Şirket özeti

| KOSEI SECURITIES İnceleme Özeti | |

| Kuruluş Yılı | 1997 |

| Kayıtlı Ülke/Bölge | Japonya |

| Düzenleme | FSA |

| İşlem Ürünleri | Hisse Senetleri, Tahviller, Yatırım Fonları, ETF'ler/REIT'ler, Vadeli İşlemler, Opsiyonlar ve Sigorta/iDeco |

| İşlem Platformu | / |

| Minimum Yatırım | / |

| Müşteri Desteği | Tel: 0120-06-8617 |

| Adres: 2-1-10 Kitahama, Chuo-ku, Osaka | |

KOSEI SECURITIES Bilgileri

Kosei Securities'in merkezi, Osaka Şehri Chuo-ku Kitahama'da bulunmaktadır. İşletmesi menkul kıymet ticareti, yatırım fonları, vadeli işlemler ve opsiyonlar, hayat sigortası acenteliği vb. alanları kapsamaktadır ve aynı zamanda belirli hesaplar (basitleştirilmiş vergi beyannamesi) ve NISA hesapları (küçük ölçekli yatırımlar için vergi muafiyeti) gibi özel hizmetler sunmaktadır.

Artıları ve Eksileri

| Artılar | Eksiler |

| FSA tarafından düzenlenir | Karmaşık komisyon yapısı |

| Fon güvenliği garantisi | Yetersiz İngilizce desteği (genellikle Japonca) |

| Çevrimiçi ve çevrimdışı kombinasyonu | |

| Uzun işletme geçmişi | |

| Çeşitli işlem ürünleri | |

| Şeffaf ücret bilgileri |

KOSEI SECURITIES Güvenilir mi?

Kosei Securities, Tokyo Menkul Kıymetler Borsası'nda listelenmiş olup Japonya Finansal Hizmetler Ajansı (FSA) tarafından düzenlenmektedir. 近畿財務局長(金商)第14号 lisans numarasıyla yasal olarak kayıtlı bir menkul kıymetler şirketidir.

| Düzenleyici Kurum | Mevcut Durum | Düzenlenen Ülke | Lisanslı Kuruluş | Lisans Türü | Lisans No. |

| Finansal Hizmetler Ajansı (FSA) | Düzenlenmiş | Japonya | KOSEI SECURITIES株式会社 | Perakende Forex Lisansı | 近畿財務局長(金商)第14号 |

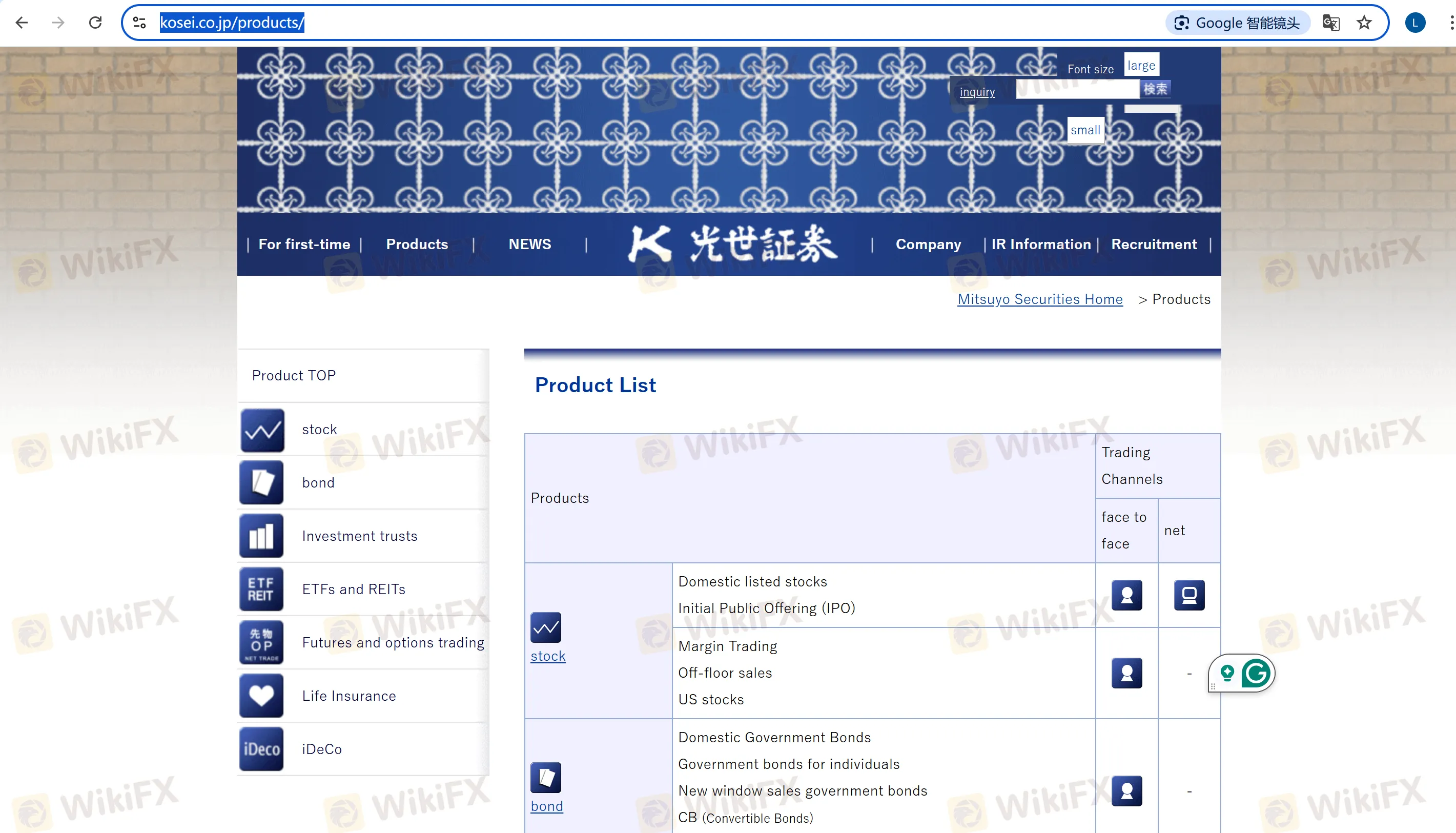

KOSEI SECURITIES Üzerinde Neler İşlem Yapabilirim?

| İşlem Ürünleri | Desteklenen | Detaylar |

| Hisse Senetleri | ✔ | Yurtiçi listelenmiş hisse senetleri, ABD hisse senetleri, halka arzlar (IPO'lar) ve kaldıraçlı işlemler |

| Bono | ✔ | Bireysel devlet tahvilleri, kurumsal tahviller, yabancı para cinsinden tahviller ve dönüştürülebilir tahviller |

| Yatırım Fonları | ✔ | Özkaynak yatırım fonları, kurumsal tahvil yatırım fonları ve hedge fon türü fonlar |

| ETF'ler/REIT'ler | ✔ | Listelenmiş yatırım fonları, gayrimenkul yatırım fonları (örneğin, TOPIX REIT Endeksi) |

| Vadeli İşlemler ve Opsiyonlar | ✔ | Nikkei 225 vadeli işlemleri, TOPIX opsiyonları, kıymetli maden vadeli işlemleri (altın standardı) ve emtia endeks vadeli işlemleri (CME ham petrol) |

| Sigorta/iDeco | ✔ | Hayat sigortası acentelik hizmetleri, Nomura iDeco (emeklilik hesapları) |

Hesap Türü

Belirli Hesap: Müşteriler adına kar ve zarar hesaplamaları yapar, vergi ödemelerini yönetir ve yıllık vergi beyannamelerini basitleştirir.

NISA Hesabı: Küçük ölçekli yatırımlar için vergiden muaf bir hesap, yıllık yatırım limiti ¥1,000,000. Temettüler ve satış gelirleri 5 yıl boyunca vergiden muaf tutulur.

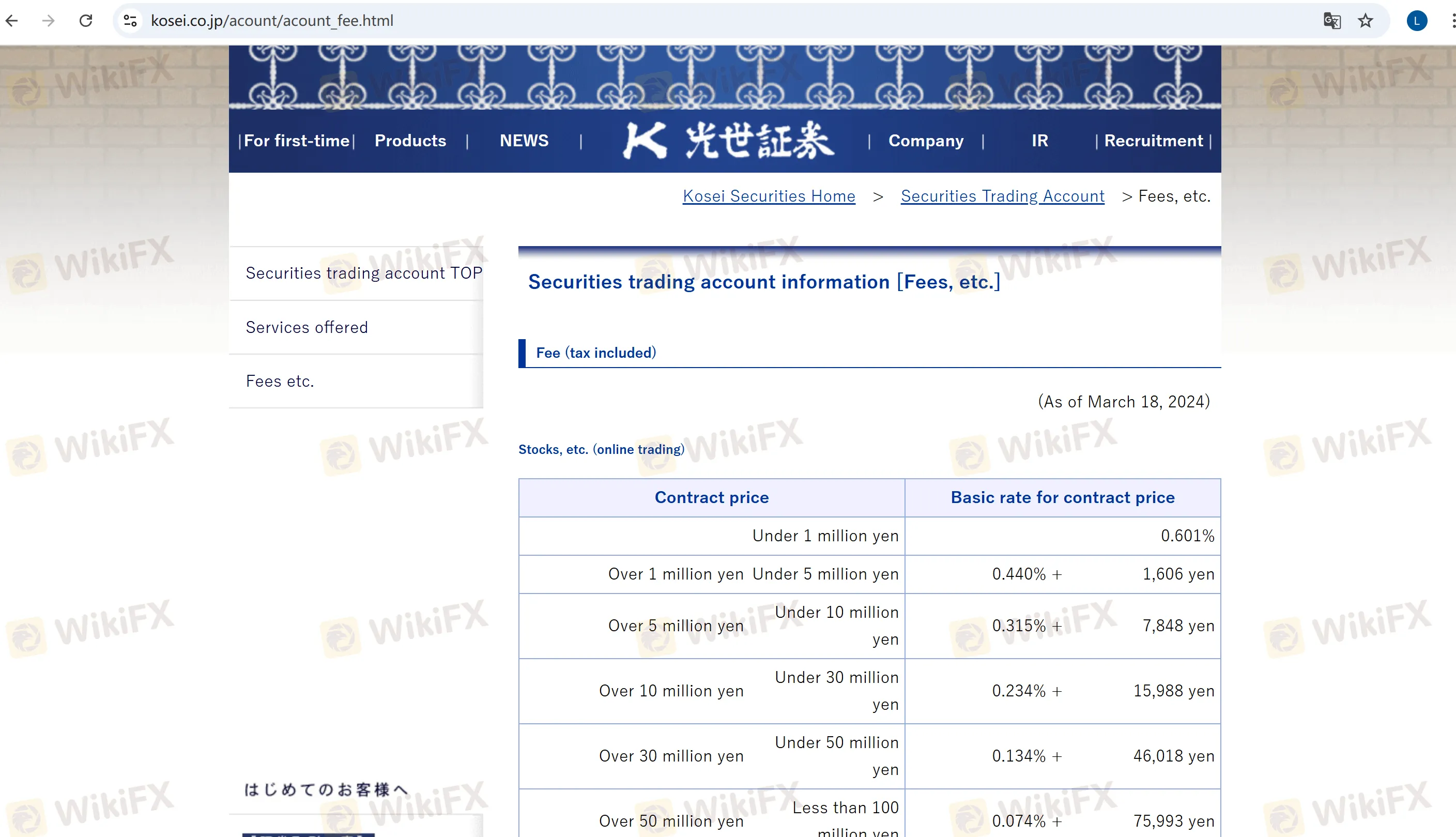

KOSEI SECURITIES Ücretleri

Ana Komisyon Ücretleri:

Hisse Senetleri (Çevrimiçi): ¥1,000,000 altındaki işlemler için %0.601 (minimum ¥1,100). ¥1,000,000,000 üzerindeki tutarlar için ücretler bireysel pazarlığa tabidir.

ABD Hisse Senetleri: Sabit %0.495 (minimum ¥550). SEC ücretleri 13 Mayıs 2025'ten itibaren geçici olarak kaldırılacaktır.

Vadeli İşlemler ve Opsiyonlar (Çevrimiçi): Endeks vadeli işlemler için %0.022, devlet tahvili vadeli işlemler için %0.0044, minimum ücret ¥440.

Hesap Bakım Ücreti: Yılda ¥2,200 (firmanın hisselerinden 100+ adet bulunduran müşteriler için feragat edilir).

Diğer Ücretler:

Marjinal Kredi Faiz Oranları (Alım Tarafı): Kurumsal marjinal: %1.64–1.92 (yıllık faiz); Genel marjinal: %2.14–2.42.

Daha detaylı hesap ücret bilgileri için lütfen resmi web sitesini ziyaret edin.