Buod ng kumpanya

| HACHIJUNI Buod ng Pagsusuri | |

| Itinatag | 2006 |

| Rehistradong Bansa/Rehiyon | Hapon |

| Regulasyon | FSA |

| Mga Produkto at Serbisyo | Mga Stock, investment trust, bonds |

| Demo Account | / |

| Platform ng Paggagalaw | Online Trading System |

| Minimum na Deposit | ¥1,000 |

| Suporta sa Customer | Telepono: 0120-70-3782 |

Impormasyon Tungkol sa HACHIJUNI

Ang Hachijuni Securities, na itinatag noong 2006, ay isang kumpanyang pang-serbisyong pinansiyal na nakabase sa Hapon na regulado ng Financial Services Agency (FSA). Nagbibigay ito ng malawak na hanay ng mga produkto, kabilang ang mga stock, investment trust, at bonds, na may diin sa pasadyang serbisyo sa harapan, gayunpaman ang mga presyo ay mas mataas kaysa sa mga singil ng online brokers.

Mga Kalamangan at Disadvantages

| Mga Kalamangan | Mga Disadvantages |

| Regulado ng FSA | Mas mataas na bayad, lalo na para sa face-to-face trading |

| Walang bayad sa deposito/pag-withdraw | Nakatuon sa Hachijuni Bank para sa mga serbisyong pang-transfer |

| Personalized na serbisyo sa customer | Mataas na minimum na deposito |

Totoo ba ang HACHIJUNI?

Oo, ang HACHIJUNI (八十二証券株式会社) ay totoo. Pinapasiya ito ng Financial Services Agency (FSA) ng Japan sa ilalim ng Retail Forex License, na may opisyal na numero ng lisensya na 関東財務局長(金商)第21号.

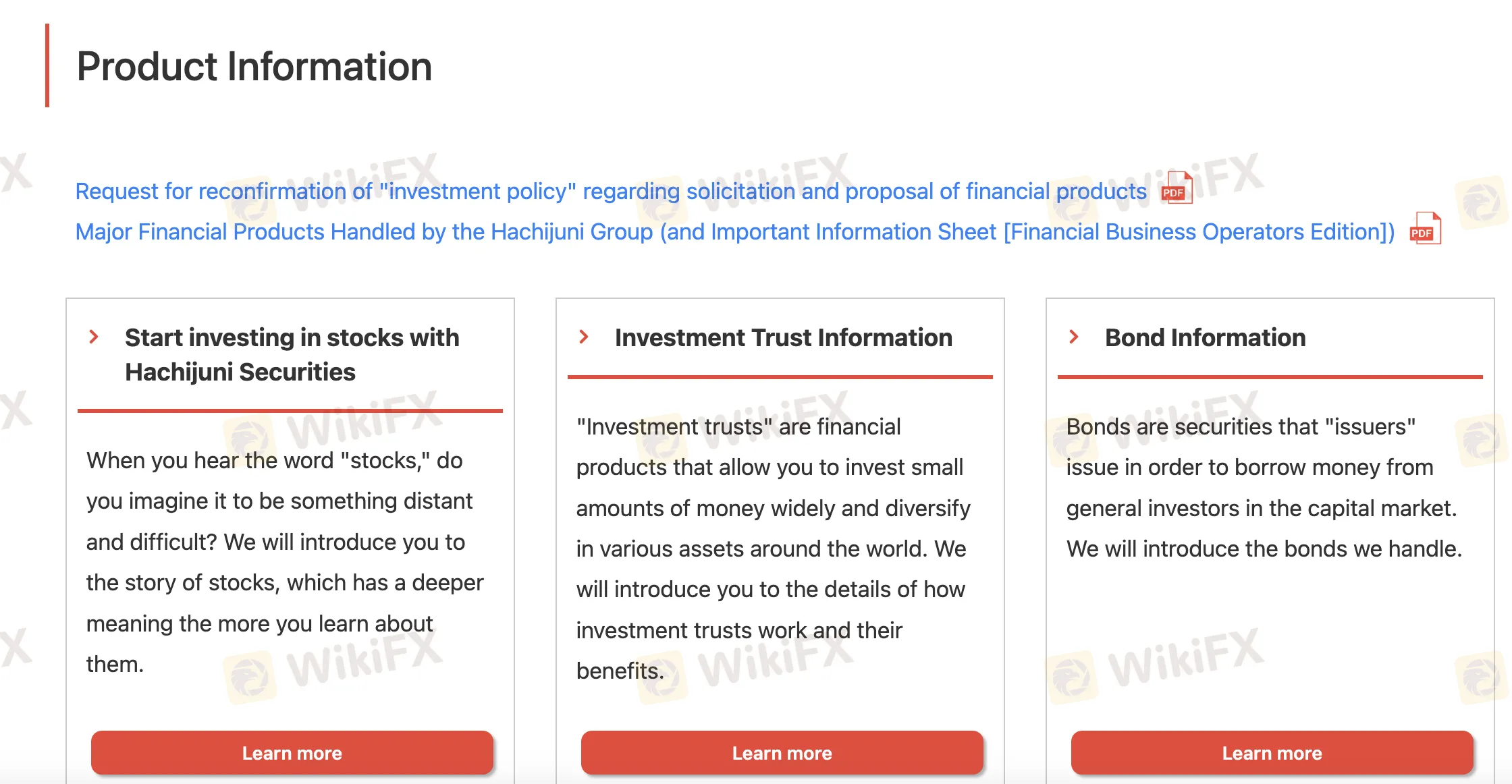

Ano ang Maaari Kong I-trade sa Hachijuni?

Nag-aalok ang Hachijuni Securities ng maraming iba't ibang produkto sa pinansiyal sa parehong baguhan at may karanasan na mga investor. Kasama dito ang mga stock, investment trust, at bonds.

| Mga Instrumento ng Paggagalaw | Supported |

| Stocks | ✓ |

| Investment Trusts | ✓ |

| Bonds | ✓ |

| Forex | × |

| Commodities | × |

| Indices | × |

| Cryptocurrencies | × |

| Options | × |

| ETFs | × |

Mga Bayad sa HACHIJUNI

Ang mga bayad ng HACHIJUNI ay mas mataas kaysa sa karaniwan para sa global internet trading business, lalo na para sa face-to-face stock transactions at pag-manage ng foreign asset accounts. Ito ay mas mainam na pagpipilian para sa traditional o local na mga investor kaysa sa mga online trader na nais magtipid ng pera.

| Contract Price Range | Commission (Face-to-Face, Tax Included) |

| Under 1 million yen | 1.265% ng halaga ng kontrata (minimum na 2,750 yen) |

| 1M–1.5M yen | 0.990% + 2,750 yen |

| 1.5M–2.5M yen | 0.935% + 3,575 yen |

| 2.5M–3M yen | 0.913% + 4,125 yen |

| 3M–5M yen | 0.880% + 5,115 yen |

| 5M–10M yen | 0.715% + 13,365 yen |

| 10M–20M yen | 0.495% + 35,365 yen |

| 20M–30M yen | 0.440% + 46,365 yen |

| 30M–40M yen | 0.330% + 79,365 yen |

| 40M–50M yen | 0.275% + 101,365 yen |

| Over 50M yen | Flat 242,000 yen |

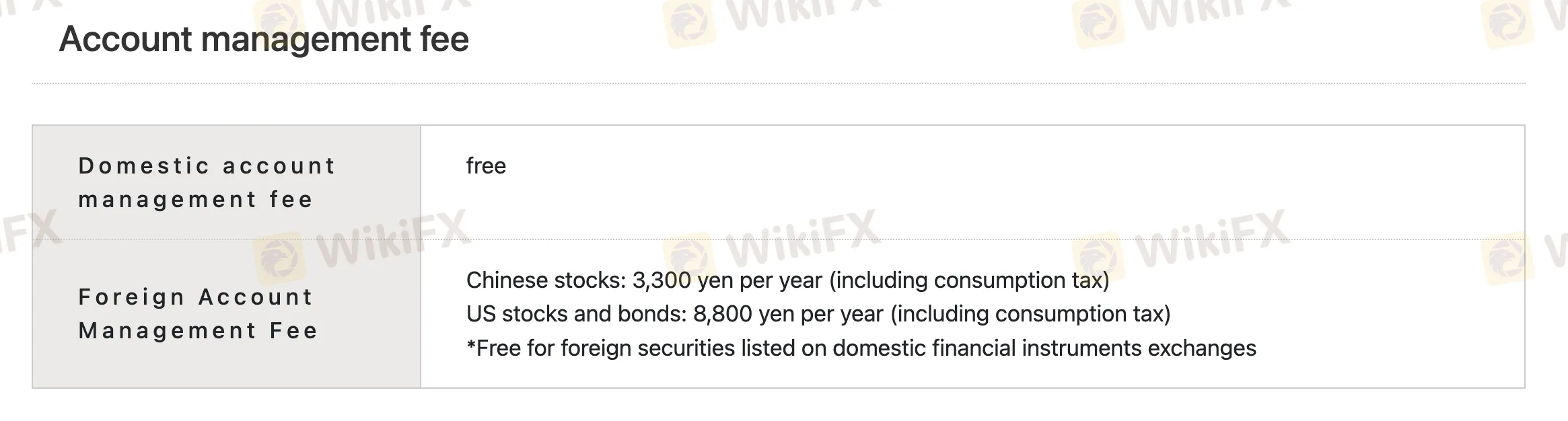

Non-Trading Fees

| Fee Type | Amount |

| Domestic Account Fee | 0 |

| Foreign Account Fee | Chinese stocks: 3,300 yen/year |

| US stocks & bonds: 8,800 yen/year (libre para sa ilang assets) | |

| Share Transfer (<1 unit) | 1,100 yen bawat stock |

| Share Transfer (>1 unit) | 550 yen bawat unit (max 11,000 yen bawat stock) |

| Copies, Certificates | 1,100 yen bawat isa (account ledgers, balance certificates, bills of sale, at iba pa) |

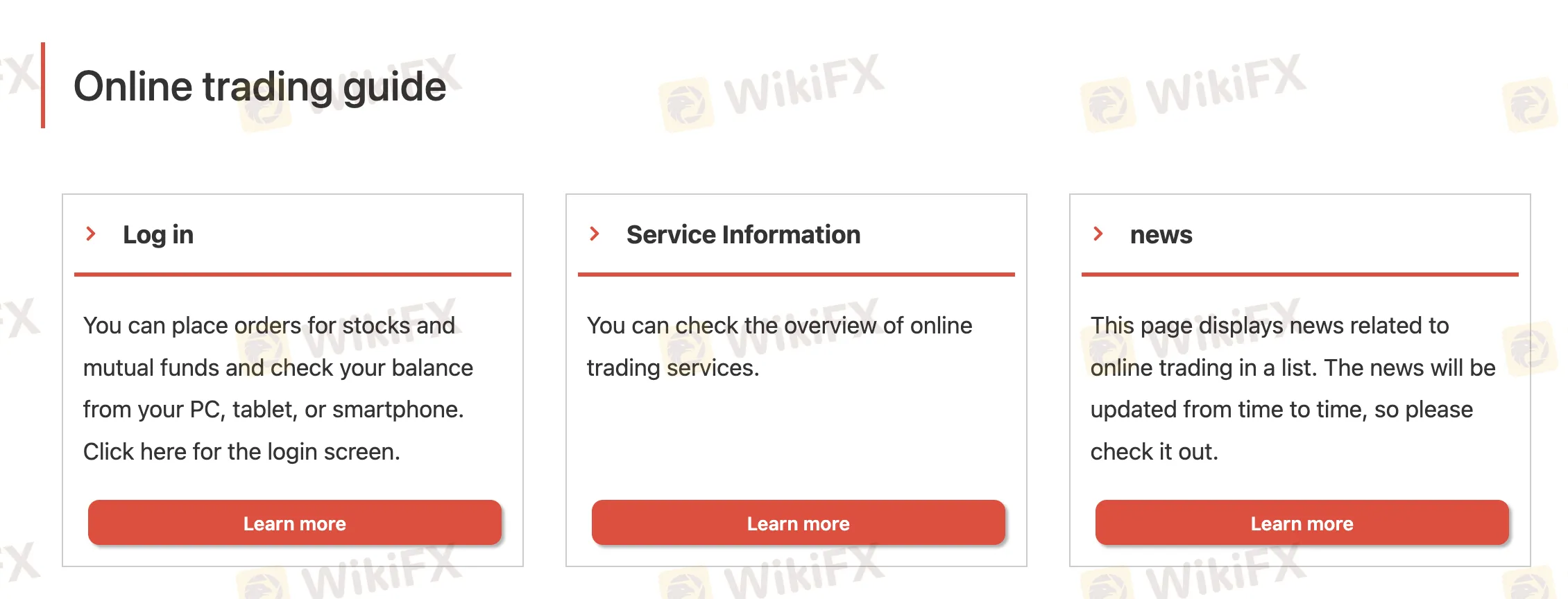

Trading Platform

| Trading Platform | Supported | Available Devices |

| Online Trading System | ✔ | PC, Tablet, Smartphone |

Deposit and Withdrawal

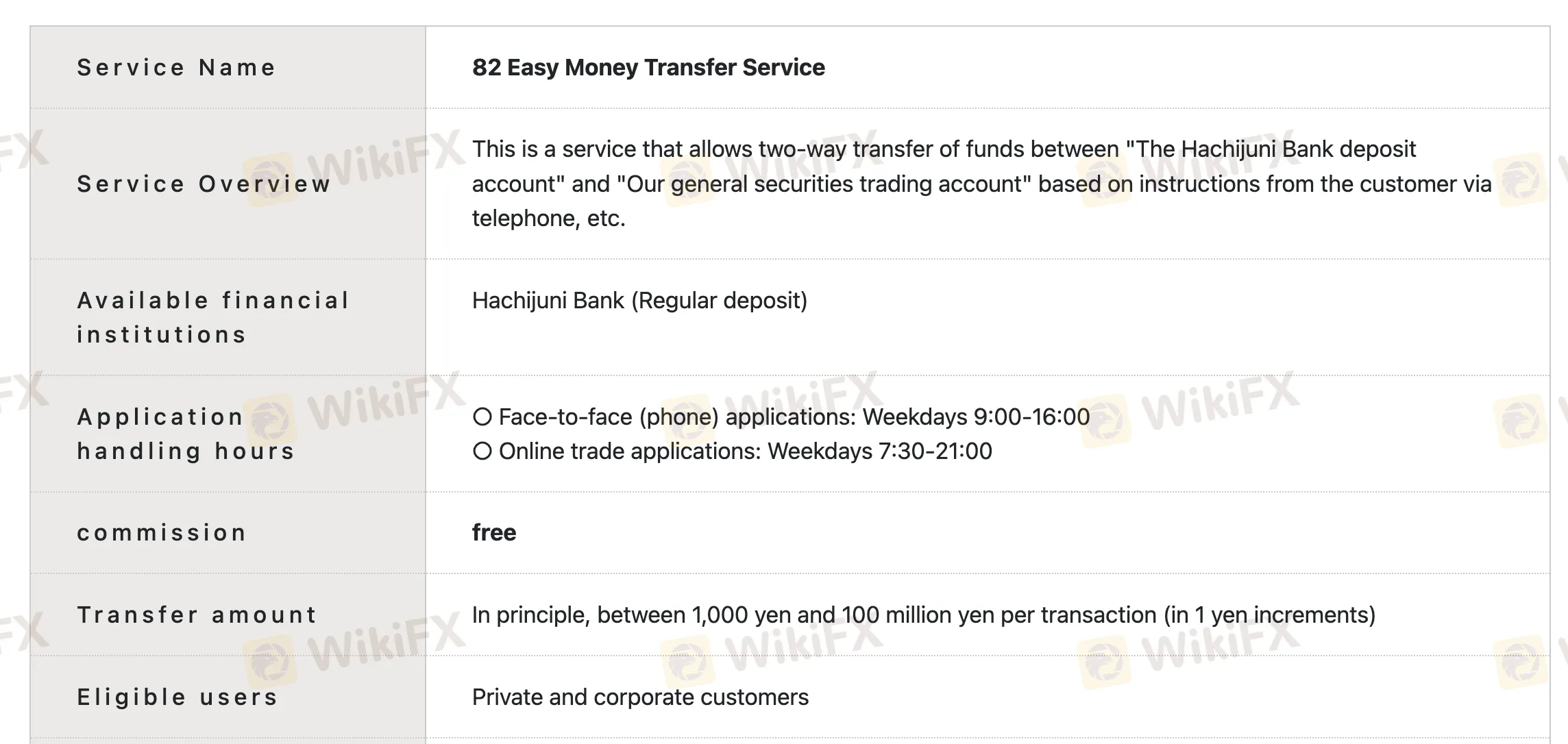

Ang Hachijuni Securities ay hindi nagpapataw ng bayad para sa deposito o withdrawal, at lahat ng bayad para sa transfer at remittance ay sakop ng kumpanya. Ang minimum deposit para sa "82 Easy Money Transfer Service" ay karaniwang ¥1,000 bawat transaksyon.

| Paymenr Option | Minimum Amount | Fee | Processing Time |

| 82 Easy Money Transfer (Bank ↔ Securities) | ¥1,000 – ¥100 million bawat transaksyon | 0 | Phone: Weekdays 9:00–16:00; |

| Online: Weekdays 7:30–21:00 |