Perfil de la compañía

| Resumen de la revisión de Access Bank | |

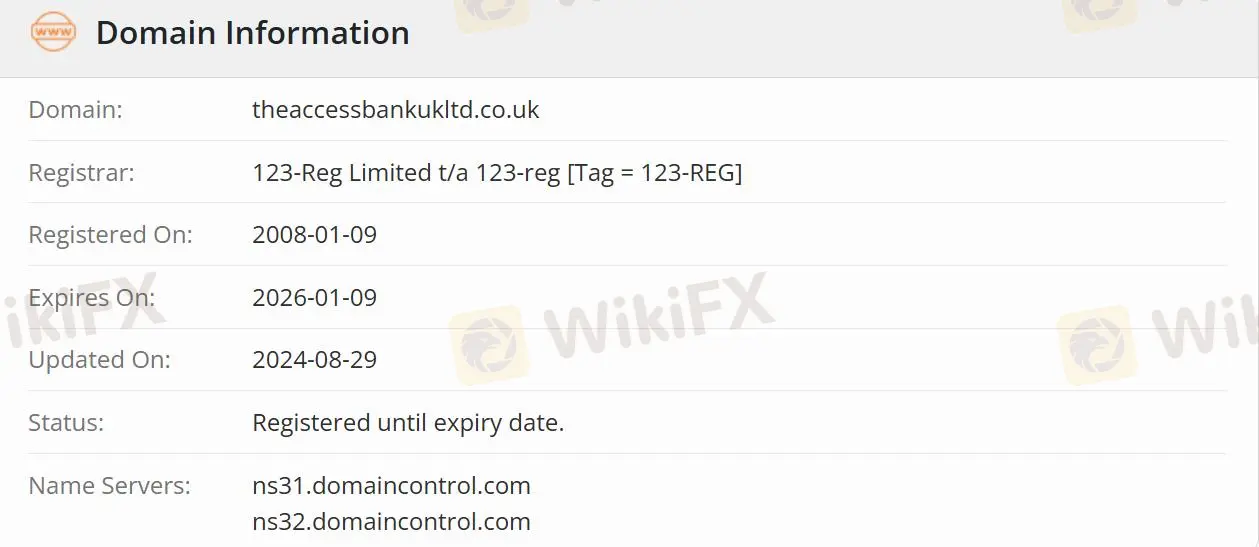

| Fundado | 2008-01-19 |

| País/Región Registrado | Reino Unido |

| Regulación | Regulado |

| Servicios | Financiamiento Comercial/Banca Comercial/Gestión de Activos/Inversión |

| Soporte al Cliente | Email: ccontactaaccessprivatebank.com |

| Teléfono: 0333 222 4516 (Reino Unido)/+44 1606 813020 | |

Información de Access Bank

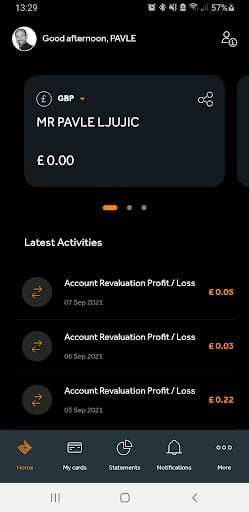

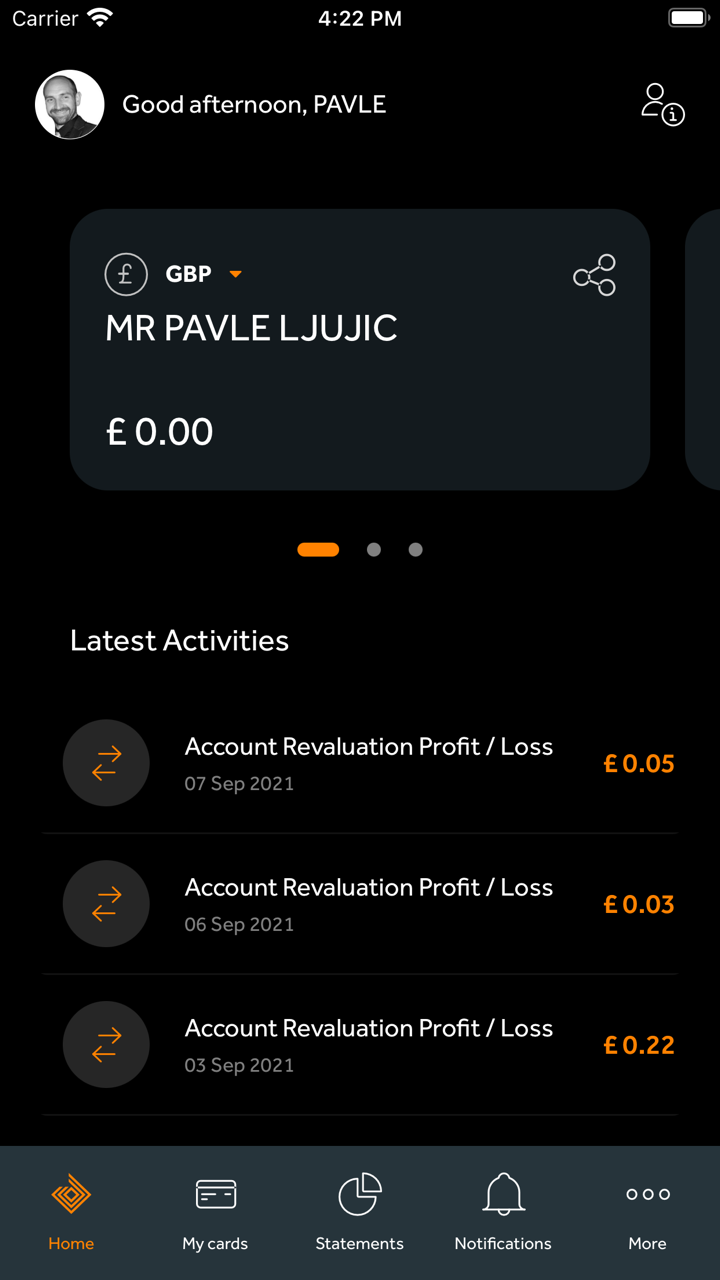

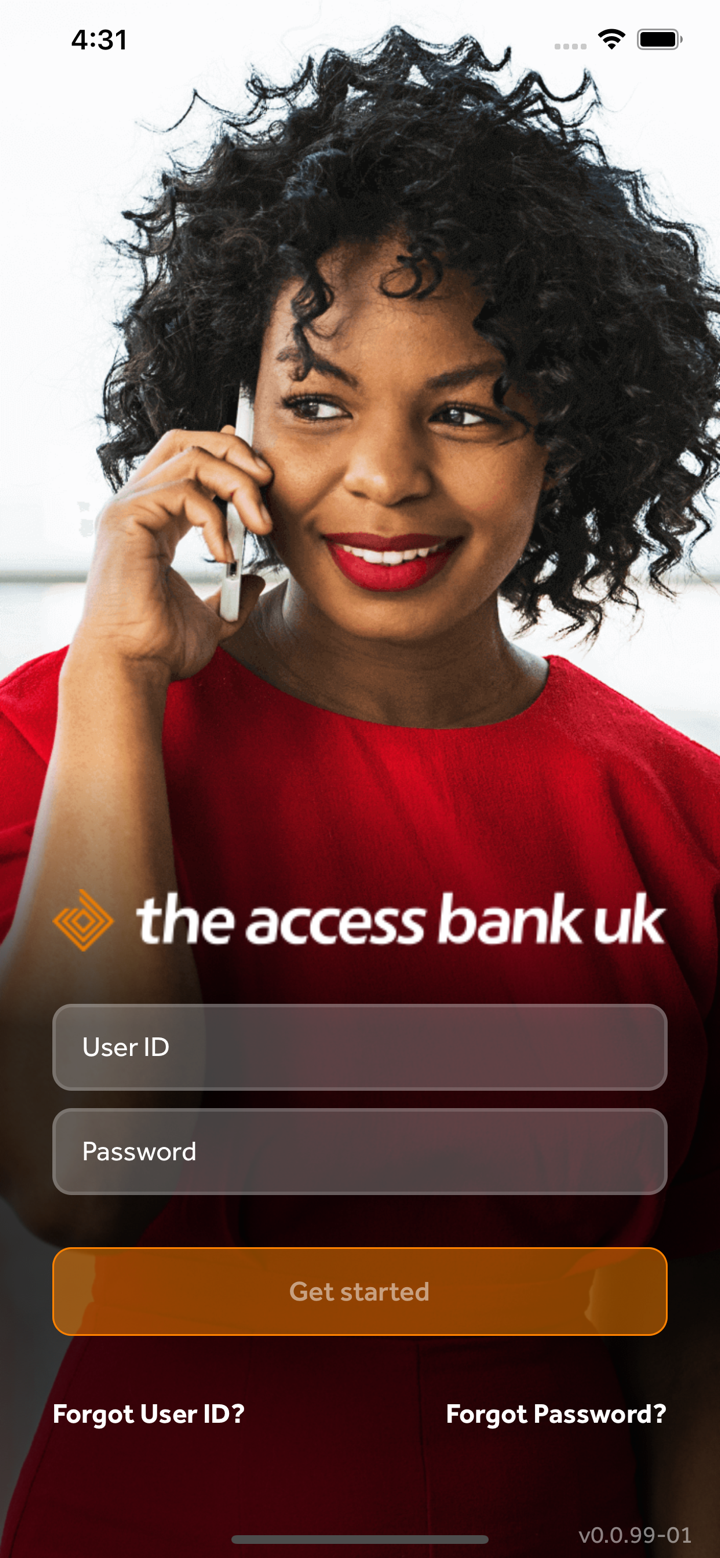

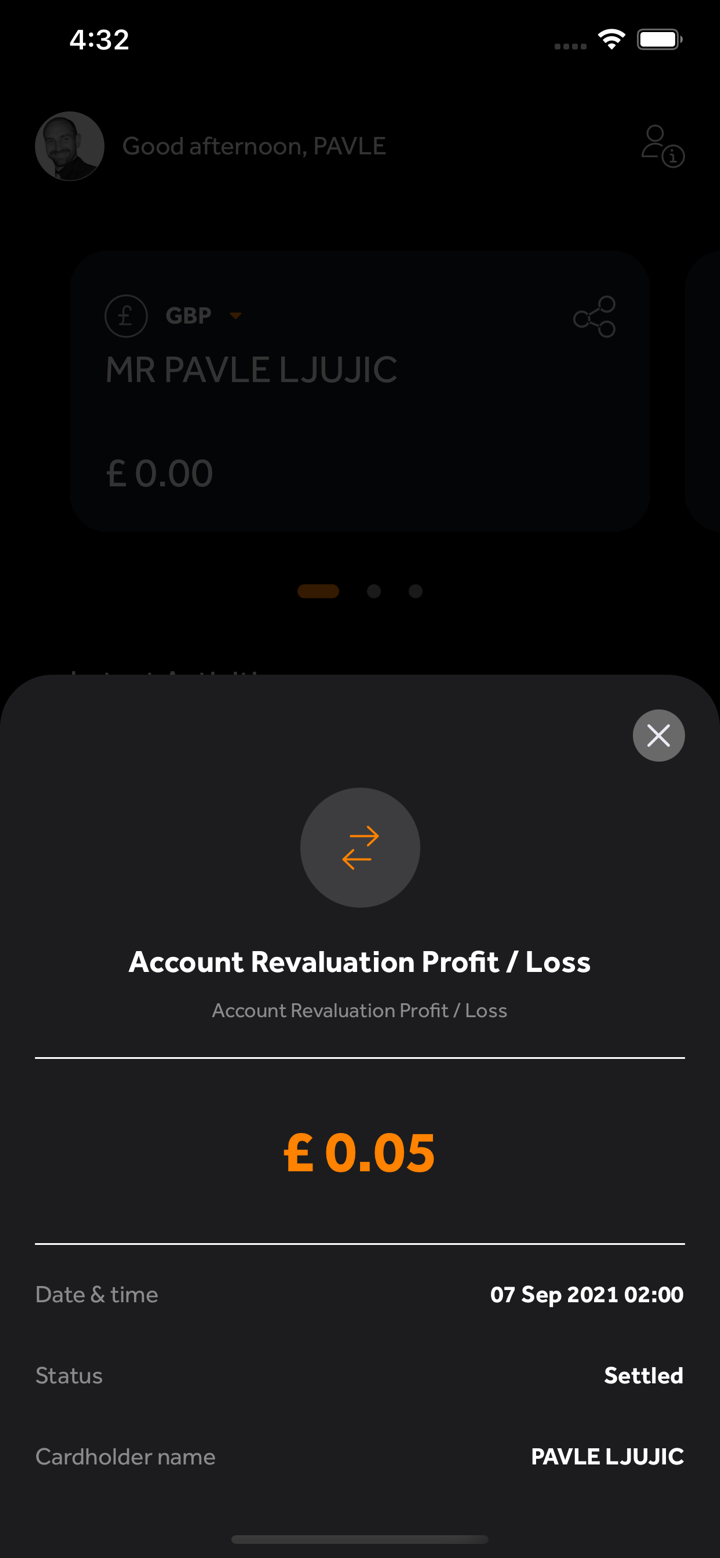

Access Bank registrado en el Reino Unido ofrece una amplia gama de productos y servicios innovadores, incluyendo financiamiento comercial, banca comercial y gestión de activos, así como apoya el flujo de inversión en los mercados de Nigeria, África y la región de MENA. El objetivo del banco es hacer crecer el negocio internacional del Grupo Access Bank a través del servicio al cliente y soluciones innovadoras en Financiamiento Comercial, Banca Comercial y Gestión de Activos

¿Es Access Bank legítimo?

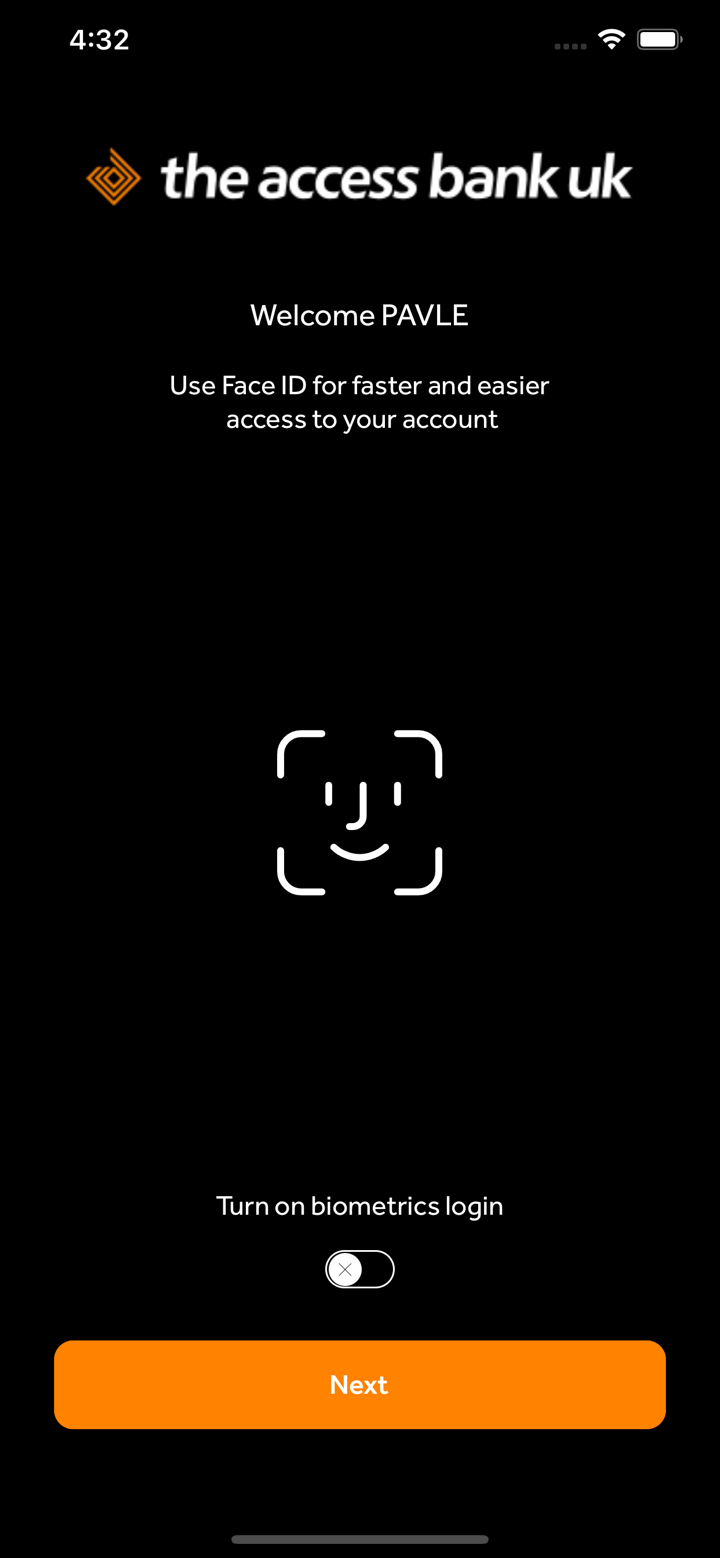

Access Bank está autorizado y regulado por la Autoridad de Conducta Financiera (FCA) con licencia No. 478415. Una empresa regulada es más segura que una no regulada.

¿Qué servicios ofrece Access Bank?

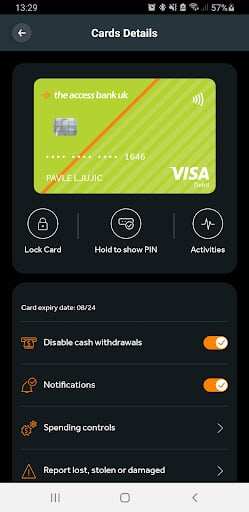

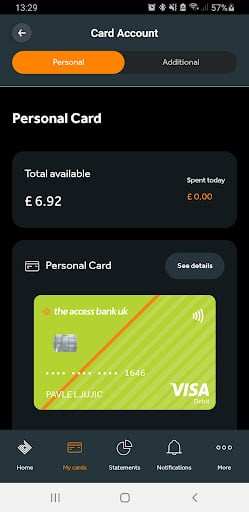

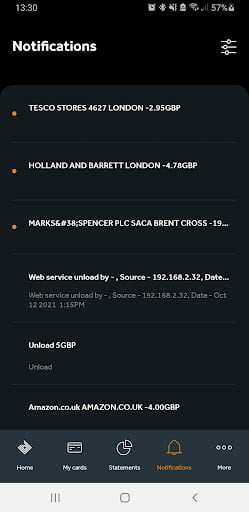

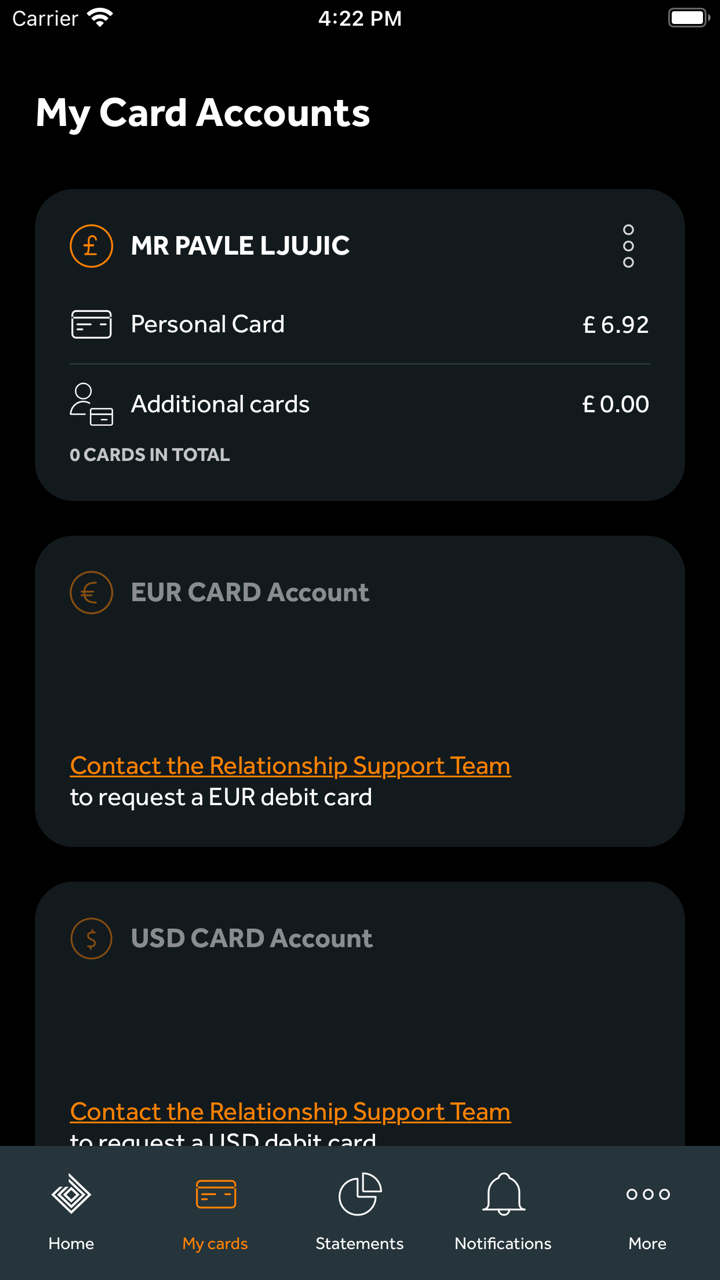

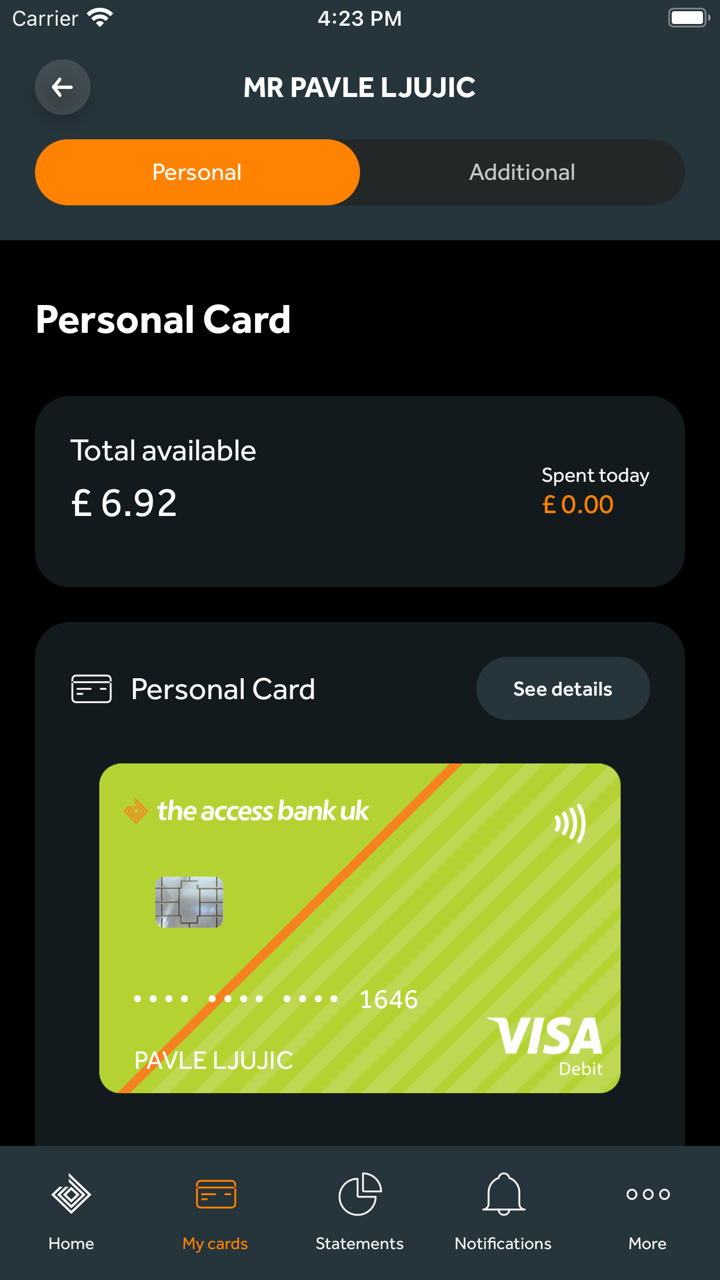

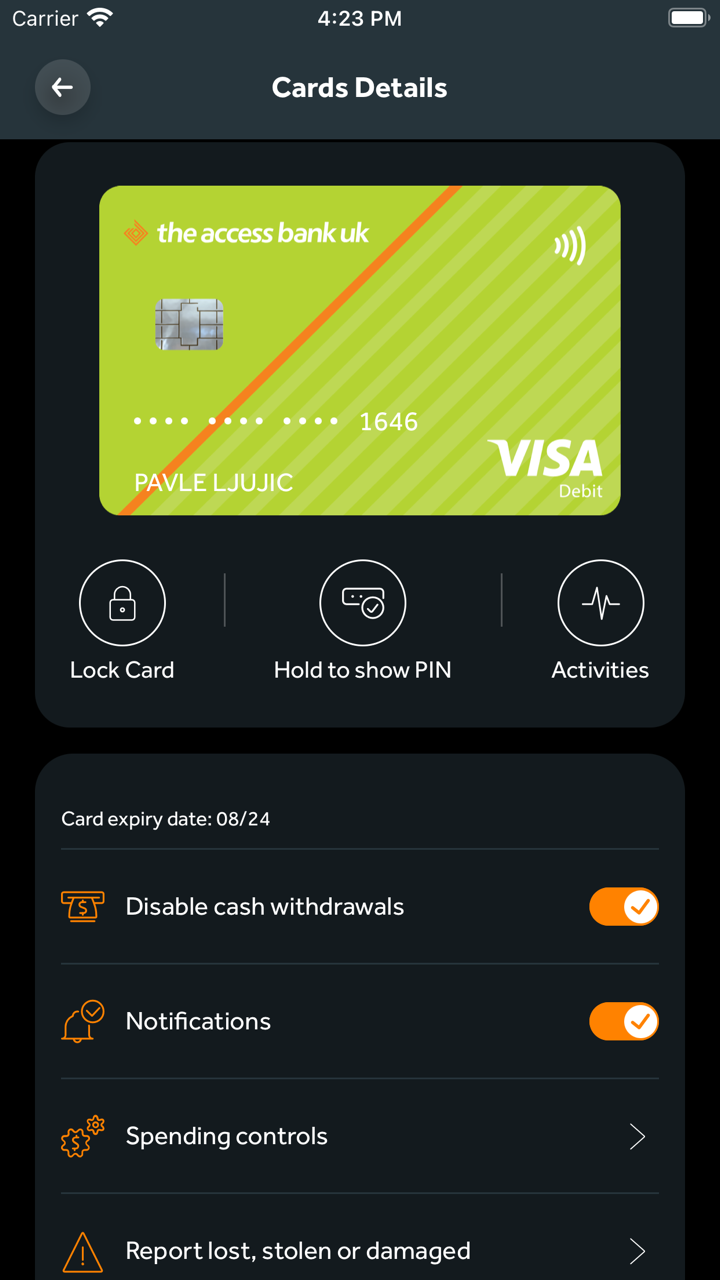

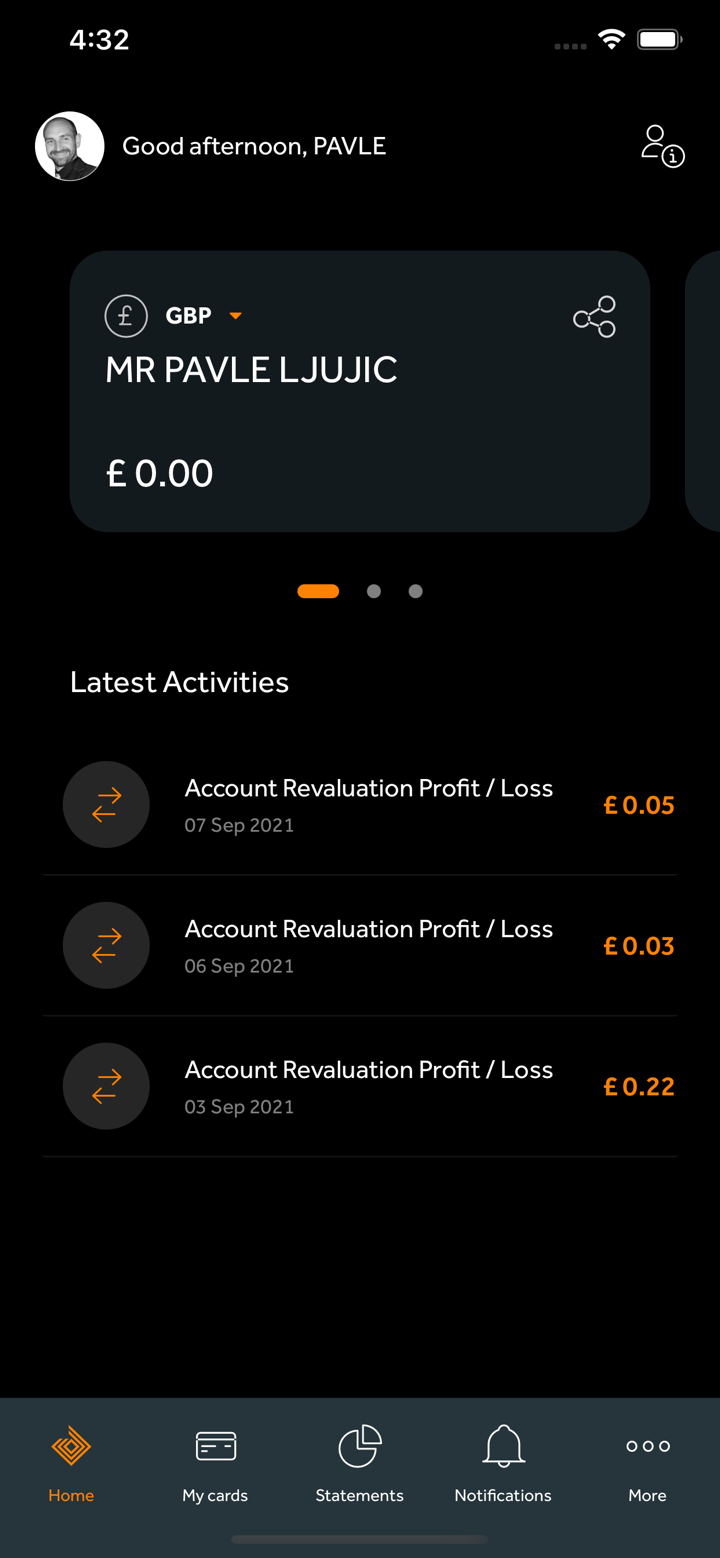

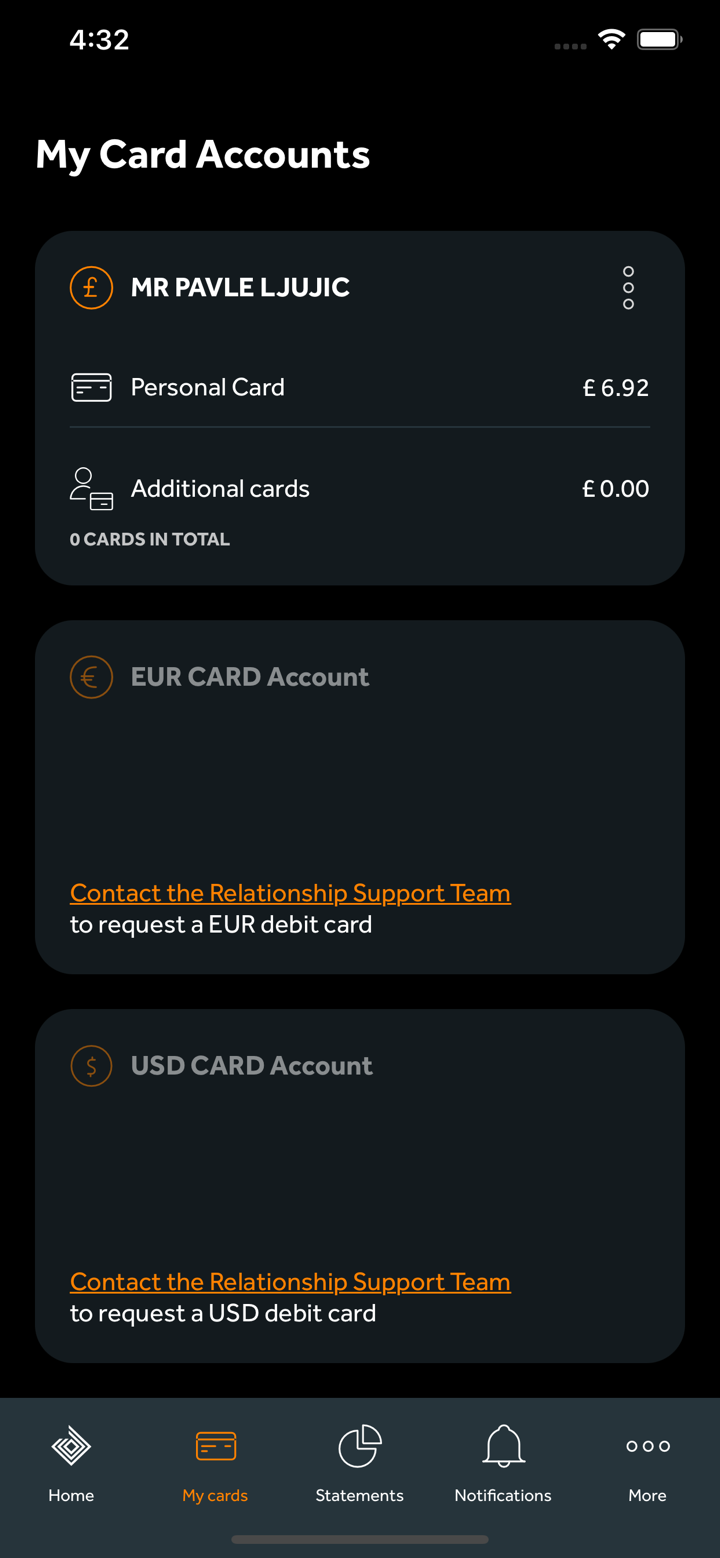

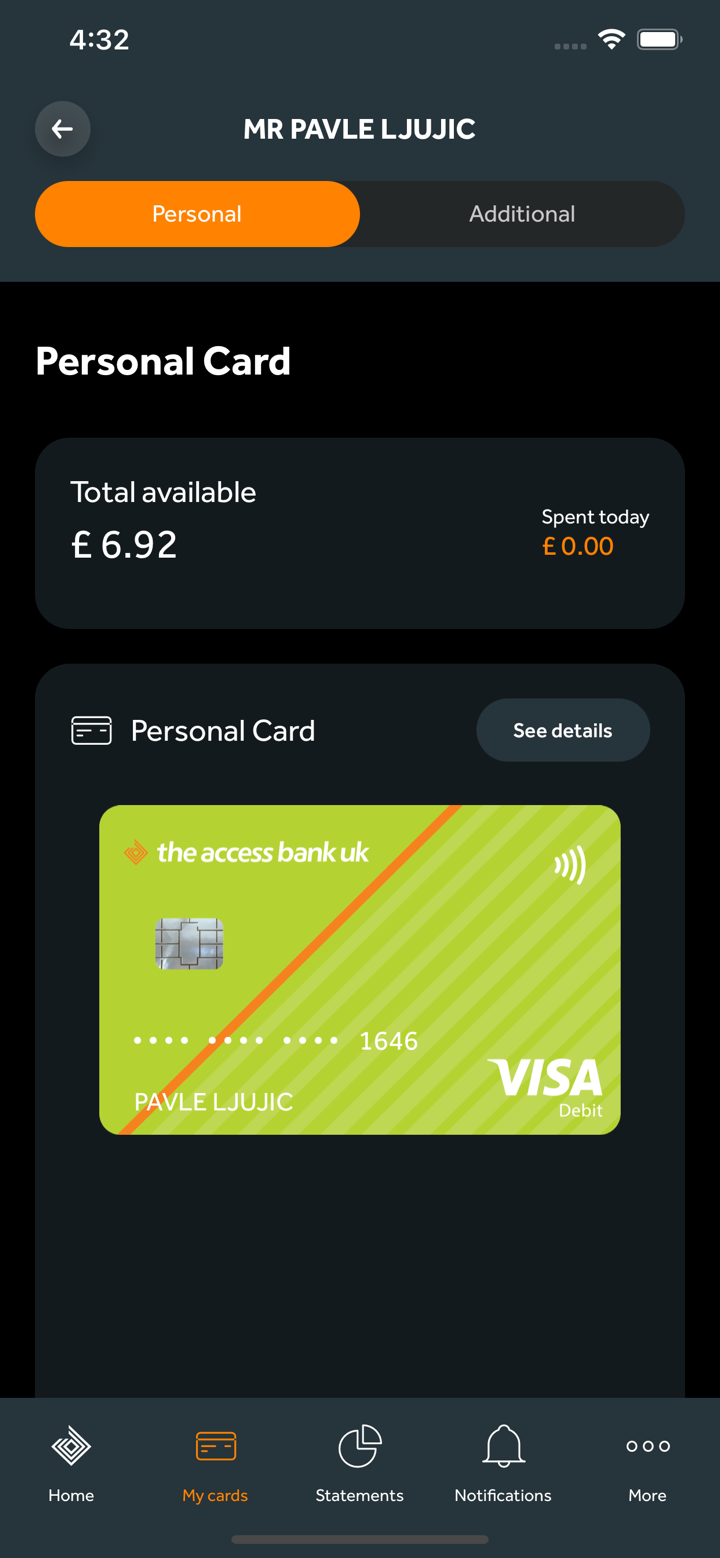

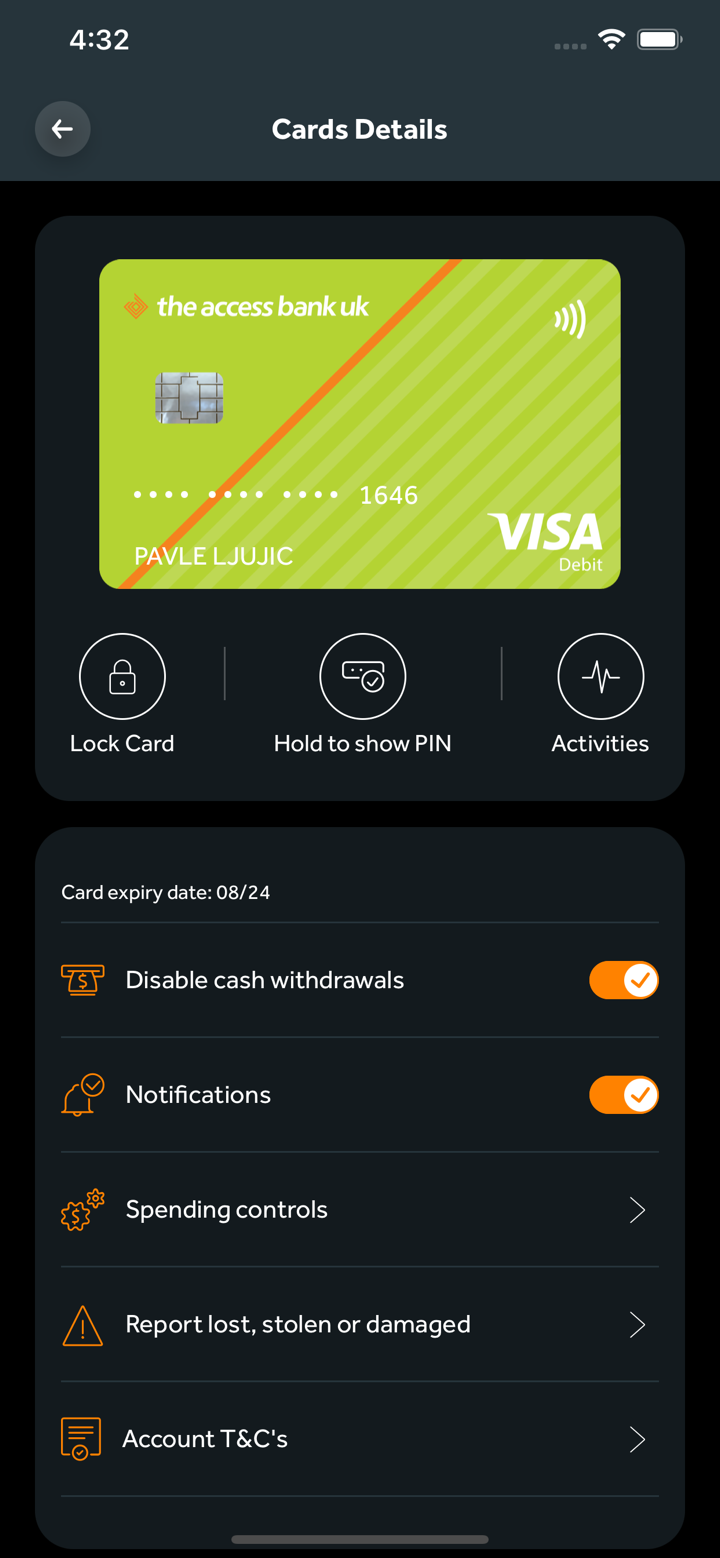

Access Bank ofrece diversos servicios financieros a individuos, empresas y particulares en el Reino Unido. Otros usuarios internacionales pueden disfrutar de servicios como banca comercial y financiamiento comercial.

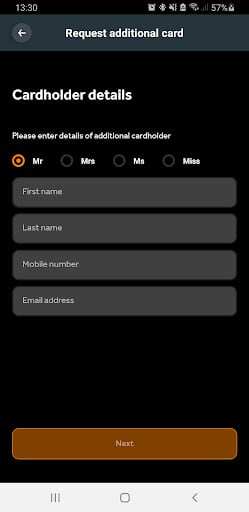

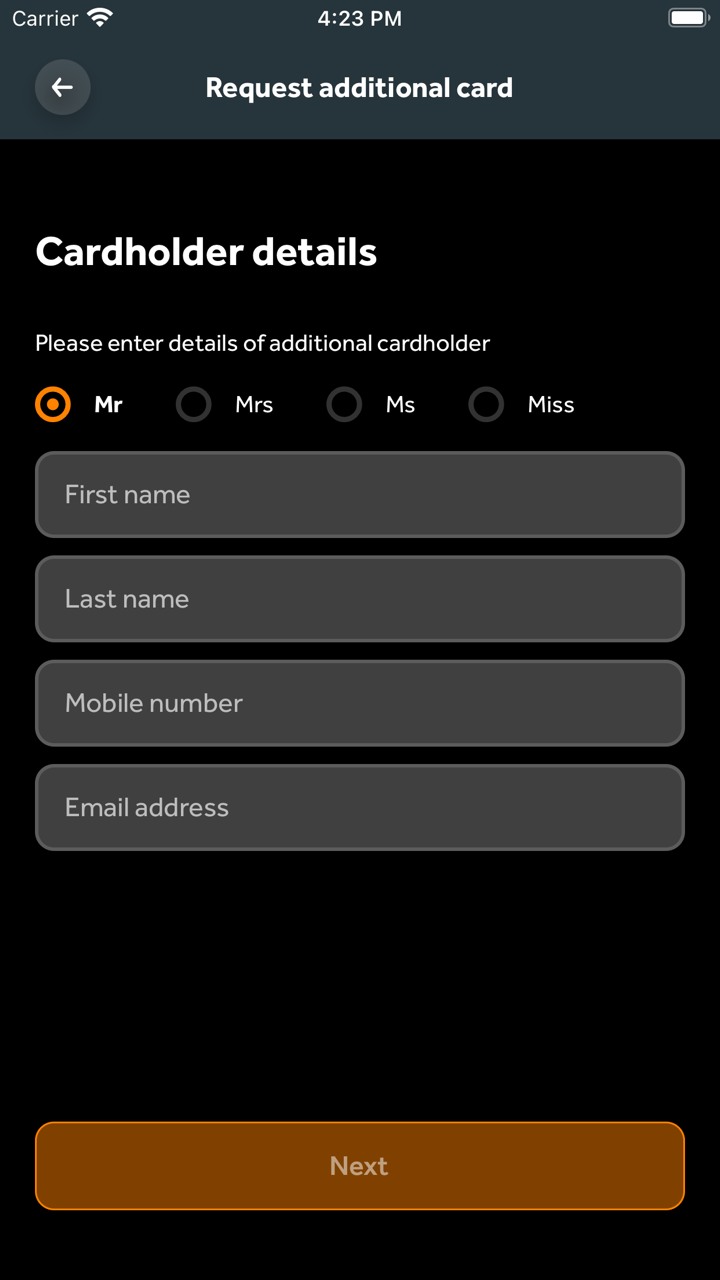

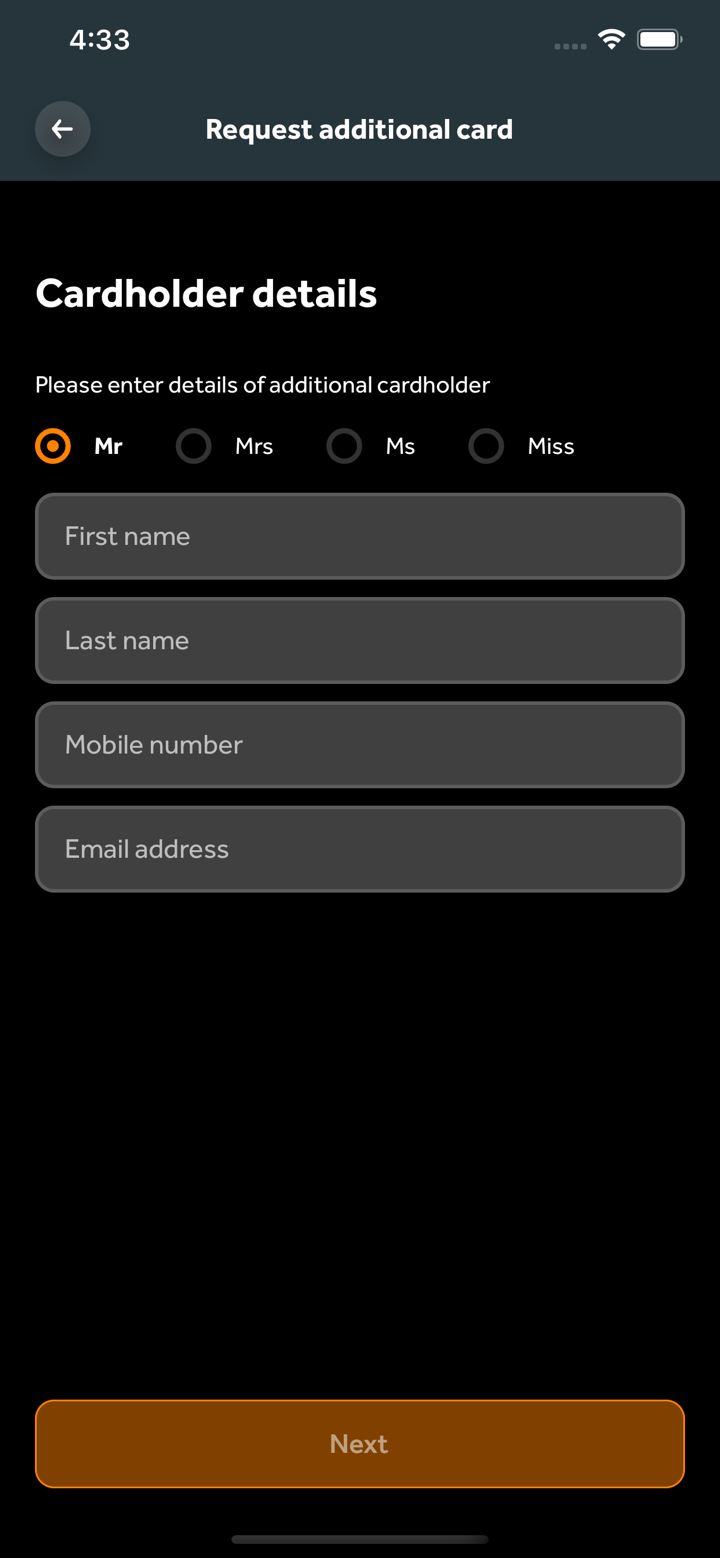

Los clientes personales del Reino Unido pueden elegir banca personal, cuentas corrientes, préstamos hipotecarios, servicios de cambio de divisas, pagos más rápidos, preguntas frecuentes y cuentas de depósito a plazo.

El banco ofrece a los clientes empresariales del Reino Unido banca empresarial, cuentas comerciales, financiamiento comercial, préstamos hipotecarios, cuentas de depósito a plazo, préstamos directos, pagos más rápidos y preguntas frecuentes.

Los clientes privados del Reino Unido tienen acceso a banca privada exclusiva, carteras discrecionales, carteras de solo ejecución, préstamos hipotecarios, cuentas de depósito a plazo, pagos más rápidos y préstamos garantizados por cartera.

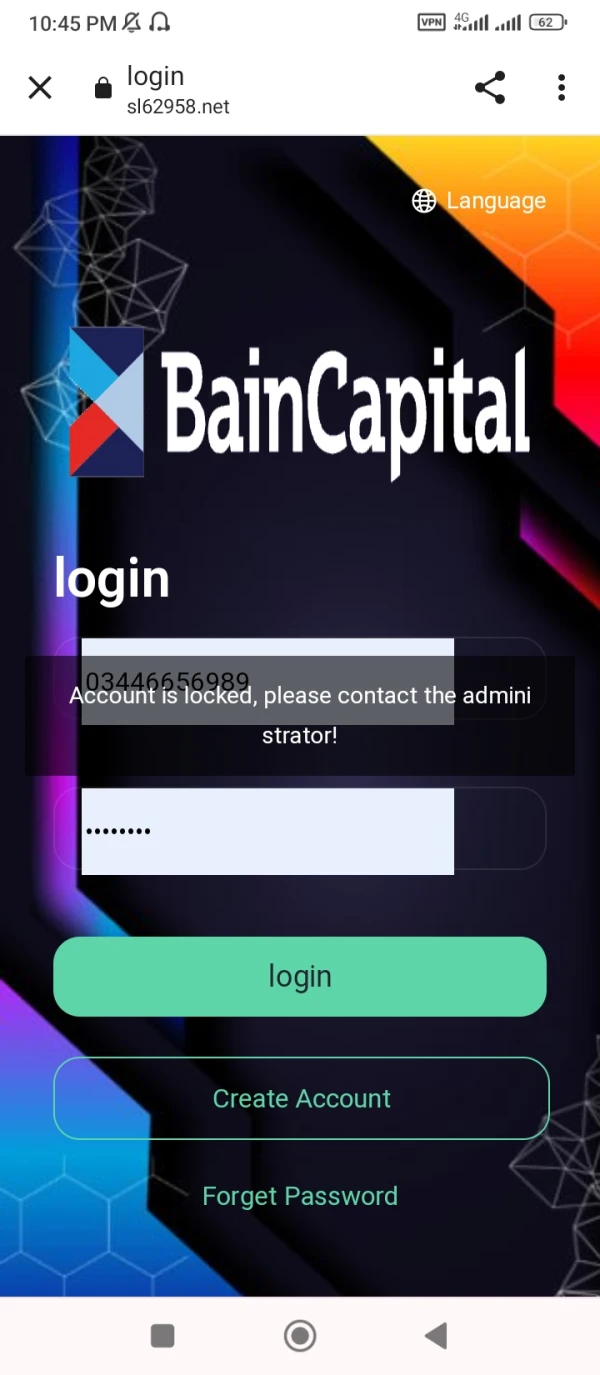

Ghazi6612

Pakistán

Ahora mi cuenta también está bloqueada.

Exposición

sunny91

Turquía

Banca con Access Bank UK se siente genuinamente personal. Realmente priorizan entender y satisfacer mis necesidades. Su banca en línea es sencilla y eficiente.

Positivo

拳

Singapur

¡Confiable y confiable! ¡Servicio bancario de primera categoría!

Positivo

KASLAS

Nigeria

el principal problema de los corredores es la mala red, pero el corredor de Access Bank es muy bueno en la red, es simple para negociar y obtener ganancias, el proceso de retiro fue exitoso

Positivo

程安 -陶

Argentina

El servicio al cliente de esta empresa es muy bueno. Recibí una respuesta una hora después de enviar el correo electrónico, y el servicio de atención al cliente me ayudó con paciencia y meticulosidad a resolver el problema.

Positivo

Rith Rith

Hong Kong

He intentado muchas cosas de este tipo, en cierto sentido, quiero intentarlo, pero en mi subconsciente pienso, ¡sí, sí, quiero intentarlo! Alguien puede decirme que funciona.

Positivo