Buod ng kumpanya

| Pangkalahatang Pagsusuri ng Access Bank | |

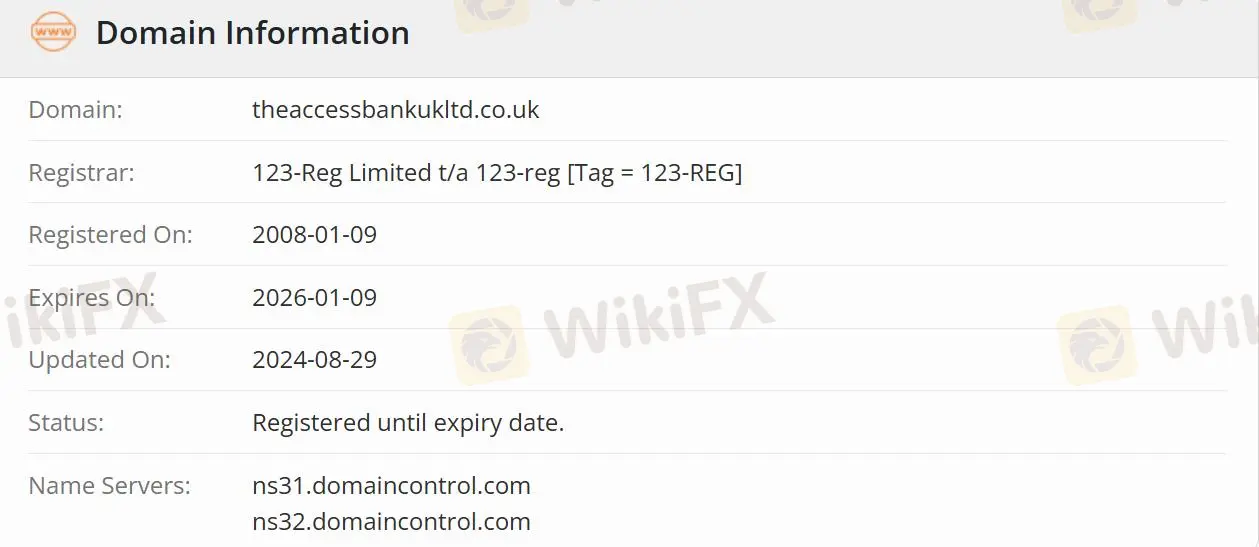

| Itinatag | 2008-01-19 |

| Rehistradong Bansa/Rehiyon | United Kingdom |

| Regulasyon | Regulated |

| Mga Serbisyo | Trade Finance/Commercial Banking/Asset Management/Investment |

| Suporta sa Customer | Email: ccontactaaccessprivatebank.com |

| Telepono: 0333 222 4516 (UK)/+44 1606 813020 | |

Impormasyon ng Access Bank

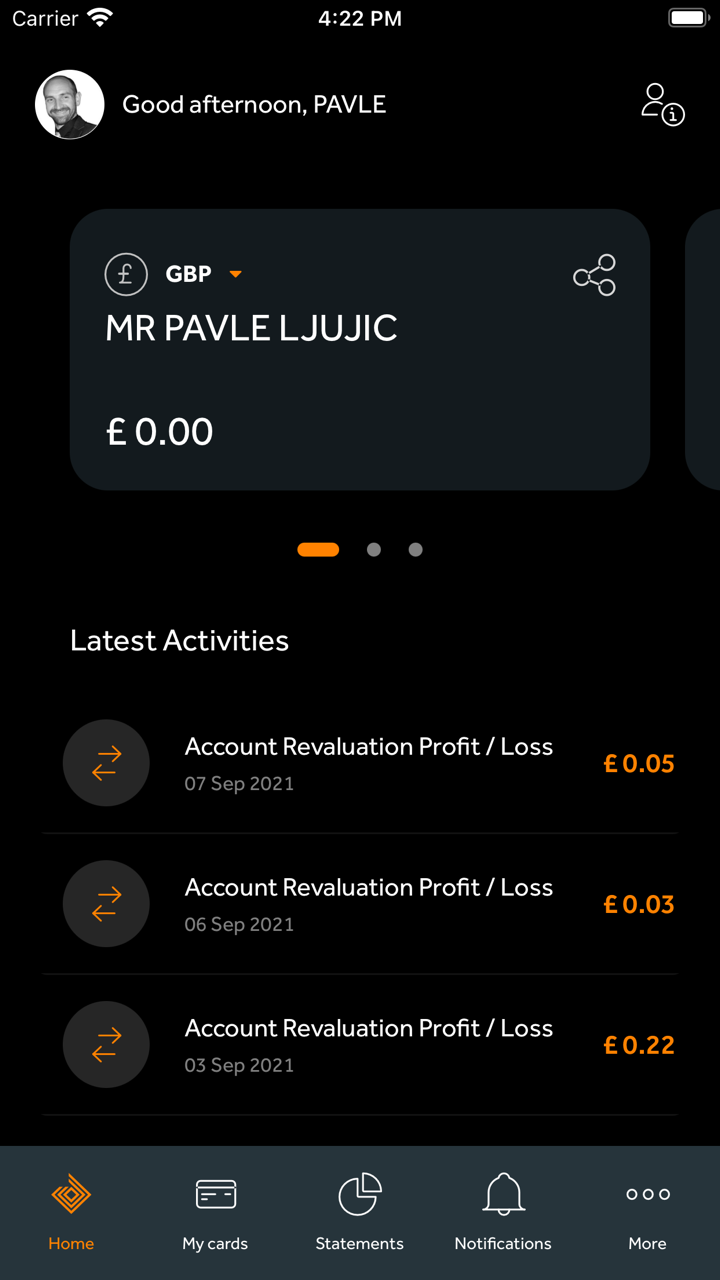

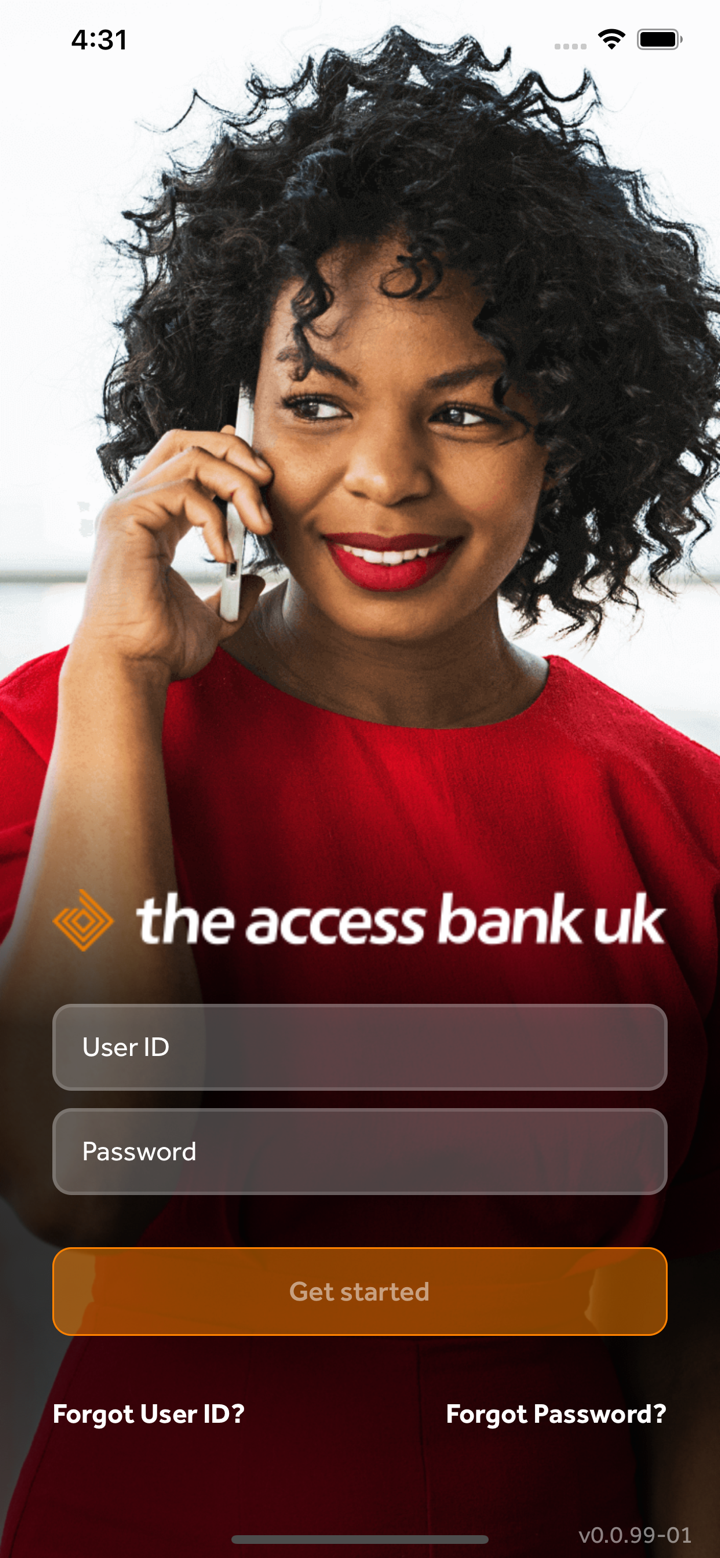

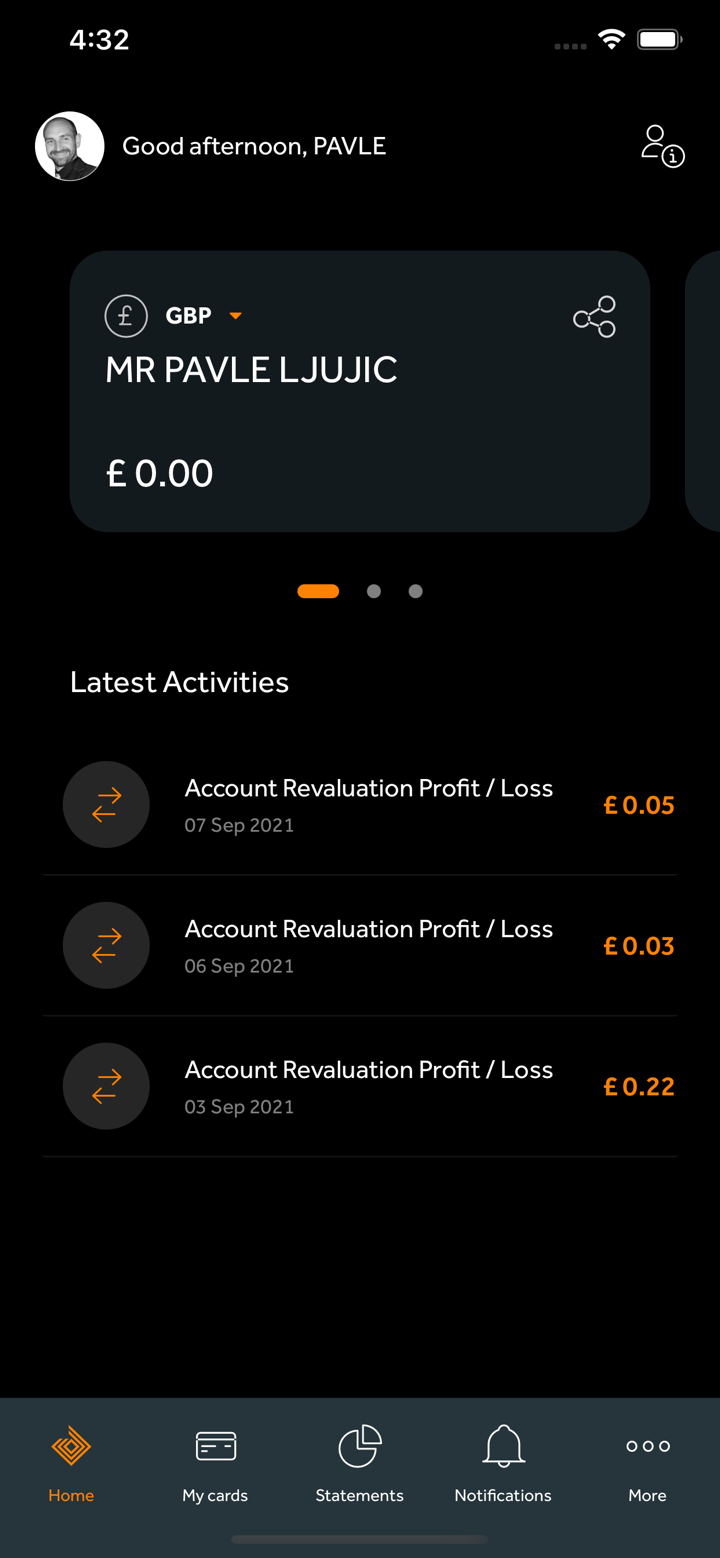

Ang Access Bank na rehistrado sa United Kingdom ay nag-aalok ng malawak na hanay ng mga inobatibong produkto at serbisyo kabilang ang trade finance, commercial banking, at asset management, pati na rin ang suporta sa pagdaloy ng pamumuhunan sa mga merkado sa Nigeria, Africa, at rehiyon ng MENA. Ang layunin ng bangko ay palakihin ang internasyonal na negosyo ng Access Bank Group sa pamamagitan ng serbisyong pang-customer at mga inobatibong solusyon sa Trade Finance, Commercial Banking, at Asset Management.

Totoo ba ang Access Bank?

Ang Access Bank ay awtorisado at regulasyon ng Financial Conduct Authority(FCA) na may lisensya No. 478415. Ang isang regulasyon na kumpanya ay mas ligtas kaysa sa hindi regulasyon.

Anong mga serbisyo ang ibinibigay ng Access Bank?

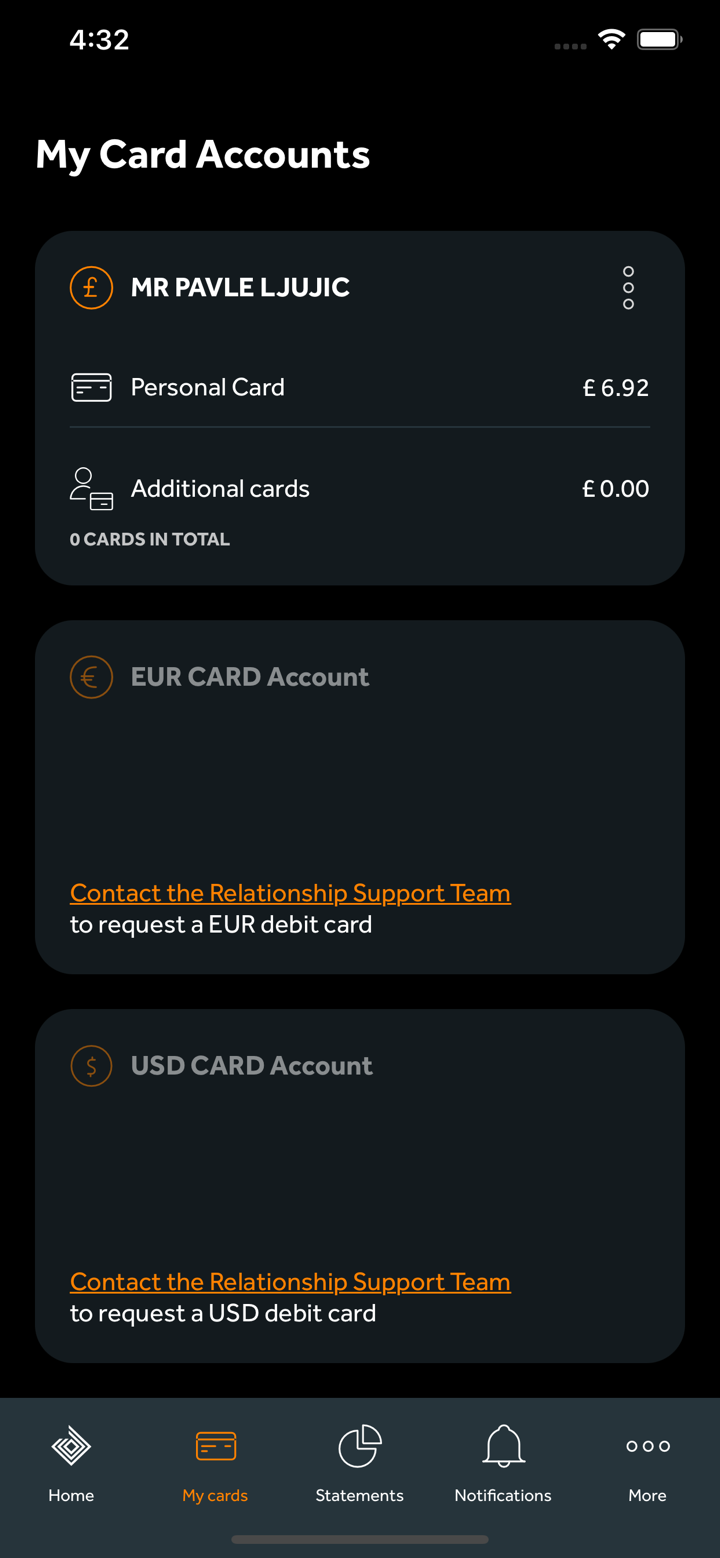

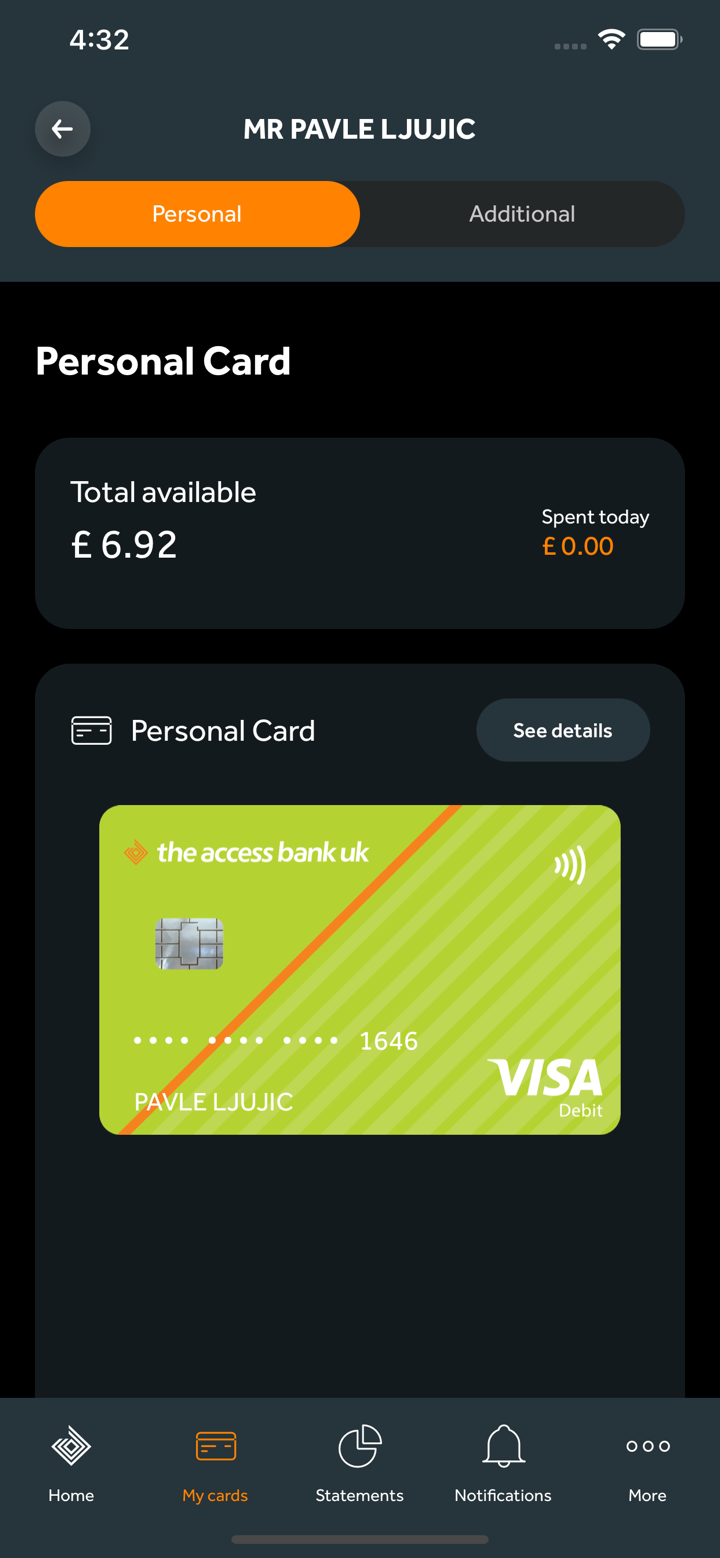

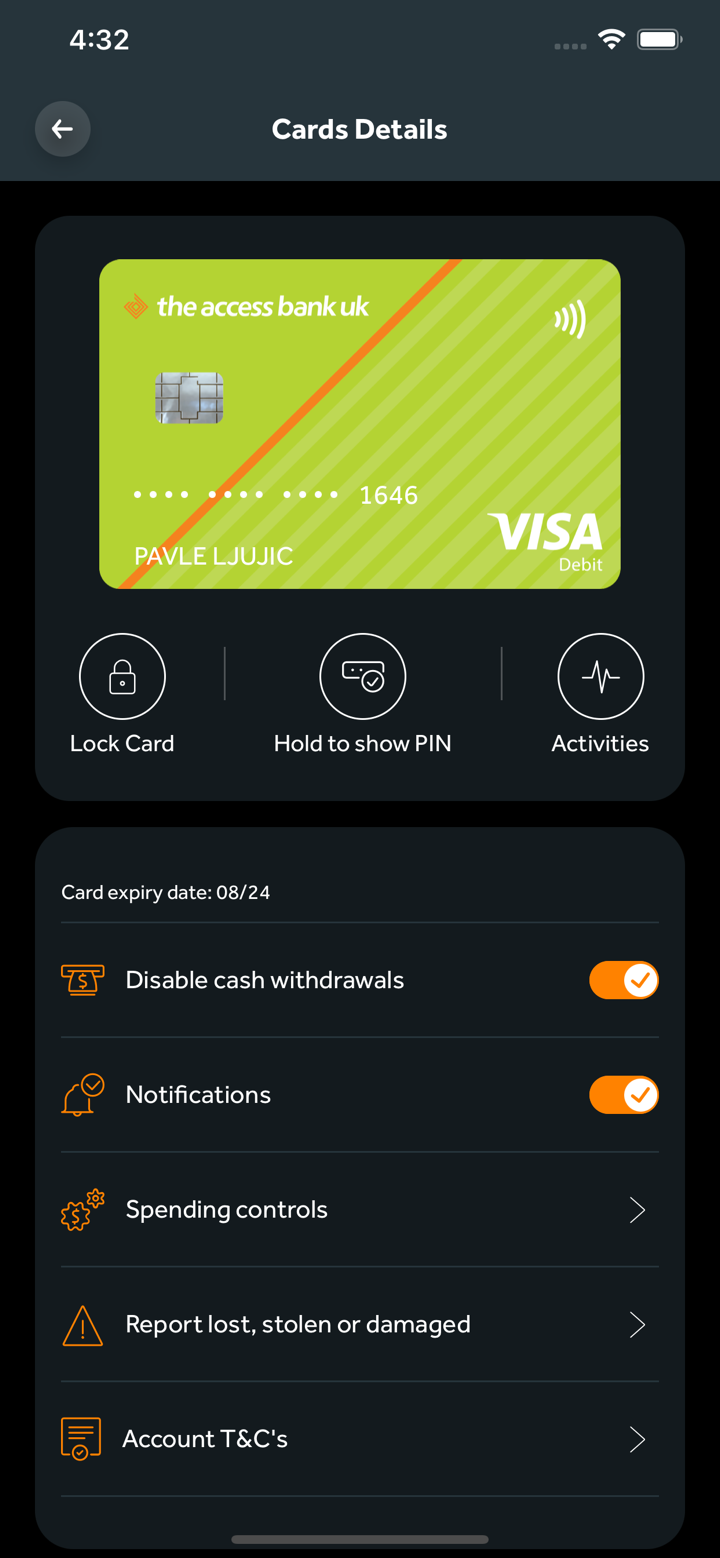

Ang Access Bank ay nagbibigay ng iba't ibang serbisyong pinansyal sa mga indibidwal, negosyo, at pribadong indibidwal sa UK. Ang ibang internasyonal na mga gumagamit ay maaaring mag-enjoy ng mga serbisyo tulad ng commercial banking at trade financing.

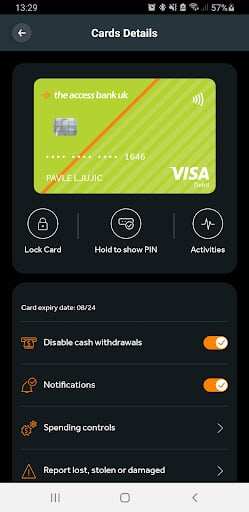

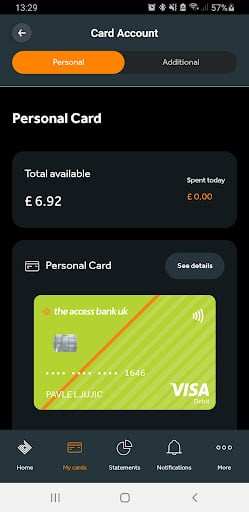

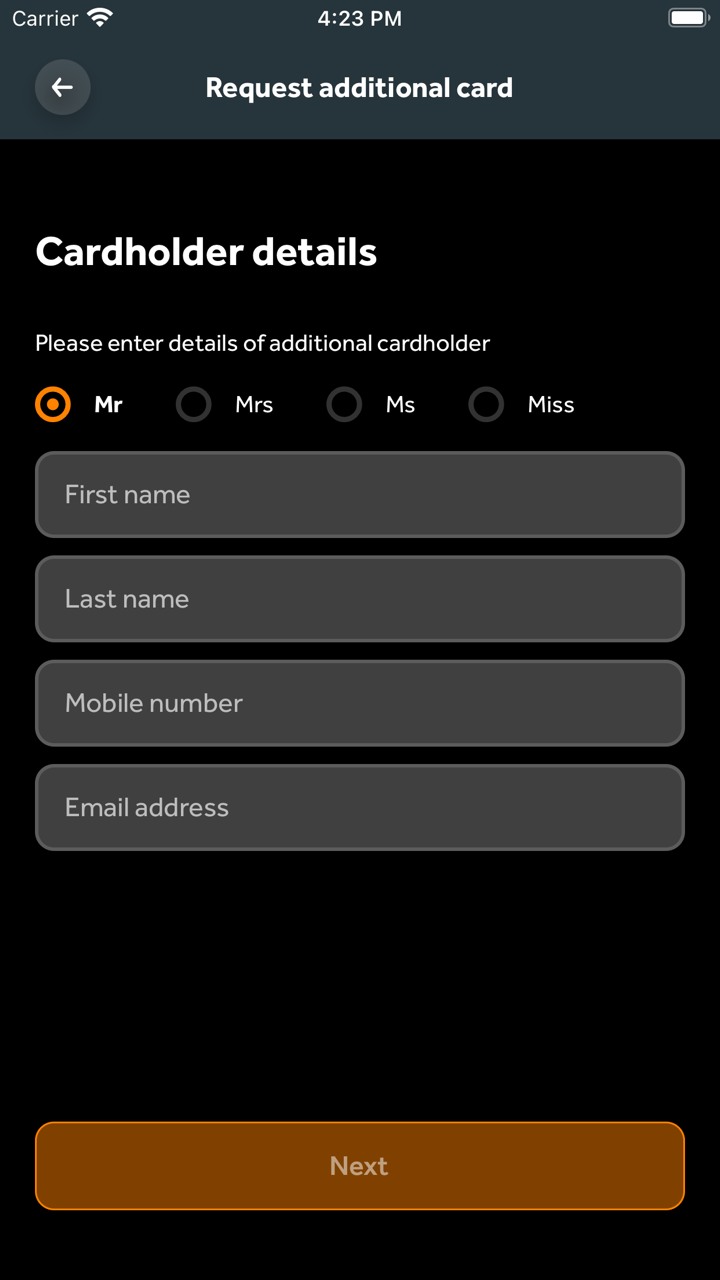

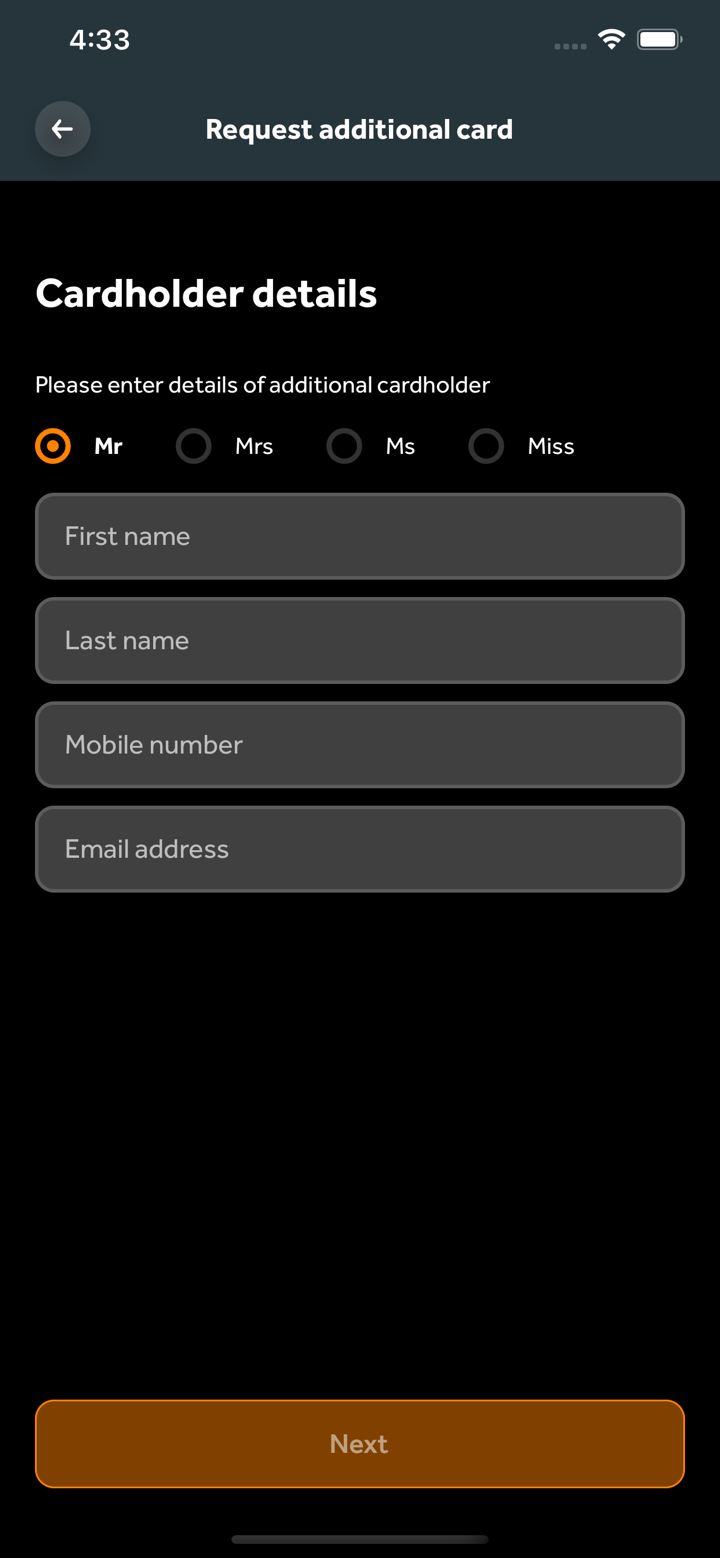

Ang mga personal na customer sa UK ay maaaring pumili ng personal banking, current accounts, property loans, foreign exchange services, faster payments, frequently asked questions, at notice deposit accounts.

Ang bangko ay nagbibigay ng mga negosyong customer sa UK ng business banking, business accounts, trade finance, property loans, notice deposit accounts, direct lending, faster payments, at frequently asked questions.

Ang mga pribadong customer sa UK ay may eksklusibong private banking, discretionary portfolios, execution-only portfolios, property loans, notice deposit accounts, faster payments, at portfolio-secured lending.

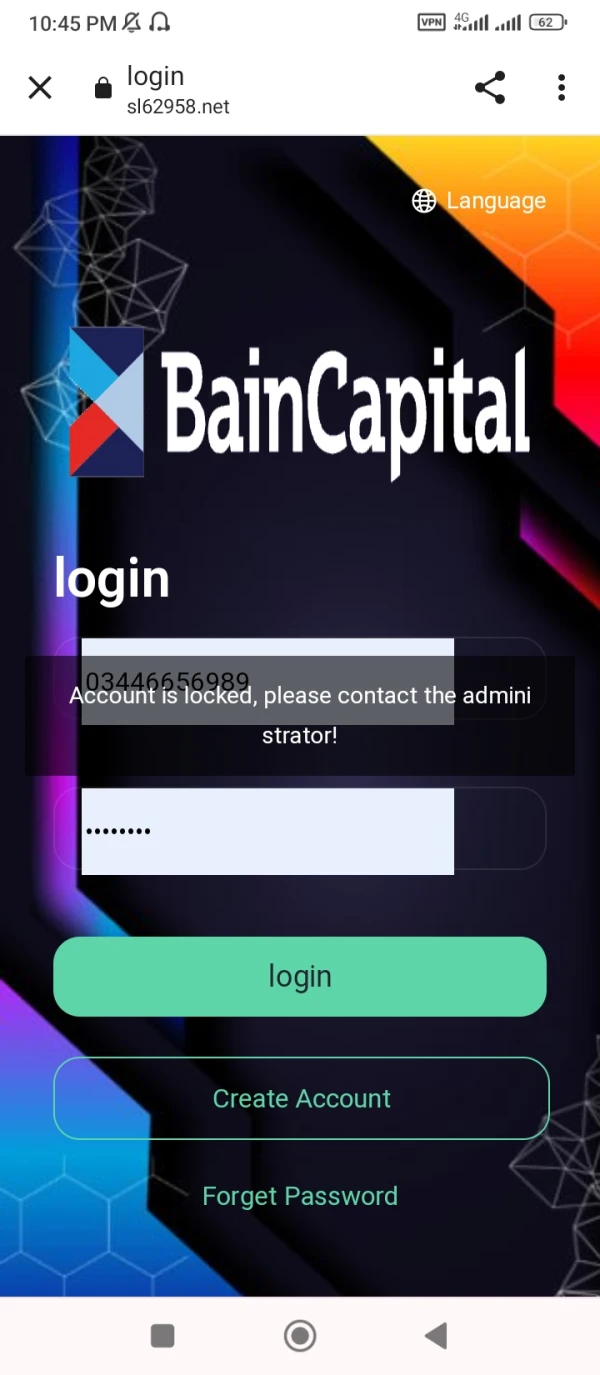

Ghazi6612

Pakistan

Ngayon, ang aking account ay naka-lock din.

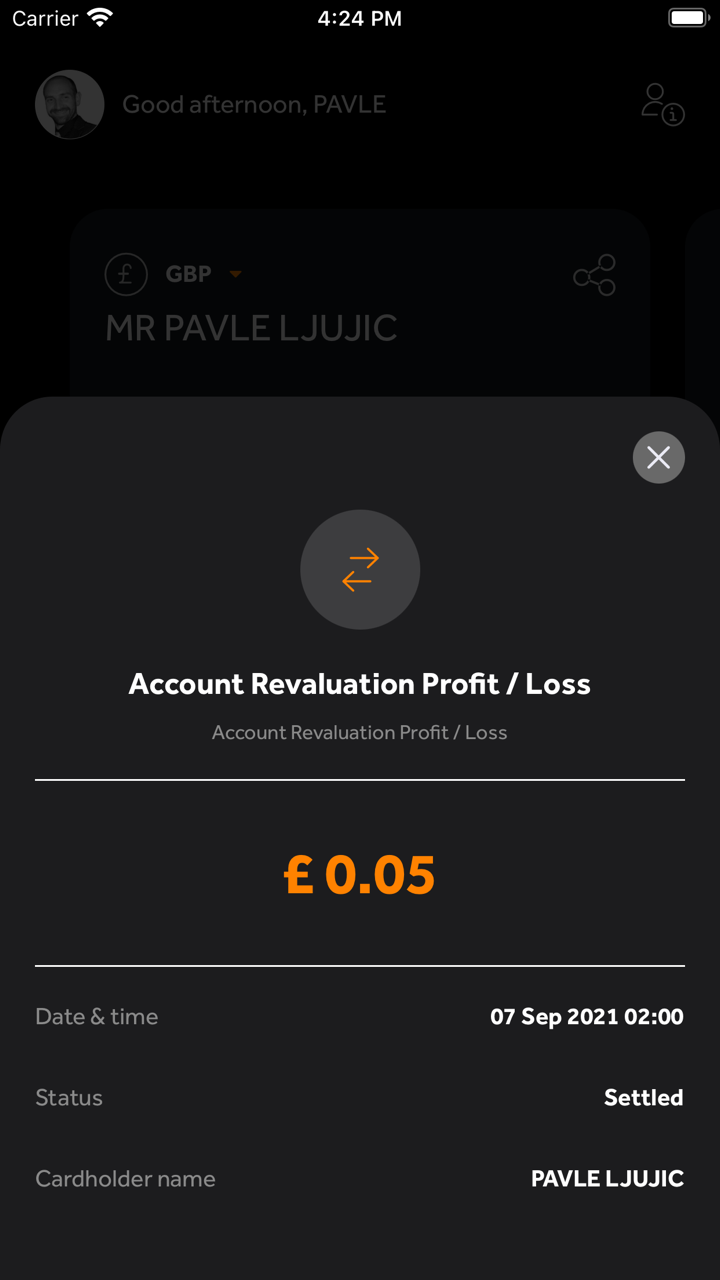

Paglalahad

sunny91

Turkey

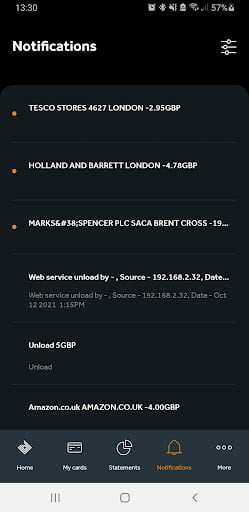

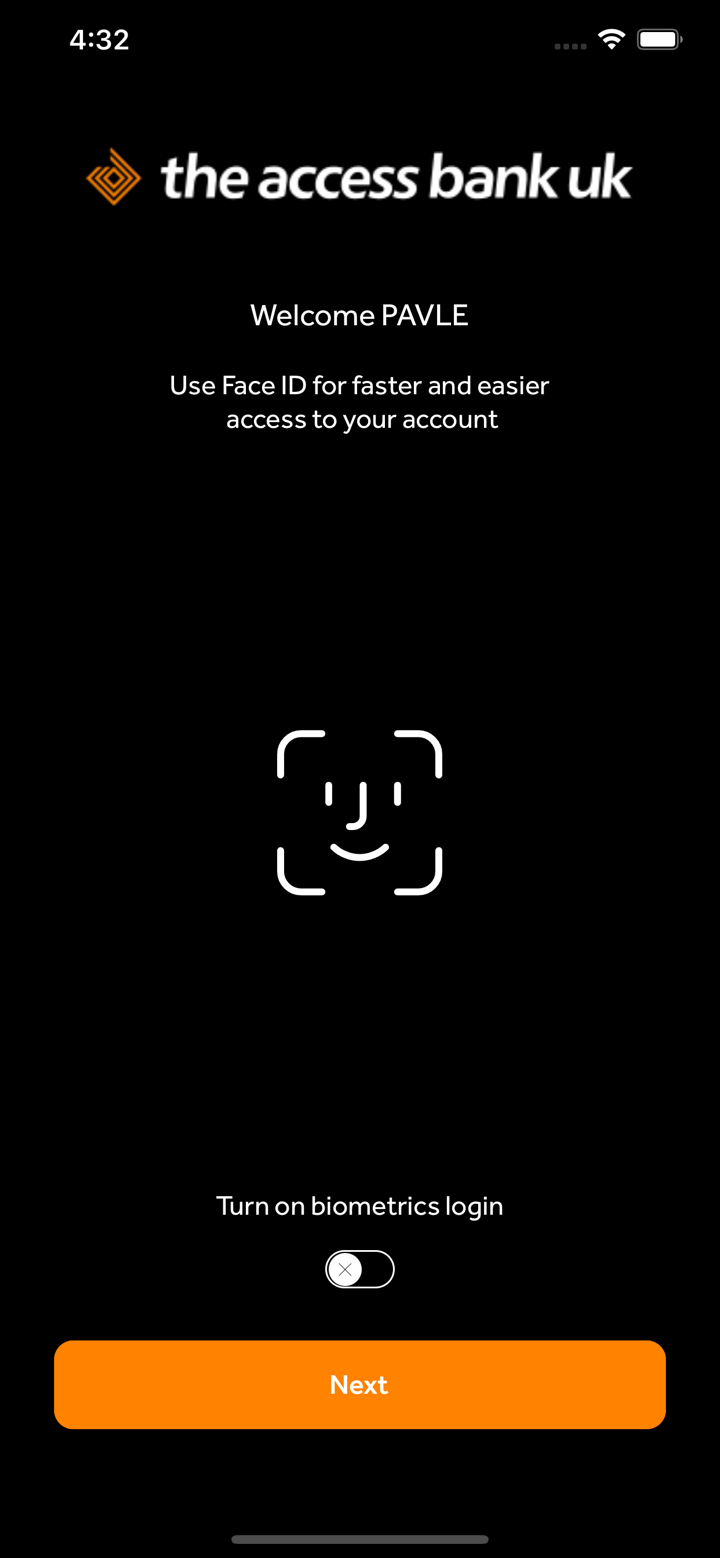

Ang pagba-bank sa Access Bank UK ay tunay na personal. Tunay nilang pinapahalagahan ang pag-unawa at pagtugon sa aking mga pangangailangan. Ang kanilang online banking ay simple at maaasahan.

Positibo

拳

Singapore

Maaasahan at mapagkakatiwalaan! Matataas na serbisyong pangbanko!

Positibo

KASLAS

Nigeria

ang pangunahing problema ng mga broker ay masamang network ngunit ang Access Bank broker ay napakahusay sa network ay simple para sa pangangalakal at ang proseso ng pagkuha ng kita ay matagumpay

Positibo

程安 -陶

Argentina

Ang serbisyo sa customer ng kumpanyang ito ay napakahusay. Nakatanggap ako ng tugon sa loob ng isang oras ng pagpapadala ng email, at matiyaga at masusing tinulungan ako ng serbisyo sa customer na malutas ang isyu.

Positibo

Rith Rith

Hong Kong

Marami na akong nasubukang mga ganitong bagay, in a sense, gusto kong subukan ito, pero sa subconscious ko iniisip ko, oo, oo, gusto kong subukan!! Maaari bang sabihin sa akin ng isang tao na gumagana ito.

Positibo