公司简介

| 中信期货 评论摘要 | |

| 成立时间 | 2007 |

| 注册国家/地区 | 中国 |

| 监管 | CFFEX |

| 服务 | 经纪服务、投资咨询、技术支持、资产管理 |

| 模拟账户 | ✅ |

| 交易平台 | Fast Issue (V2)、Fast Issue (V3)、Mandarin WH6 等 |

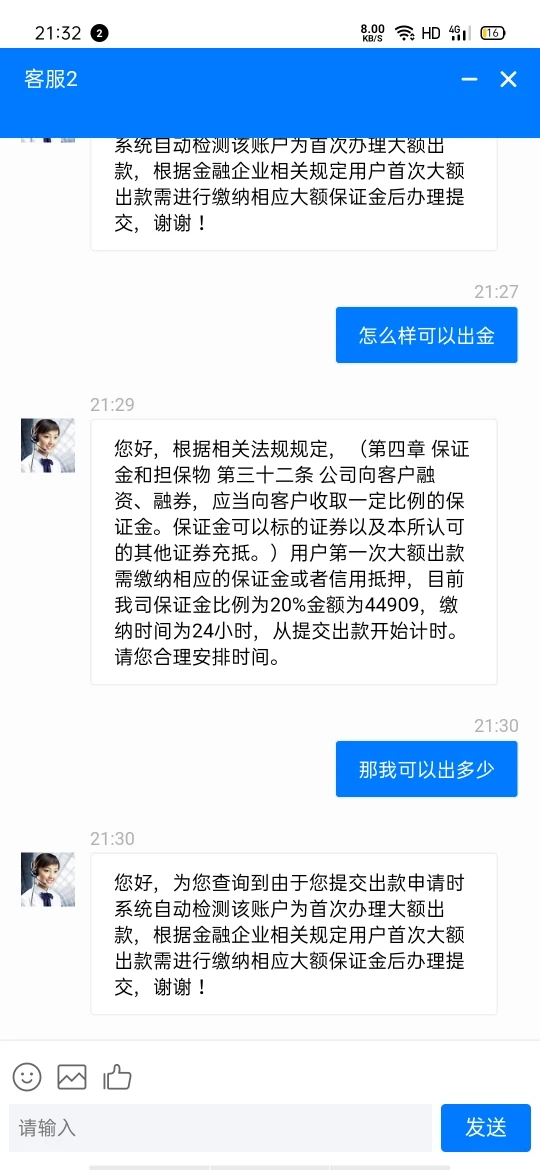

| 客户支持 | 24/7 在线聊天 |

| 电话:400-9908-826 | |

| 传真:0755-83217421 | |

| 邮编:518048 | |

| 地址:中国深圳市福田区中心三路8号时代广场卓越时代二期13-14楼1301-1305室,518048 | |

| Facebook、X、Instagram、LinkedIn | |

中信期货 信息

中信期货 是一家总部位于中国的受监管的一流经纪和金融服务提供商,成立于2007年。提供经纪服务、投资咨询、技术支持和资产管理等服务。

优缺点

| 优点 | 缺点 |

| 模拟 账户 | 交易产品有限 |

| 操作时间长 | 收取各种 手续费 |

| 多种联系渠道 | |

| 监管良好 |

中信期货 是否合法?

是的。中信期货获得中国金融期货交易所(CFFEX)的许可提供服务。其许可证号码为0018。CFFEX是经中华人民共和国国务院和中国证券监督管理委员会批准成立的公司,专门提供金融期货、期权和其他衍生品的交易和结算服务。

| 监管国家 | 监管机构 | 当前状态 | 受监管实体 | 许可证类型 | 许可证号码 |

| 中国金融期货交易所(CFFEX) | 受监管 | 中信期货有限公司 | 期货许可证 | 0018 |

中信期货 服务

| 服务 | 支持 |

| 经纪服务 | ✔ |

| 投资咨询 | ✔ |

| 技术支持 | ✔ |

| 资产管理 | ✔ |

中信期货 费用

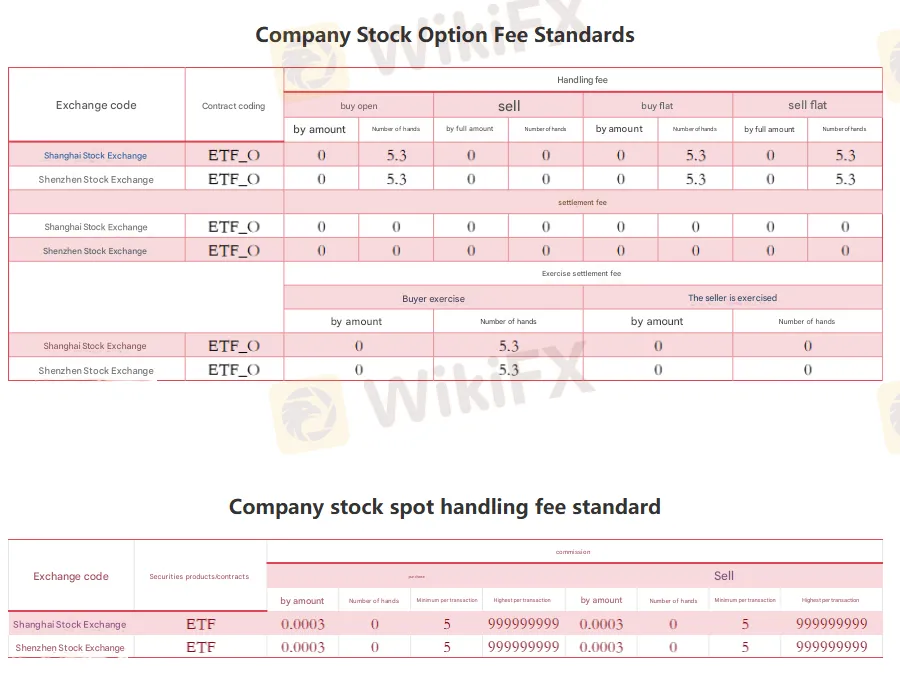

不同手续费产品在不同交易所上有所不同,请访问官方网站获取详细信息(图片由Google翻译,不太清晰,请访问官方网站获取详细信息)。

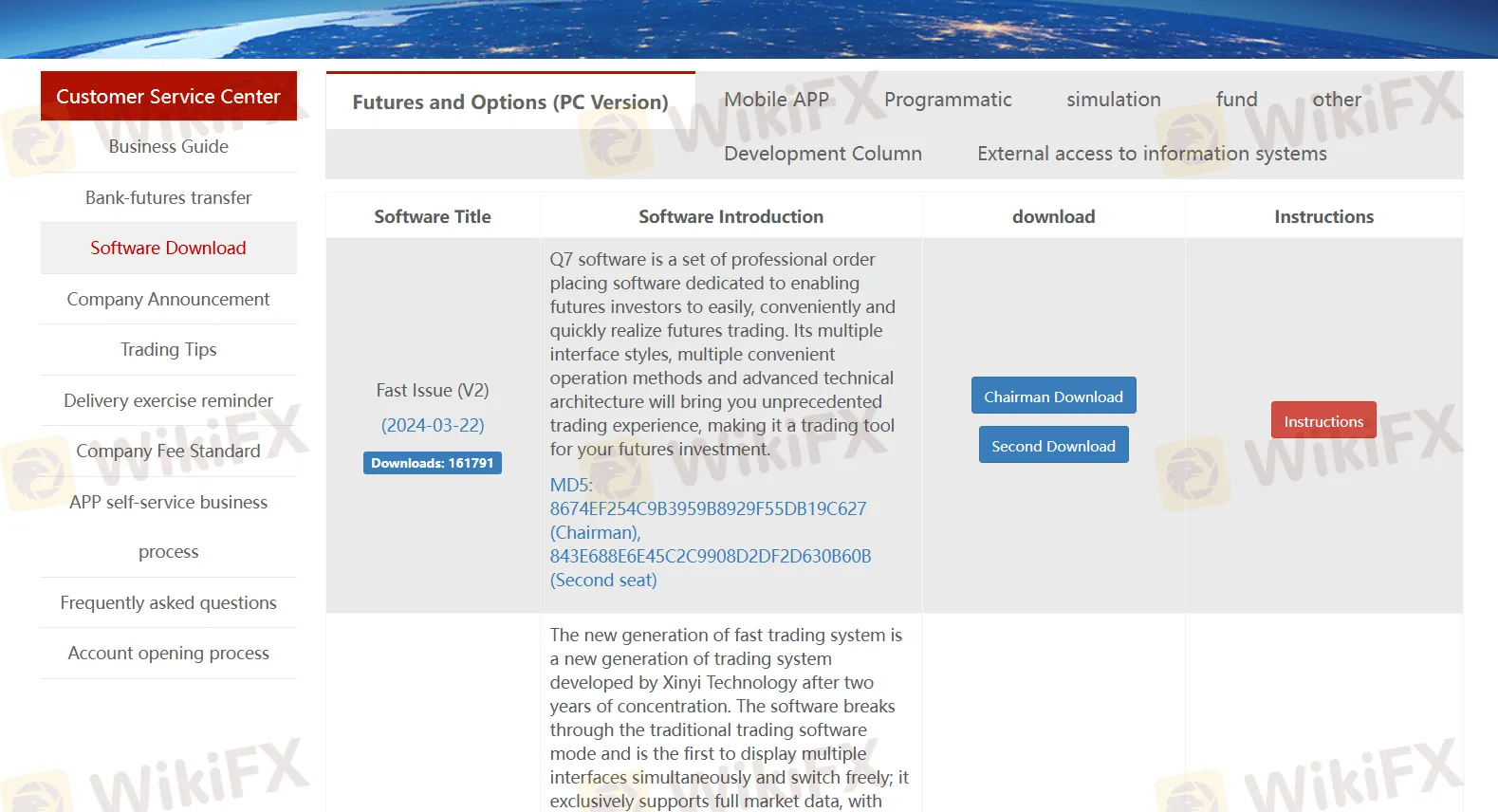

交易平台

| 交易平台 | 支持 | 可用设备 |

| 快速发布(V2) | ✔ | PC、笔记本电脑、平板电脑 |

| 快速发布(V3) | ✔ | PC、笔记本电脑、平板电脑 |

| 华语WH6 | ✔ | PC、笔记本电脑、平板电脑 |

| 博易大师7 | ✔ | PC、笔记本电脑、平板电脑 |

| 博易大师5 | ✔ | PC、笔记本电脑、平板电脑 |

| 中信期货 同花顺期货 | ✔ | PC、笔记本电脑、平板电脑 |

| 中信期货 无限轻松 | ✔ | PC、笔记本电脑、平板电脑 |

| 极星9.5 | ✔ | PC、笔记本电脑、平板电脑 |

| 中信极星9.3 | ✔ | PC、笔记本电脑、平板电脑 |

| 千龙期权 | ✔ | PC、笔记本电脑、平板电脑 |

| 汇点股票期权专业投资系统 | ✔ | PC、笔记本电脑、平板电脑 |

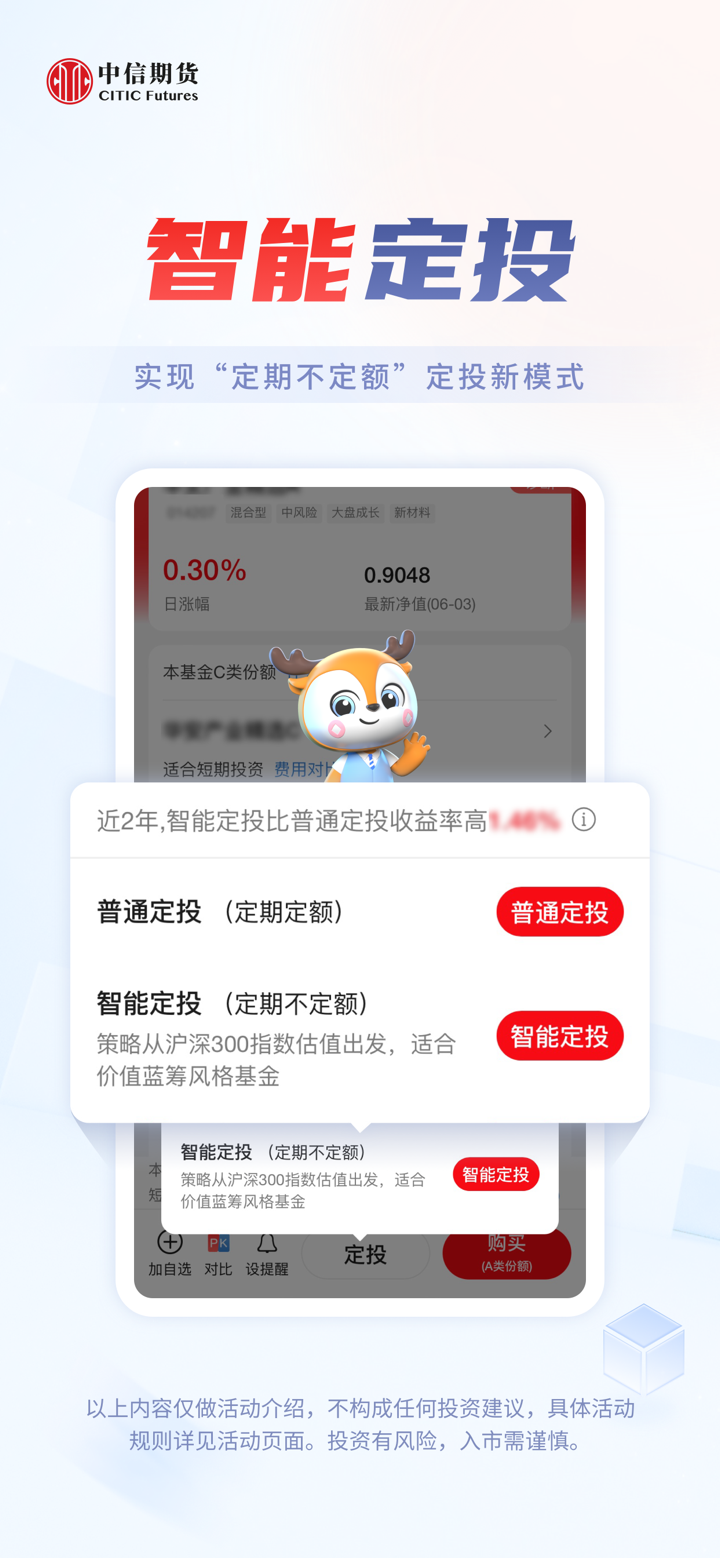

| 中信期货-新e路 | ✔ | 手机 |

| 中信期货-交易版 | ✔ | 手机 |