Buod ng kumpanya

| HUA TAI Buod ng Pagsusuri | |

| Itinatag | 1991 |

| Rehistradong Bansa/Rehiyon | China |

| Regulasyon | CFFEX |

| Mga Instrumento sa Merkado | Mga stock, mga opsyon, mga pambihirang metal |

| Mga Serbisyo | Mga serbisyong pangangalaga ng ari-arian, mga serbisyong pagpapalabas ng operasyon |

| Uri ng Account | Live Account |

| Leverage | Hanggang 1:2 |

| Plataporma ng Pagkalakalan | MD5, Zhangle App |

| Pamamaraan ng Pagbabayad | Bank Transfer |

| Suporta sa Customer | Telepono: 955597 |

| Email: 95597@htsc.com | |

| Tirahan: No. 228, Jiangdong Middle Road, Nanjing, Jiangsu Province, China | |

Impormasyon tungkol sa HUA TAI

HUA TAI, na itinatag noong 1991, ay isang brokerage na rehistrado sa China. Ang mga instrumento sa pagkalakalan na ibinibigay nito ay sumasaklaw sa mga stock, mga opsyon, mga pambihirang metal. Ito ay regulado ng CFFEX.

Mga Kalamangan at Disadvantages

| Mga Kalamangan | Mga Disadvantages |

| Regulado | Walang impormasyon sa komisyon |

| Malawak na hanay ng mga instrumento sa pagkalakalan | Walang malinaw na impormasyon tungkol sa minimum na deposito |

| Maraming mga inaalok na serbisyo | Limitadong uri ng account na inaalok |

| Walang demo account | |

| Hindi sinusuportahan ang MT4 |

Totoo ba ang HUA TAI?

Ang HUA TAI ay regulado ng CFFEX sa China. Ang kasalukuyang katayuan nito ay regulado.

| Rehistradong Bansa | Rehistradong Pangasiwaan | Rehistradong Entidad | Uri ng Lisensya | Numero ng Lisensya | Kasalukuyang Katayuan |

| China | CFFEX | 华泰期货有限公司 | Futures License | 0011 | Regulado |

Ano ang Maaari Kong Ikalakal sa HUA TAI?

HUA TAI nag-aalok ng mga Stocks, options, at precious metals para sa mga mangangalakal.

| Mga Tradable Instruments | Supported |

| Stocks | ✔ |

| Options | ✔ |

| Precious metals | ✔ |

| Forex | ❌ |

| Commodities | ❌ |

| Indices | ❌ |

| Futures | ❌ |

Mga Serbisyo

HUA TAI nagbibigay ng mga serbisyong pangangalaga ng ari-arian, mga serbisyong pagpapalabas ng operasyon. Kasama sa mga serbisyong pangangalaga ng ari-arian ang pangangalaga ng ari-arian, pagtatasa ng halaga, pagsubaybay sa pamumuhunan, paglilipat ng pondo. Kasama sa mga serbisyong pagpapalabas ng operasyon

ang pagpaparehistro ng mga shares, pagsubaybay sa account, pagtatasa ng halaga, pagpapahayag ng impormasyon.

Uri ng Account

HUA TAI nag-aalok ng 1 uri ng account sa mga mangangalakal - Live Account.

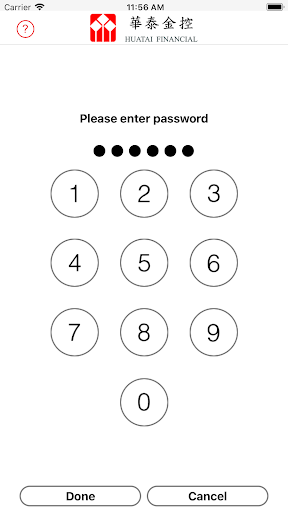

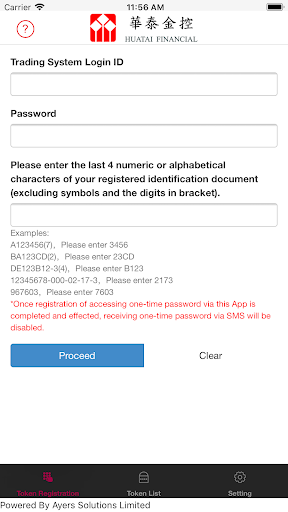

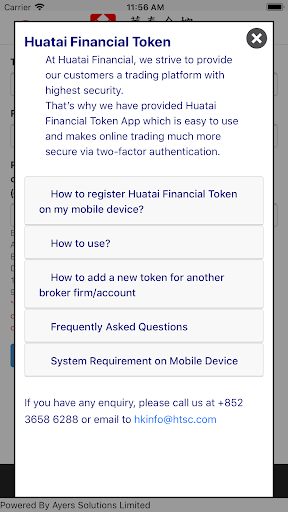

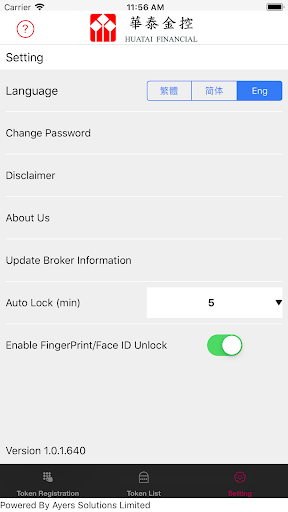

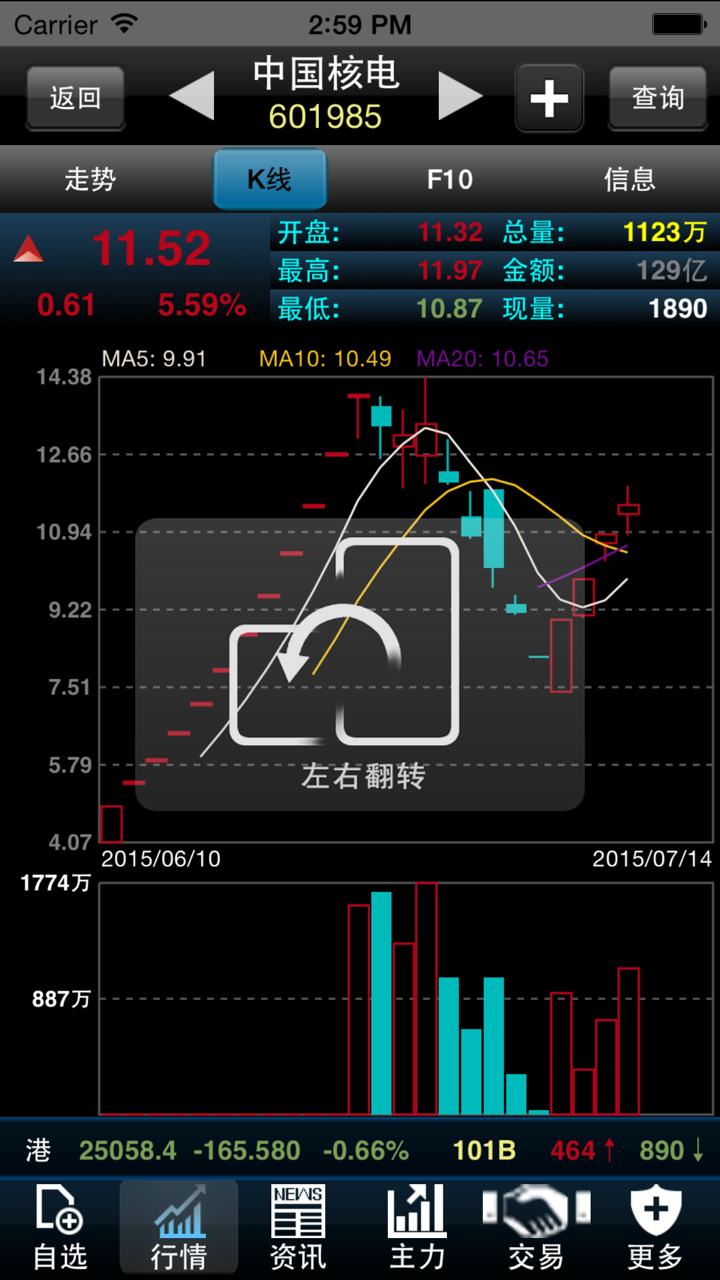

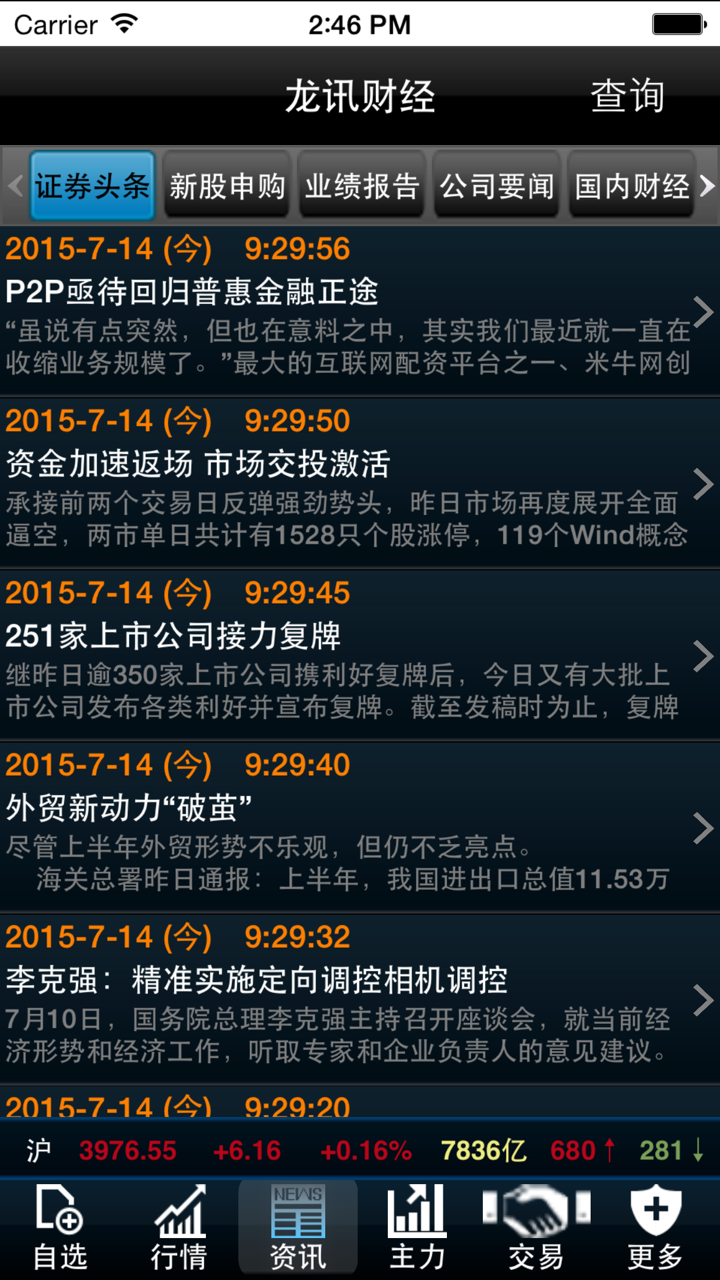

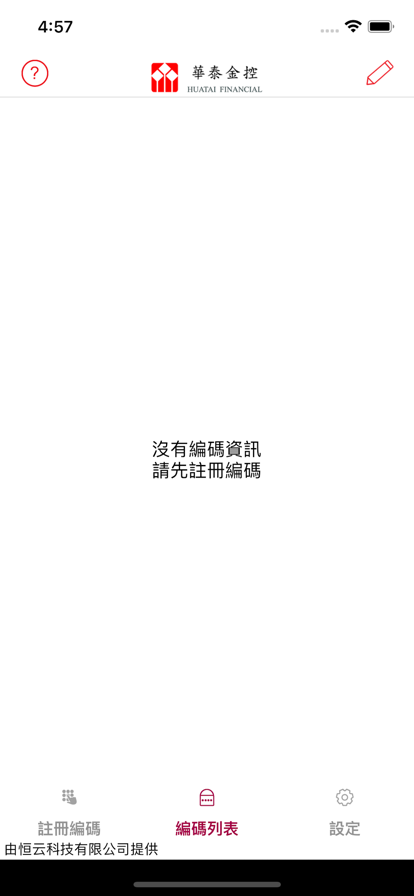

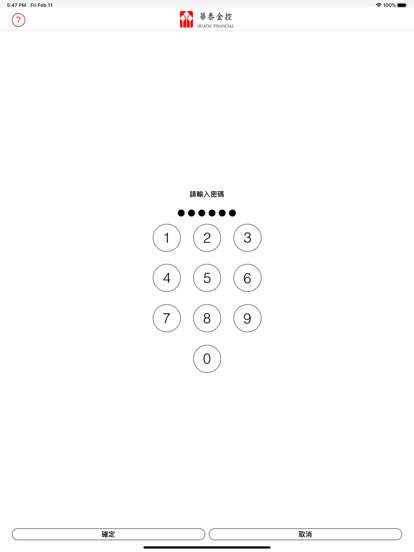

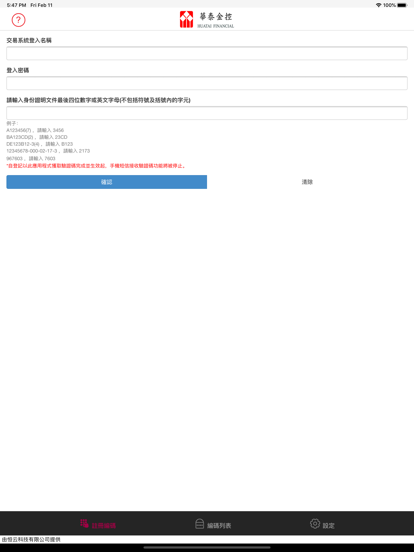

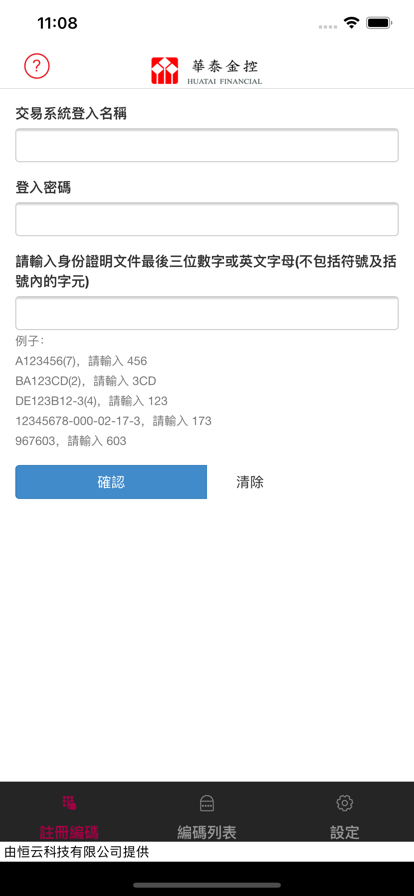

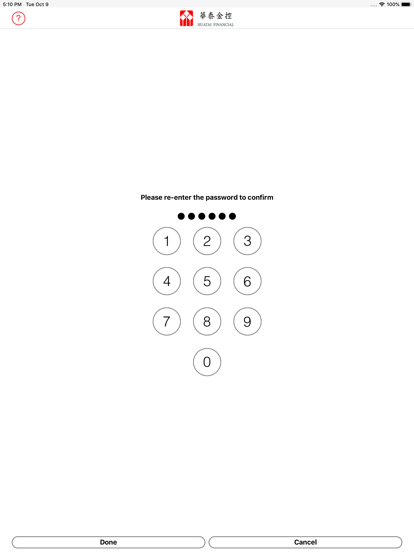

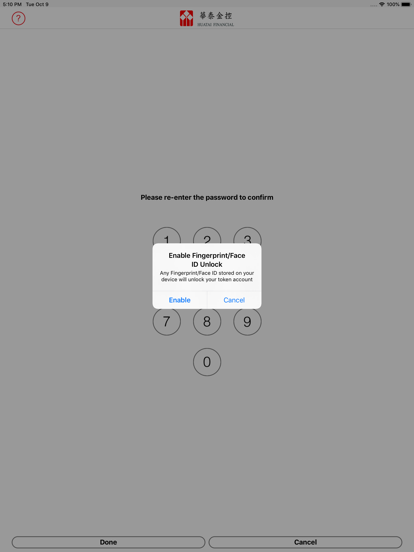

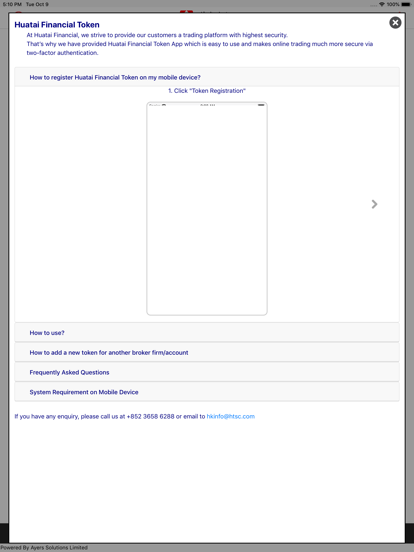

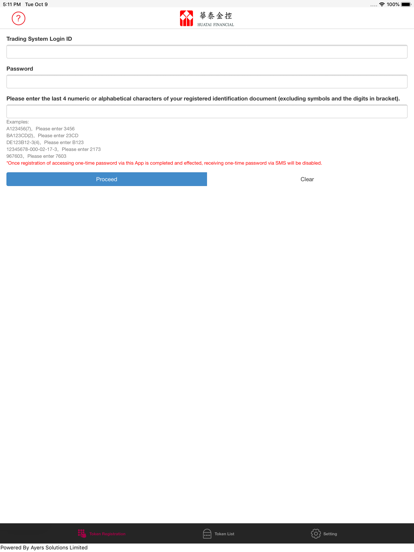

Platform ng Pagkalakalan

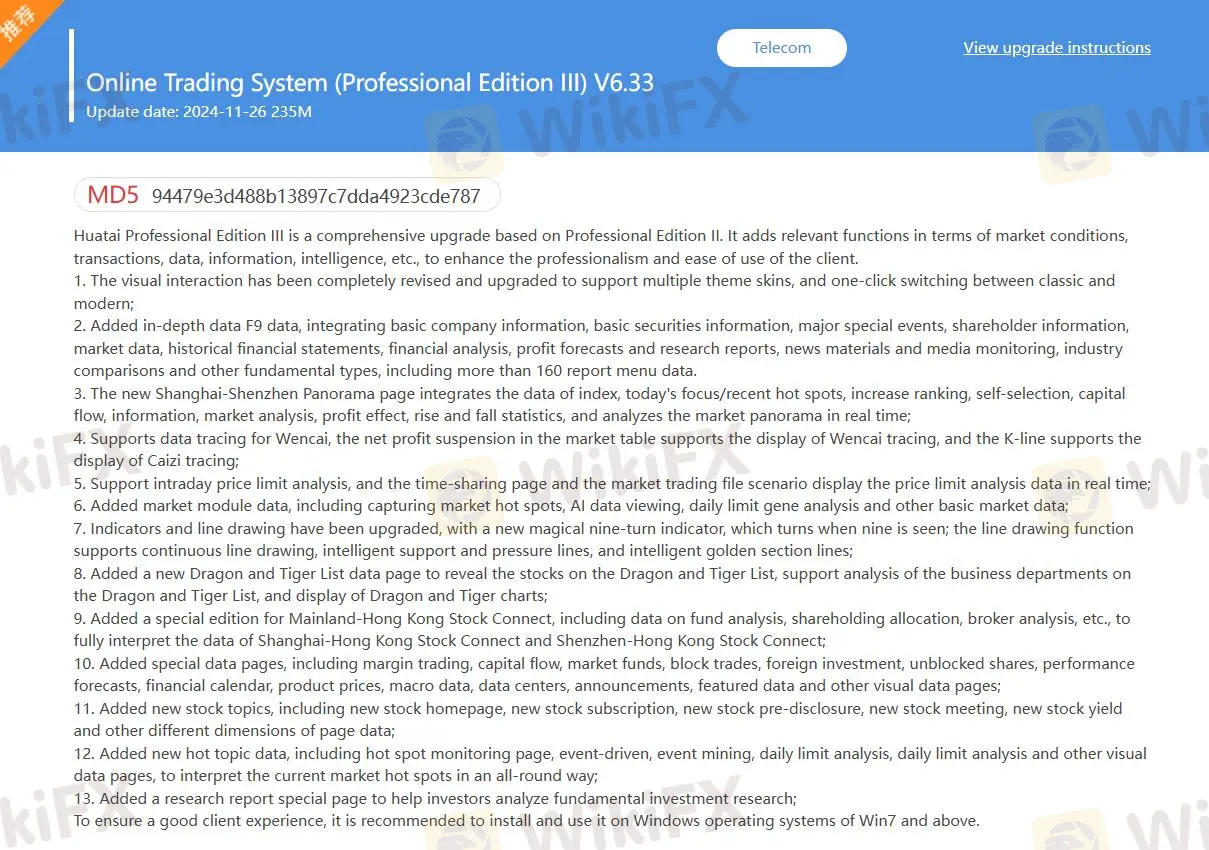

Ang mga platform ng pagkalakalan ng HUA TAI ay ang MD5, Zhangle App, na sumusuporta sa mga mangangalakal sa PC, Mac, iPhone, at Android.

| Platform ng Pagkalakalan | Supported | Available Devices |

| MD5 | ✔ | Web |

| Zhangle App | ✔ | Mobile |

| MT4 Margin WebTrader | ❌ | |

| MT5 | ❌ |

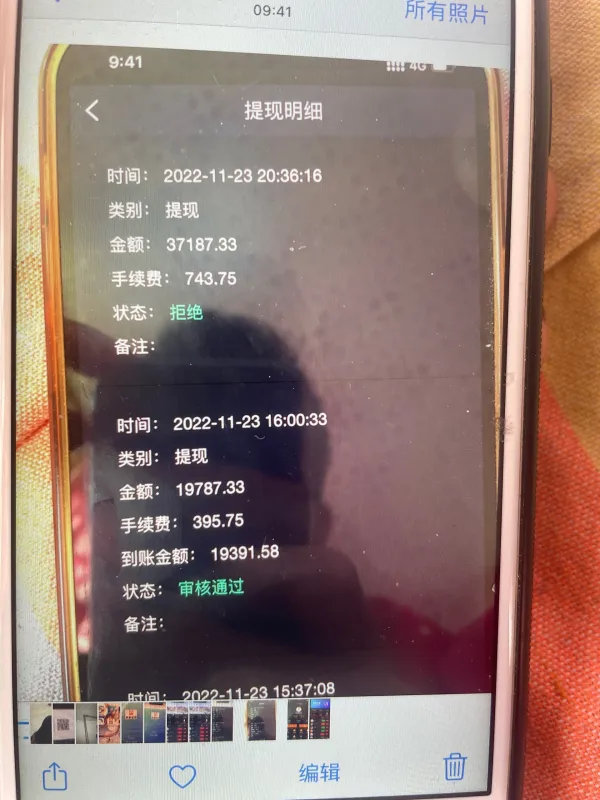

Pag-iimpok at Pag-withdraw

Ang paraan ng pag-iimpok at pag-withdraw nito ay pamamagitan ng bank transfer. Sinusuportahan nito ang mga sumusunod na debit card, tulad ng ICBC card, ABC card, CCB card, BOC card, at iba pa.