S jonas

1-2年

Based on your own experience, what would you say are the three main benefits of using HUA TAI?

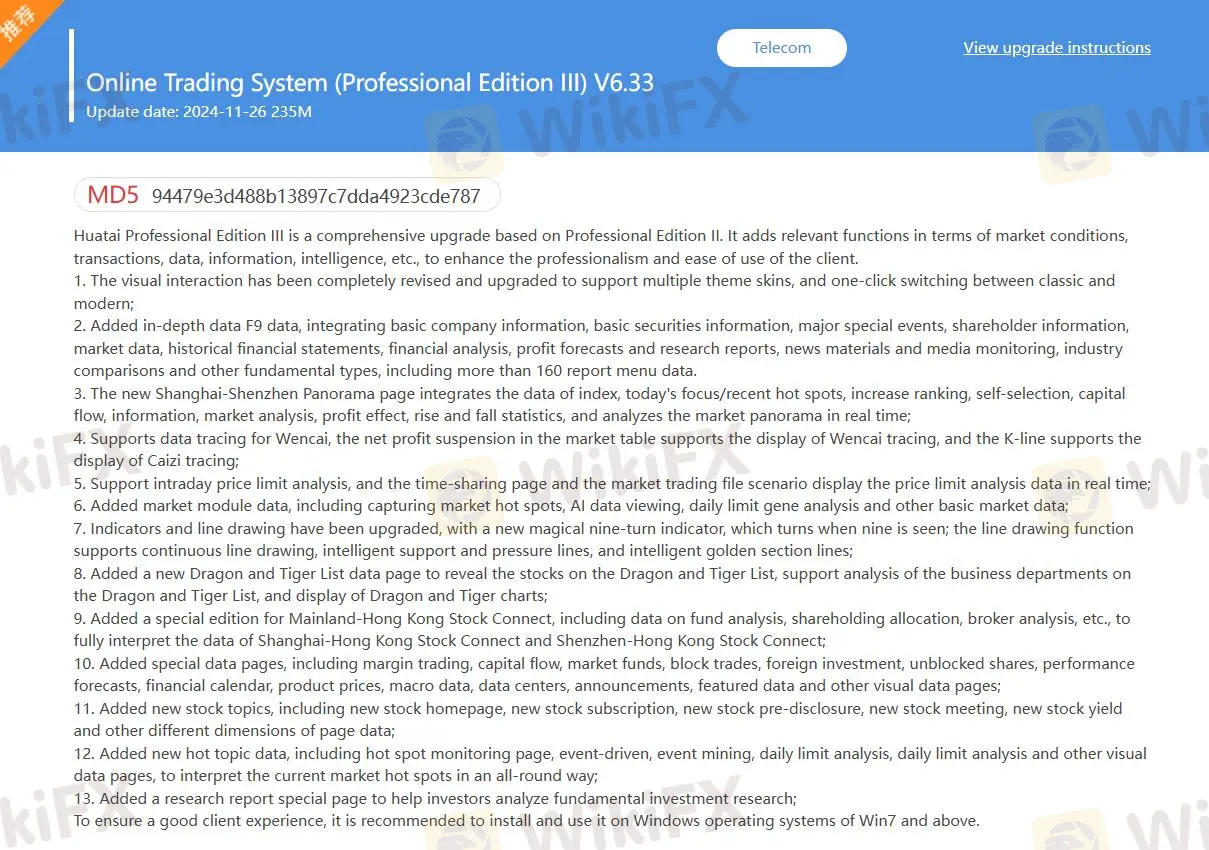

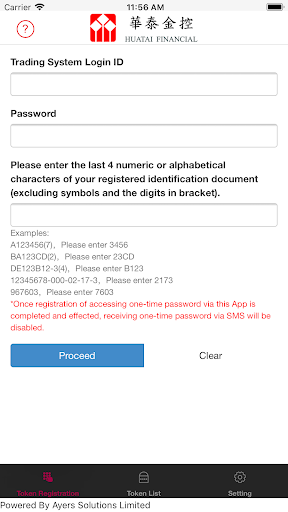

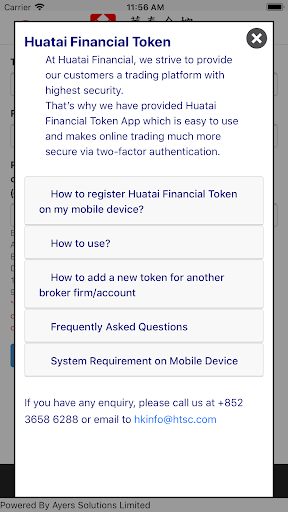

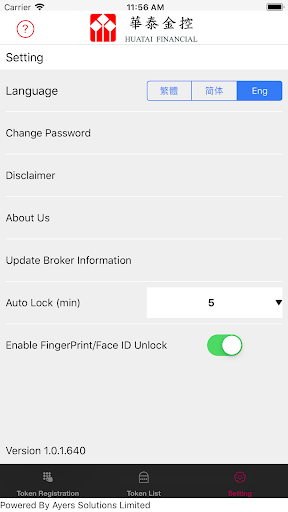

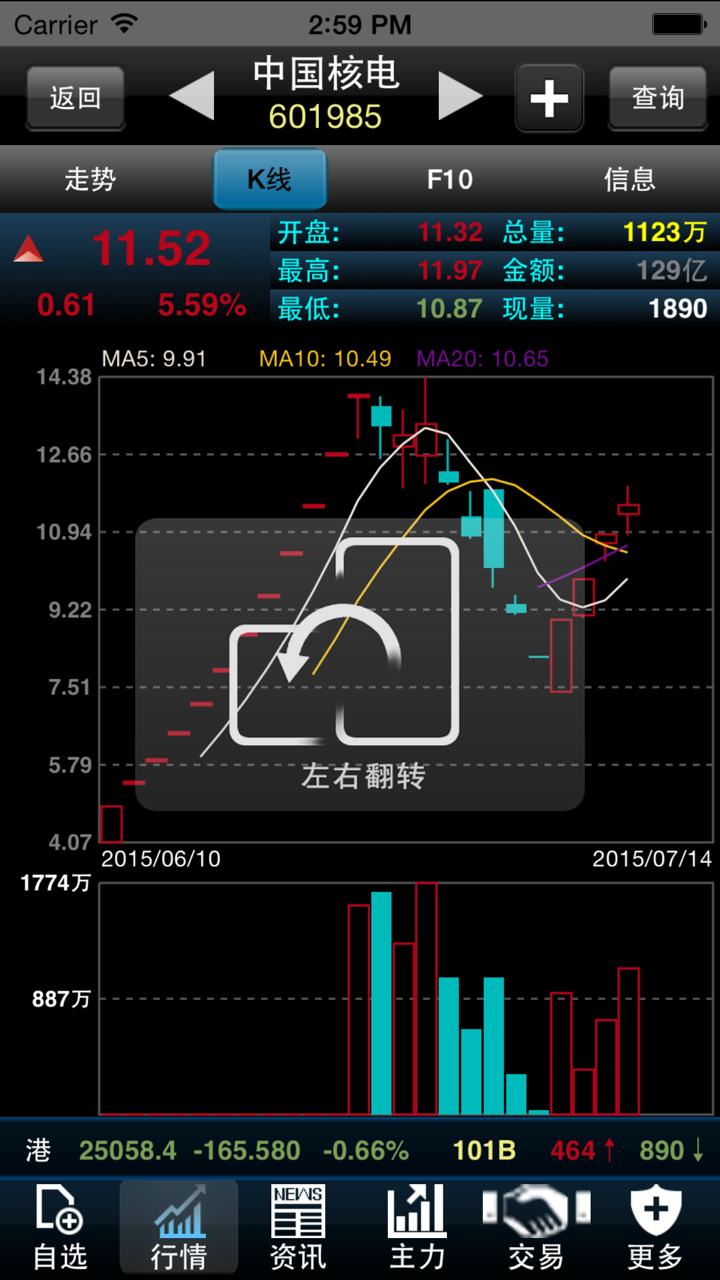

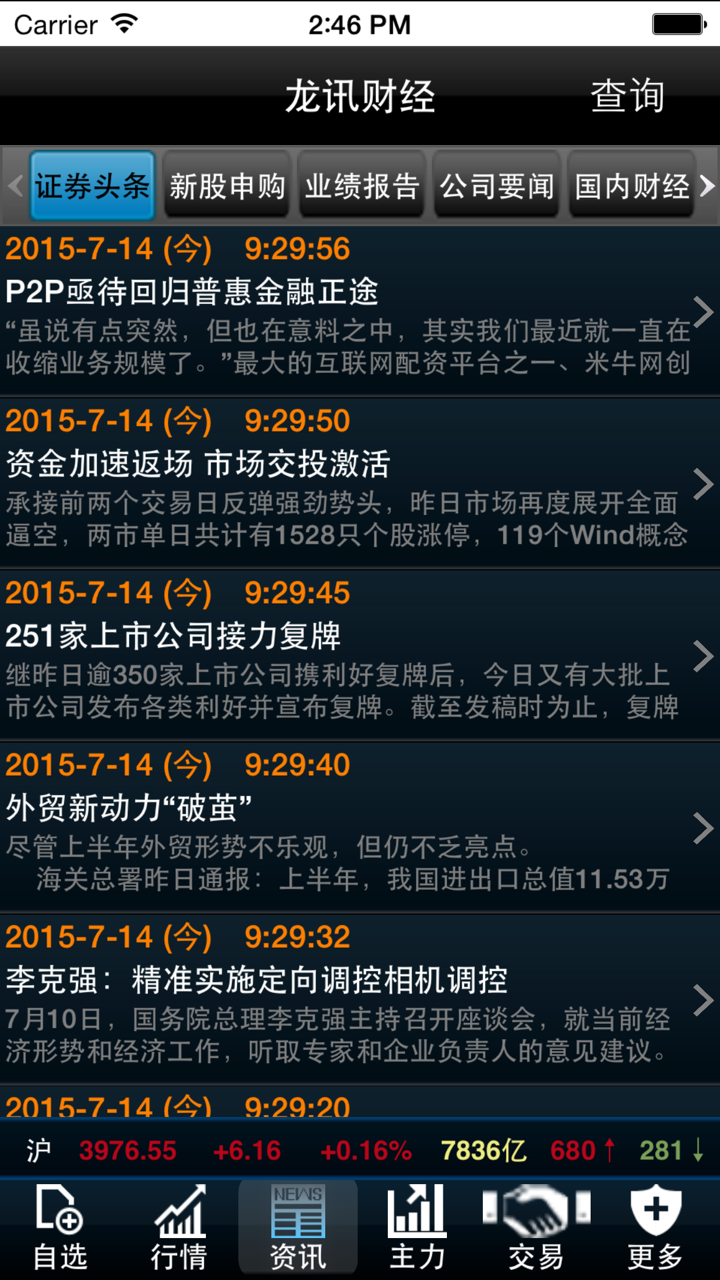

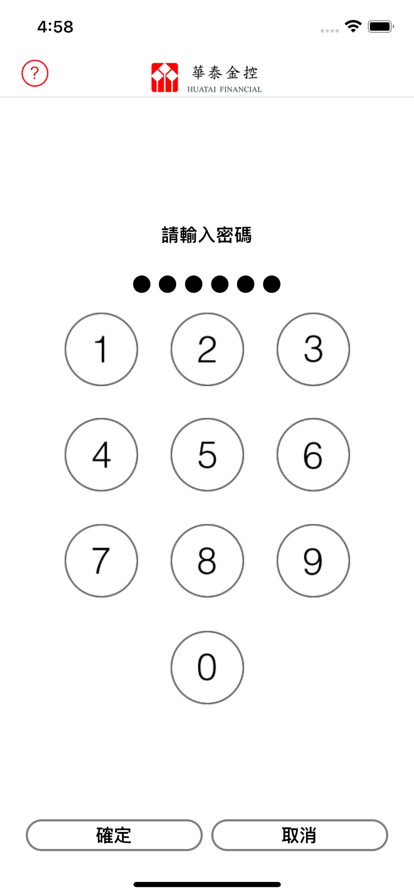

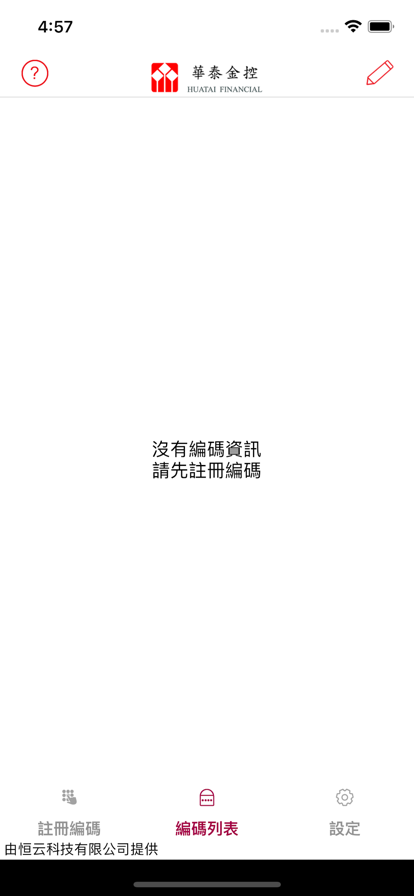

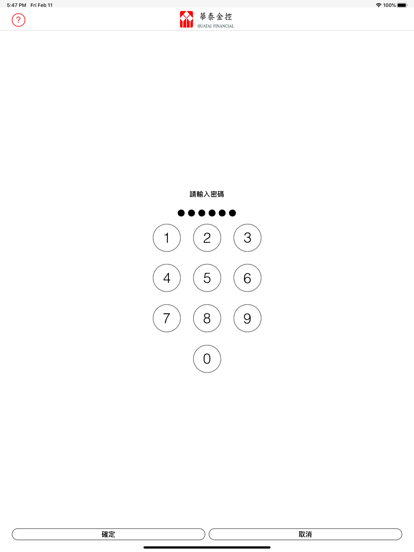

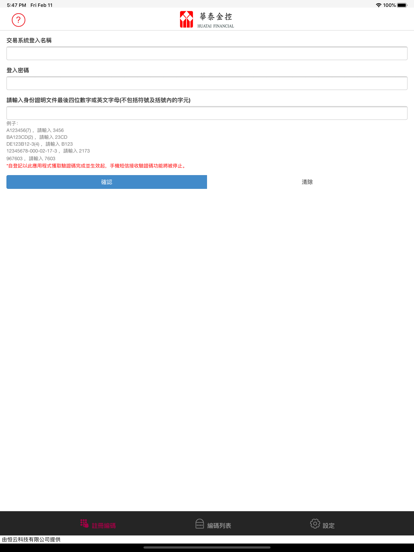

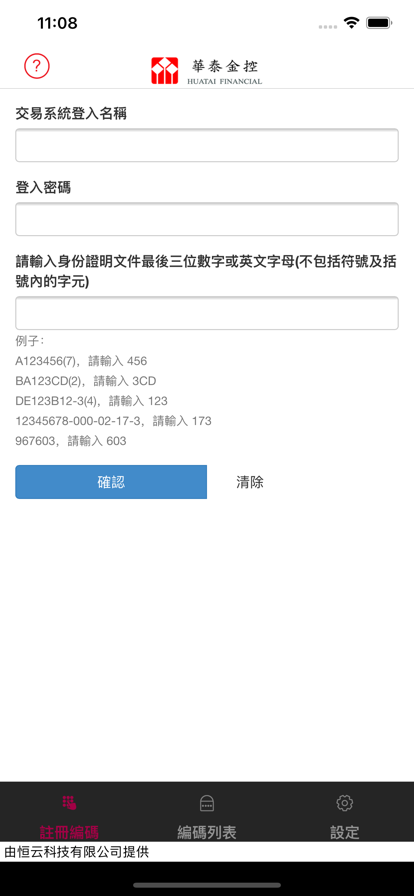

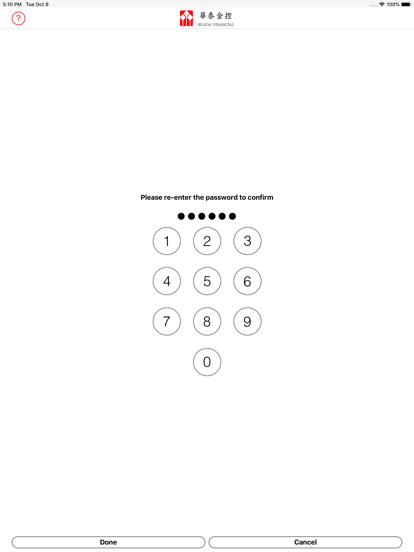

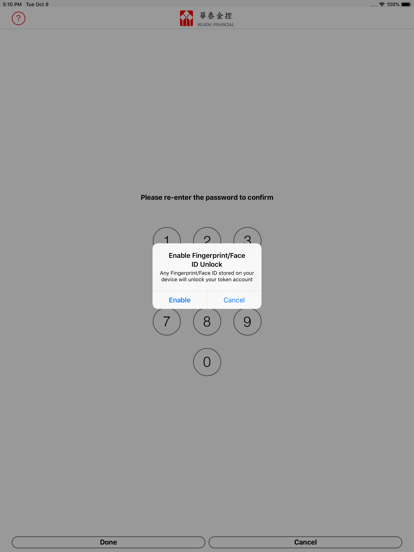

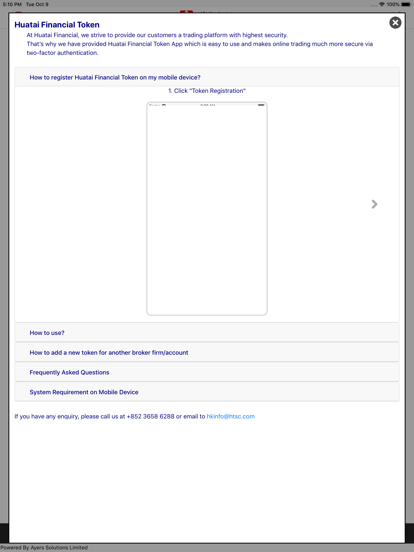

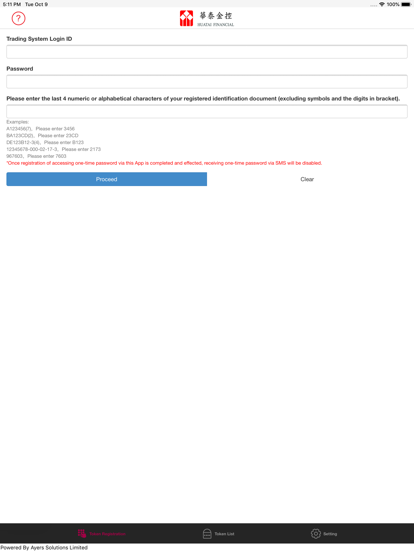

In my experience as a trader, the main benefit I’ve found with HUA TAI is its regulatory status. HUA TAI is regulated both in China by CFFEX and in Hong Kong, which helps give me an added sense of security that some regional compliance standards are being met. I believe strong regulation reduces some of the potential risks of dealing with unlicensed brokers, though it never completely eliminates them. Another advantage for me is HUA TAI’s broad product offering in traditional financial instruments such as stocks, options, and precious metals. While it doesn’t provide access to forex or a diverse range of commodities, for traders focused on equity and derivative markets—especially in the Chinese or Hong Kong sphere—this focused selection may be appropriate. Lastly, I’ve appreciated the self-developed trading platforms like Zhangle App and MD5, which offer multi-device access (including mobile), and have been generally stable in my usage; this is critical for real-time market access. However, I would note that the lack of demo accounts, and the absence of popular platforms like MT4/MT5, makes this broker less suitable for those just starting or for those who require a more versatile trading environment. Overall, HUA TAI’s regulatory coverage, product selection, and custom technology are its main benefits, but like with any broker, I urge careful consideration before committing significant funds.

Vladimir

1-2年

Which deposit and withdrawal options does HUA TAI offer, such as credit cards, PayPal, Skrill, or cryptocurrencies?

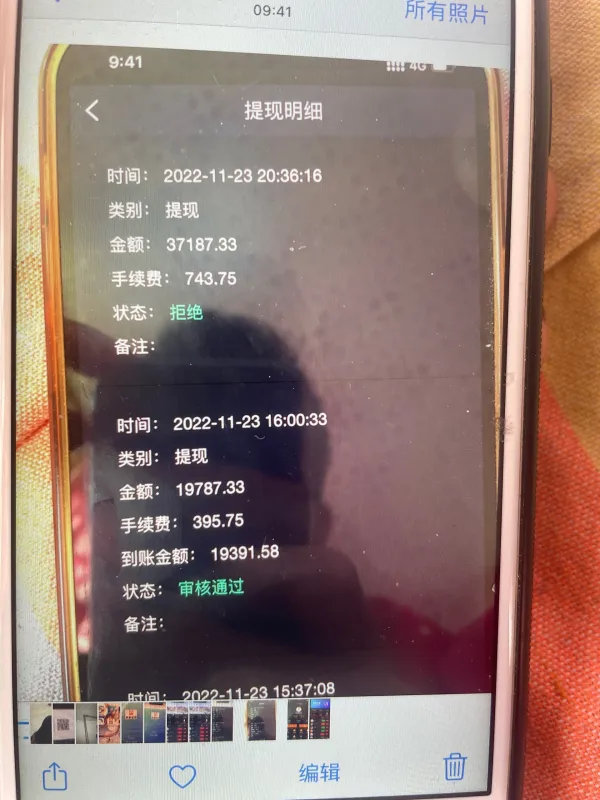

From my experience exploring HUA TAI, their deposit and withdrawal options are limited strictly to bank transfers using major Chinese debit cards, such as those issued by ICBC, ABC, CCB, and BOC. There is no support for credit cards, PayPal, Skrill, or any form of cryptocurrency. For me, this means a relatively narrow path for moving funds in and out, which could present a challenge if you are accustomed to the flexibility found with more internationally oriented brokers.

I always look for diverse funding methods not only for convenience but also for speed and flexibility, especially when reacting to market volatility. The absence of digital wallets and credit card support at HUA TAI inevitably leads to longer processing times, while the lack of crypto options removes a layer of privacy that some traders value. I also could not find any transparent guidance about minimum deposits or withdrawal fees, which impacted my confidence in understanding the total cost of transacting.

Based on all this, I think anyone considering HUA TAI should carefully weigh whether bank transfers alone will meet their needs, and factor in any delays or administrative constraints that typically accompany such methods. I always recommend traders be deliberate and risk-averse when dealing with less versatile brokers, especially regarding fund accessibility.

Broker Issues

Deposit

Withdrawal

J Forex Trader

1-2年

Can you tell me the typical spread for EUR/USD when trading on HUA TAI’s standard account?

As an experienced trader, when I'm evaluating a broker like HUA TAI, understanding trading costs—such as spreads—is essential for my risk management and strategy. However, based on the information available about HUA TAI, I could not find any disclosed or transparent details on typical spreads for EUR/USD or other forex pairs. In fact, forex trading as an instrument is not supported at all on HUA TAI’s platform. Their product range is strictly limited to stocks, options, and precious metals; currencies, commodities, indices, and futures are not offered.

For me, this lack of forex market access, especially the popular EUR/USD pair, is a significant limitation. Additionally, the absence of key cost-related specifics—such as spreads, commissions, or minimum deposit requirements—makes it challenging to assess the broker's overall competitiveness. The trading platforms provided also do not include MT4 or MT5, which are industry standards for forex traders seeking transparency in spread pricing.

Given these gaps, I personally would exercise caution and recommend that other traders looking for forex-specific services, and particularly those checking for EUR/USD spreads, carefully verify such basic trading conditions before proceeding with HUA TAI. As always, I base my decisions on clear, disclosed data; the lack thereof is a red flag for me when considering a broker for any trading activity, but especially for forex.

Broker Issues

Fees and Spreads

Wahab

1-2年

In what ways does HUA TAI’s regulatory standing help safeguard my funds?

From my experience as a trader, the regulatory status of a broker is central to how I assess the safety of my funds. With HUA TAI, what stands out is its regulation by Chinese authorities, specifically under the CFFEX with a futures license, and also oversight in Hong Kong. This regulation means the broker is subject to specific rules for client fund segregation, operational transparency, and reporting—key pillars for protecting client assets from misuse or mismanagement.

The reason I take this seriously is that regulatory oversight typically involves rigorous checks, including regular audits and compliance reviews. For me, knowing a broker is closely monitored reduces the risk of fraudulent practices or insolvency issues jeopardizing my deposits. In HUA TAI’s case, their licenses and business longevity suggest a relatively established operation, with further safeguards such as asset custody and supervised fund settlement services.

However, while regulation certainly lowers some risks, it doesn’t eliminate them entirely. There’s always the possibility of operational lapses or external market shocks. That’s why, even with HUA TAI’s regulated status, I remain cautious and diversify my trading relationships rather than relying solely on any single firm for large fund deposits.