회사 소개

| MUFG 리뷰 요약 | |

| 설립 | 2001 |

| 등록 국가/지역 | 일본 |

| 규제 | FCA, LFSA |

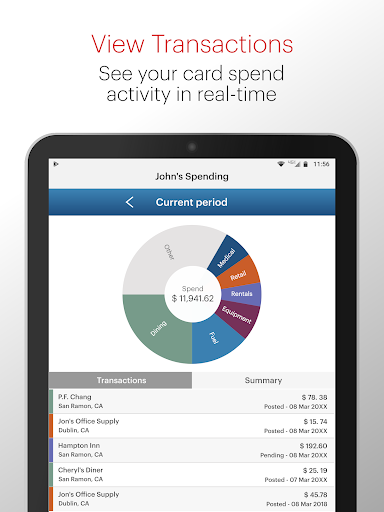

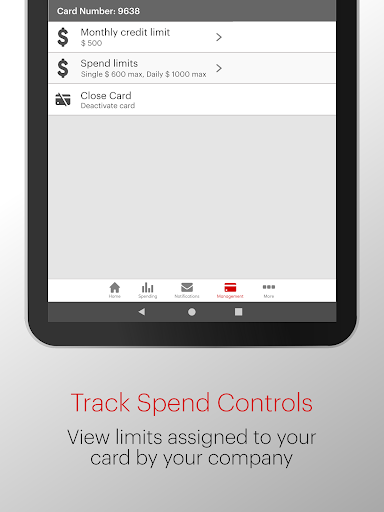

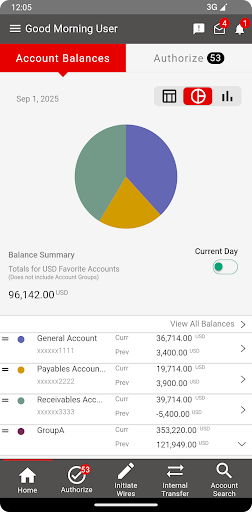

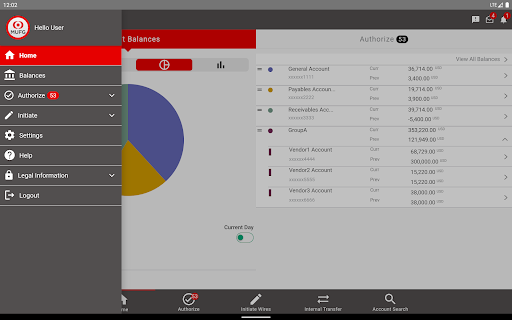

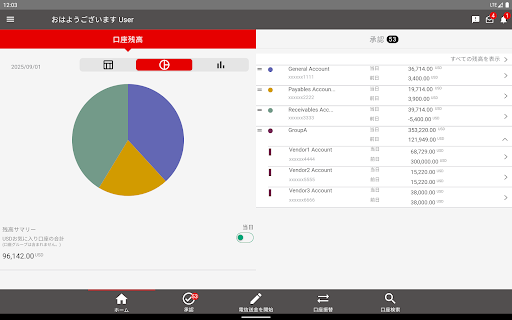

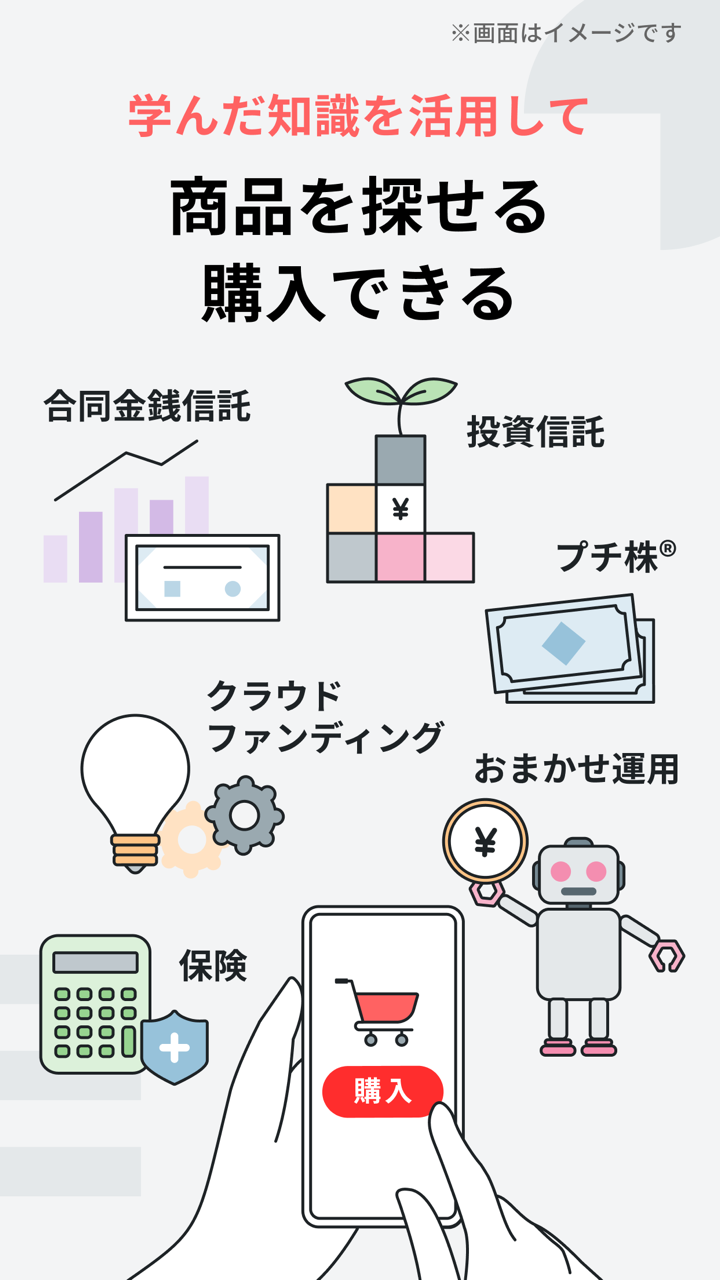

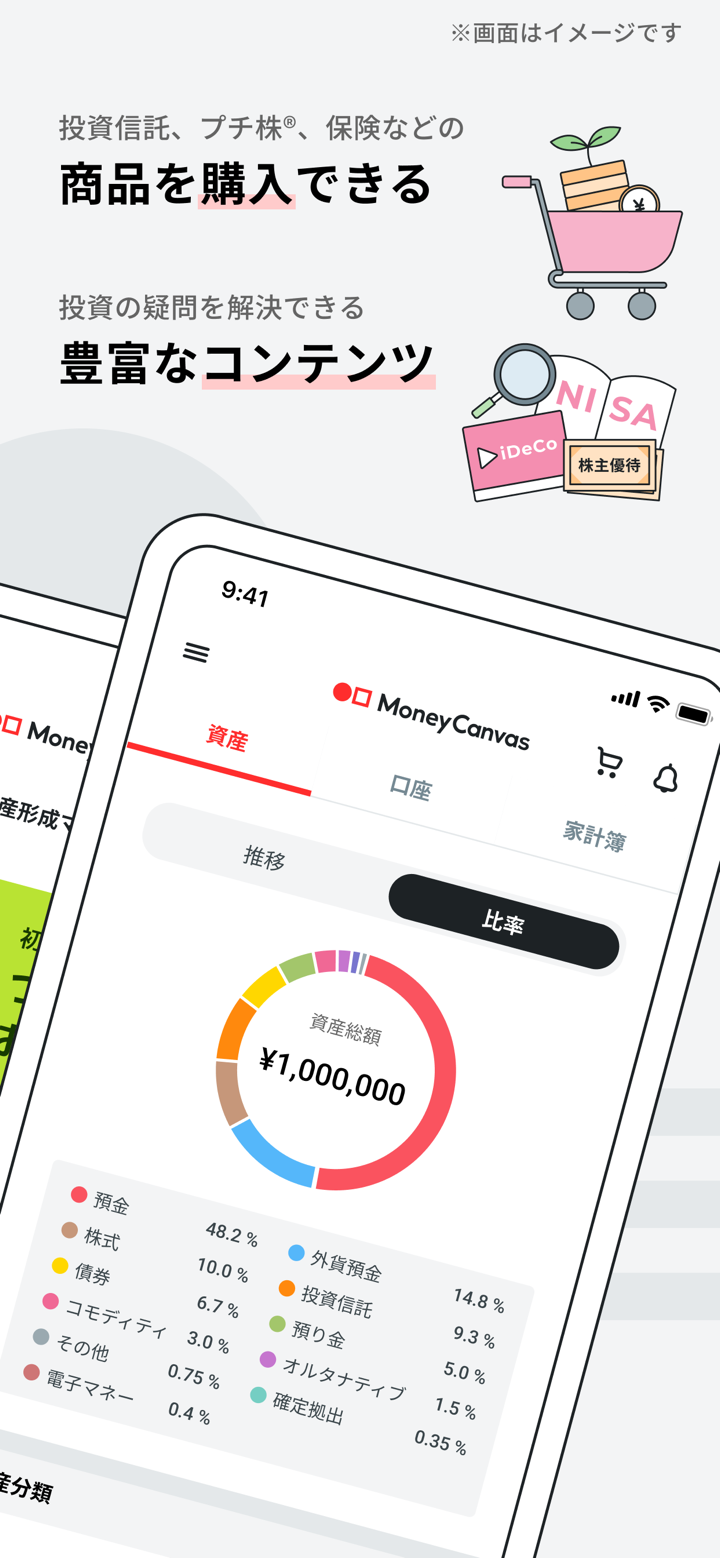

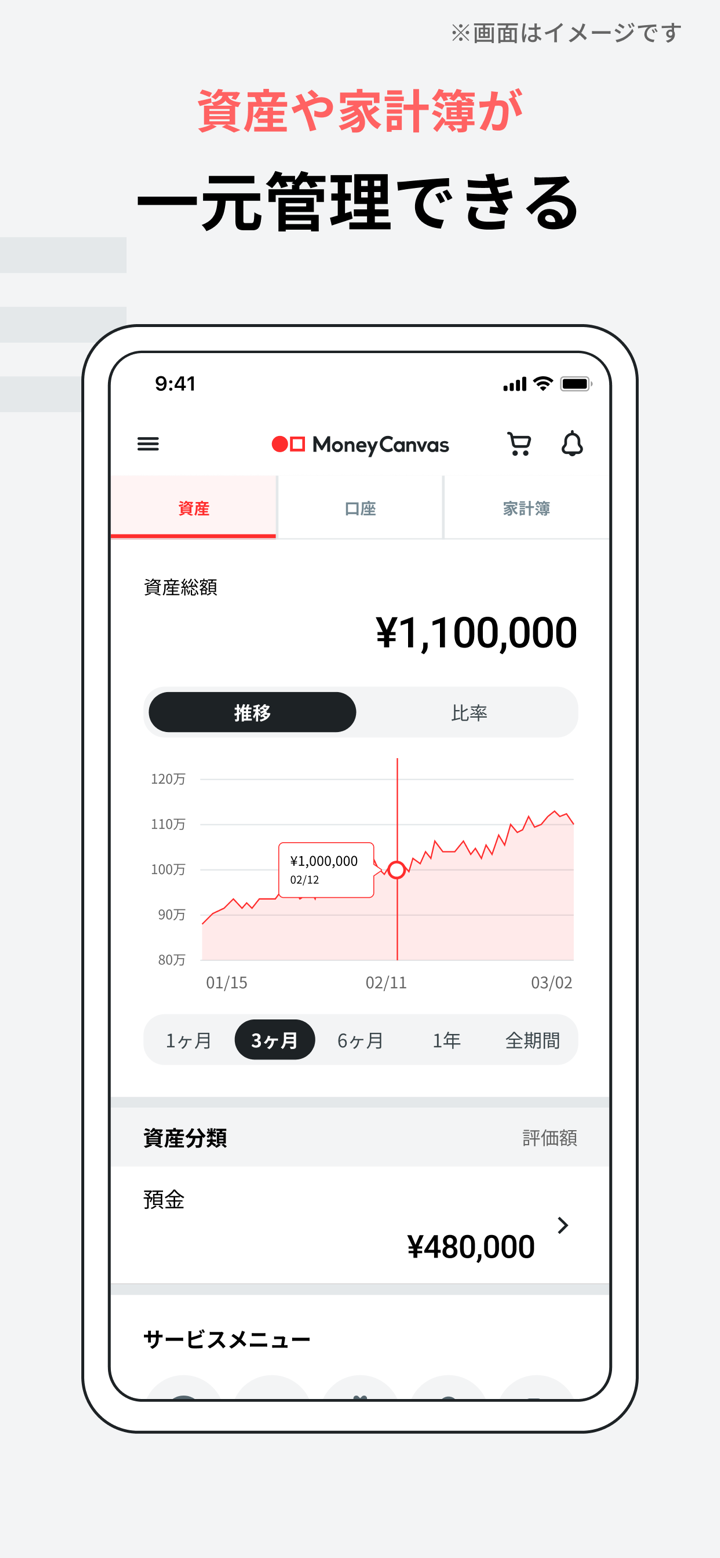

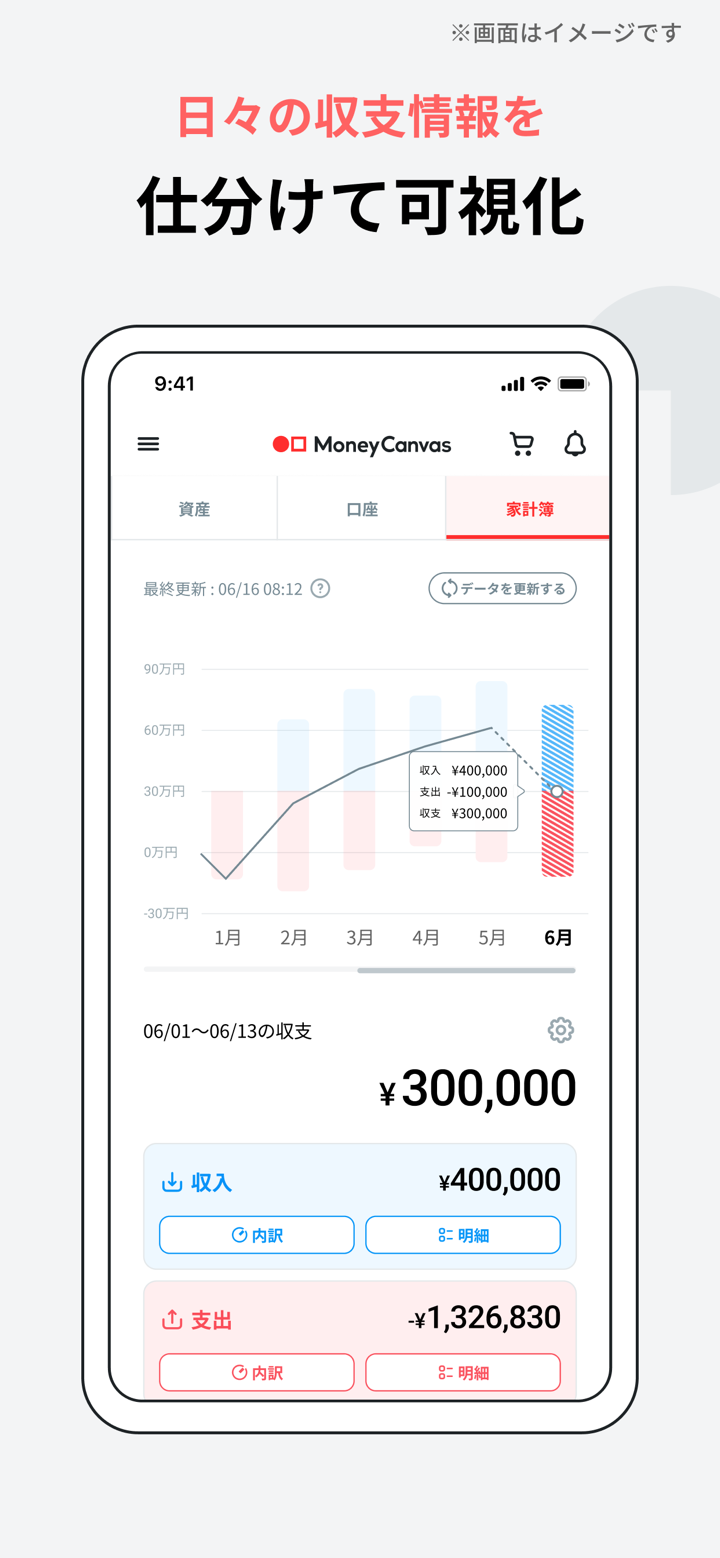

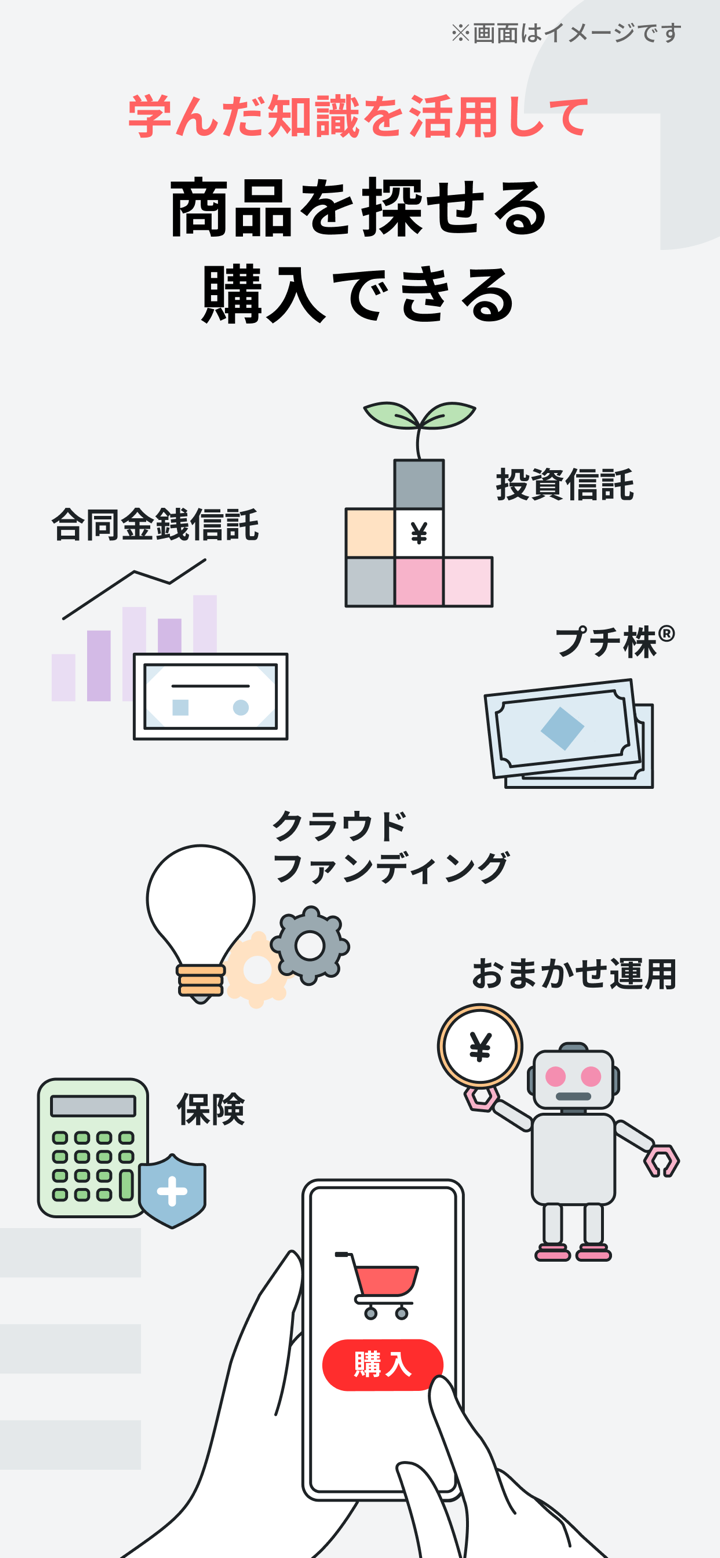

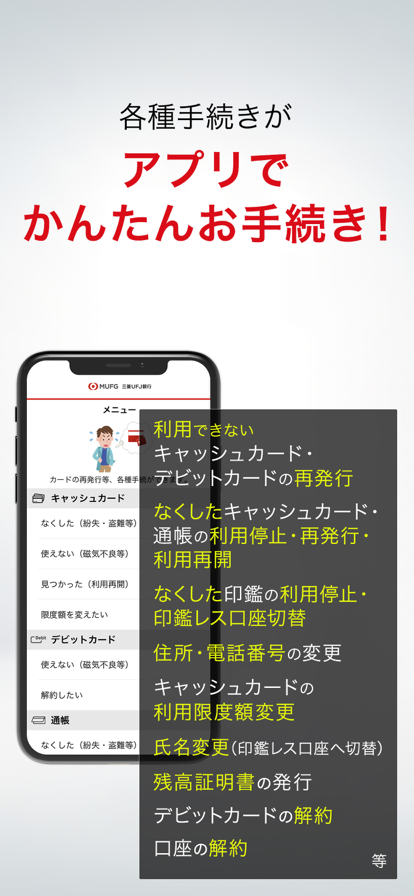

| 서비스 | 투자자 서비스, 자산 관리, 부동산 및 주식 이전 기관 |

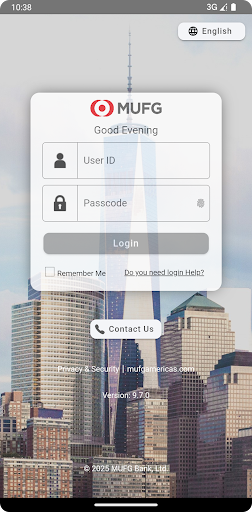

| 고객 지원 | 문의 양식 |

| 라인, 페이스북, 유튜브 | |

| 주소: 일본 도쿄, 치요다구 마루노우치 1-4-5 | |

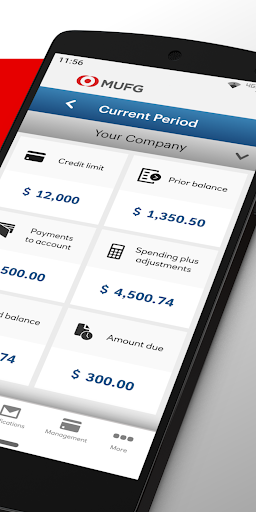

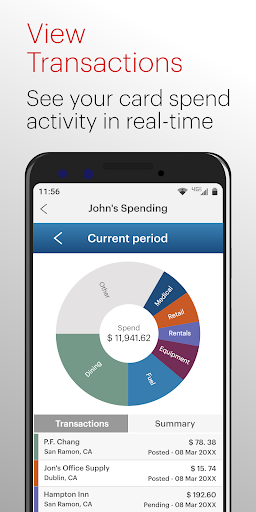

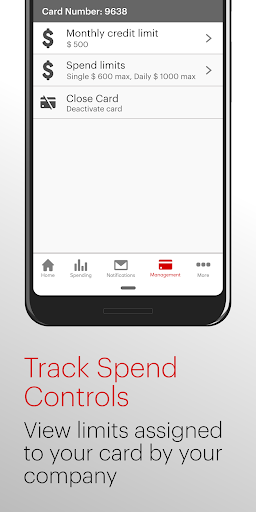

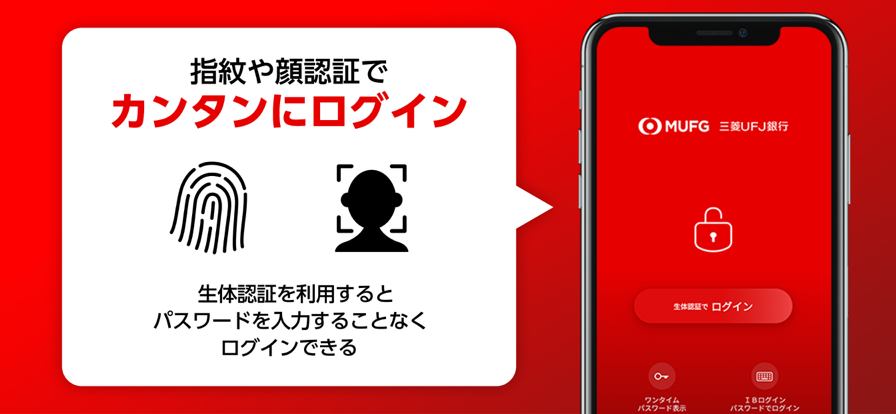

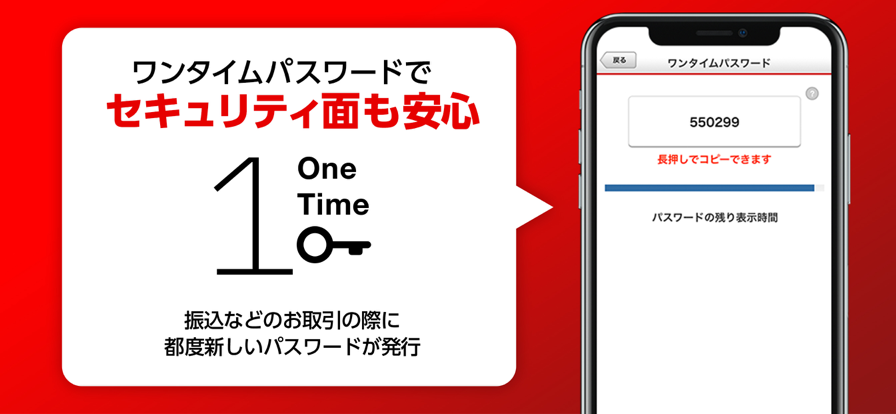

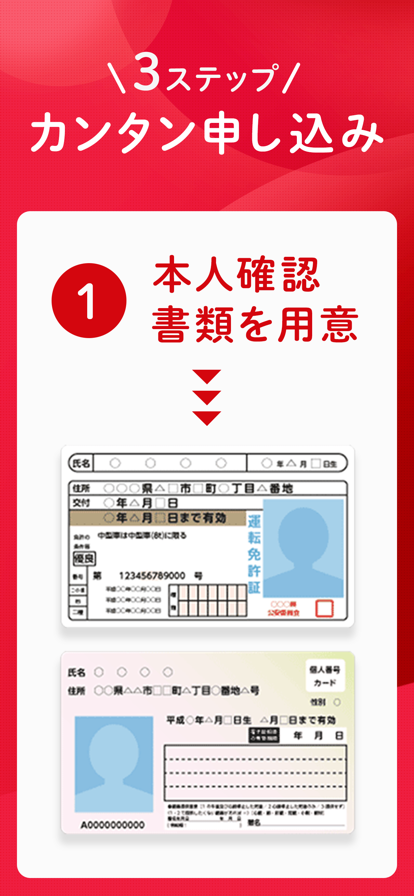

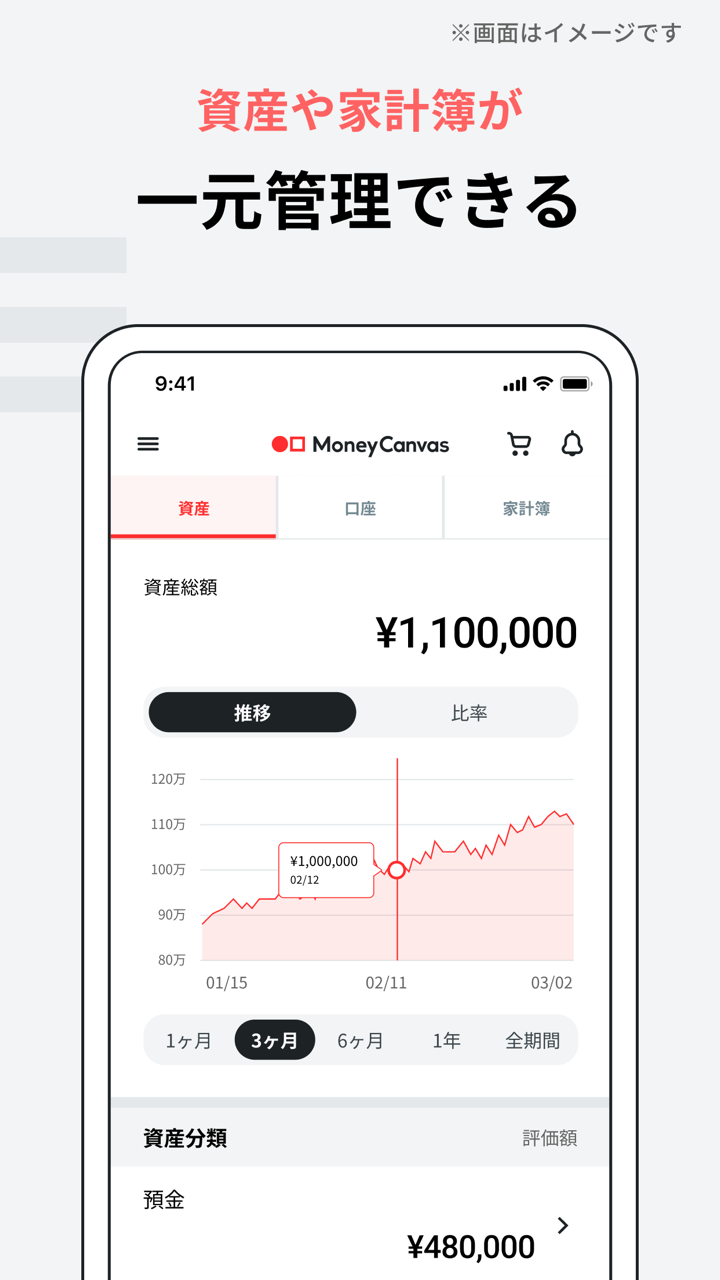

2001년에 설립된 Mitsubishi UFJ Financial Group (MUFG)은 세계에서 가장 크고 다양한 금융 그룹 중 하나입니다. 그룹의 주식은 도쿄, 나고야 및 뉴욕 증권 거래소에 상장되어 있습니다. MUFG의 서비스에는 상업 은행, 신탁 은행, 증권, 신용 카드, 소비자 금융, 자산 관리, 리스 등 다양한 금융 서비스 분야가 포함됩니다. 그룹은 일본 은행 중 가장 큰 해외 네트워크를 보유하며, 유니온 은행을 포함한 50개 이상의 국가에 사무실과 자회사를 두고 있습니다.

장단점

| 장점 | 단점 |

| 긴 역사 | 직접 연락처 없음 |

| FCA 및 LFSA 규제 | |

| 다양한 서비스 제공 |

MUFG이 신뢰할 만한가요?

네. MUFG은 신뢰할 수 있는 회사입니다. 금융행정청(FCA)와 Labuan 금융서비스청(LFSA)의 규제를 받고 있습니다.

| 규제 상태 | 규제됨 |

| 규제 기관 | 금융행정청(FCA) |

| 라이선스 기관 | Mitsubishi UFJ Trust and Banking Corporation |

| 라이선스 유형 | 마켓 메이킹 (MM) |

| 라이선스 번호 | 124708 |

| 규제 상태 | 규제됨 |

| 규제 기관 | Labuan 금융서비스청(LFSA) |

| 라이선스 기관 | MUFG 은행, Labuan 지점 |

| 라이선스 유형 | 마켓 메이킹 (MM) |

| 라이선스 번호 | 미발표 |

서비스

| 서비스 | 지원됨 |

| 투자자 서비스 | ✔ |

| 자산 관리 | ✔ |

| 부동산 | ✔ |

| 주식 이전 기관 | ✔ |