مقدمة عن الشركة

| CITIC Futures ملخص المراجعة | |

| تأسست | 2007 |

| البلد/المنطقة المسجلة | الصين |

| التنظيم | CFFEX |

| الخدمات | خدمة وساطة، استشارات استثمارية، دعم فني، إدارة الأصول |

| حساب تجريبي | ✅ |

| منصة التداول | Fast Issue (V2)، Fast Issue (V3)، Mandarin WH6، وغيرها |

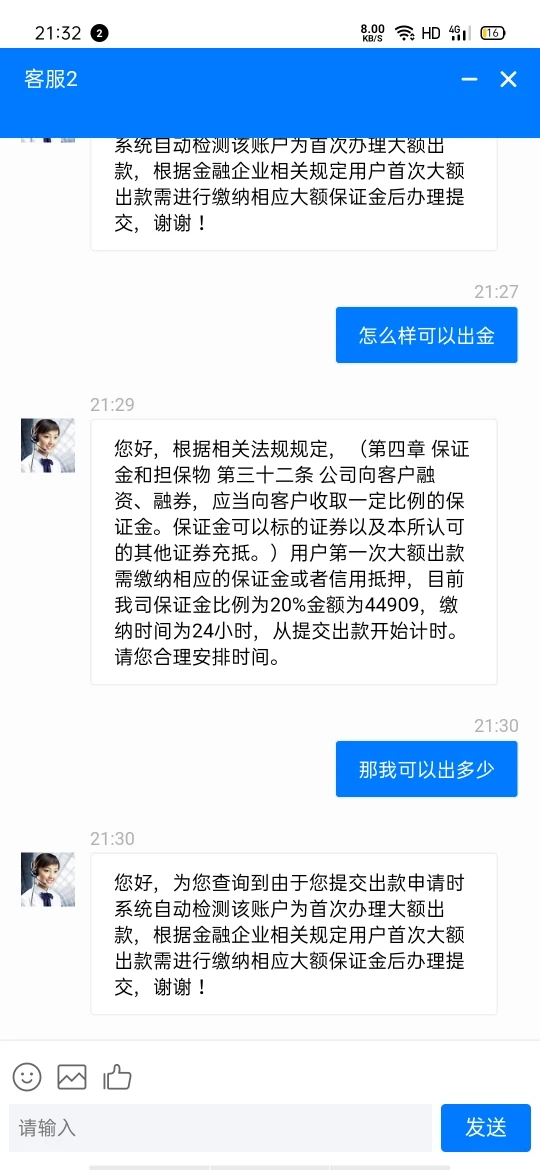

| دعم العملاء | الدردشة المباشرة على مدار الساعة طوال أيام الأسبوع |

| هاتف: 400-9908-826 | |

| فاكس: 0755-83217421 | |

| الرمز البريدي: 518048 | |

| العنوان: غرفة 1301-1305، الطابق 13 والطابق 14، الكتلة الشمالية، تايمز سكوير إكسلنس (المرحلة الثانية)، رقم 8 زهونجشين الثالث، منطقة فوتيان، شنتشن، 518048، الصين | |

| فيسبوك، إكس، إنستغرام، لينكدإن | |

معلومات CITIC Futures

CITIC Futures هو مزود خدمات مرخص يقدم خدمات وساطة وخدمات مالية رئيسية، تأسست في الصين عام 2007. يقدم خدمات لخدمة الوساطة، الاستشارات الاستثمارية، الدعم الفني وإدارة الأصول.

الإيجابيات والسلبيات

| الإيجابيات | السلبيات |

| حسابات تجريبية | تحديد المنتجات التجارية المحدودة |

| وقت التشغيل الطويل | تفرض رسوم متنوعة |

| قنوات اتصال متنوعة | |

| منظم بشكل جيد |

هل CITIC Futures شرعي؟

نعم. CITIC Futures مرخصة من قبل CFFEX لتقديم الخدمات. رقم الترخيص الخاص بها هو 0018. CFFEX، التي تأسست بموافقة مجلس الدولة لجمهورية الصين الشعبية وهيئة تنظيم الأوراق المالية في الصين (CSRC)، هي بورصة مدرجة تختص في تقديم خدمات التداول والتسوية للعقود الآجلة المالية والخيارات والمشتقات الأخرى.

| البلد المنظم | الهيئة التنظيمية | الحالة الحالية | الكيان المنظم | نوع الترخيص | رقم الترخيص |

| بورصة العقود الآجلة المالية الصينية (CFFEX) | منظمة | 中信期货有限公司 | ترخيص العقود الآجلة | 0018 |

CITIC Futures الخدمات

| الخدمات | مدعوم |

| خدمة الوساطة | ✔ |

| الاستشارات الاستثمارية | ✔ |

| الدعم الفني | ✔ |

| إدارة الأصول | ✔ |

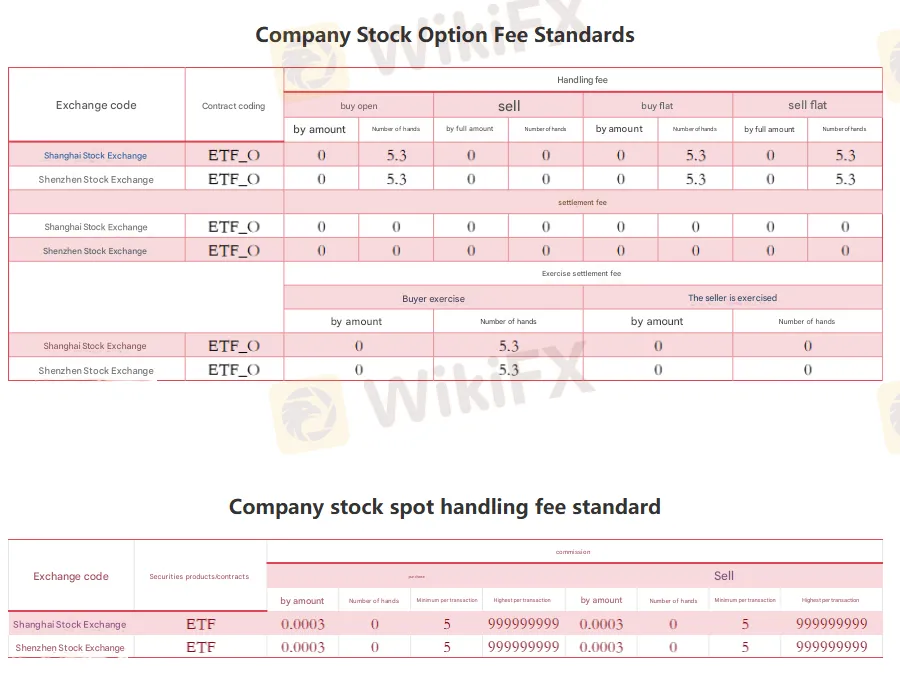

رسوم CITIC Futures

تكاليف مختلفة لمنتجات مختلفة على بورصات مختلفة، يرجى زيارة الموقع الرسمي للحصول على التفاصيل (الصورة مترجمة بواسطة Google، غير واضحة جدًا، يرجى زيارة الموقع الرسمي للحصول على التفاصيل).

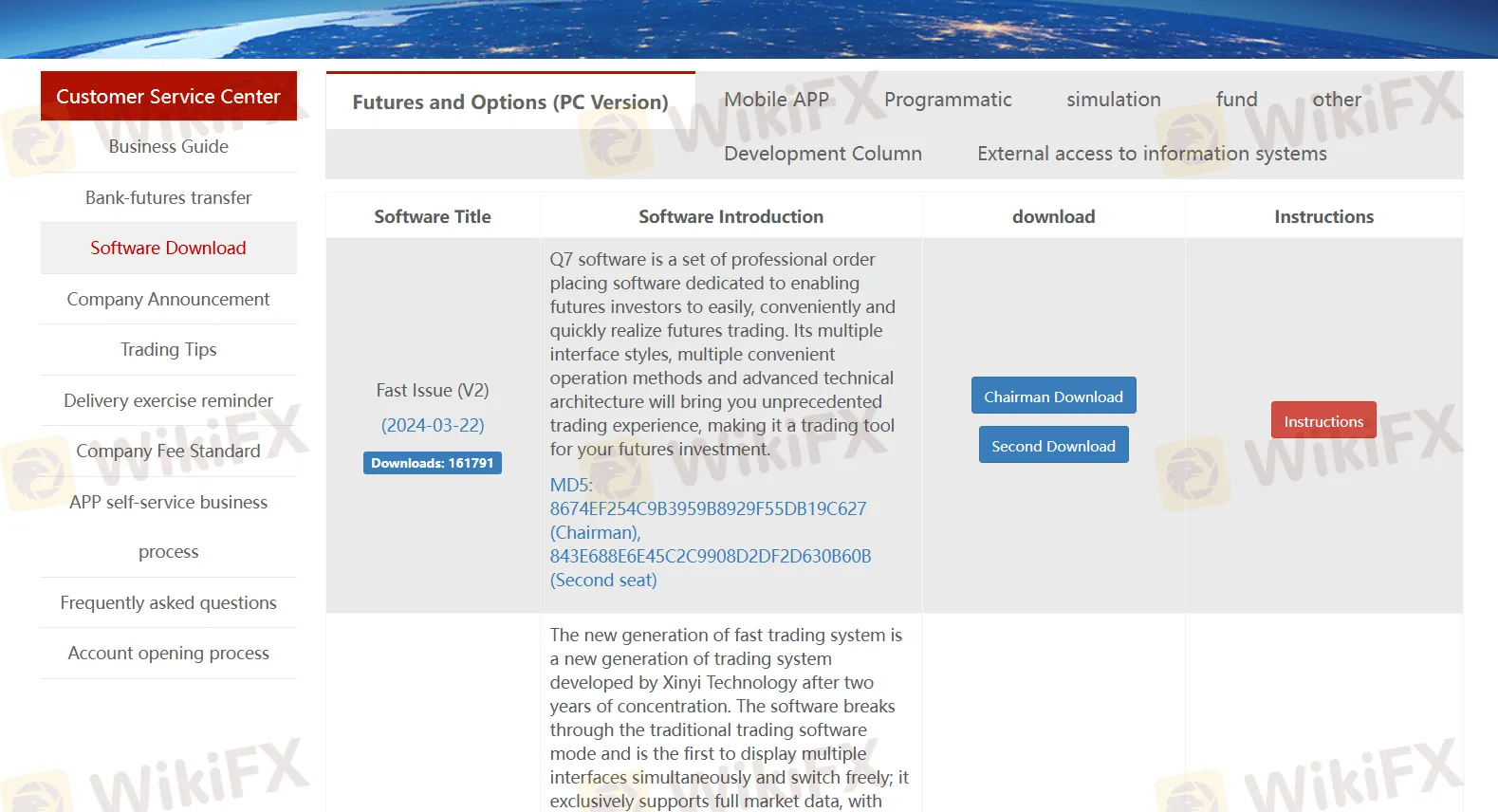

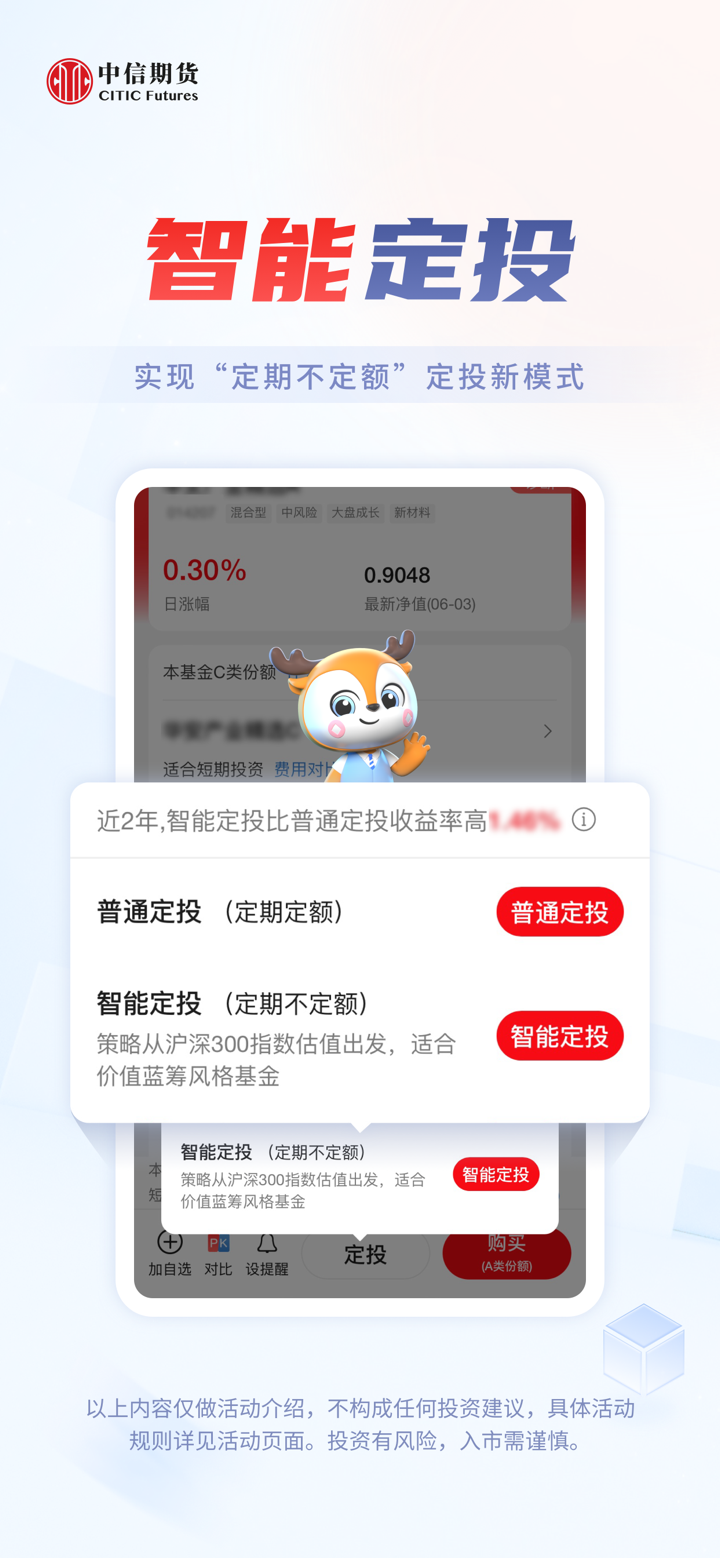

منصة التداول

| منصة التداول | مدعومة | الأجهزة المتاحة |

| Fast Issue (V2) | ✔ | كمبيوتر شخصي، كمبيوتر محمول، جهاز لوحي |

| Fast Issue (V3) | ✔ | كمبيوتر شخصي، كمبيوتر محمول، جهاز لوحي |

| Mandarin WH6 | ✔ | كمبيوتر شخصي، كمبيوتر محمول، جهاز لوحي |

| Boyi Master 7 | ✔ | كمبيوتر شخصي، كمبيوتر محمول، جهاز لوحي |

| Boyi Master 5 | ✔ | كمبيوتر شخصي، كمبيوتر محمول، جهاز لوحي |

| CITIC Futures Tonghuashun Futures | ✔ | كمبيوتر شخصي، كمبيوتر محمول، جهاز لوحي |

| CITIC Futures Infinite Easy | ✔ | كمبيوتر شخصي، كمبيوتر محمول، جهاز لوحي |

| Polestar 9.5 | ✔ | كمبيوتر شخصي، كمبيوتر محمول، جهاز لوحي |

| CITIC Polestar 9.3 | ✔ | كمبيوتر شخصي، كمبيوتر محمول، جهاز لوحي |

| Qianlong Option | ✔ | كمبيوتر شخصي، كمبيوتر محمول، جهاز لوحي |

| Huidian Stock Options Professional Investment System | ✔ | كمبيوتر شخصي، كمبيوتر محمول، جهاز لوحي |

| CITIC Futures-Xin eLu | ✔ | جوال |

| CITIC Futures-Trading Edition | ✔ | جوال |