Şirket özeti

| MUFG İnceleme Özeti | |

| Kuruluş Yılı | 2001 |

| Kayıtlı Ülke/Bölge | Japonya |

| Regülasyon | FCA, LFSA |

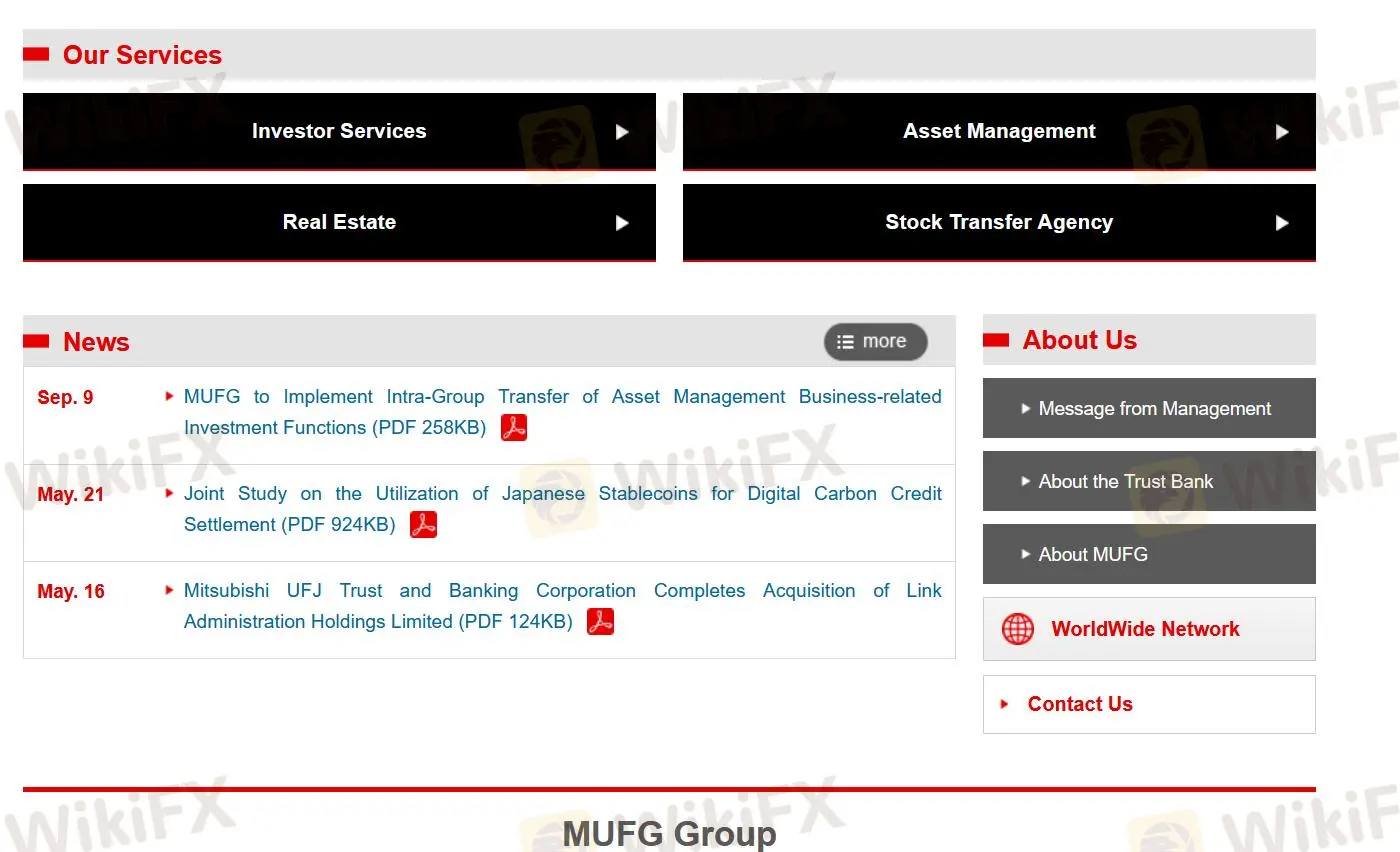

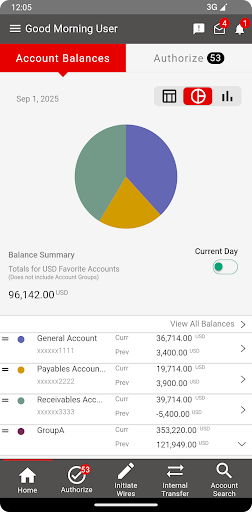

| Hizmetler | Yatırımcı hizmetleri, Varlık yönetimi, Gayrimenkul ve Hisse senedi transfer ajansı |

| Müşteri Desteği | İletişim formu |

| Line, Facebook, Youtube | |

| Adres: 1-4-5, Marunouchi, Chiyoda-ku, Tokyo, Japonya | |

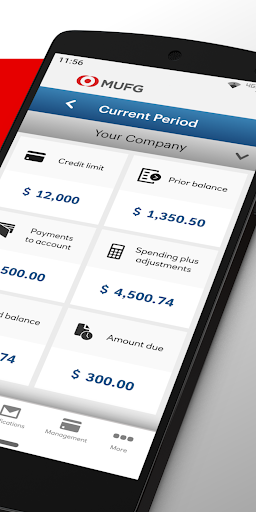

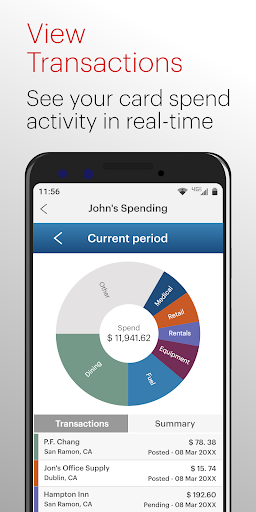

2001 yılında kurulan Mitsubishi UFJ Financial Group (MUFG), dünyanın en büyük ve en çeşitlendirilmiş finansal gruplarından biridir. Grubun hisseleri Tokyo, Nagoya ve New York borsalarında işlem görmektedir. MUFG'nin hizmetleri arasında ticari bankacılık, güven bankacılığı, menkul kıymetler, kredi kartları, tüketici finansmanı, varlık yönetimi, leasing ve daha birçok finansal hizmet alanı bulunmaktadır. Grup, Japon bankaları arasında en büyük yurtdışı ağına sahiptir ve 50'den fazla ülkede Union Bank dahil olmak üzere ofisler ve iştiraklerden oluşmaktadır.

Artıları ve Eksileri

| Artıları | Eksileri |

| Uzun geçmiş | Doğrudan iletişim kanalları yok |

| FCA ve LFSA tarafından düzenlenir | |

| Çeşitli hizmetler sunulur |

MUFG Güvenilir mi?

Evet. MUFG saygın bir şirkettir. Finansal İdare Kurumu (FCA) ve Labuan Finansal Hizmetler Otoritesi (LFSA) düzenlemesi altında faaliyet göstermektedir.

| Düzenleyici Durumu | Düzenlenmiş |

| Tarafından Düzenlenmiştir | Finansal İdare Kurumu (FCA) |

| Lisanslı Kuruluş | Mitsubishi UFJ Trust and Banking Corporation |

| Lisans Türü | Piyasa Yapıcılığı (MM) |

| Lisans Numarası | 124708 |

| Düzenleyici Durumu | Düzenlenmiş |

| Tarafından Düzenlenmiştir | Labuan Finansal Hizmetler Otoritesi (LFSA) |

| Lisanslı Kuruluş | MUFG Bankası, Ltd., Labuan Şubesi |

| Lisans Türü | Piyasa Yapıcılığı (MM) |

| Lisans Numarası | Yayınlanmamış |

Hizmetler

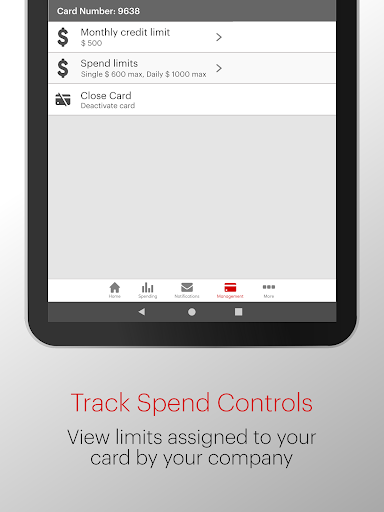

| Hizmetler | Desteklenir |

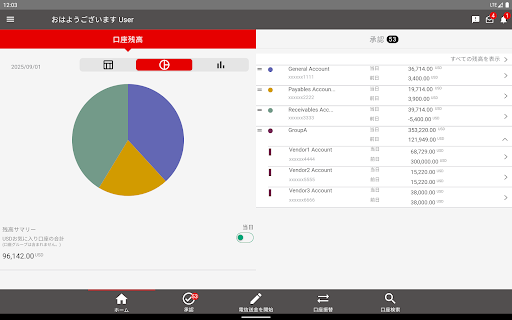

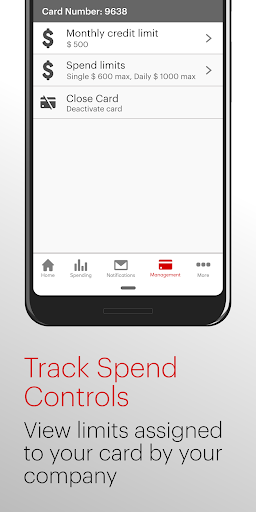

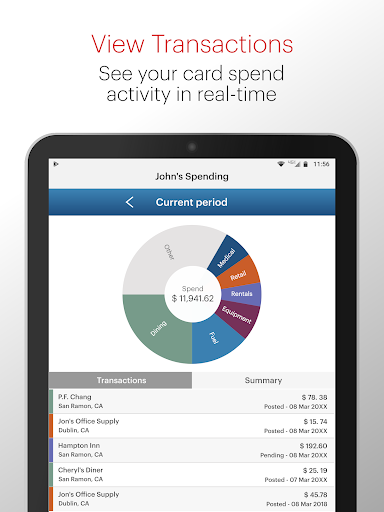

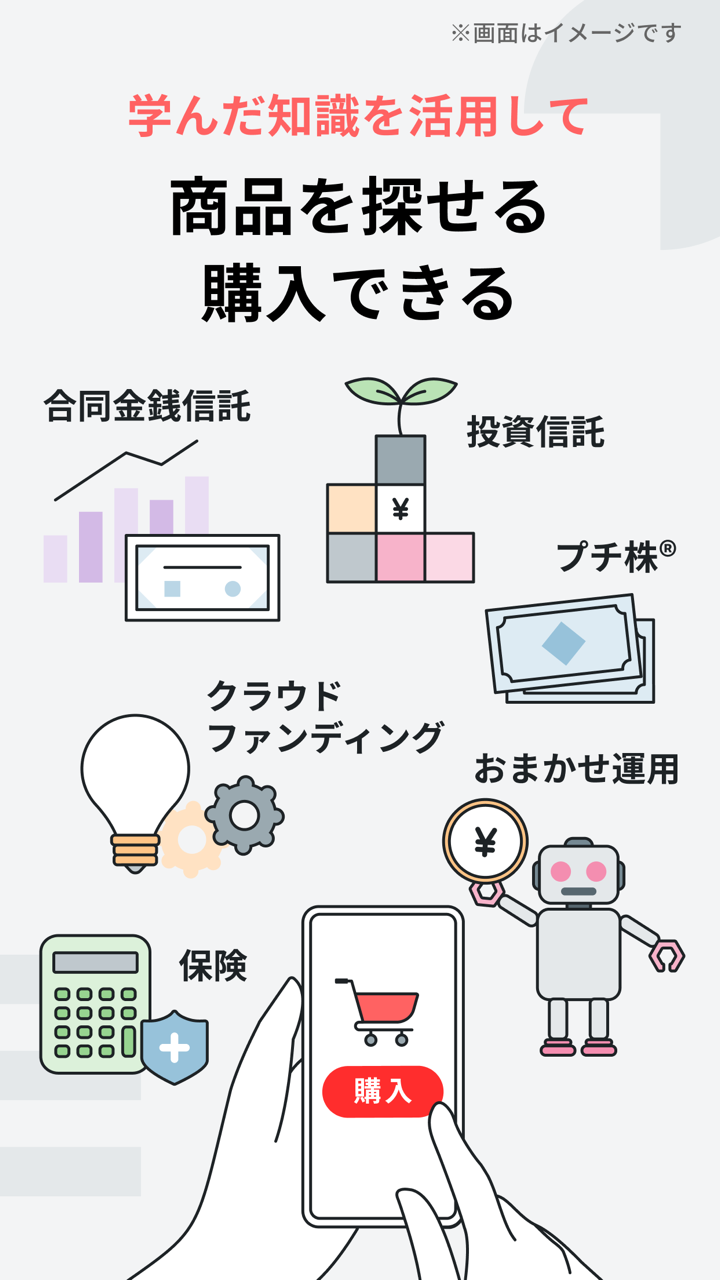

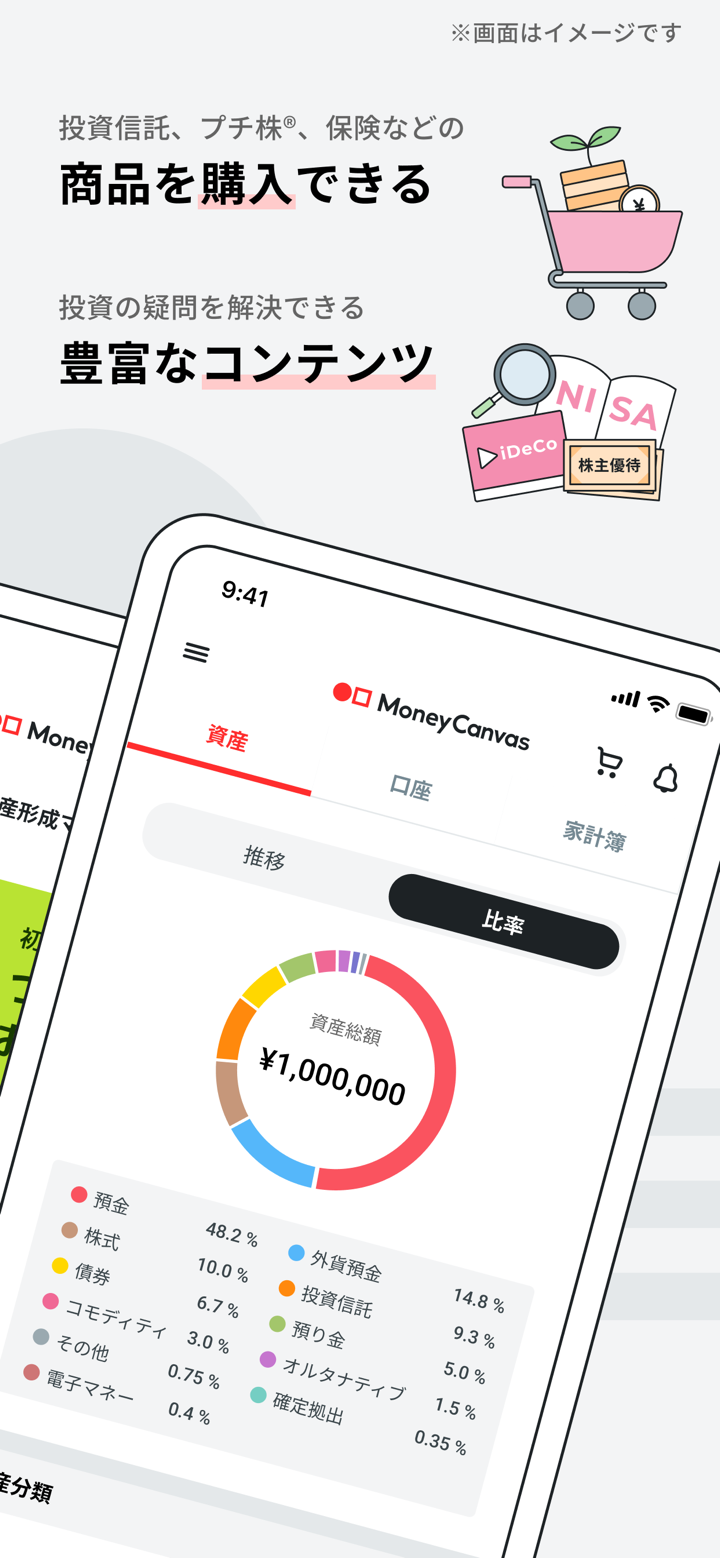

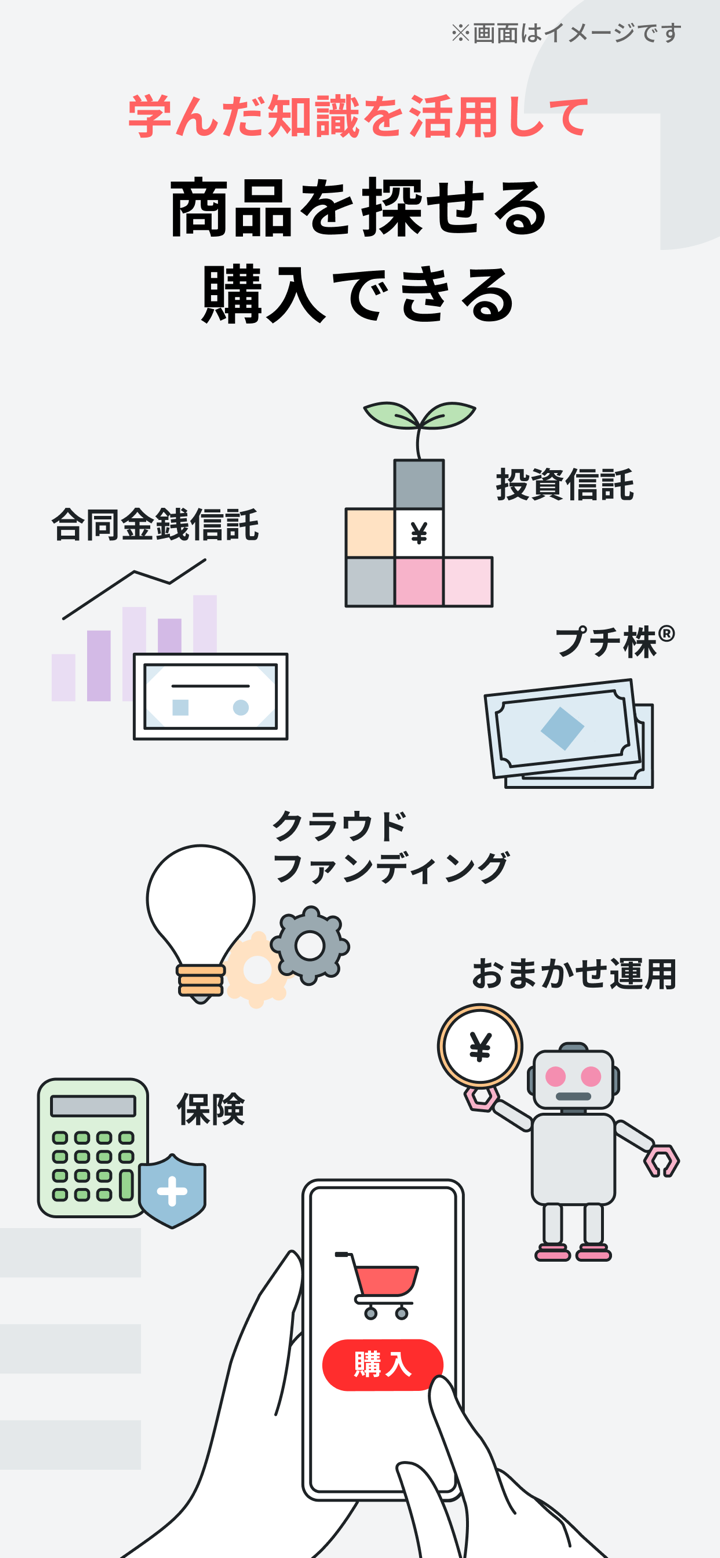

| Yatırımcı Hizmetleri | ✔ |

| Varlık yönetimi | ✔ |

| Gayrimenkul | ✔ |

| Hisse senedi transfer ajansı | ✔ |