Présentation de l'entreprise

| KOSEI SECURITIES Résumé de l'examen | |

| Fondé | 1997 |

| Pays/Région d'enregistrement | Japon |

| Régulation | FSA |

| Produits de trading | Actions, Obligations, Fonds d'investissement, ETF/SCPI, Contrats à terme, Options et Assurance/iDeco |

| Plateforme de trading | / |

| Dépôt minimum | / |

| Support client | Tél : 0120-06-8617 |

| Adresse : 2-1-10 Kitahama, Chuo-ku, Osaka | |

Informations sur KOSEI SECURITIES

Le siège de Kosei Securities est situé à Kitahama, Chuo-ku, ville d'Osaka. Son activité couvre le trading de titres, les fonds d'investissement, les contrats à terme et les options, l'agence d'assurance vie, etc., tout en proposant également des services spéciaux tels que des comptes spécifiques (déclaration fiscale simplifiée) et des comptes NISA (exonération fiscale pour les petits investissements).

Avantages et Inconvénients

| Avantages | Inconvénients |

| Régulé par la FSA | Structure de commission complexe |

| Garantie de sécurité des fonds | Support en anglais insuffisant (principalement en japonais) |

| Combinaison en ligne et hors ligne | |

| Longue histoire opérationnelle | |

| Divers produits de trading | |

| Informations de frais transparentes |

KOSEI SECURITIES est-il légitime ?

Kosei Securities est cotée à la Bourse de Tokyo et réglementée par l'Agence des services financiers (FSA) du Japon. Avec un numéro de licence 近畿財務局長(金商)第14号, c'est une société de valeurs mobilières légalement enregistrée.

| Autorité de réglementation | Statut actuel | Pays réglementé | Entité autorisée | Type de licence | Numéro de licence |

| Agence des services financiers (FSA) | Réglementée | Japon | KOSEI SECURITIES株式会社 | Licence de courtier Forex au détail | 近畿財務局長(金商)第14号 |

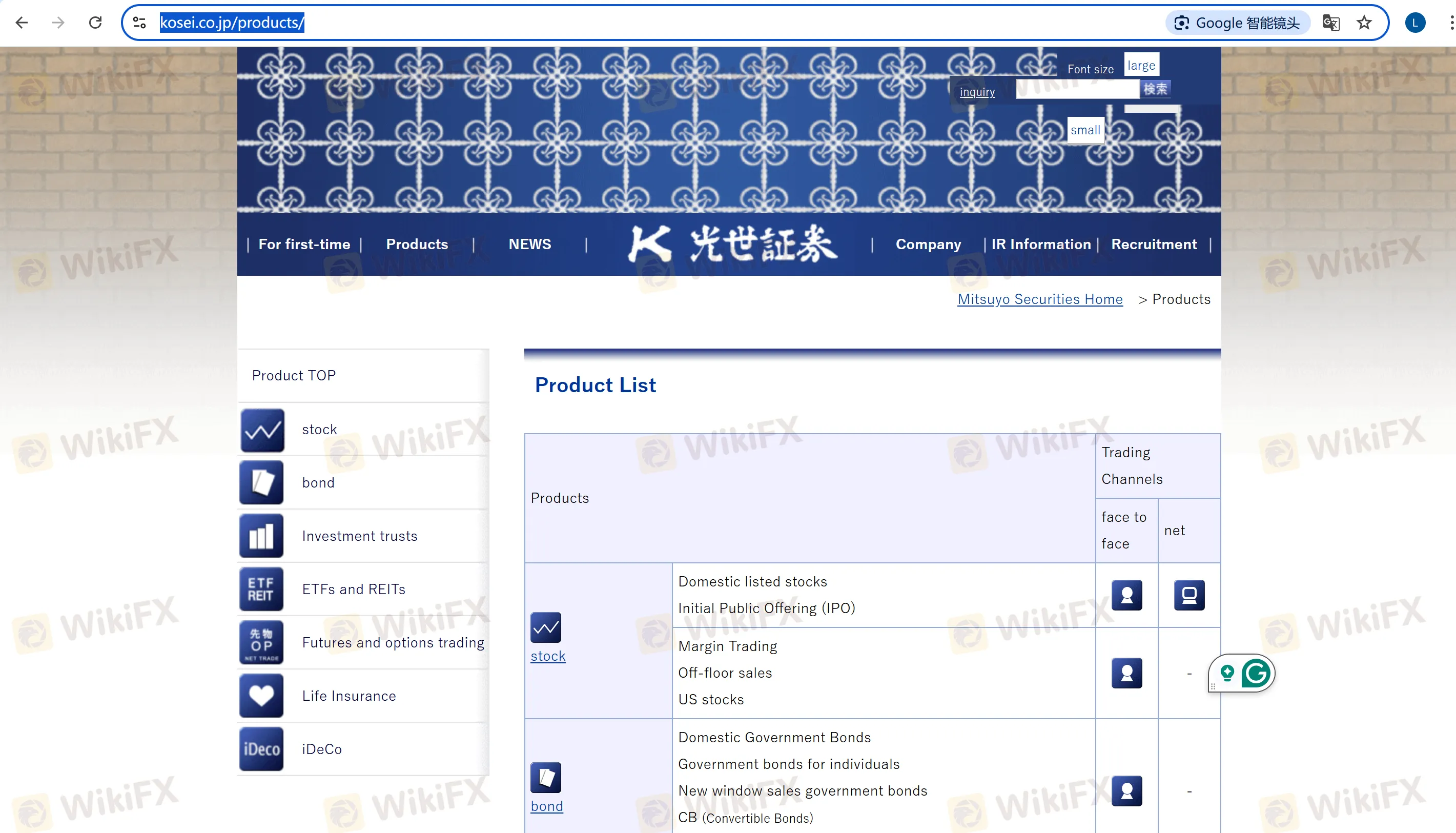

Que puis-je trader sur KOSEI SECURITIES ?

| Produits de trading | Pris en charge | Détails |

| Actions | ✔ | Actions cotées domestiques, actions américaines, introductions en bourse (IPO) et trading sur marge |

| Obligations | ✔ | Obligations d'État individuelles, obligations d'entreprise, obligations libellées en devises étrangères et obligations convertibles |

| Fonds d'investissement | ✔ | Fonds d'investissement en actions, fonds d'investissement en obligations d'entreprise et fonds de type hedge fund |

| ETF/SCPI | ✔ | Fonds d'investissement cotés, sociétés d'investissement immobilier (par exemple, indice TOPIX REIT) |

| Contrats à terme et options | ✔ | Contrats à terme sur le Nikkei 225, options TOPIX, contrats à terme sur métaux précieux (étalon-or) et contrats à terme sur indices de matières premières (pétrole brut CME) |

| Assurance/iDeco | ✔ | Services d'agence d'assurance-vie, Nomura iDeco (comptes de retraite) |

Type de compte

Compte spécifique : Calcule les profits et les pertes pour le compte des clients, gère les paiements d'impôts et simplifie les déclarations fiscales annuelles.

Compte NISA : Un compte exonéré d'impôt pour les investissements à petite échelle, avec une limite d'investissement annuelle de ¥1,000,000. Les dividendes et les produits de vente sont exonérés d'impôt pendant 5 ans.

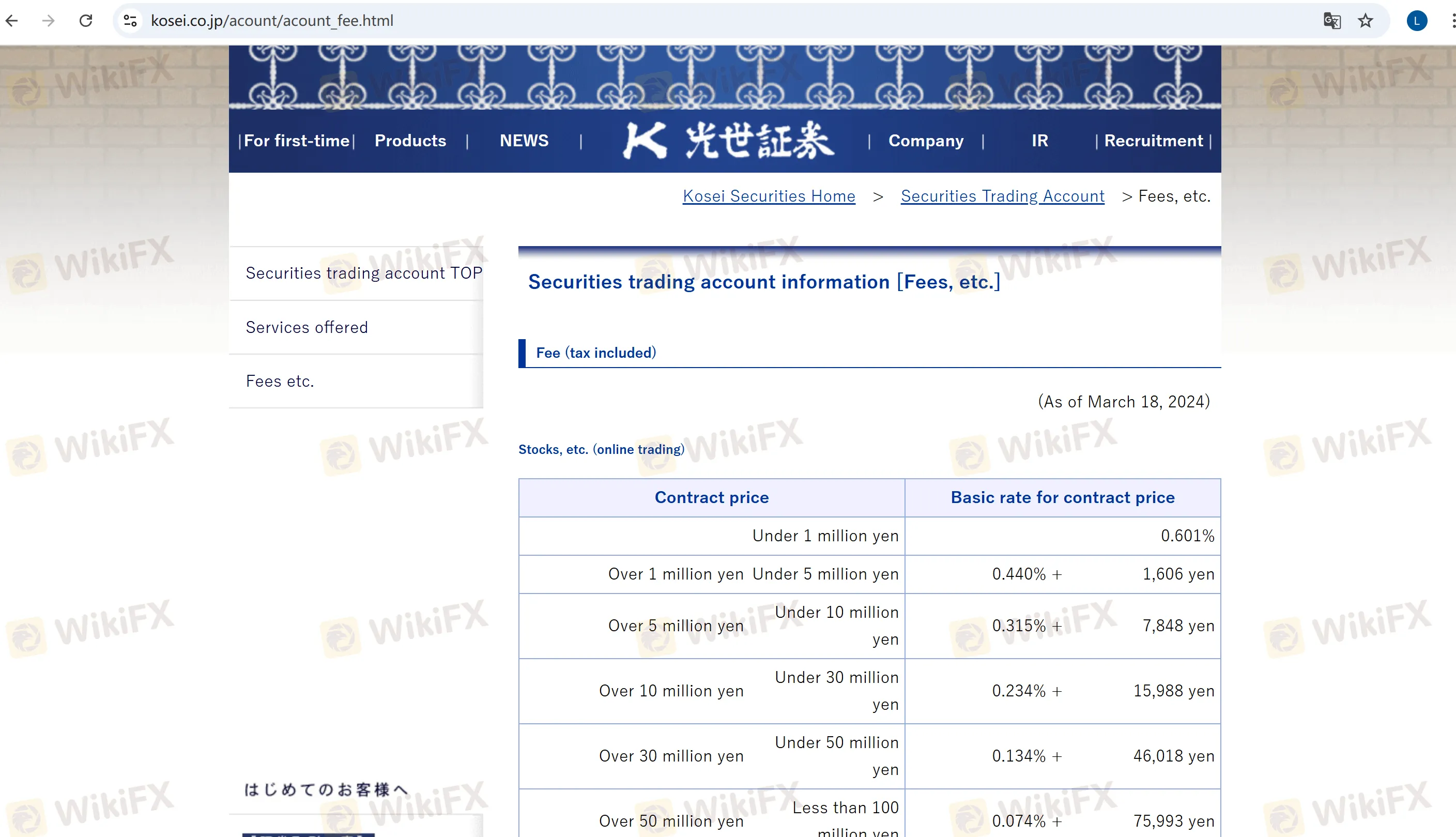

Frais KOSEI SECURITIES

Frais de commission principaux :

Actions (En ligne) : 0,601 % pour les transactions de moins de ¥1,000,000 (minimum ¥1,100). Pour les montants supérieurs à ¥1,000,000,000, les frais sont soumis à une négociation individuelle.

Actions américaines : Un forfait de 0,495 % (minimum ¥550). Les frais de la SEC seront temporairement annulés à partir du 13 mai 2025.

Contrats à terme et options (En ligne) : 0,022 % pour les contrats à terme sur indice, 0,0044 % pour les contrats à terme sur obligations d'État, avec des frais minimum de ¥440.

Frais de maintenance de compte : ¥2,200 annuellement (exonérés pour les clients détenant 100 actions ou plus de la société).

Autres frais :

Taux de prêt sur marge (Côté achat) : Marge institutionnelle : 1,64 %–1,92 % (intérêt annuel) ; Marge générale : 2,14 %–2,42 %.

Pour des informations plus détaillées sur les frais de compte, veuillez visiter le site officiel.