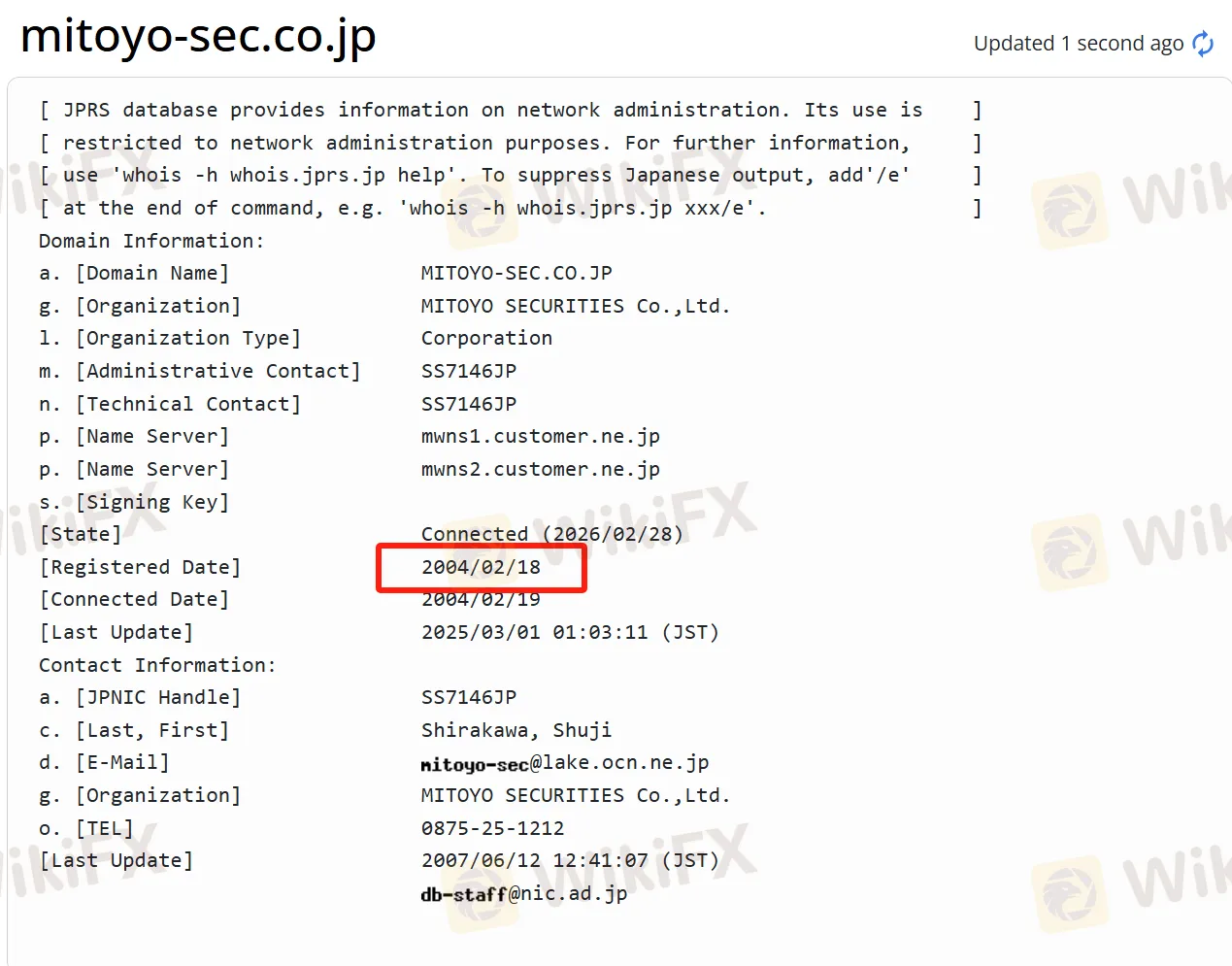

| Fondé | 2004 |

| Pays/Région d'enregistrement | Japon |

| Régulation | FSA (Réglementé) |

| Instruments de marché | Fonds d'investissement, Obligations et Actions |

| Plateforme de trading | / |

| Support client | Tél : 0875-25-1212 |

| Fax : 0875-25-1221 | |

Informations sur Mitoyo

Mitoyo Securities est une société de courtage japonaise avec une longue histoire. Depuis sa création, elle est profondément enracinée dans la région locale et mène ses activités avec la région de Mitoyo comme point fort. Elle propose une grande variété de produits financiers, couvrant des actions cotées sur plusieurs bourses nationales, divers fonds d'investissement et différents types d'obligations. En même temps, elle fournit des solutions financières personnalisées et plusieurs outils de trading, qui peuvent répondre aux besoins de différents investisseurs. La société dispose d'un bon système de bien-être et d'avantages, accorde une grande importance au développement local et participe activement à la revitalisation locale.

Avantages et Inconvénients

| Avantages | Inconvénients |

| Réglementé | Activité internationale limitée |

| Multiples instruments de trading | |

| Bon système de bien-être et d'avantages | |

| Accent mis sur le développement local | |

| Longue durée d'exploitation |

Mitoyo est-il légitime ?

Mitoyo est une société de courtage légitime et conforme. L'Agence des services financiers (FSA) a réglementé Mitoyo Securities, et son numéro de licence est Shikoku Chief Financial Officer (Marchand financier) n° 7.

Enquête sur le terrain WikiFX

L'équipe d'enquête sur le terrain de WikiFX a visité l'adresse de Mitoyo au Japon, et nous avons confirmé qu'elle dispose d'un bureau physique sur place.

Que puis-je trader sur Mitoyo ?

Mitoyo propose des actions nationales cotées sur plusieurs bourses, y compris la Bourse de Tokyo, la Bourse de Nagoya, la Bourse de Sapporo et la Bourse de Fukuoka.

Les fonds d'investissement sont de types divers, y compris des fonds d'investissement en actions, des fonds d'investissement en obligations publiques (MRF, fonds d'investissement en obligations publiques), des ETF, des J-REITs, etc. Les investisseurs peuvent diversifier leurs investissements grâce aux fonds d'investissement.

Les investisseurs peuvent également choisir parmi divers produits obligataires, tels que des obligations gouvernementales orientées vers les particuliers (comprenant trois types : variable sur 10 ans, fixe sur 5 ans et fixe sur 3 ans), des obligations gouvernementales de nouvelle fenêtre, des CB (obligations d'entreprise de type convertible domestique avec de nouveaux droits de souscription d'actions), des obligations libellées en devises étrangères, etc.

| Instruments négociables | Pris en charge |

| Fonds d'investissement | ✔ |

| Obligations | ✔ |

| Actions | ✔ |

| Forex | ❌ |

| Matières premières | ❌ |

| Indices | ❌ |

| Cryptomonnaies | ❌ |

| Options | ❌ |

| ETFs | ❌ |