Resumo da empresa

| HUA TAI Resumo da Revisão | |

| Fundado | 1991 |

| País/Região Registrado | China |

| Regulação | CFFEX |

| Instrumentos de Mercado | Ações, opções, metais preciosos |

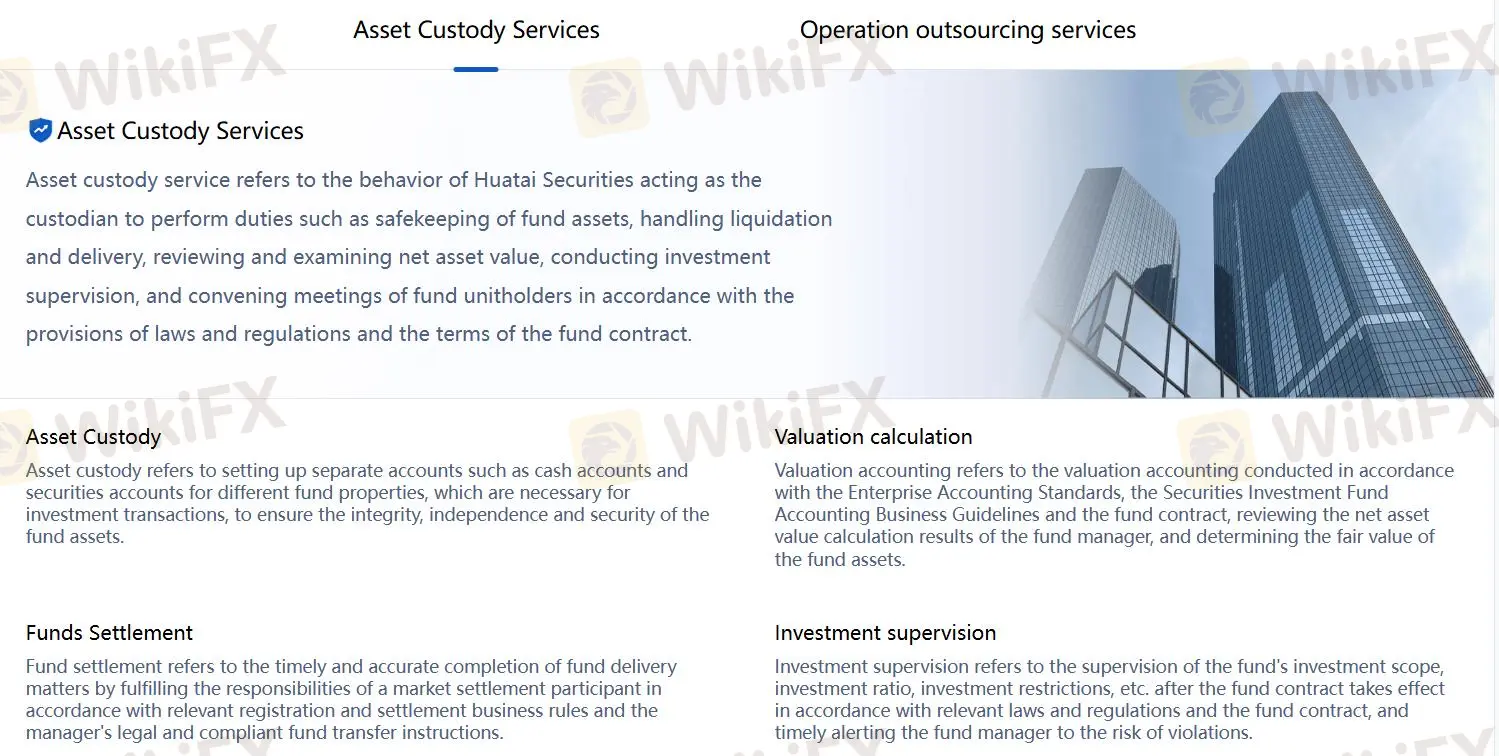

| Serviços | Serviços de custódia de ativos, serviços de terceirização de operações |

| Tipo de Conta | Conta Real |

| Alavancagem | Até 1:2 |

| Plataforma de Negociação | MD5, Zhangle App |

| Método de Pagamento | Transferência Bancária |

| Suporte ao Cliente | Telefone: 955597 |

| Email: 95597@htsc.com | |

| Endereço Físico: No. 228, Jiangdong Middle Road, Nanjing, Província de Jiangsu, China | |

Informações sobre HUA TAI

HUA TAI, fundado em 1991, é uma corretora registrada na China. Os instrumentos de negociação que ela oferece incluem ações, opções e metais preciosos. É regulamentada pela CFFEX.

Prós e Contras

| Prós | Contras |

| Regulamentado | Sem informações de comissão |

| Ampla variedade de instrumentos de negociação | Sem informações claras sobre o depósito mínimo |

| Vários serviços oferecidos | Tipos de conta limitados oferecidos |

| Sem conta demo | |

| Sem suporte para MT4 |

HUA TAI é Legítimo?

HUA TAI é regulamentado pela CFFEX na China. Seu status atual é regulamentado.

| País Regulamentado | Autoridade Regulamentada | Entidade Regulamentada | Tipo de Licença | Número de Licença | Status Atual |

| China | CFFEX | 华泰期货有限公司 | Licença de Futuros | 0011 | Regulamentado |

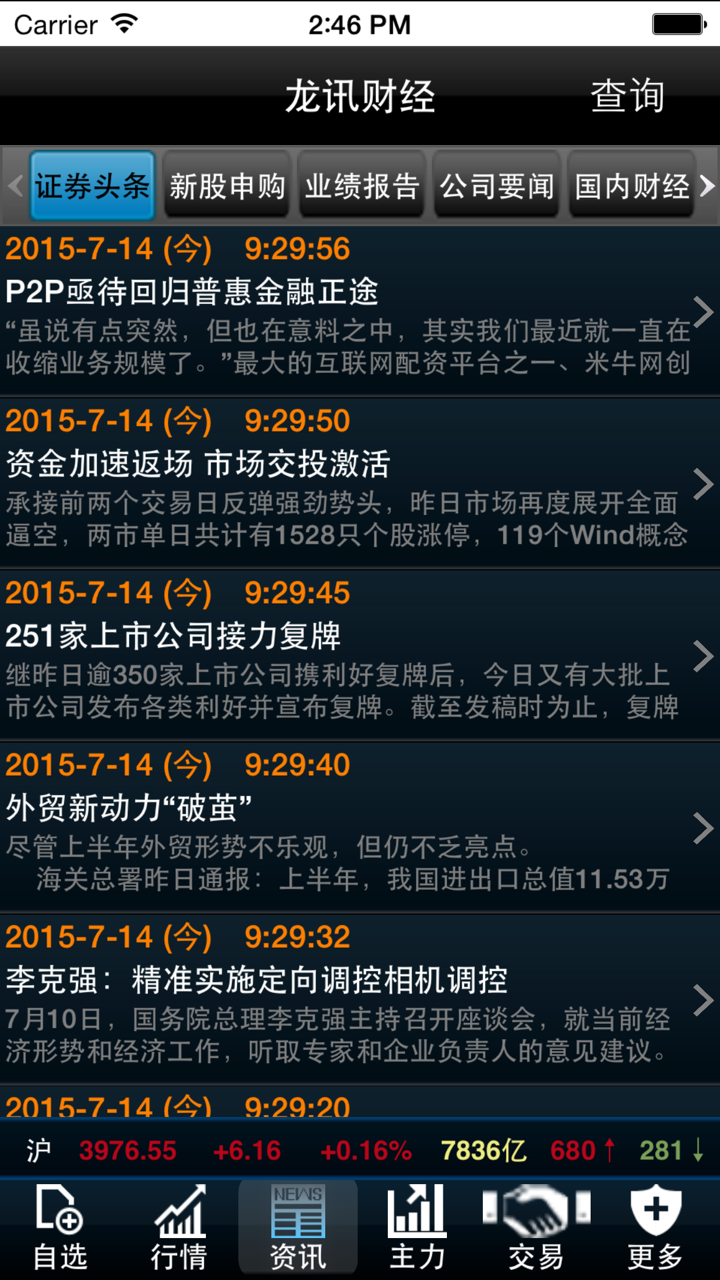

O que posso negociar na HUA TAI?

HUA TAI oferece aos traders ações, opções e metais preciosos para negociar.

| Instrumentos Negociáveis | Suportado |

| Ações | ✔ |

| Opções | ✔ |

| Metais preciosos | ✔ |

| Forex | ❌ |

| Commodities | ❌ |

| Índices | ❌ |

| Futuros | ❌ |

Serviços

HUA TAI oferece serviços de custódia de ativos, serviços de terceirização de operações. Os serviços de custódia de ativos incluem custódia de ativos, cálculo de avaliação, supervisão de investimentos, liquidação de fundos. Os serviços de terceirização de operações

incluem registro de ações, supervisão de contas, cálculo de avaliação, divulgação de informações.

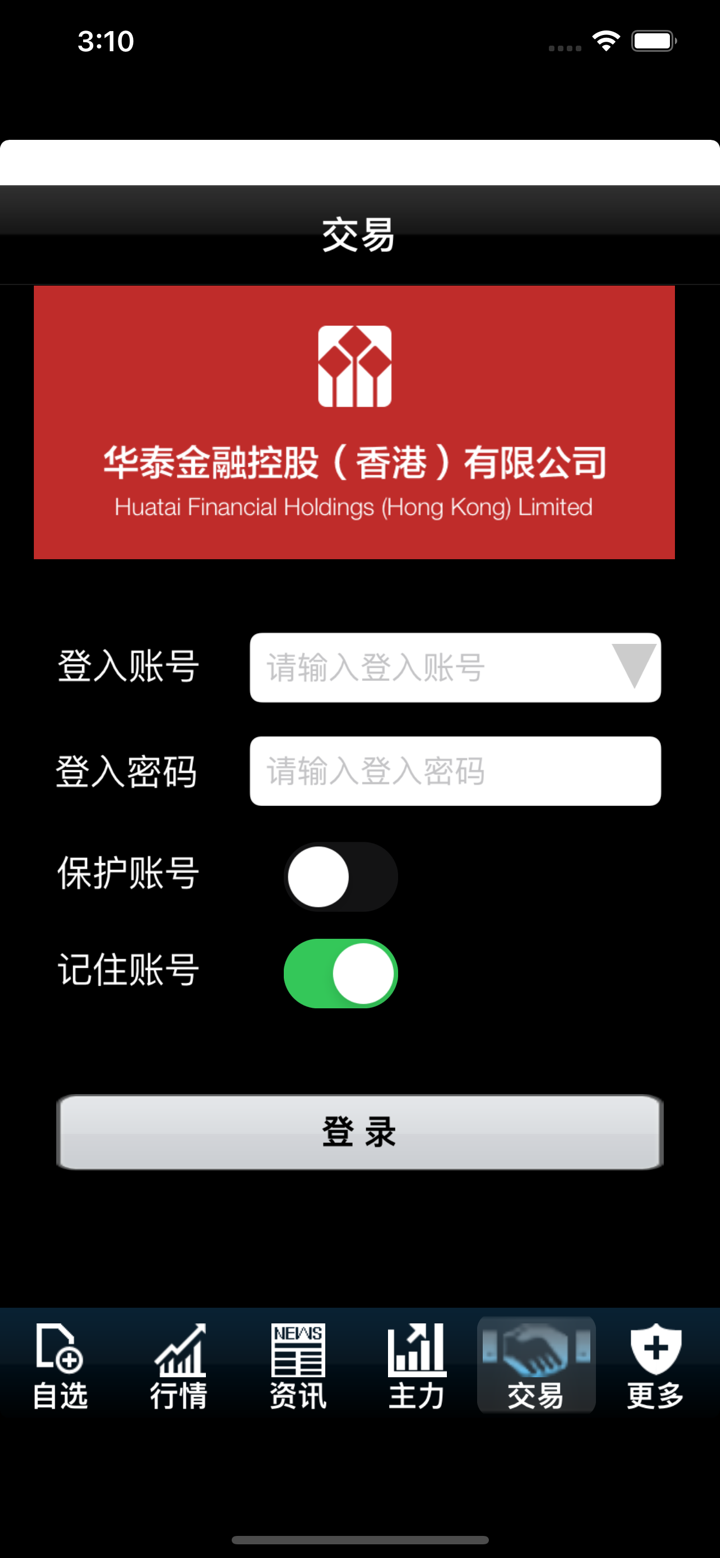

Tipos de Conta

HUA TAI oferece 1 tipo de conta para traders - Conta Real.

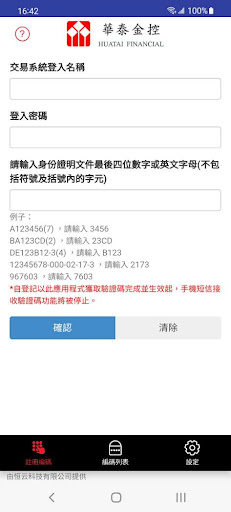

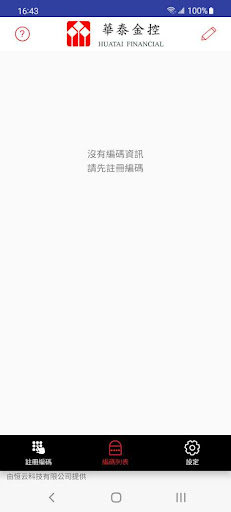

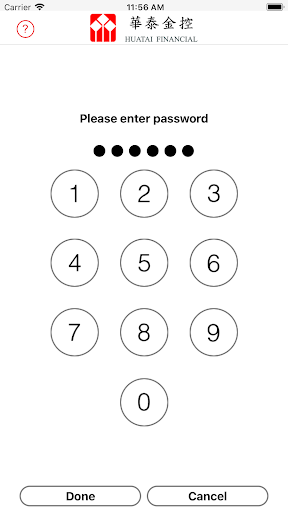

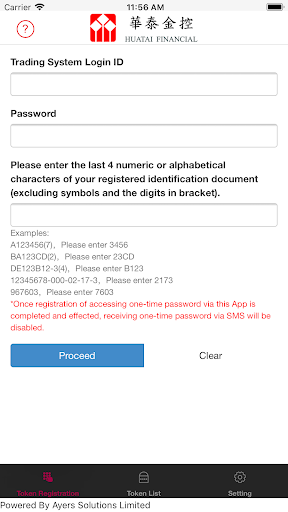

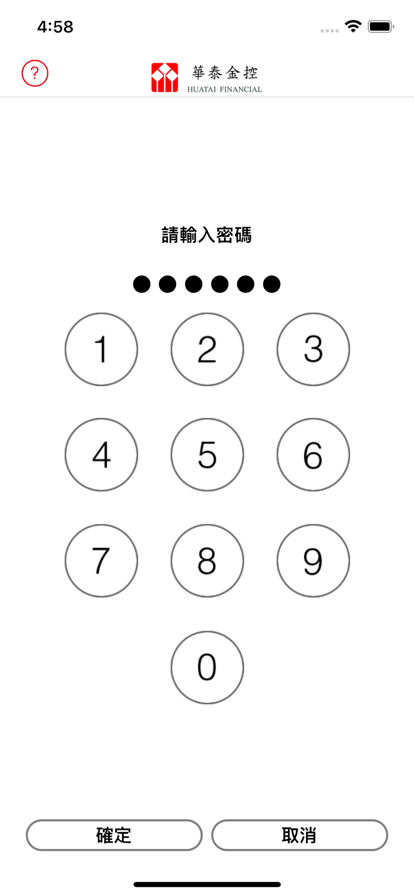

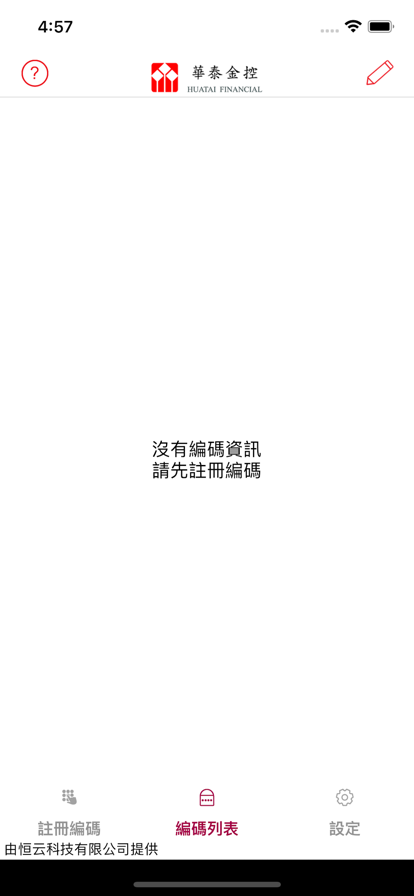

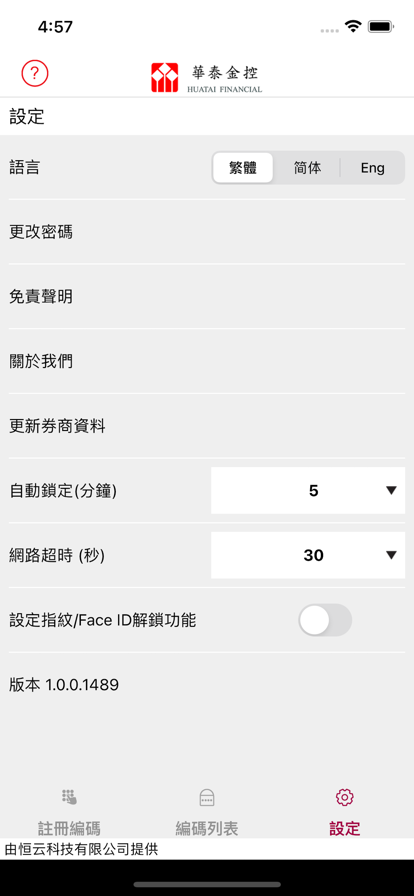

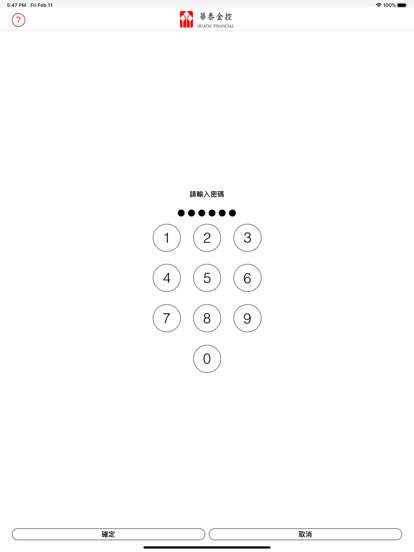

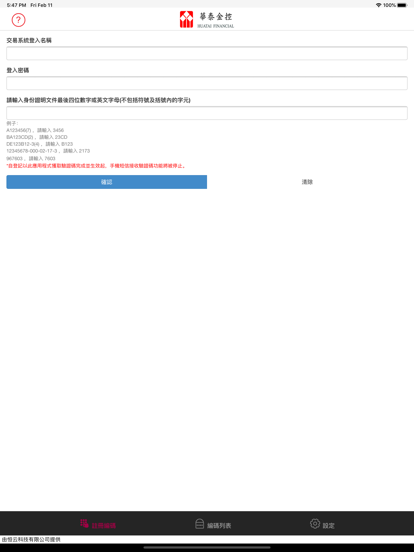

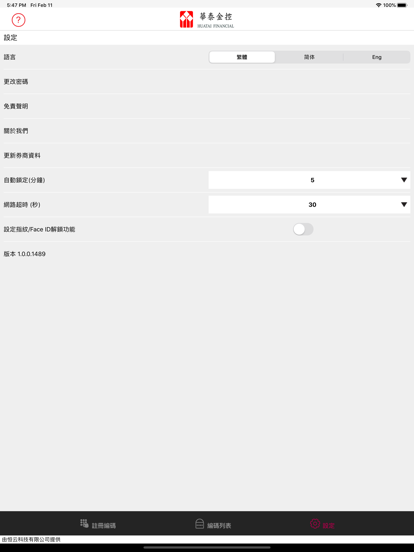

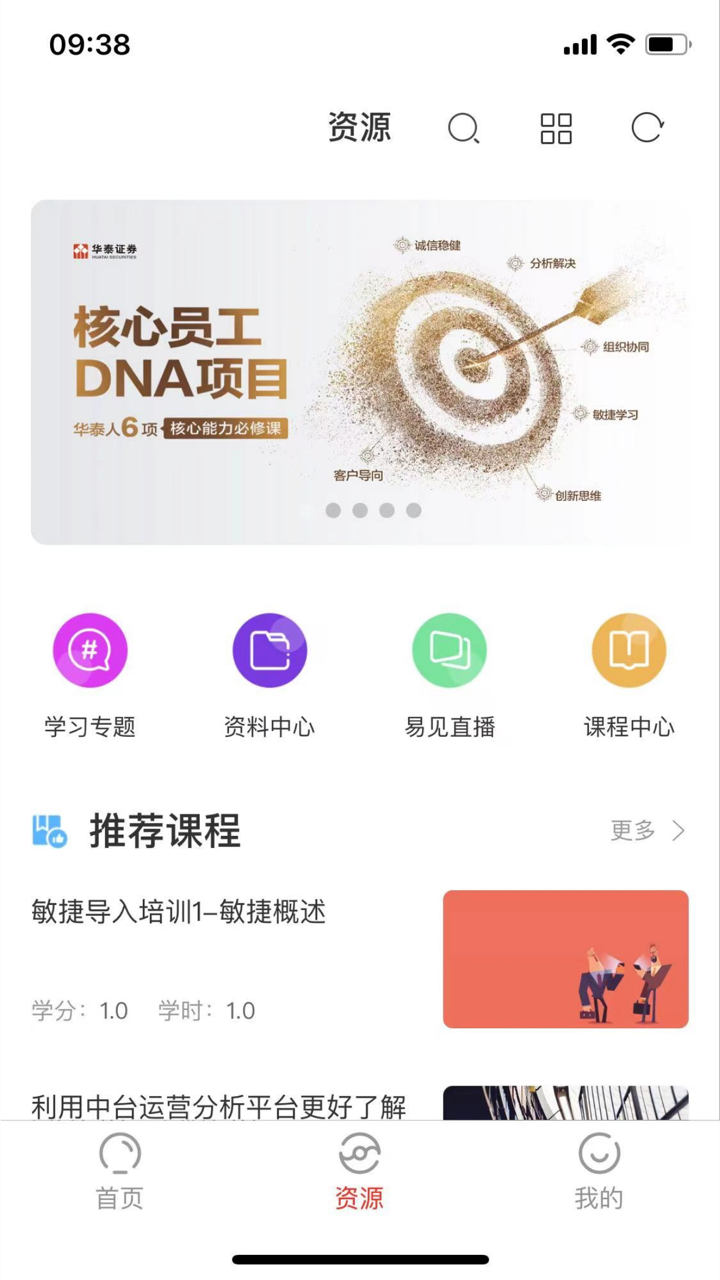

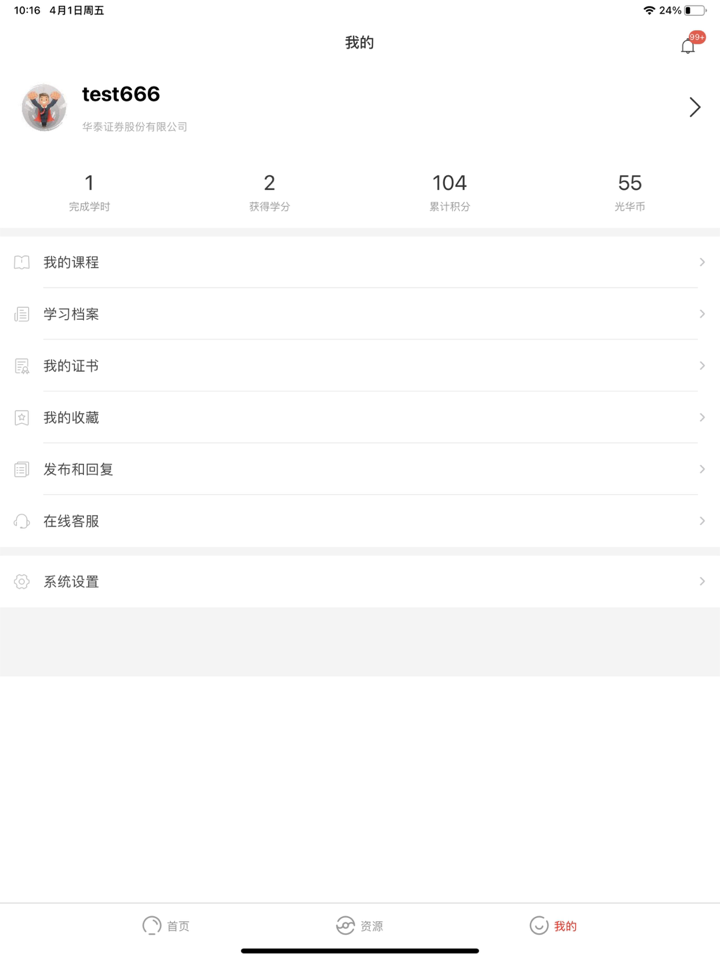

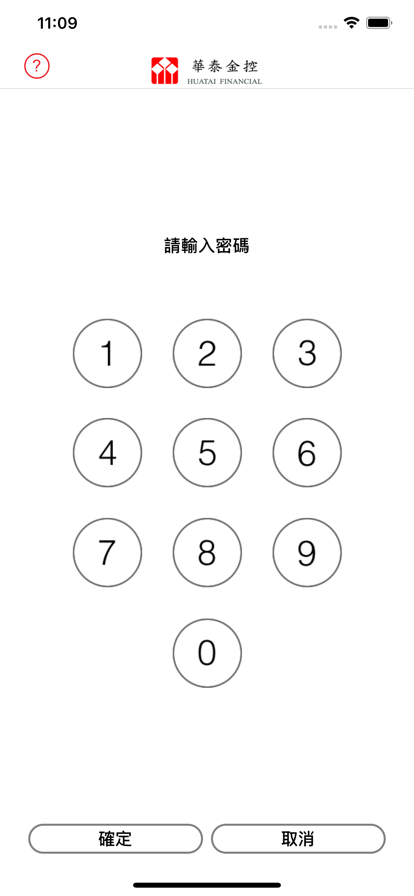

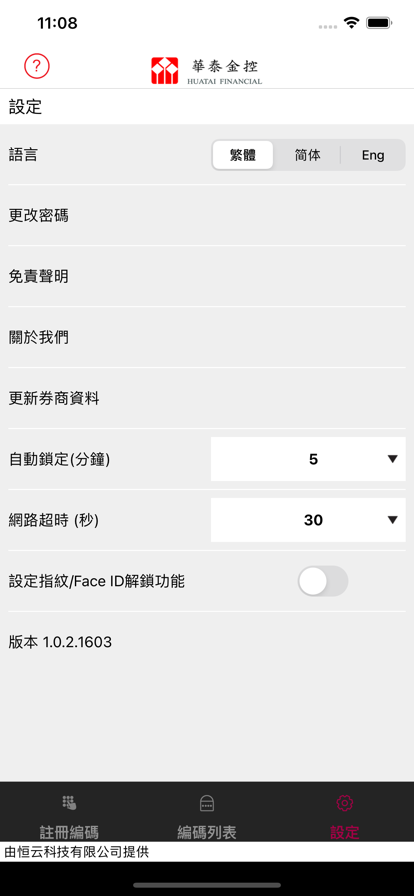

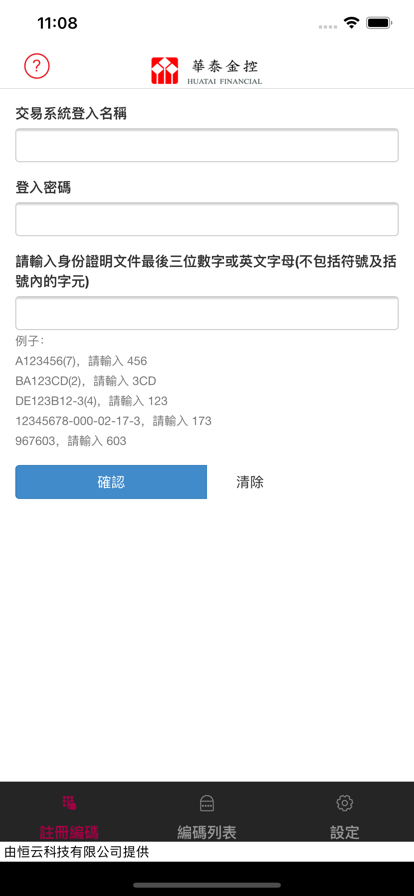

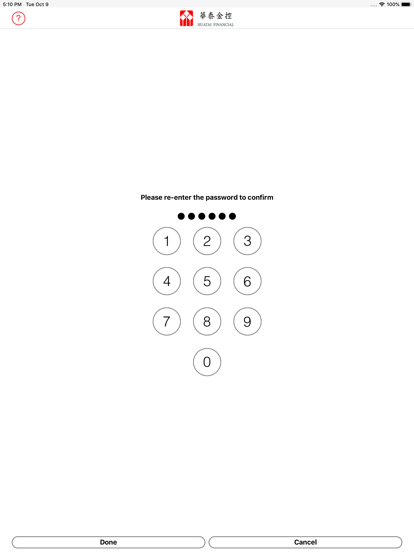

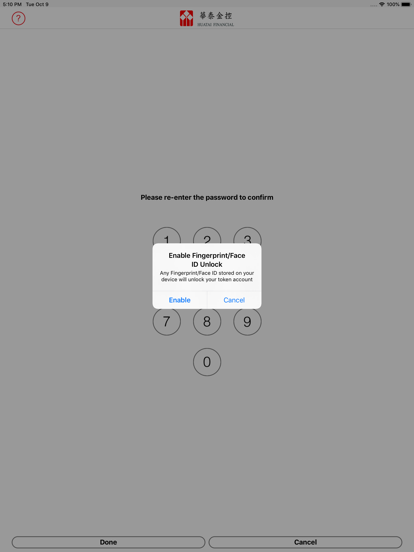

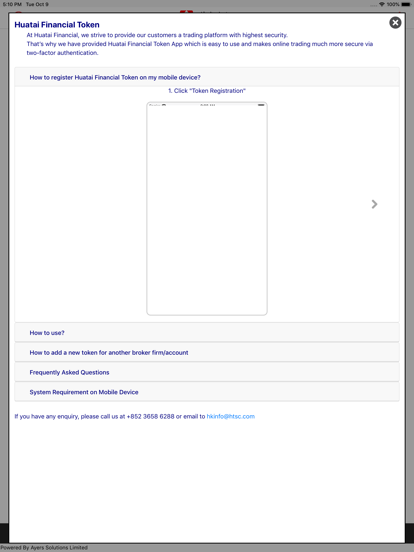

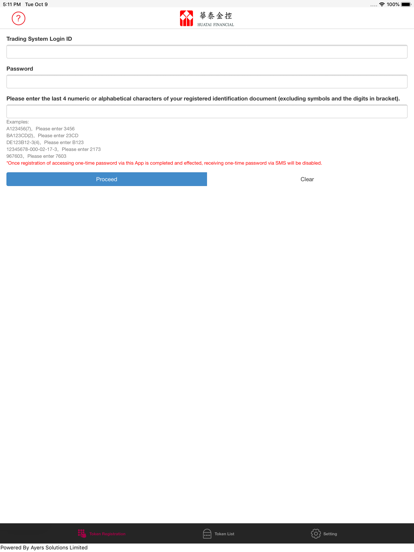

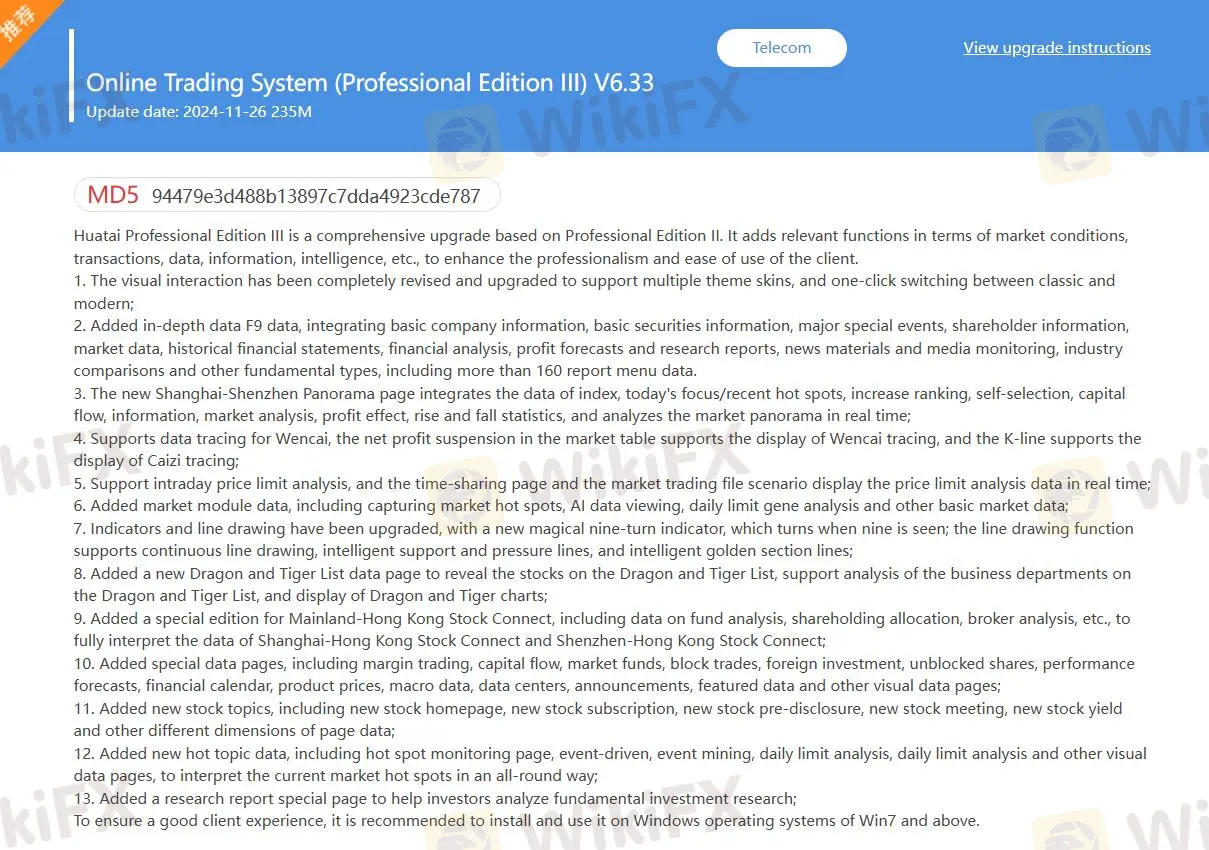

Plataforma de Negociação

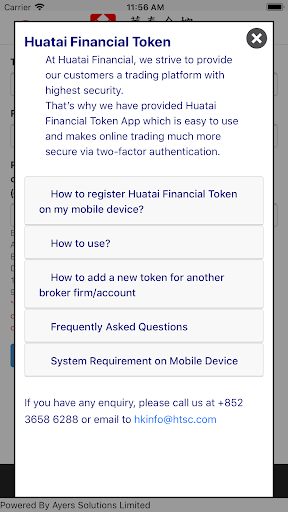

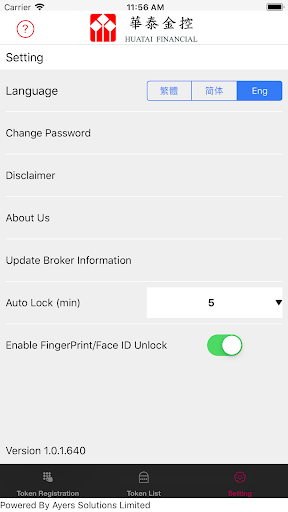

As plataformas de negociação da HUA TAI são MD5, Zhangle App, que suportam traders em PC, Mac, iPhone e Android.

| Plataforma de Negociação | Suportado | Dispositivos Disponíveis |

| MD5 | ✔ | Web |

| Zhangle App | ✔ | Mobile |

| MT4 Margin WebTrader | ❌ | |

| MT5 | ❌ |

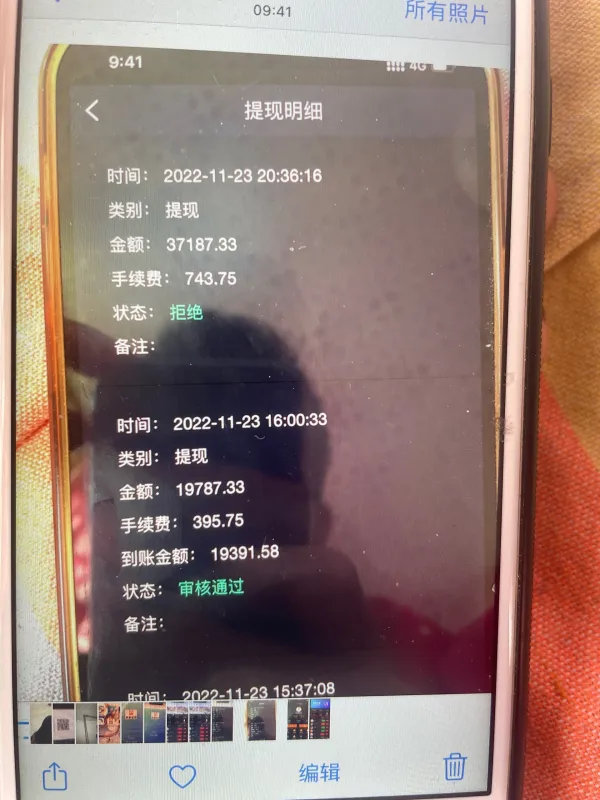

Depósito e Retirada

Seu método de depósito e retirada é transferência bancária. Ele suporta os seguintes cartões de débito, como cartão ICBC, cartão ABC, cartão CCB, cartão BOC, etc.