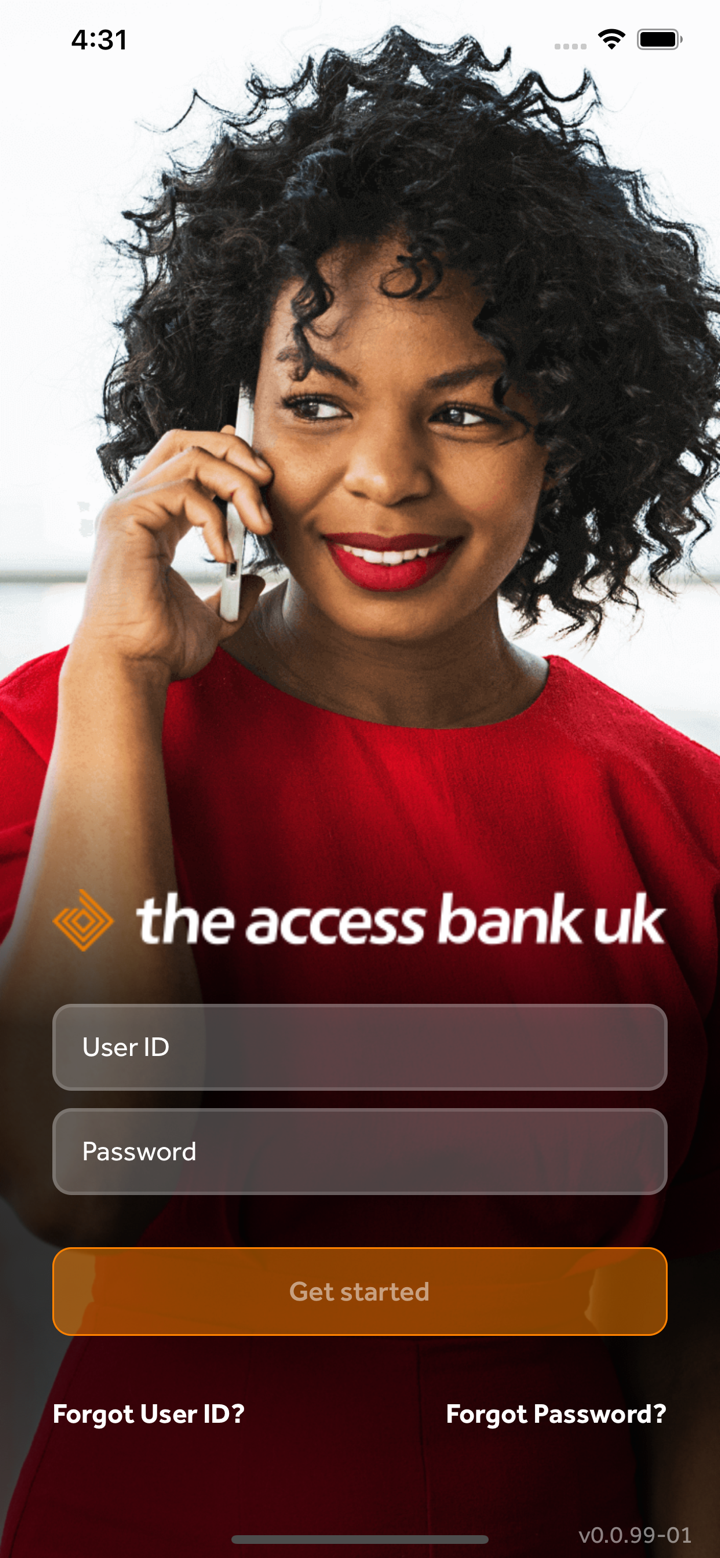

Unternehmensprofil

| Access Bank Überprüfungszusammenfassung | |

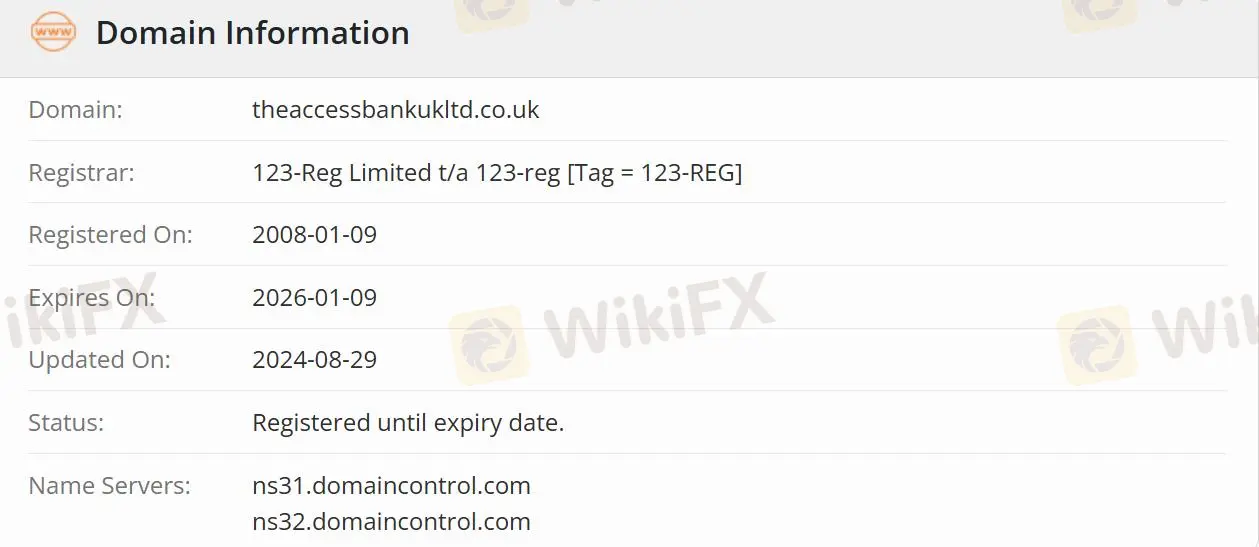

| Gegründet | 2008-01-19 |

| Registriertes Land/Region | Vereinigtes Königreich |

| Regulierung | Reguliert |

| Dienstleistungen | Handelsfinanzierung/Kommerzielles Bankwesen/Vermögensverwaltung/Investition |

| Kundensupport | E-Mail: ccontactaaccessprivatebank.com |

| Telefon: 0333 222 4516 (UK)/+44 1606 813020 | |

Access Bank Informationen

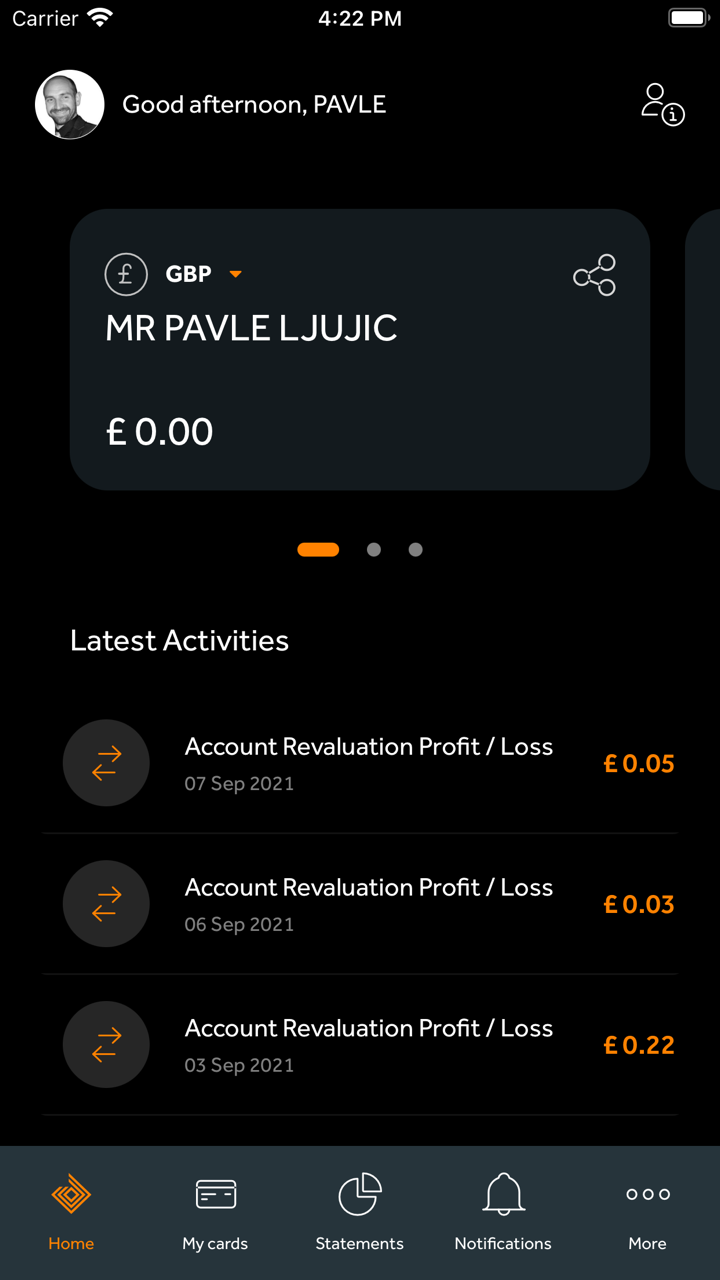

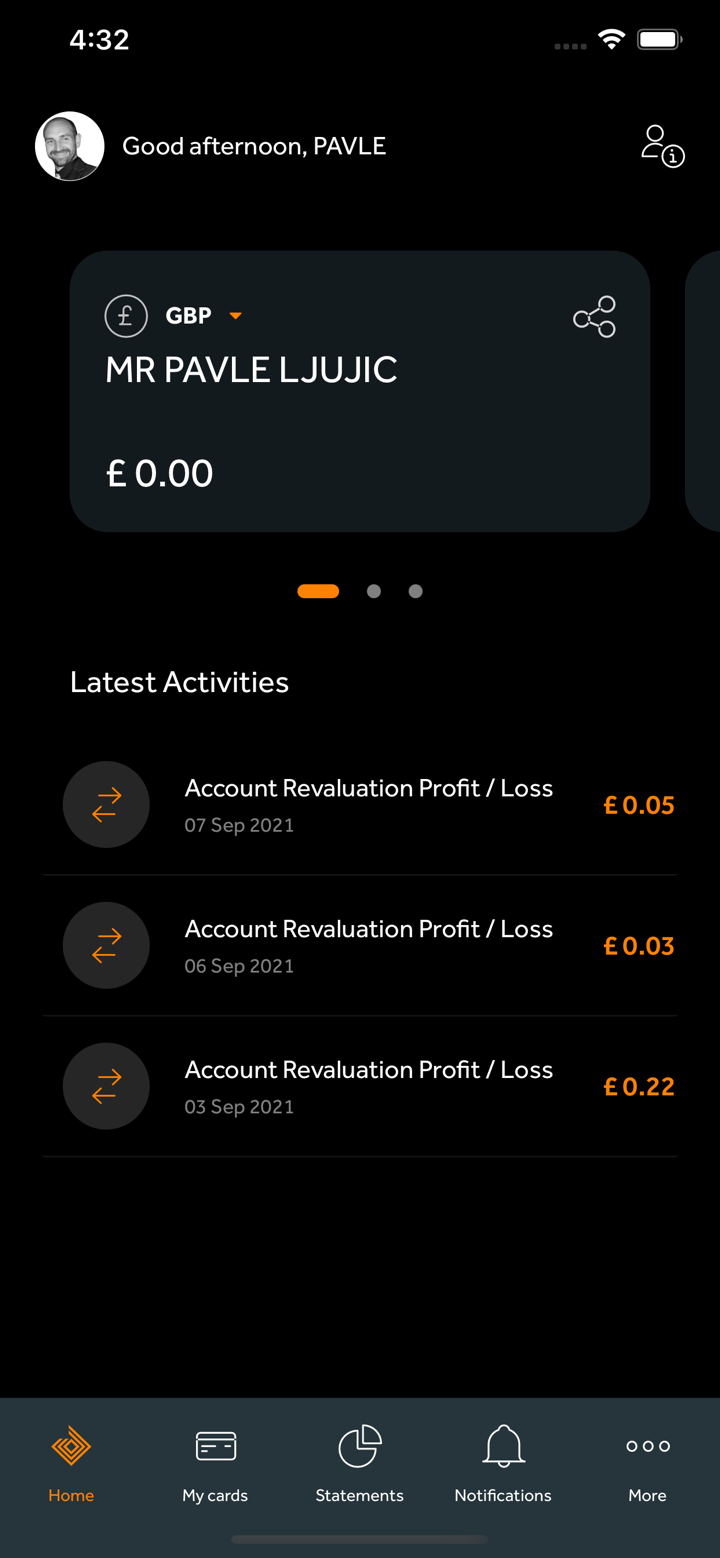

Die in Großbritannien registrierte Access Bank bietet eine breite Palette innovativer Produkte und Dienstleistungen, einschließlich Handelsfinanzierung, kommerziellem Bankwesen und Vermögensverwaltung, und unterstützt den Kapitalfluss in die Märkte in Nigeria, Afrika und der MENA-Region. Das Ziel der Bank ist es, das internationale Geschäft der Access Bank Group durch Kundenservice und innovative Lösungen im Bereich Handelsfinanzierung, kommerziellem Bankwesen und Vermögensverwaltung zu fördern.

Ist Access Bank seriös?

Access Bank ist von der Financial Conduct Authority (FCA) autorisiert und reguliert mit der Lizenznummer 478415. Ein reguliertes Unternehmen ist sicherer als ein unreguliertes Unternehmen.

Welche Dienstleistungen bietet Access Bank an?

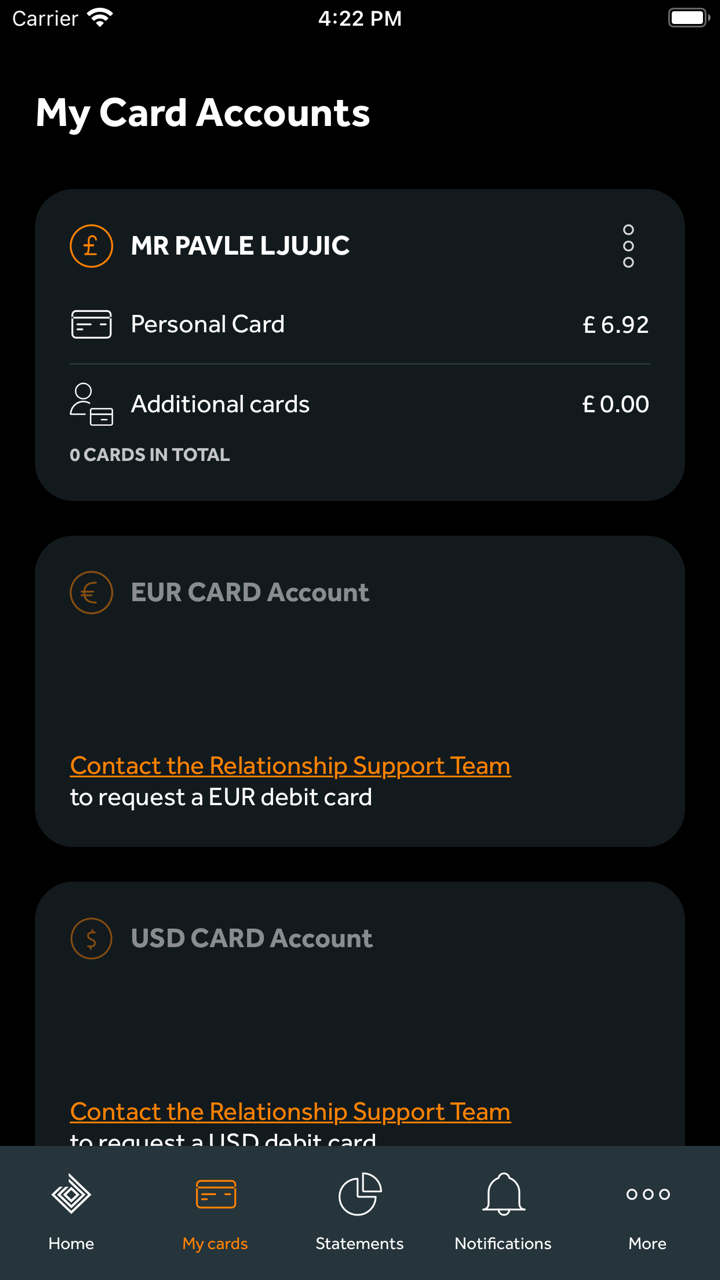

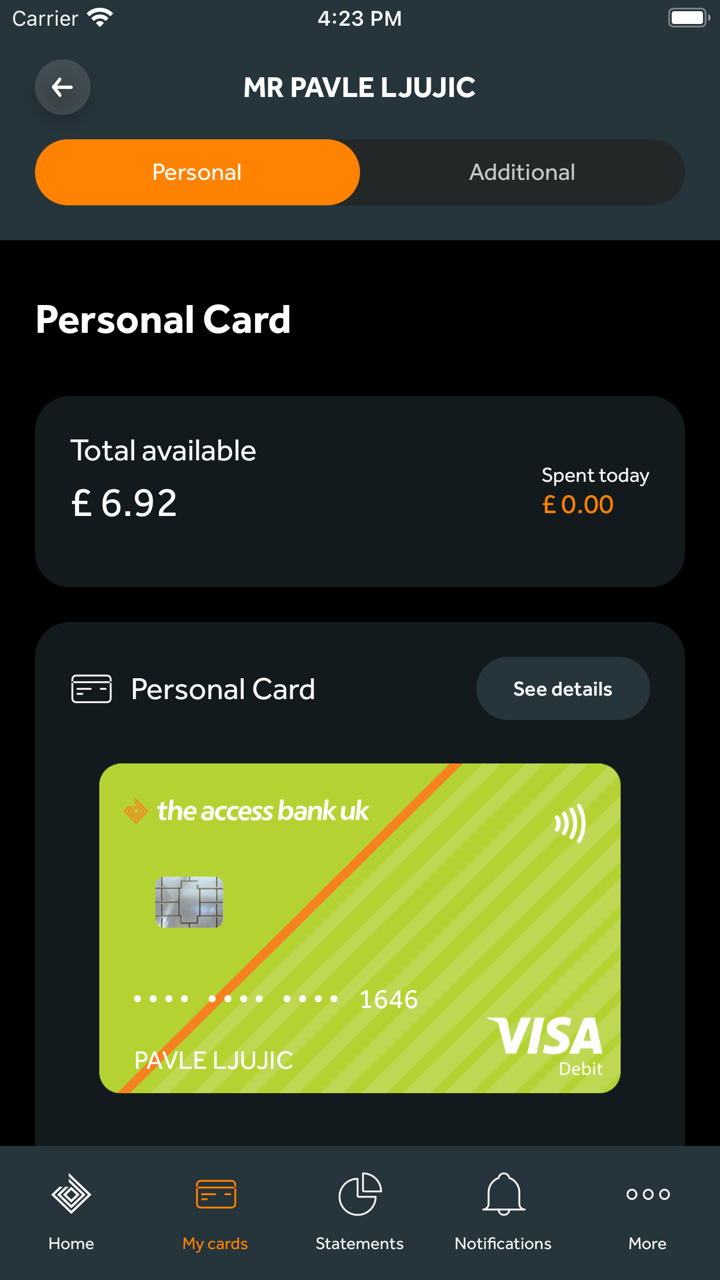

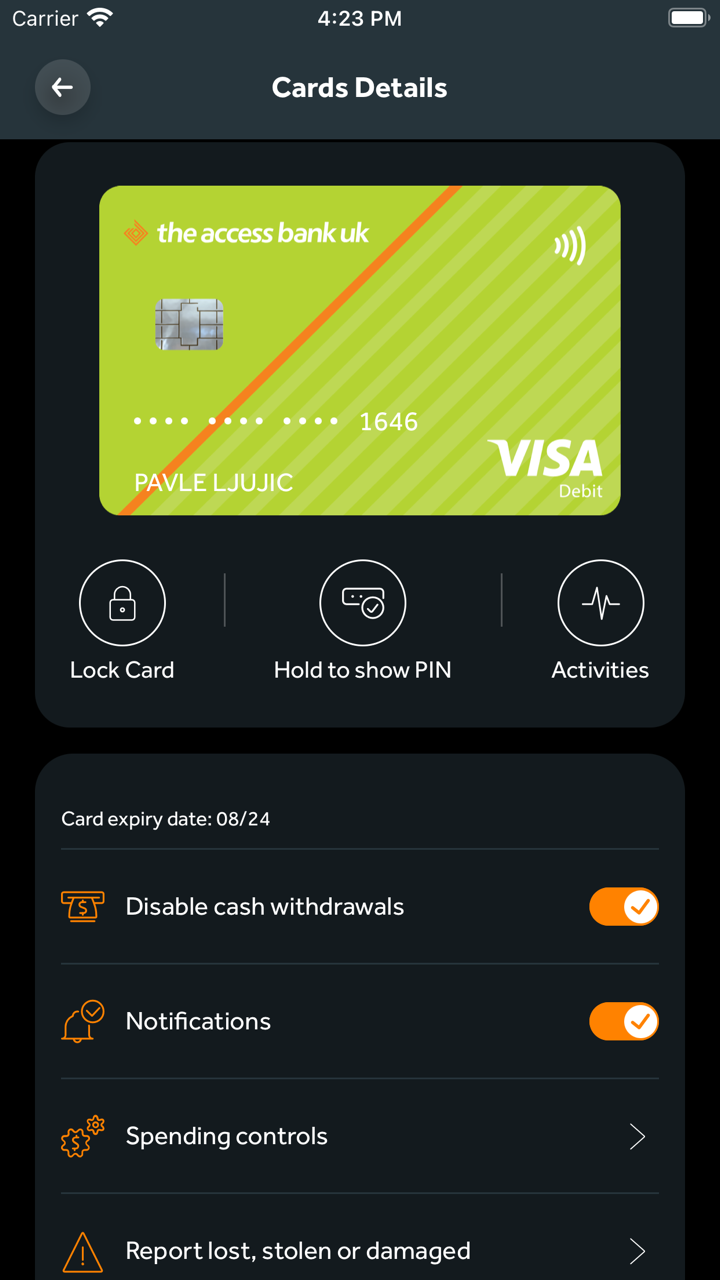

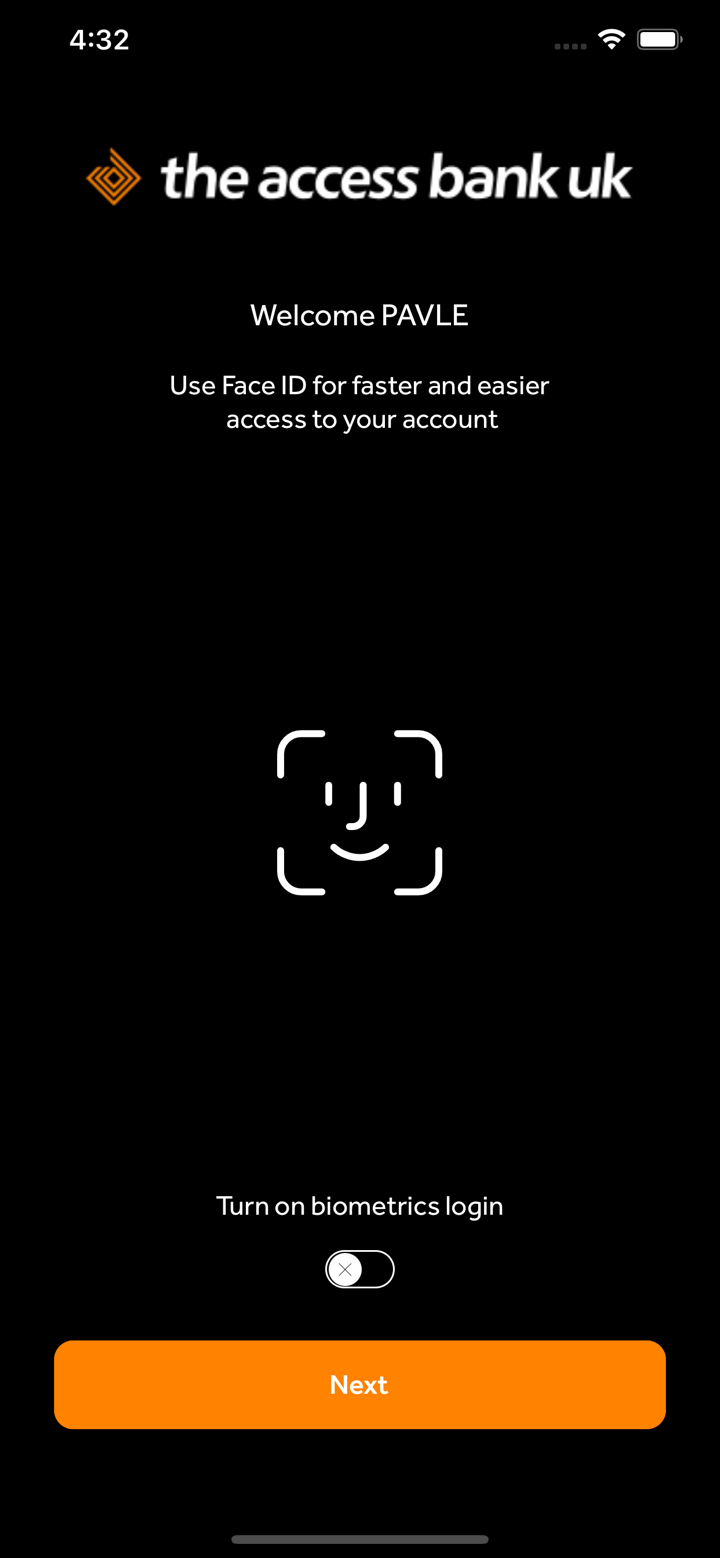

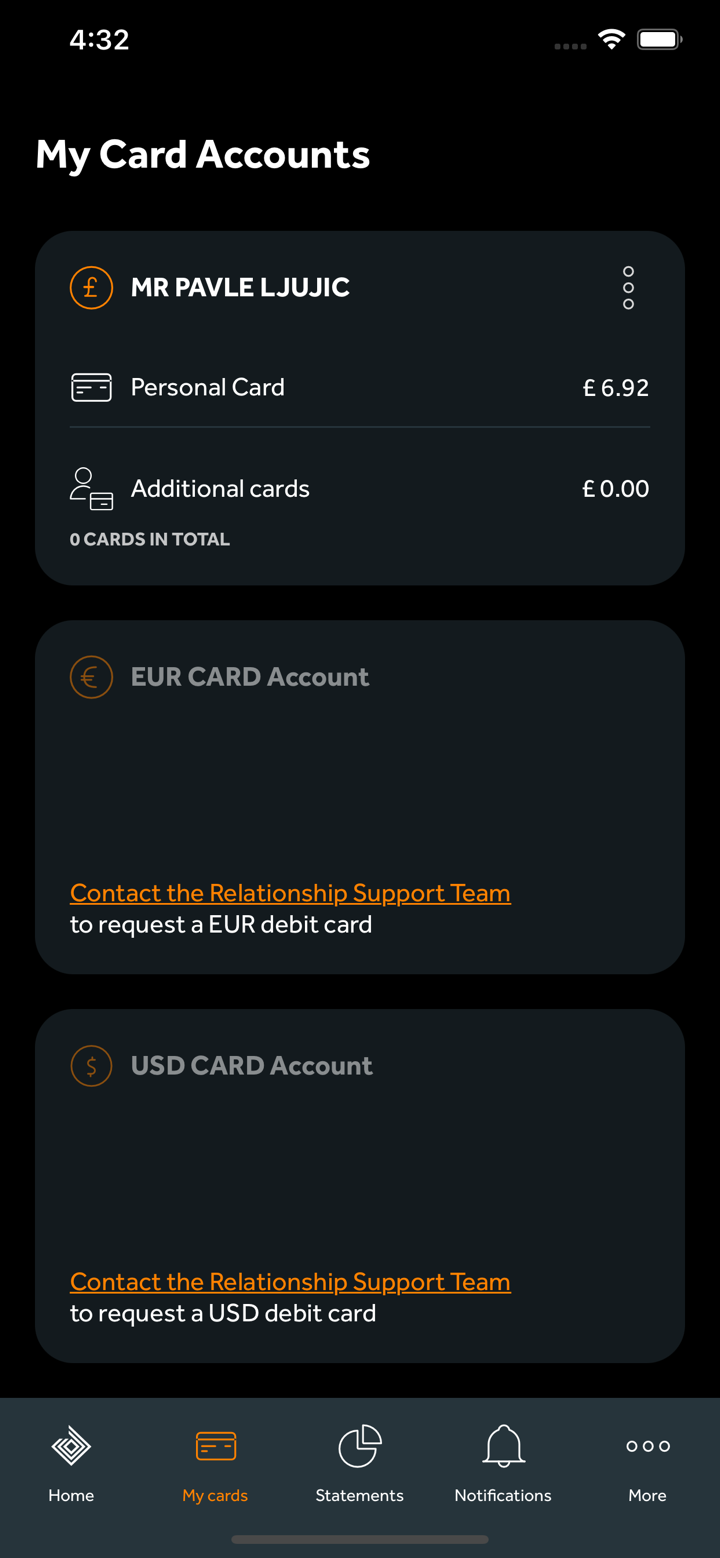

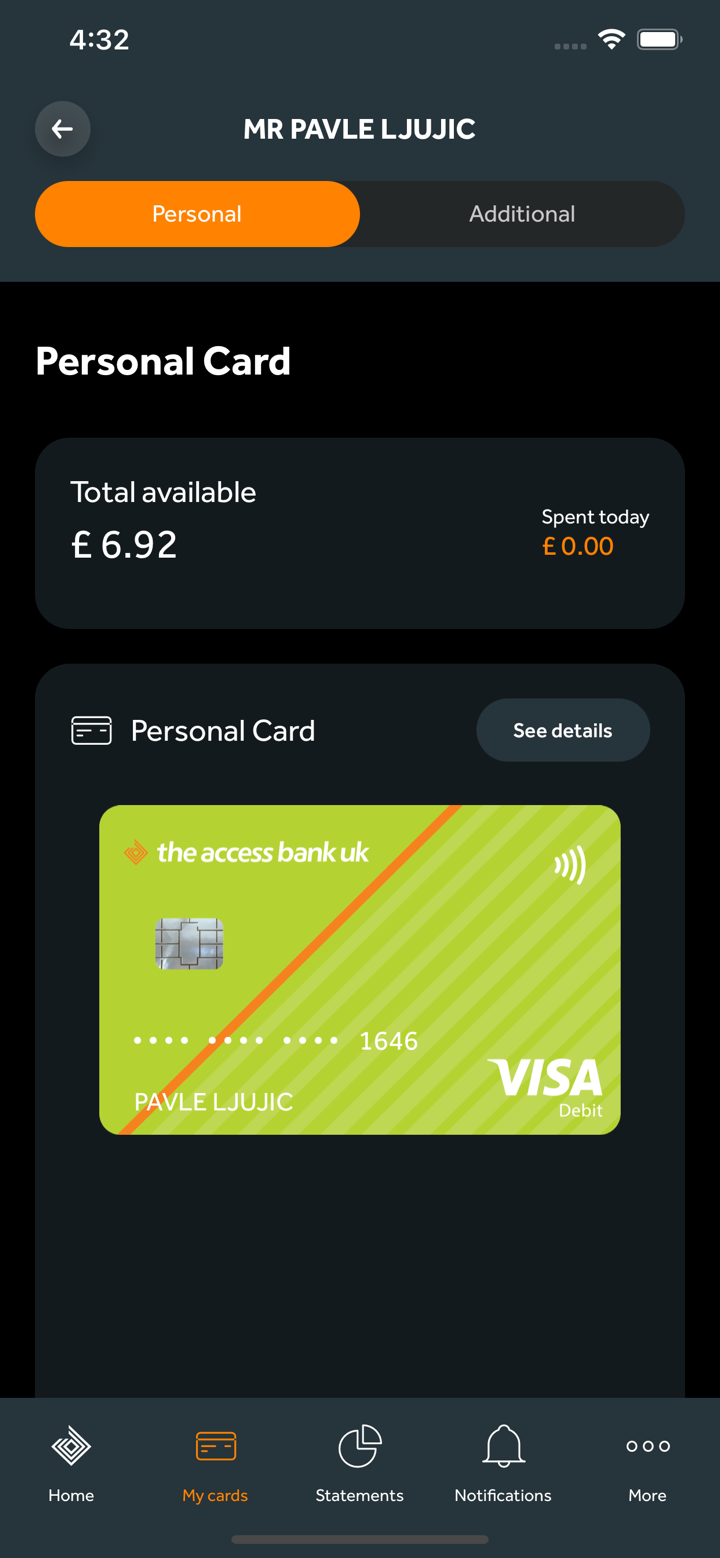

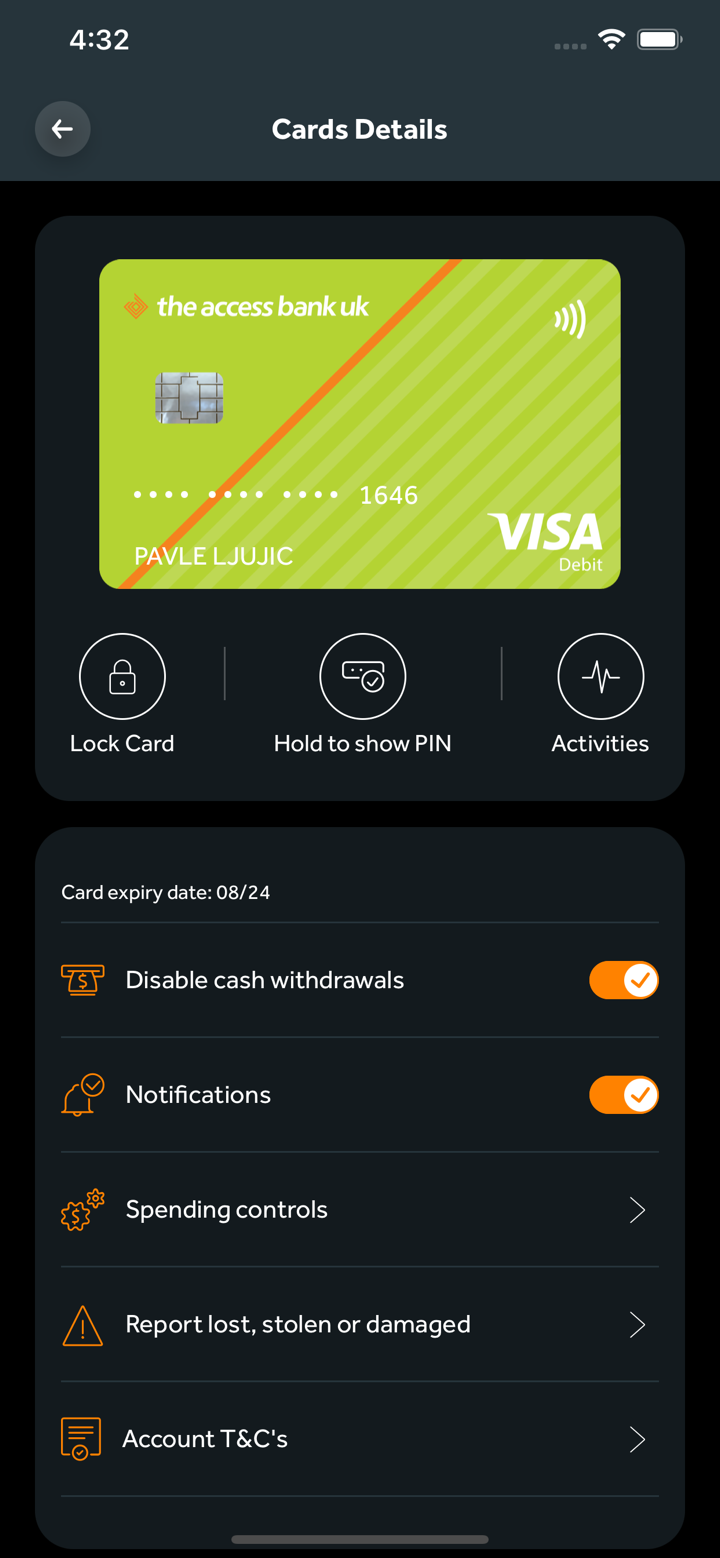

Access Bank bietet verschiedene Finanzdienstleistungen für Einzelpersonen, Unternehmen und Privatpersonen im Vereinigten Königreich an. Andere internationale Benutzer können Dienstleistungen wie kommerzielles Bankwesen und Handelsfinanzierung in Anspruch nehmen.

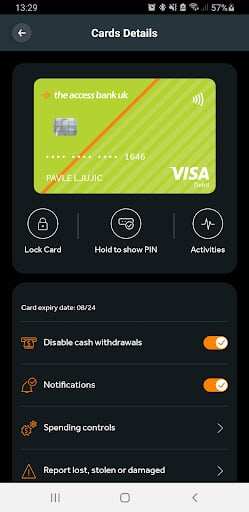

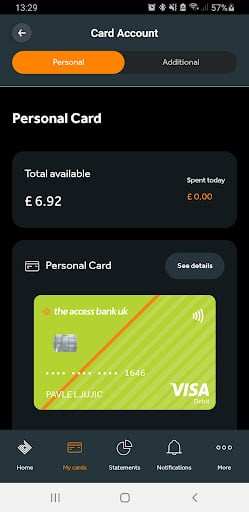

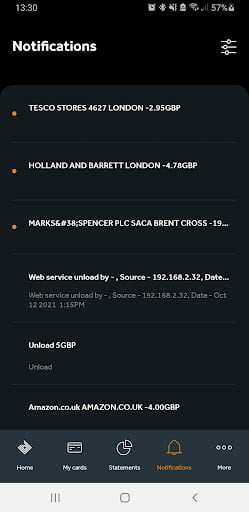

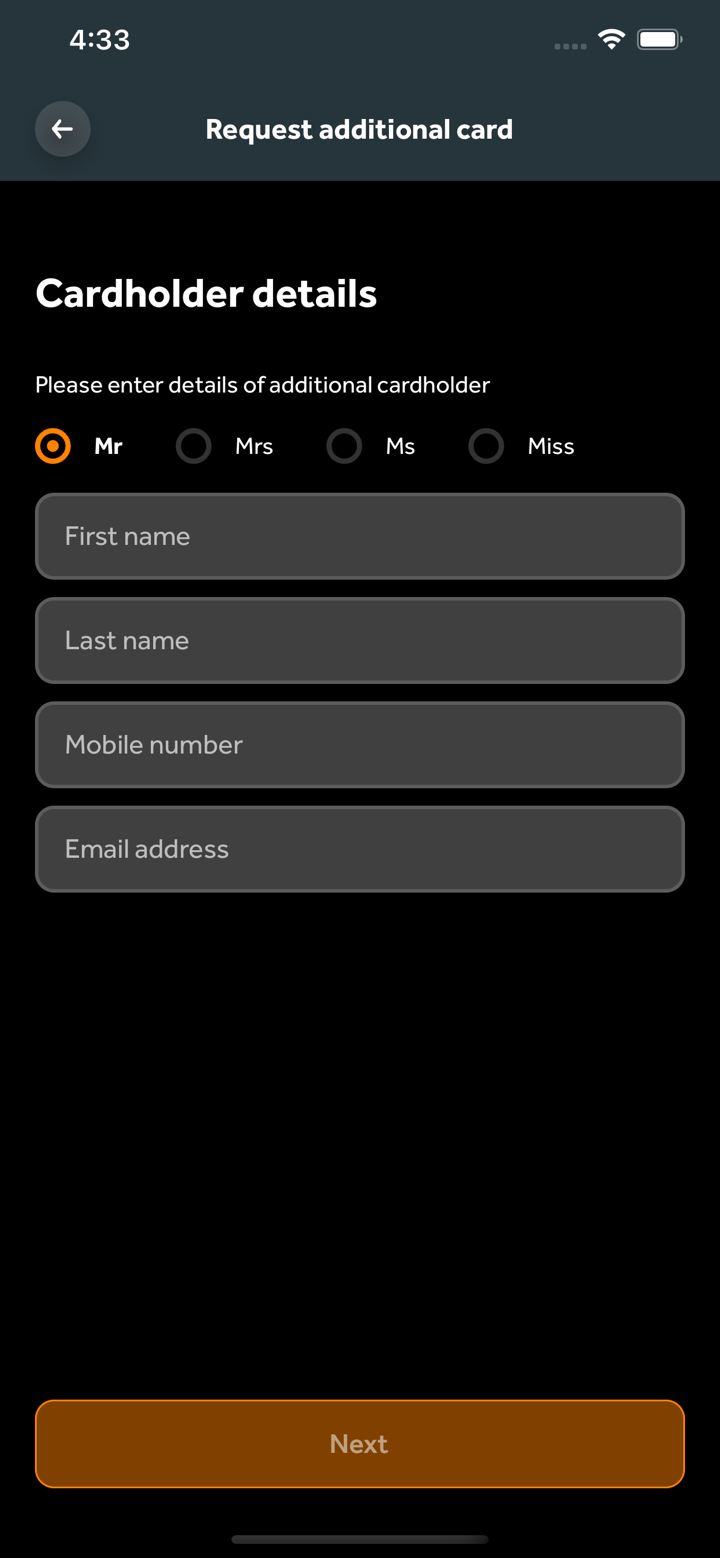

UK Privatkunden können persönliches Bankwesen, laufende Konten, Immobilienkredite, Devisendienstleistungen, schnellere Zahlungen, häufig gestellte Fragen und Kündigungseinlagenkonten wählen.

Die Bank bietet britischen Geschäftskunden Geschäftsbankwesen, Geschäftskonten, Handelsfinanzierung, Immobilienkredite, Kündigungseinlagenkonten, Direktkredite, schnellere Zahlungen und häufig gestellte Fragen.

Britische Privatkunden erhalten exklusives Privatbanking, diskretionäre Portfolios, reine Ausführungsportfolios, Immobilienkredite, Kündigungseinlagenkonten, schnellere Zahlungen und portfolio-gesicherte Kredite.

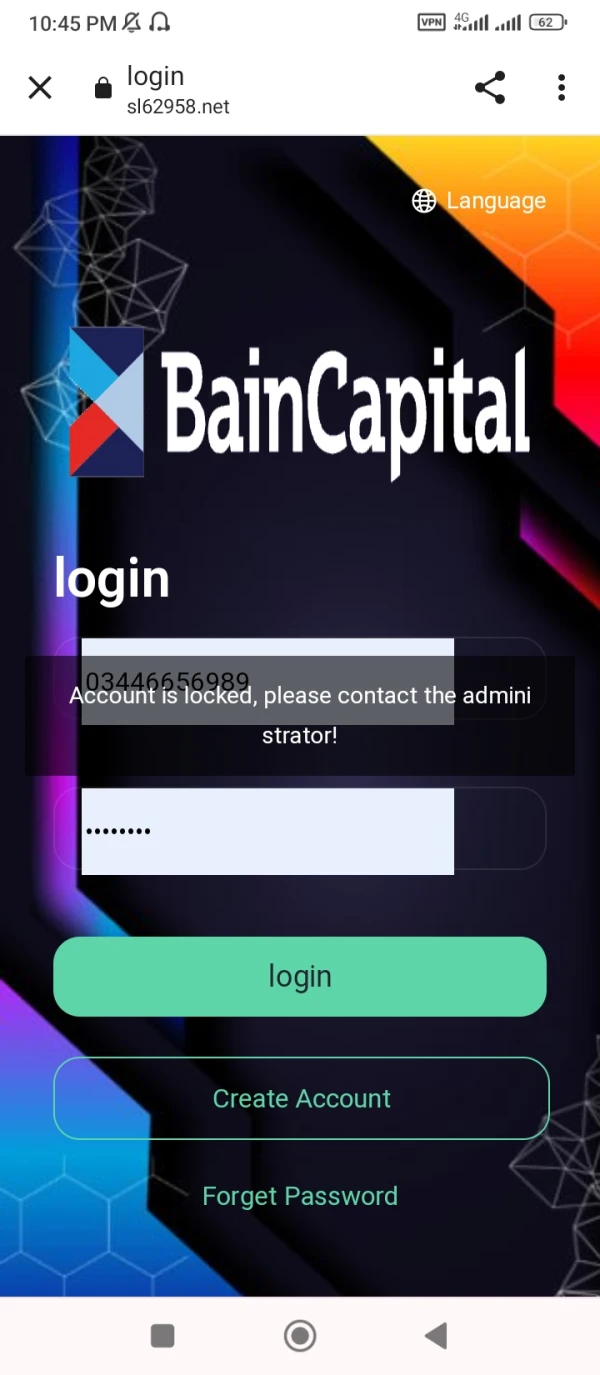

Ghazi6612

Pakistan

Jetzt ist auch mein Konto gesperrt.

Exposition

sunny91

Türkei

Das Bankgeschäft mit Access Bank UK fühlt sich wirklich persönlich an. Sie legen wirklich Wert darauf, meine Bedürfnisse zu verstehen und zu erfüllen. Ihr Online-Banking ist unkompliziert und effizient.

Positive

拳

Singapur

Vertrauenswürdig und zuverlässig! Erstklassiger Bankdienst!

Positive

KASLAS

Nigeria

Das Hauptproblem von Brokern ist ein schlechtes Netzwerk, aber der Access Bank-Broker ist sehr gut im Netzwerk, er ist einfach zu handeln und der Prozess der Gewinnabhebung war erfolgreich

Positive

程安 -陶

Argentinien

Der Kundenservice dieser Firma ist sehr gut. Ich erhielt innerhalb einer Stunde nach dem Absenden der E-Mail eine Antwort, und der Kundendienst half mir geduldig und akribisch bei der Lösung des Problems.

Positive

Rith Rith

Hongkong

Ich habe eine Menge solcher Sachen ausprobiert, in gewisser Weise möchte ich es versuchen, aber in meinem Unterbewusstsein denke ich, ja, ja, ich möchte es versuchen!! Kann mir jemand sagen das es funktioniert.

Positive