Buod ng kumpanya

| CITIC Futures Buod ng Pagsusuri | |

| Itinatag | 2007 |

| Nakarehistrong Bansa/Rehiyon | China |

| Regulasyon | CFFEX |

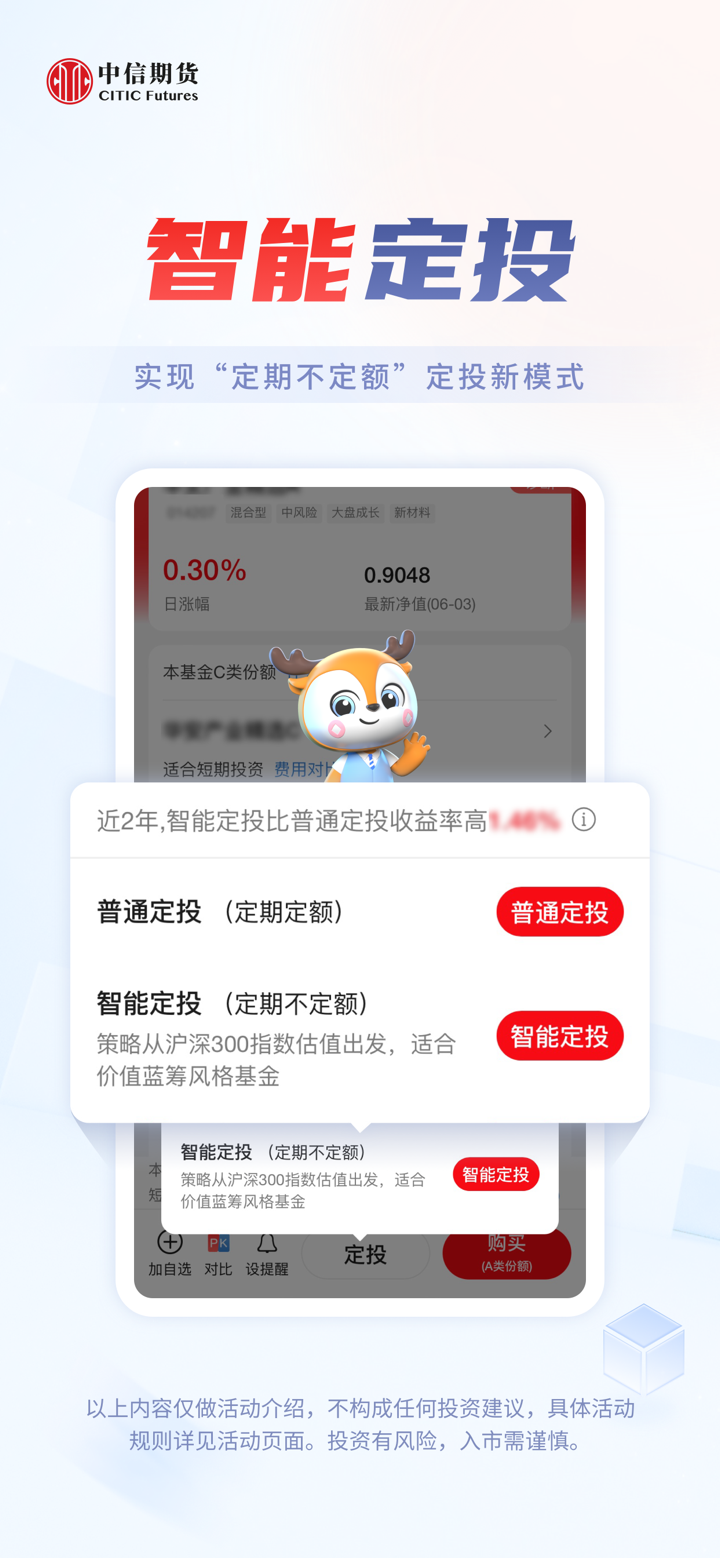

| Mga Serbisyo | Serbisyong Brokerage, Payo sa Pamumuhunan, Suporta sa Teknikal, Pamamahala ng Ari-arian |

| Demo Account | ✅ |

| Platform ng Paggagalaw | Mabilis na Isyu (V2), Mabilis na Isyu (V3), Mandarin WH6, at iba pa. |

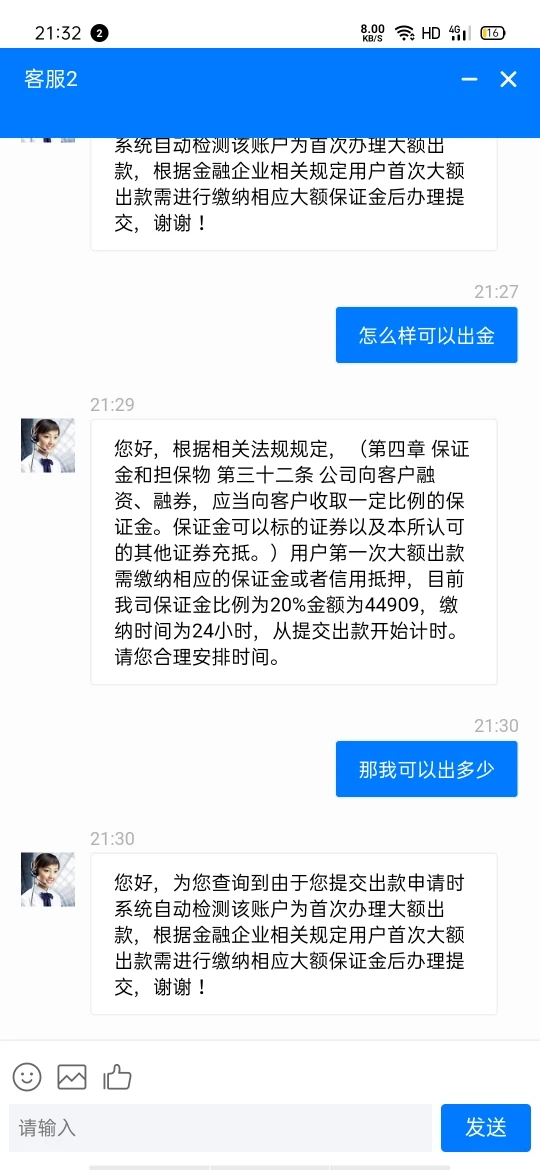

| Suporta sa Customer | 24/7 live chat |

| Tel: 400-9908-826 | |

| Fax: 0755-83217421 | |

| Zip Code: 518048 | |

| Address: Kuwarto 1301-1305, 13F at 14F, Hilagang Bloke, Times Square Excellence (Phase II), Walang 8 Zhongxin 3rd Road, Distrito ng Futian, Shenzhen, 518048, China | |

| Facebook, X, Instagram, LinkedIn | |

Impormasyon ng CITIC Futures

Ang CITIC Futures ay isang reguladong tagapagbigay ng pangunahing serbisyo sa brokerage at serbisyong pinansiyal, na itinatag sa China noong 2007. Nag-aalok ito ng mga serbisyo para sa Serbisyong Brokerage, Payo sa Pamumuhunan, Suporta sa Teknikal, at Pamamahala ng Ari-arian.

Mga Kalamangan at Disadvantages

| Mga Kalamangan | Mga Disadvantages |

| Mga demo account | Limitadong mga produkto sa kalakalan |

| Mahabang oras ng operasyon | Iba't ibang bayarin na kinokolekta |

| Iba't ibang mga paraan ng pakikipag-ugnayan | |

| Mahusay na regulado |

Tunay ba ang CITIC Futures?

Oo. Ang CITIC Futures ay lisensyado ng CFFEX upang mag-alok ng mga serbisyo. Ang numero ng lisensya nito ay 0018. Ang CFFEX, itinatag sa pahintulot ng State Council ng People's Republic of China at ng China Securities Regulatory Commission (CSRC), ay isang incorporated exchange na nagspecialize sa pagbibigay ng mga serbisyo sa kalakalan at paglilinis para sa financial futures, options, at iba pang derivatives.

| Regulated Country | Regulator | Current Status | Regulated Entity | License Type | License No. |

| China Financial Futures Exchange (CFFEX) | Regulated | 中信期货有限公司 | Futures License | 0018 |

CITIC Futures Serbisyo

| Services | Supported |

| Brokerage Service | ✔ |

| Investment Advisory | ✔ |

| Technical Support | ✔ |

| Asset Management | ✔ |

Mga Bayad ng CITIC Futures

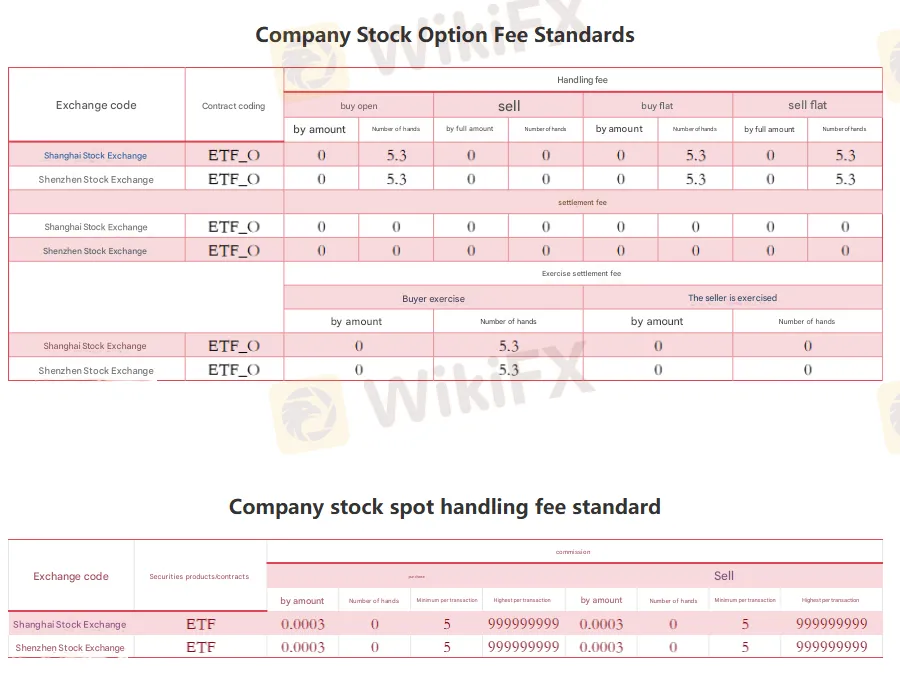

Iba't ibang bayad para sa iba't ibang produkto sa iba't ibang palitan, mangyaring bisitahin ang opisyal na website para sa mga detalye (ang larawan ay isinalin ng Google, hindi gaanong malinaw, mangyaring bisitahin ang opisyal na website para sa mga detalye).

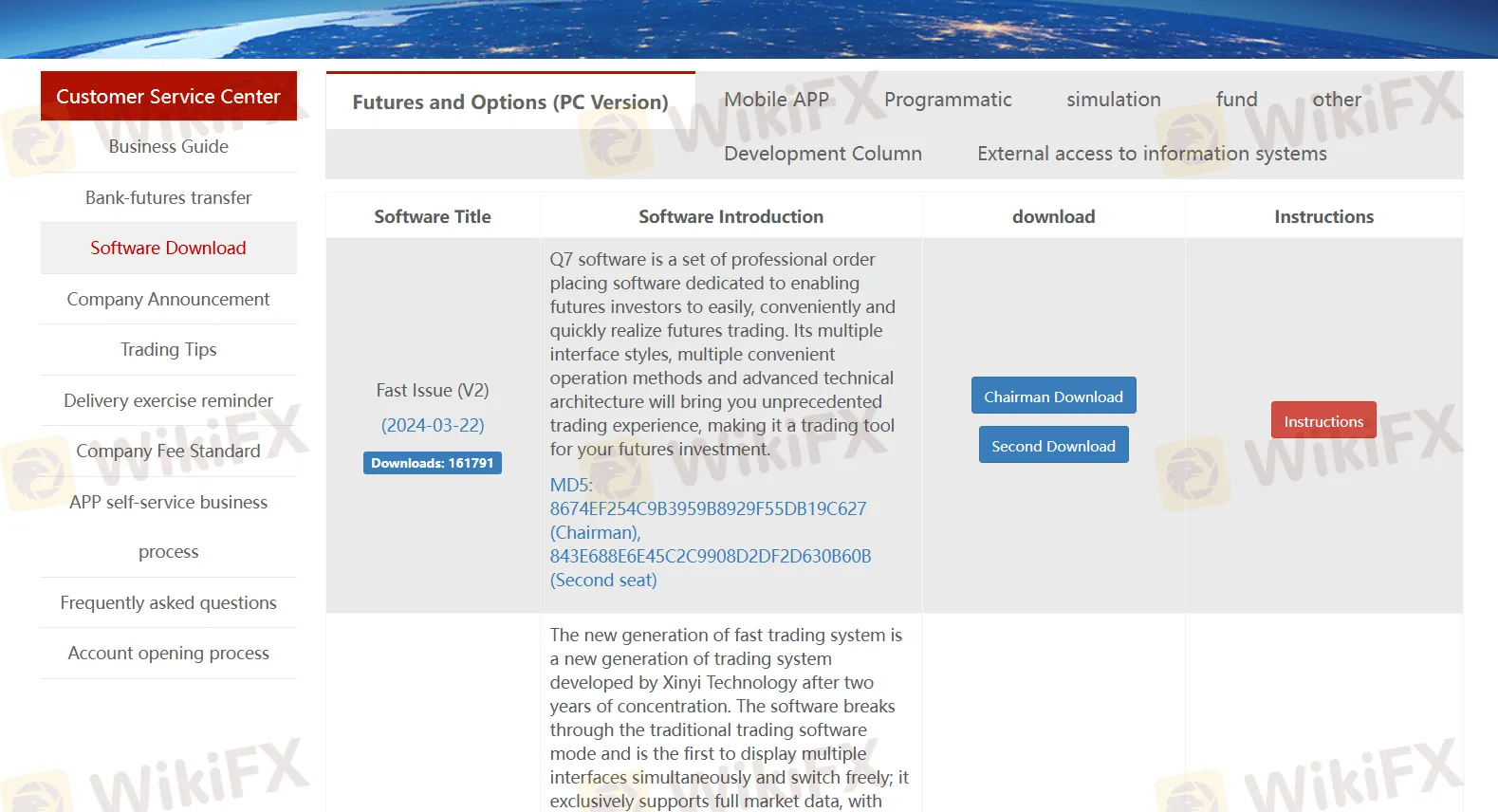

Plataforma ng Kalakalan

| Plataforma ng Kalakalan | Supported | Available Devices |

| Mabilis na Isyu (V2) | ✔ | PC, laptop, tablet |

| Mabilis na Isyu (V3) | ✔ | PC, laptop, tablet |

| Mandarin WH6 | ✔ | PC, laptop, tablet |

| Boyi Master 7 | ✔ | PC, laptop, tablet |

| Boyi Master 5 | ✔ | PC, laptop, tablet |

| CITIC Futures Tonghuashun Futures | ✔ | PC, laptop, tablet |

| CITIC Futures Infinite Easy | ✔ | PC, laptop, tablet |

| Polestar 9.5 | ✔ | PC, laptop, tablet |

| CITIC Polestar 9.3 | ✔ | PC, laptop, tablet |

| Qianlong Option | ✔ | PC, laptop, tablet |

| Huidian Stock Options Professional Investment System | ✔ | PC, laptop, tablet |

| CITIC Futures-Xin eLu | ✔ | Mobile |

| CITIC Futures-Trading Edition | ✔ | Mobile |