مقدمة عن الشركة

| HUA TAI ملخص المراجعة | |

| تأسست | 1991 |

| البلد/المنطقة المسجلة | الصين |

| التنظيم | CFFEX |

| أدوات السوق | الأسهم، الخيارات، المعادن الثمينة |

| الخدمات | خدمات حفظ الأصول، خدمات تفويض العمليات |

| نوع الحساب | حساب حقيقي |

| الرافعة المالية | حتى 1:2 |

| منصة التداول | MD5، تطبيق Zhangle |

| طريقة الدفع | تحويل بنكي |

| دعم العملاء | هاتف: 955597 |

| البريد الإلكتروني: 95597@htsc.com | |

| العنوان الفعلي: رقم 228، طريق جيانغدونغ المتوسط، نانجينغ، مقاطعة جيانغسو، الصين | |

معلومات HUA TAI

تأسست HUA TAI في عام 1991، وهي وسيط مسجل في الصين. تغطي أدوات التداول التي يوفرها الأسهم والخيارات والمعادن الثمينة. يتم تنظيمها بواسطة CFFEX.

المزايا والعيوب

| المزايا | العيوب |

| منظمة | لا توجد معلومات عن العمولة |

| مجموعة واسعة من أدوات التداول | لا توجد معلومات واضحة عن الحد الأدنى للإيداع |

| تقدم خدمات متعددة | تقدم أنواع محدودة من الحسابات |

| لا يوجد حساب تجريبي | |

| لا يدعم MT4 |

هل HUA TAI شرعي؟

HUA TAI م regule par CFFEX في الصين. حالتها الحالية هي م regule.

| البلد المنظم | السلطة المنظمة | الكيان المنظم | نوع الترخيص | رقم الترخيص | الحالة الحالية |

| الصين | CFFEX | 华泰期货有限公司 | ترخيص العقود الآجلة | 0011 | م regule |

ما يمكنني التداول به على HUA TAI؟

HUA TAI يقدم للتجار الأسهم والخيارات والمعادن الثمينة للتداول.

| الأدوات التجارية | مدعوم |

| الأسهم | ✔ |

| الخيارات | ✔ |

| المعادن الثمينة | ✔ |

| الفوركس | ❌ |

| السلع | ❌ |

| المؤشرات | ❌ |

| العقود الآجلة | ❌ |

الخدمات

HUA TAI يقدم خدمات حفظ الأصول وخدمات تفويض العمليات. تشمل خدمات حفظ الأصول حفظ الأصول وحساب القيمة والإشراف على الاستثمار وتسوية الأموال. تشمل خدمات تفويض العمليات

تسجيل المساهمة والإشراف على الحساب وحساب القيمة والكشف عن المعلومات.

أنواع الحسابات

HUA TAI يقدم نوعًا واحدًا من الحساب للتجار - حساب حقيقي.

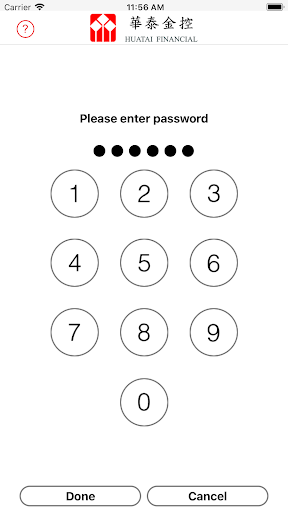

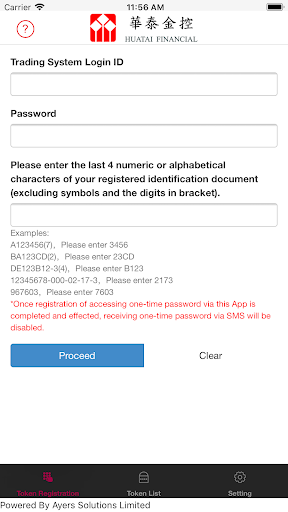

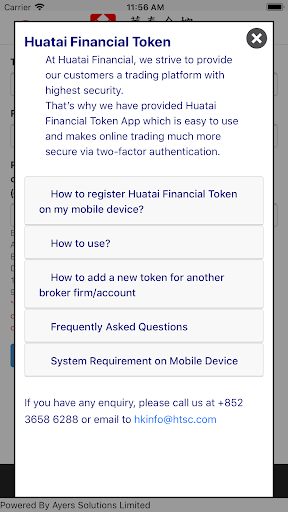

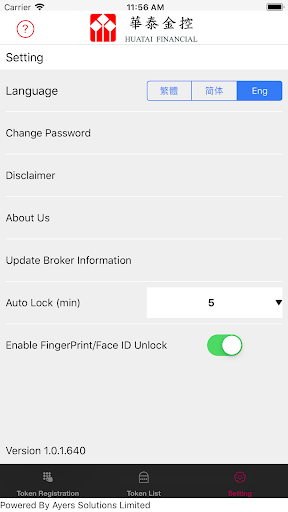

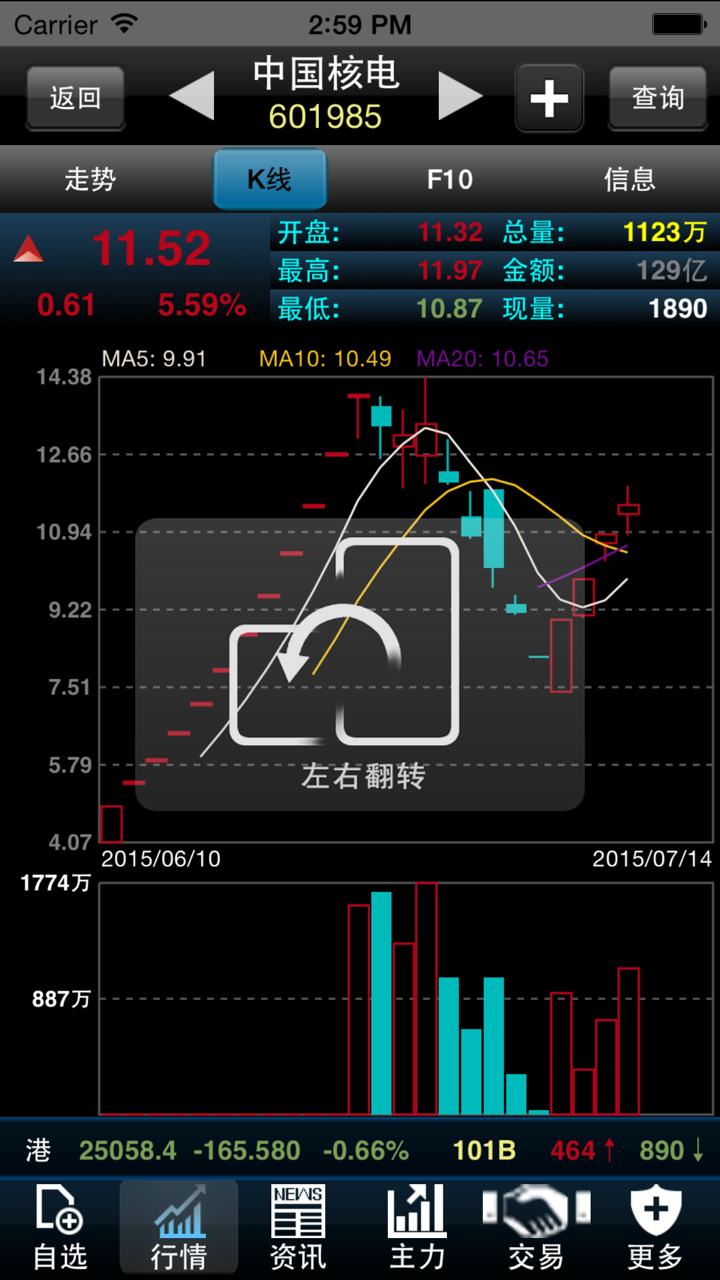

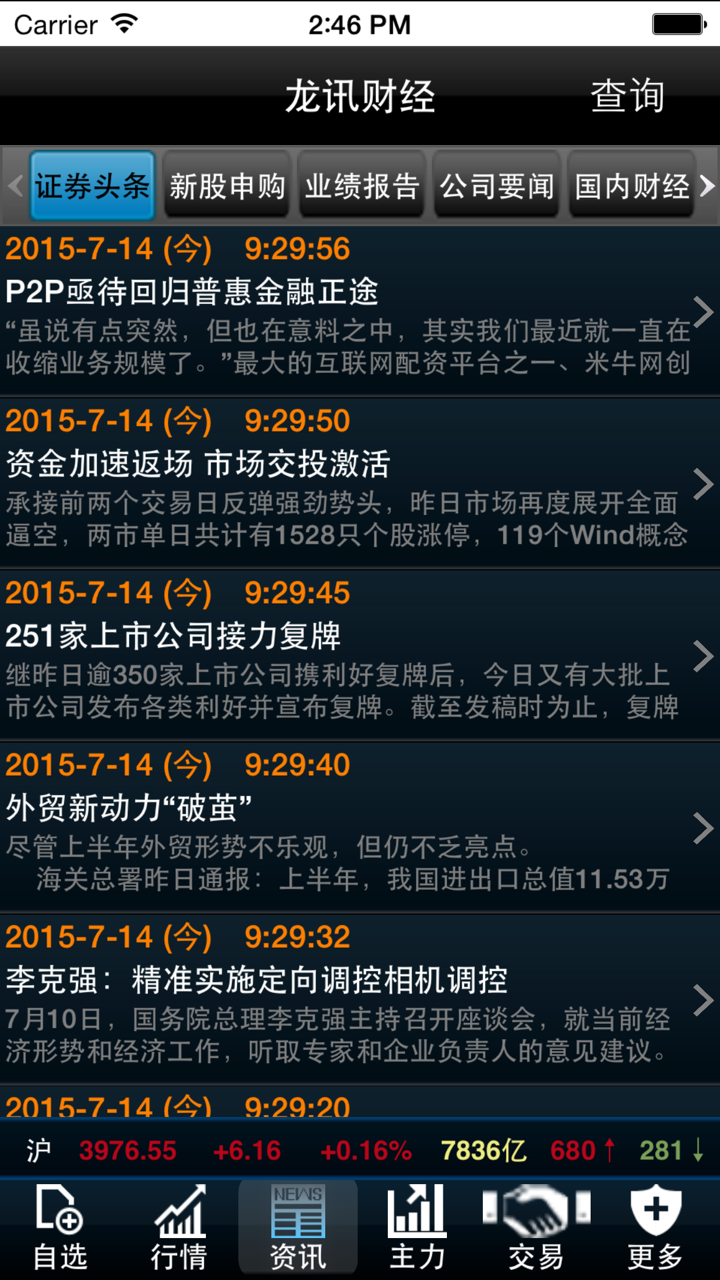

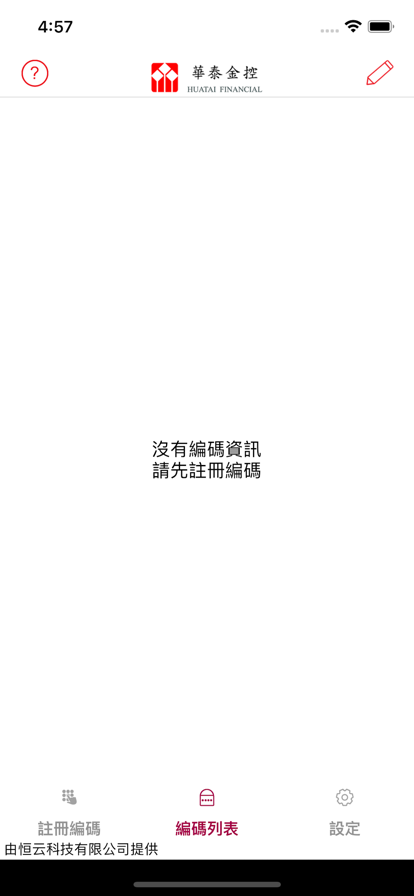

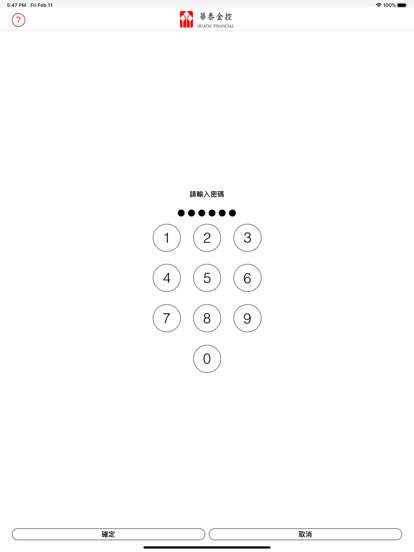

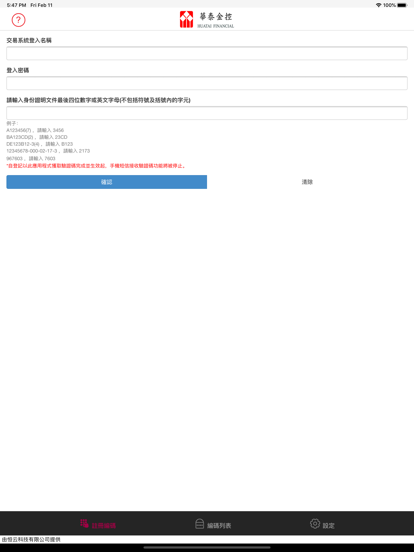

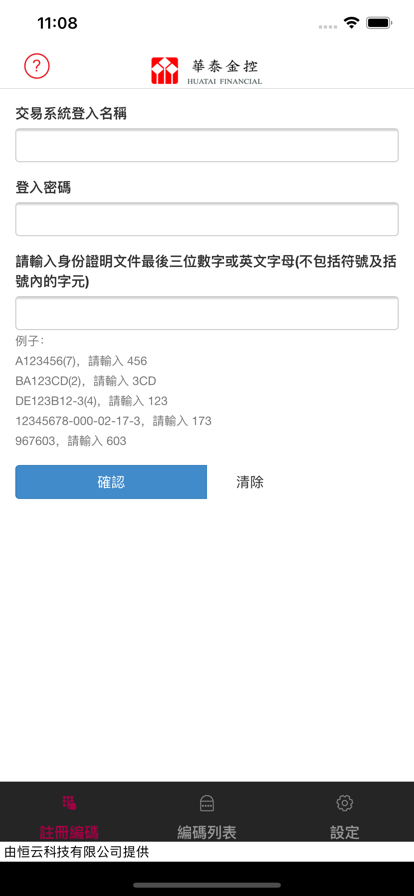

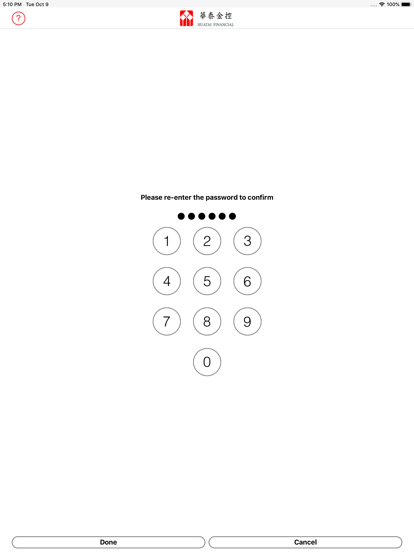

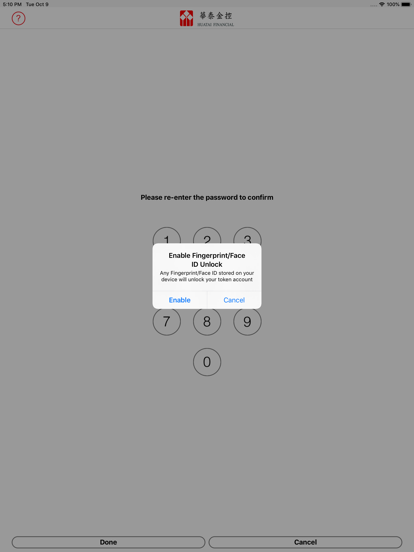

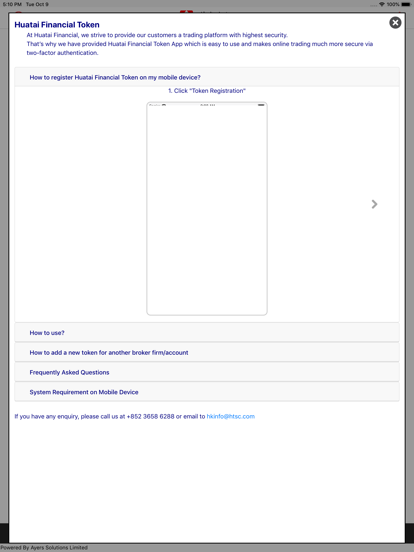

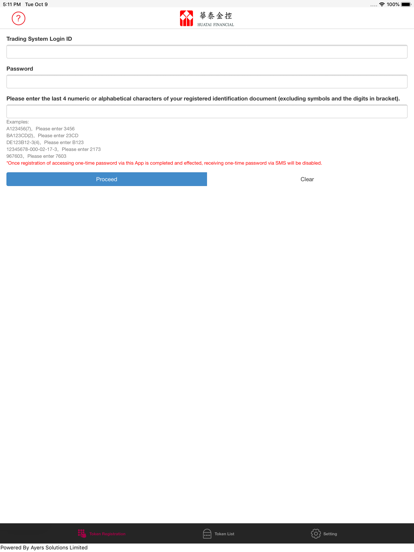

منصة التداول

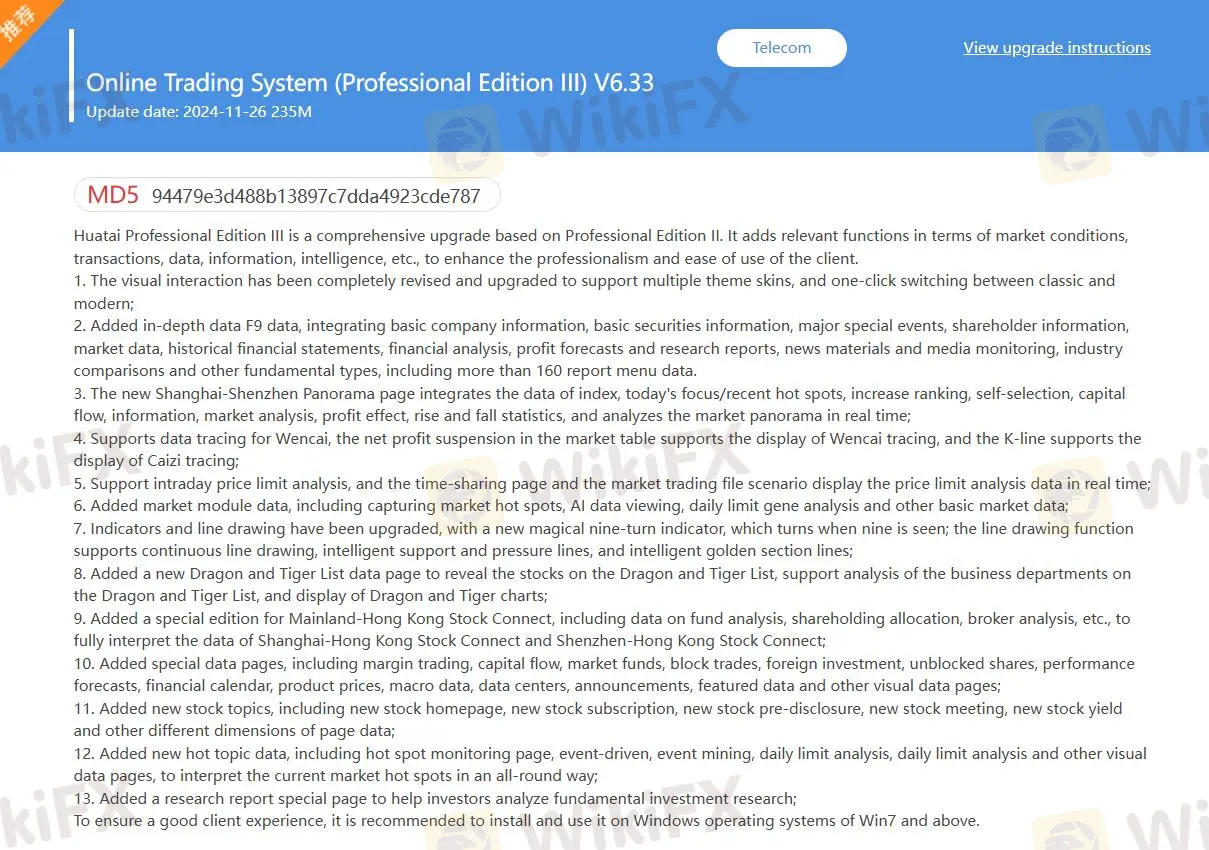

منصات التداول في HUA TAI هي MD5 وتطبيق Zhangle، والتي تدعم التجار على أجهزة الكمبيوتر وماك وأجهزة iPhone و Android.

| منصة التداول | مدعوم | الأجهزة المتاحة |

| MD5 | ✔ | الويب |

| تطبيق Zhangle | ✔ | الجوال |

| MT4 Margin WebTrader | ❌ | |

| MT5 | ❌ |

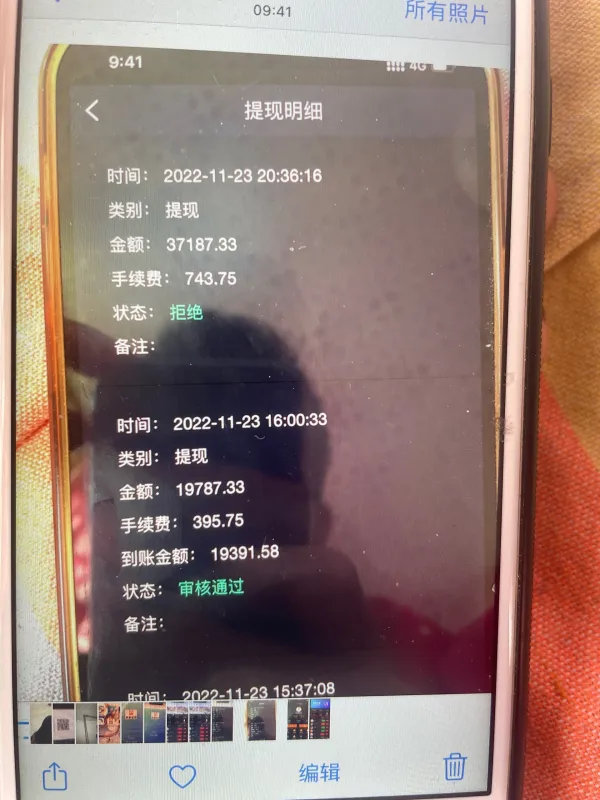

الإيداع والسحب

طريقة الإيداع والسحب هي التحويل البنكي. يدعم بطاقات الخصم التالية ، مثل بطاقة ICBC وبطاقة ABC وبطاقة CCB وبطاقة BOC ، إلخ.