Profil perusahaan

| CITIC Futures Ringkasan Ulasan | |

| Didirikan | 2007 |

| Negara/Daerah Terdaftar | China |

| Regulasi | CFFEX |

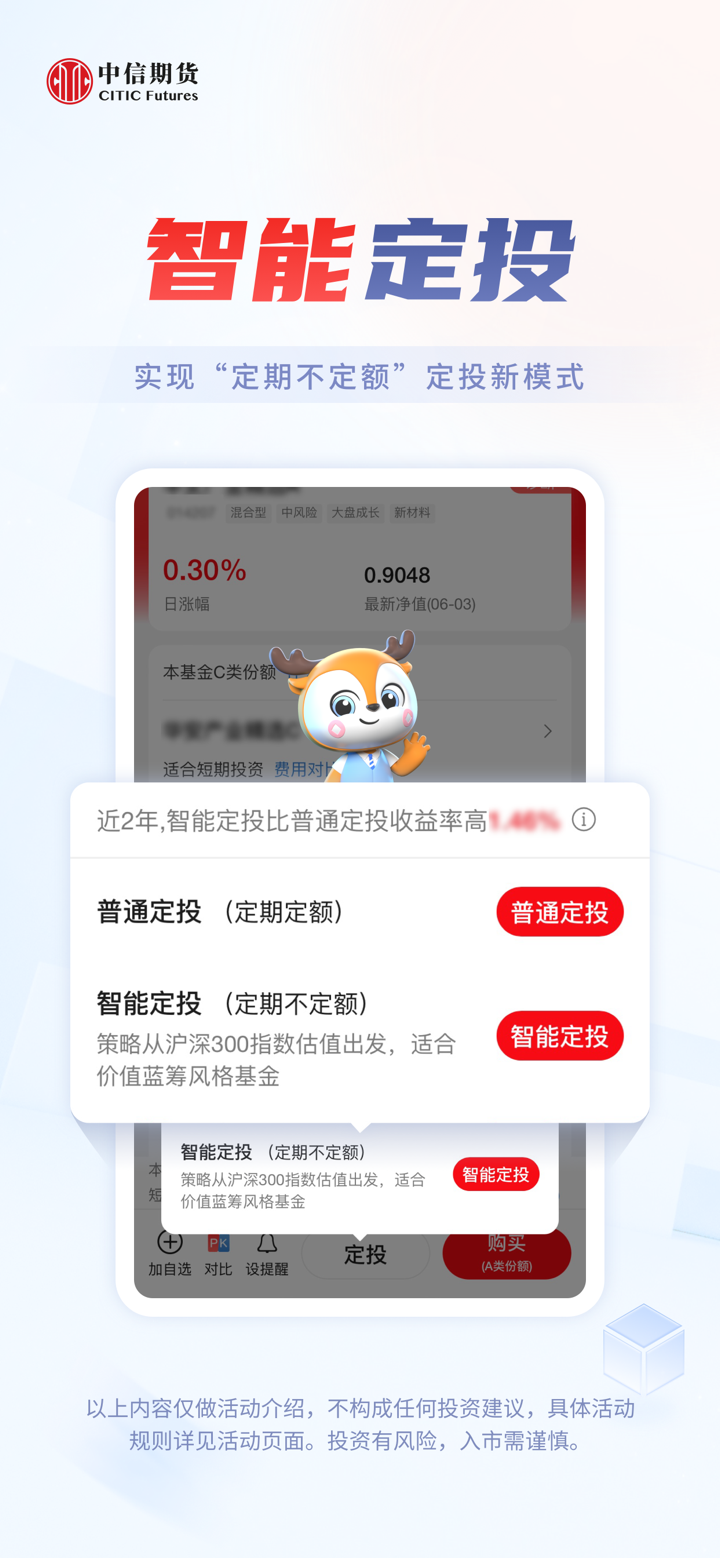

| Layanan | Layanan Brokerage, Penasihat Investasi, Dukungan Teknis, Manajemen Aset |

| Akun Demo | ✅ |

| Platform Perdagangan | Fast Issue (V2), Fast Issue (V3), Mandarin WH6, dll. |

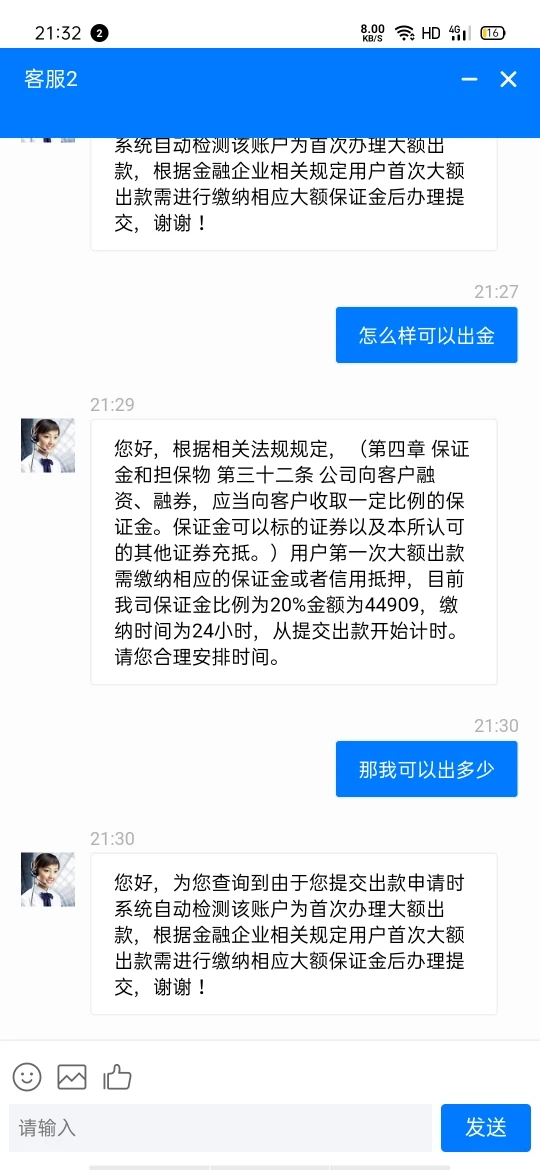

| Dukungan Pelanggan | Obrolan langsung 24/7 |

| Tel: 400-9908-826 | |

| Fax: 0755-83217421 | |

| Kode Pos: 518048 | |

| Alamat: Ruang 1301-1305, Lantai 13 dan 14, Blok Utara, Times Square Excellence (Fase II), No. 8 Zhongxin 3rd Road, Distrik Futian, Shenzhen, 518048, China | |

| Facebook, X, Instagram, LinkedIn | |

Informasi CITIC Futures

CITIC Futures adalah penyedia layanan yang diatur untuk layanan pialang dan keuangan utama, yang didirikan di China pada tahun 2007. Ini menawarkan layanan untuk Layanan Pialang, Penasihat Investasi, Dukungan Teknis, dan Manajemen Aset.

Kelebihan dan Kekurangan

| Kelebihan | Kekurangan |

| Akun demo | Produk perdagangan terbatas |

| Waktu operasi yang lama | Berbagai biaya yang dibebankan |

| Berbagai saluran kontak | |

| Diatur dengan baik |

Apakah CITIC Futures Legal?

Ya. CITIC Futures memiliki lisensi dari CFFEX untuk menawarkan layanan. Nomor lisensinya adalah 0018. CFFEX, didirikan dengan persetujuan Dewan Negara Republik Rakyat Tiongkok dan Otoritas Pengatur Pasar Modal Tiongkok (CSRC), adalah bursa terdaftar yang mengkhususkan diri dalam menyediakan layanan perdagangan dan kliring untuk futures keuangan, opsi, dan derivatif lainnya.

| Negara yang Diatur | Pengatur | Status Saat Ini | Entitas yang Diatur | Jenis Lisensi | No. Lisensi |

| Bursa Futures Keuangan China (CFFEX) | Diatur | 中信期货有限公司 | Lisensi Futures | 0018 |

Layanan CITIC Futures

| Layanan | Didukung |

| Layanan Broker | ✔ |

| Penasehat Investasi | ✔ |

| Dukungan Teknis | ✔ |

| Manajemen Aset | ✔ |

Biaya CITIC Futures

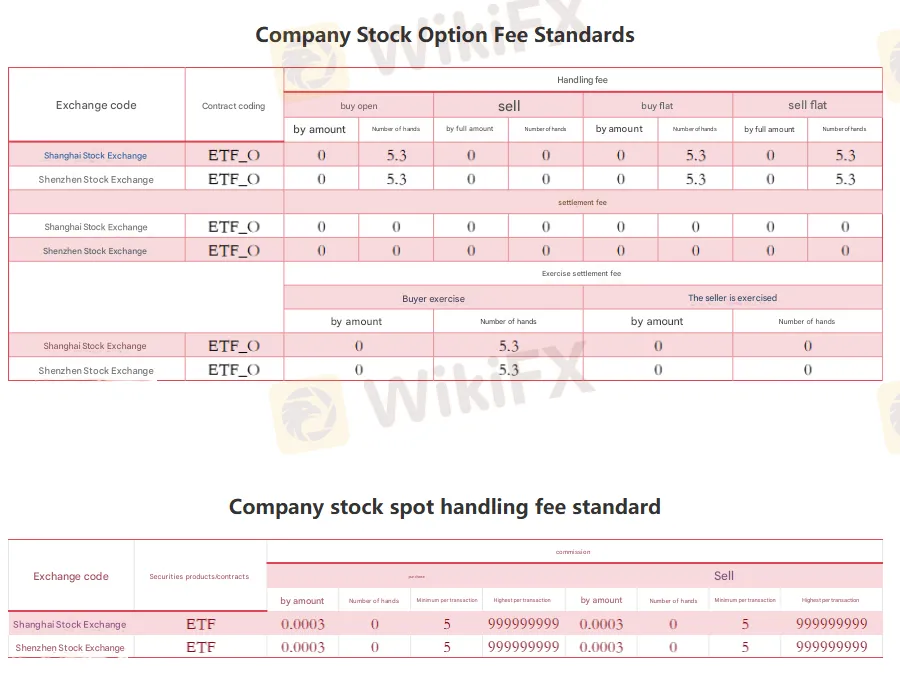

Biaya berbeda untuk produk yang berbeda di bursa yang berbeda, silakan kunjungi situs web resmi untuk rincian lebih lanjut (gambar diterjemahkan oleh Google, tidak terlalu jelas, silakan kunjungi situs web resmi untuk rincian lebih lanjut).

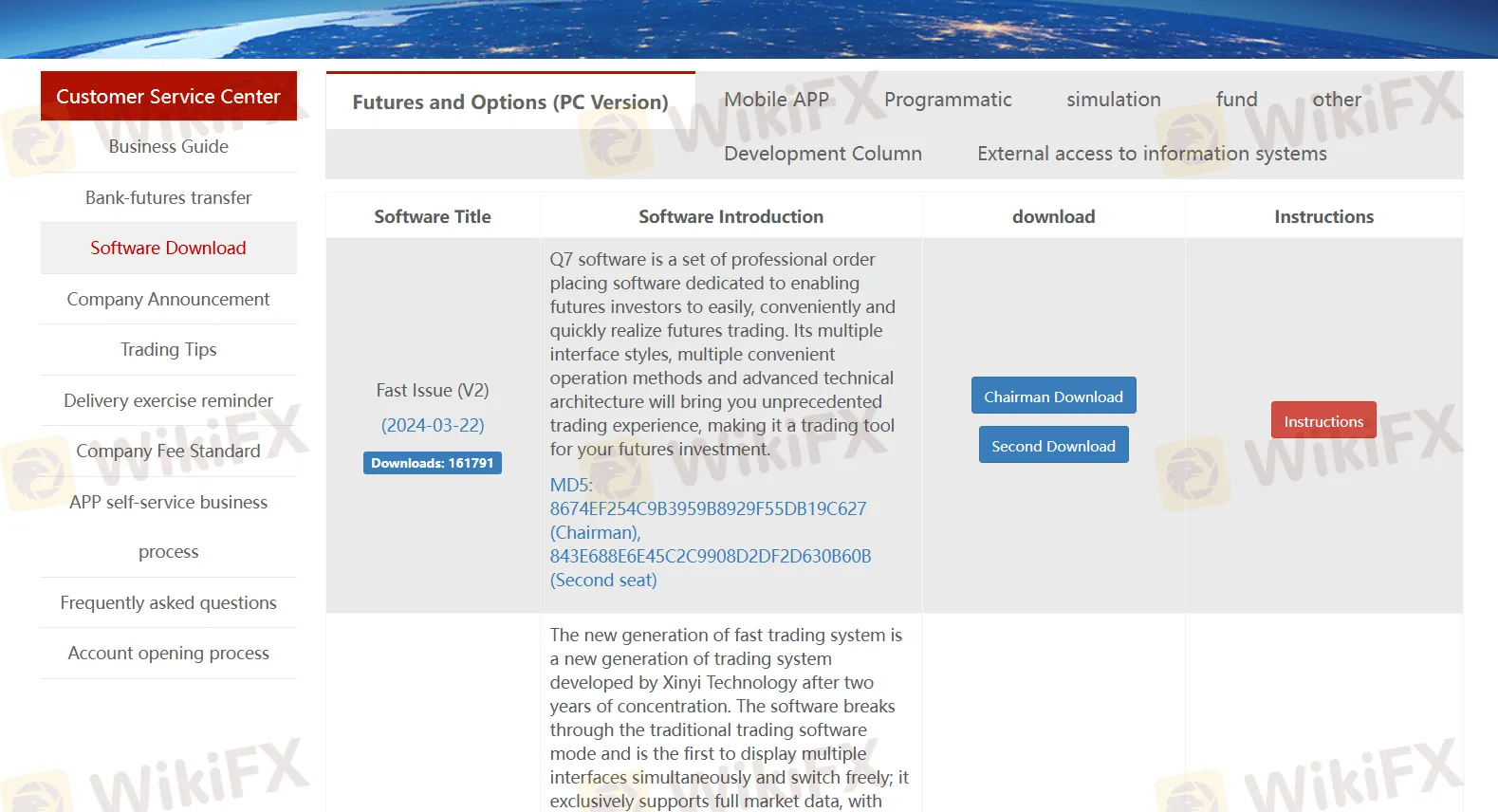

Platform Perdagangan

| Platform Perdagangan | Dukungan | Perangkat Tersedia |

| Fast Issue (V2) | ✔ | PC, laptop, tablet |

| Fast Issue (V3) | ✔ | PC, laptop, tablet |

| Mandarin WH6 | ✔ | PC, laptop, tablet |

| Boyi Master 7 | ✔ | PC, laptop, tablet |

| Boyi Master 5 | ✔ | PC, laptop, tablet |

| CITIC Futures Tonghuashun Futures | ✔ | PC, laptop, tablet |

| CITIC Futures Infinite Easy | ✔ | PC, laptop, tablet |

| Polestar 9.5 | ✔ | PC, laptop, tablet |

| CITIC Polestar 9.3 | ✔ | PC, laptop, tablet |

| Qianlong Option | ✔ | PC, laptop, tablet |

| Huidian Stock Options Professional Investment System | ✔ | PC, laptop, tablet |

| CITIC Futures-Xin eLu | ✔ | Mobile |

| CITIC Futures-Edisi Perdagangan | ✔ | Mobile |