Company Summary

| IFX Review Summary | |

| Founded | 2015 |

| Registered Country/Region | United Kingdom |

| Regulation | FCA (exceeded), DFSA (exceeded) |

| Services | Payment solutions, foreign exchange |

| Demo Account | ✅ |

| Customer Support | Phone: +4402074958888 |

| Email: private@ifxpayments.com | |

| London: 33 Cavendish Square London, W1G 0PW | |

| Dubai: Unit 31-46 Central Park offices DIFC | |

| Amersham: Chalfont Court, 5 Hill Avenue Amersham, HP6 5BB | |

| Warsaw: WorkIN, ul. Senatorska 200‑075 Warszawa | |

IFX Information

IFX is a company that focuses on providing users with comprehensive Payment Solutions and Foreign Exchange services. It was registered in the UK, but its licenses issued by FCA and DFSA are exceeded, which means potential risks cannot be ignored.

Pros and Cons

| Pros | Cons |

| Demo accounts | Exceeded licenses |

| Long history |

Is IFX Legit?

IFX has exceeded regulations currently. Please be aware of the risk!

| Regulatory Status | Exceeded |

| Regulated by | Financial Conduct Authority (FCA) |

| Licensed Institution | IFX (UK) Ltd |

| Licensed Type | Payment License |

| Licensed Number | 900517 |

| Regulatory Status | Exceeded |

| Regulated by | Dubai Financial Services Authority(DFSA) |

| Licensed Institution | IFX (UK) Ltd |

| Licensed Type | Common Financial Service License |

| Licensed Number | F001814 |

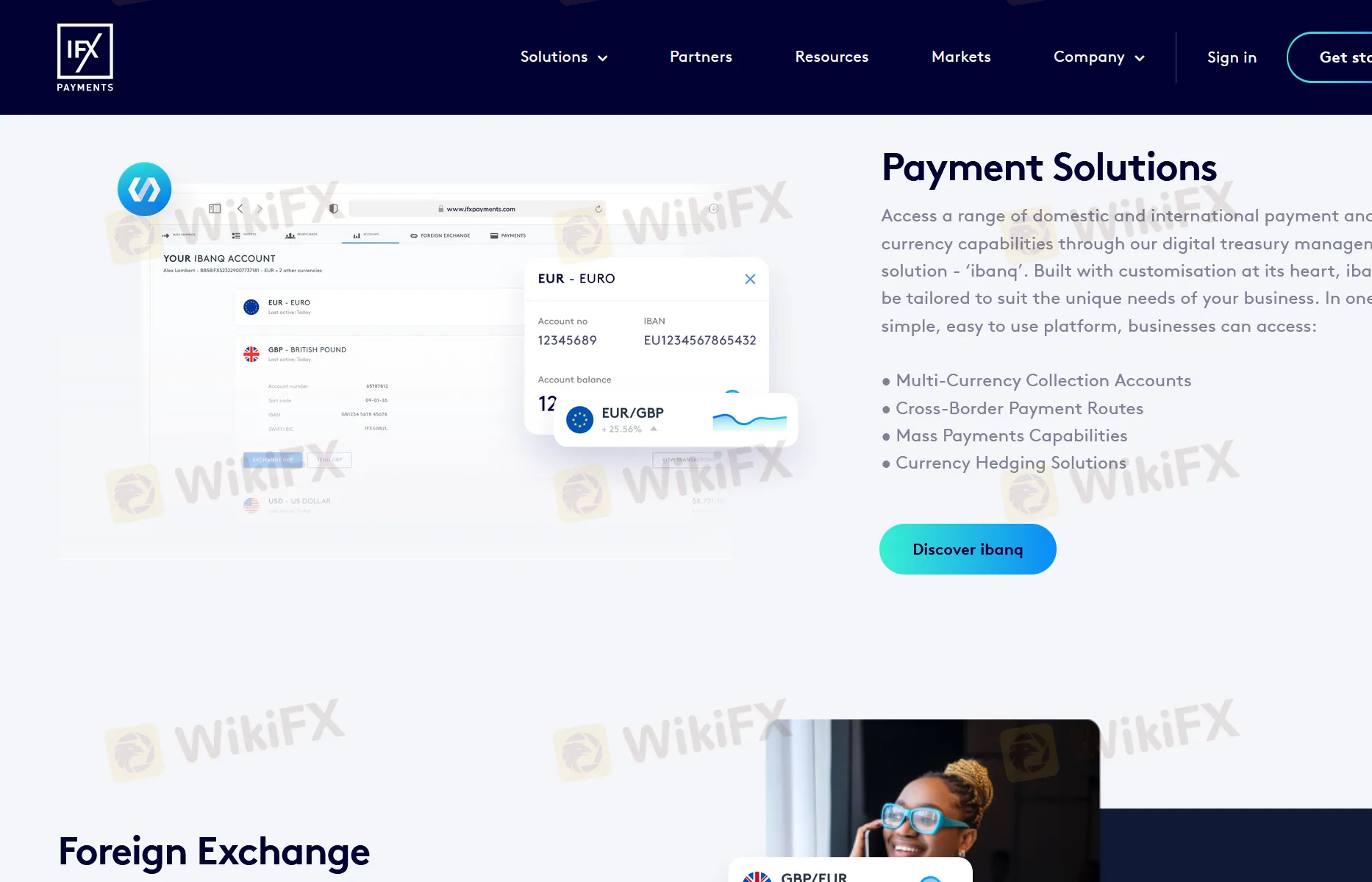

IFX Services

IFX offers Payment Solutions and Foreign Exchange services

| Tradable Instruments | Supported |

| Payment Solutions | ✔ |

| Foreign Exchange | ✔ |

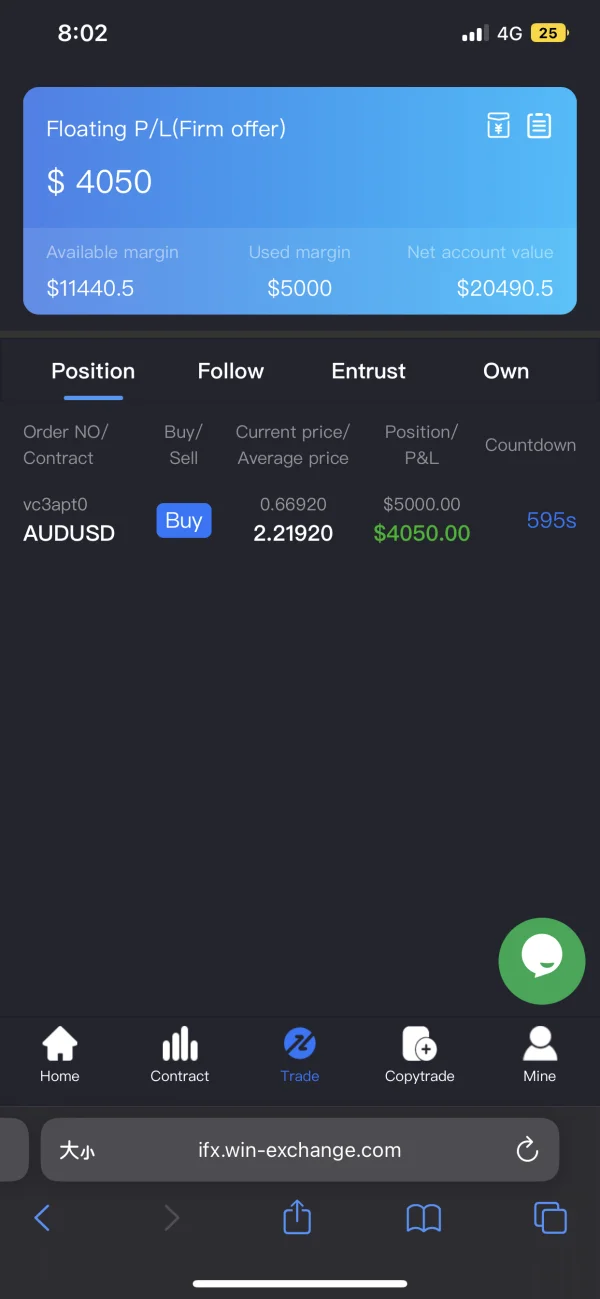

E1211

Malaysia

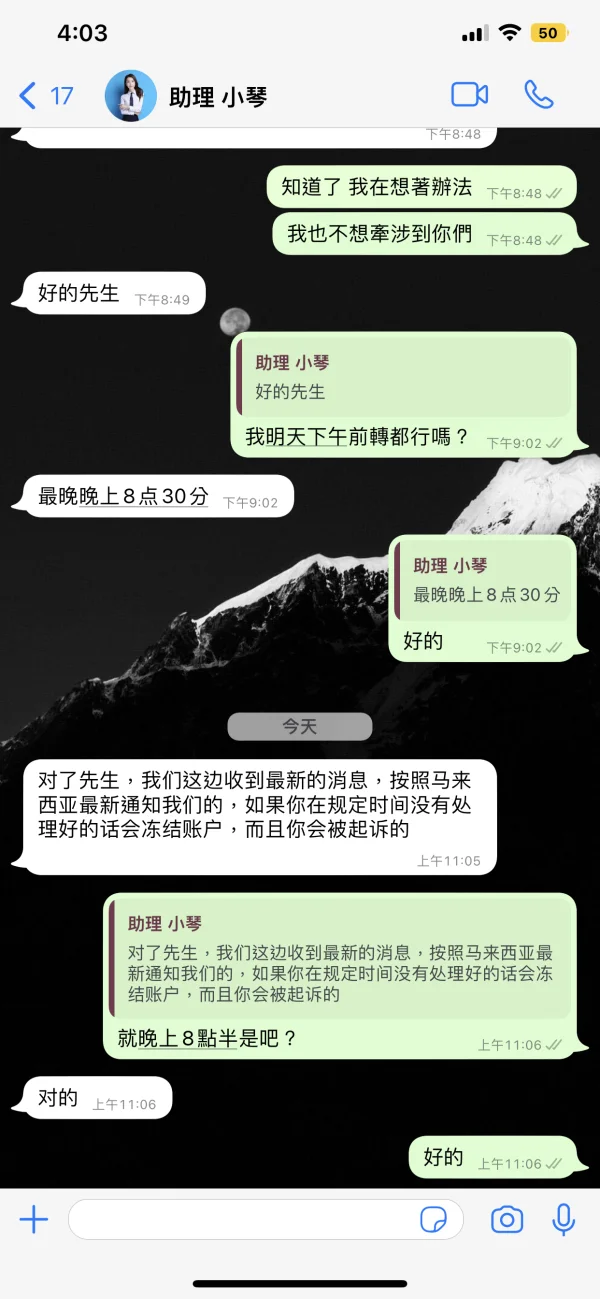

Is handling fee really RM3000 and will I get sued if I do not pay it? Is this website true?

Exposure

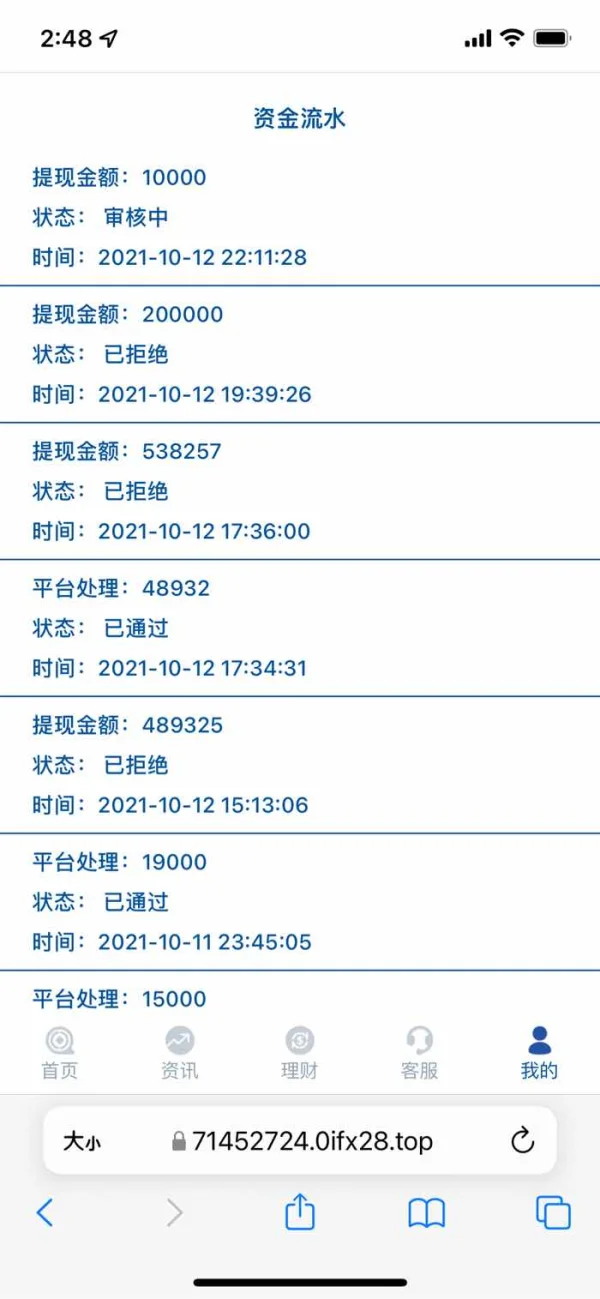

Red Star

Hong Kong

The withdrawal is unavailable in IFX .After calling the police,my account was canceled.Don’t be cheated.

Exposure

五四六一九一六六八

Hong Kong

Unable to withdraw.The platform locked clients’ accounts and gave no access to withdrawal,saying that the ID information was wrong.

Exposure

FX1287225689

Morocco

Honestly, IFX is good platform for payment transferring services. I’ve used its services for several times and I do recognize its great service.

Positive

A瞬间

United Kingdom

I have a very good trading experience with IFX. Thank you very much for the customer support who are great at assisting me when I have questions and problems. I salute your guys!

Positive

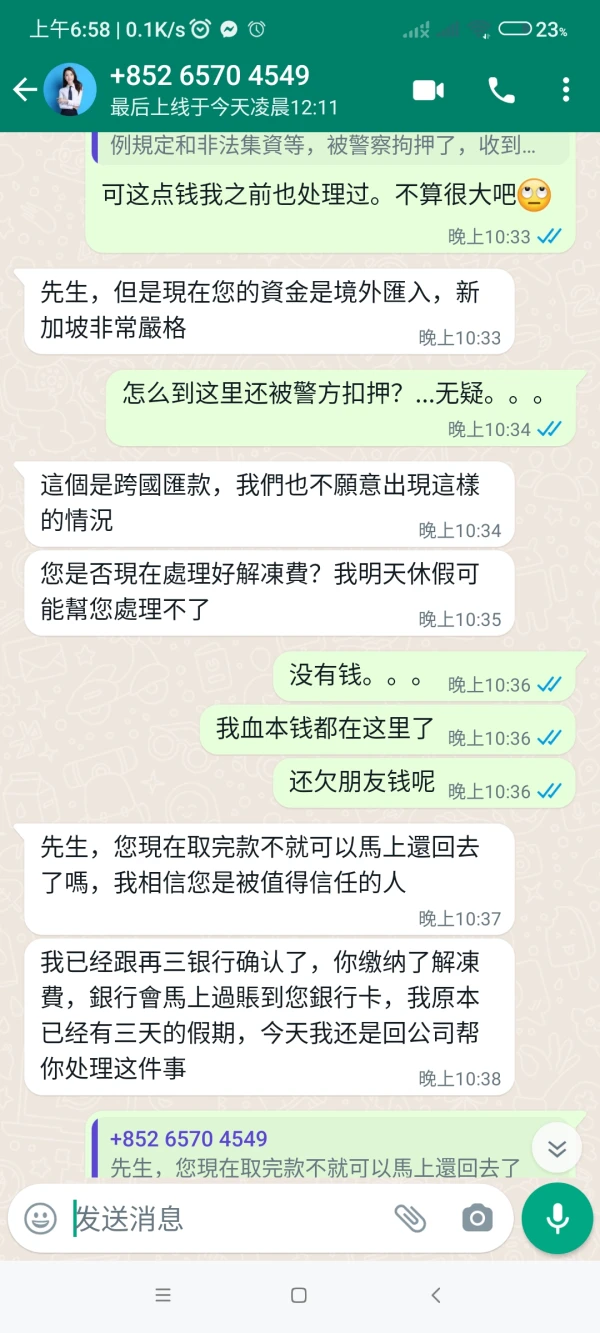

lee9022

Singapore

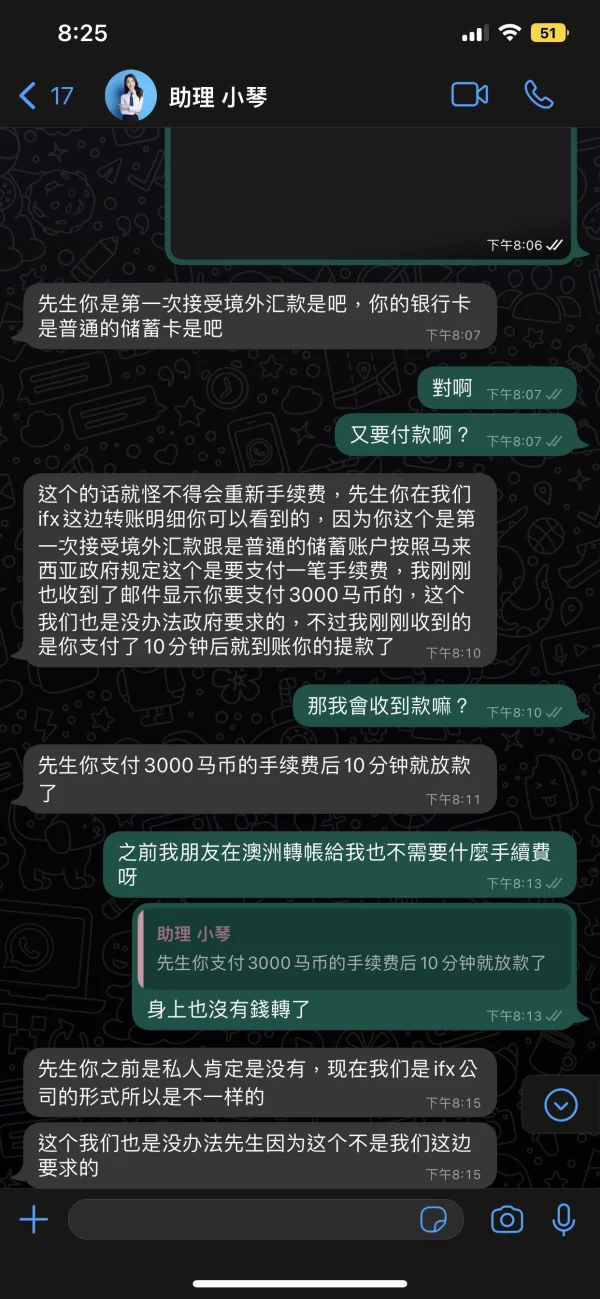

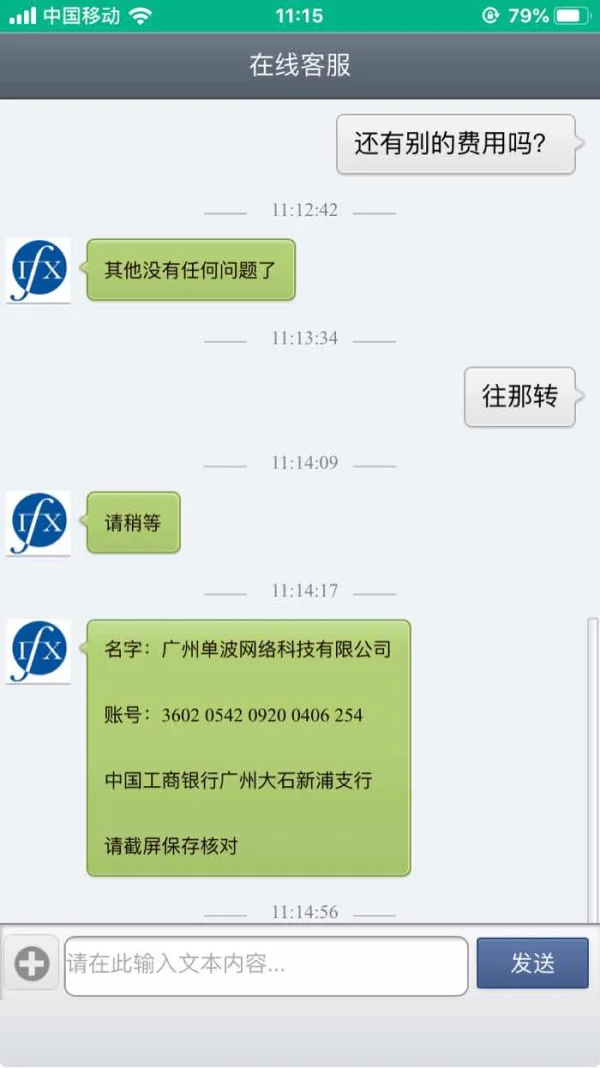

Fraud, the boss wants you to pay commission, processing fee, margin, ncome tax and unfreezing fee. There are endless fees

Exposure

生死劫

Hong Kong

Yes, I had a pleasant experience with IFX payments. Sunny was very helpful and tried her best to find me the best exchange rate. Great service and thank you.

Positive

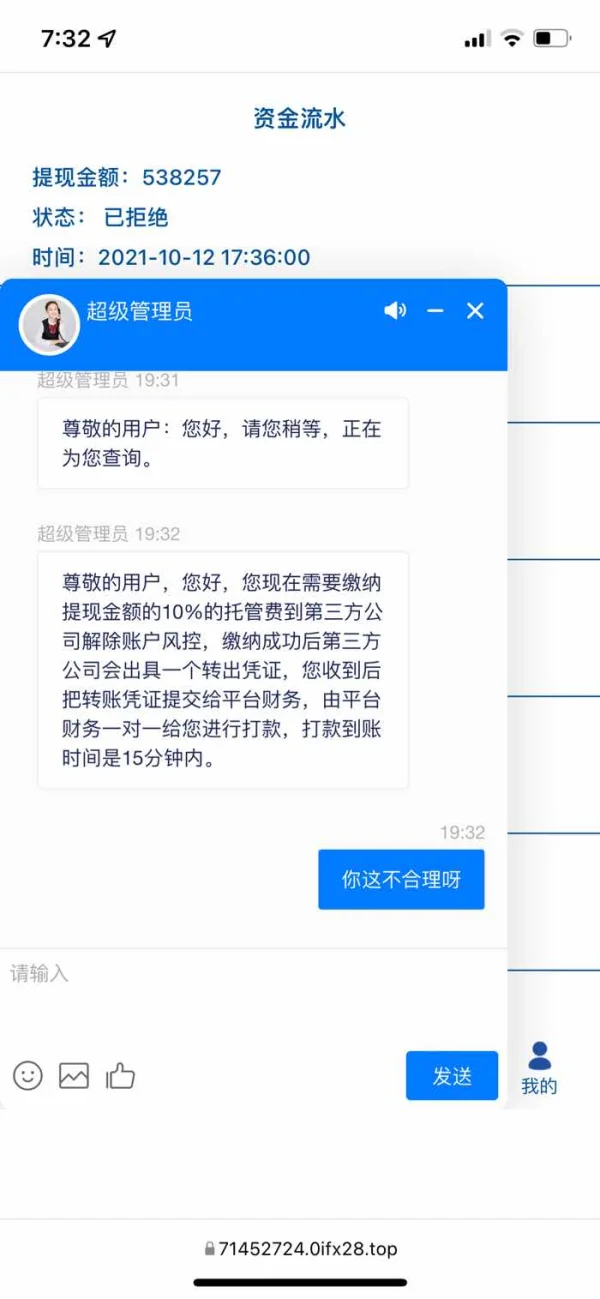

༺蜜糖༻

Hong Kong

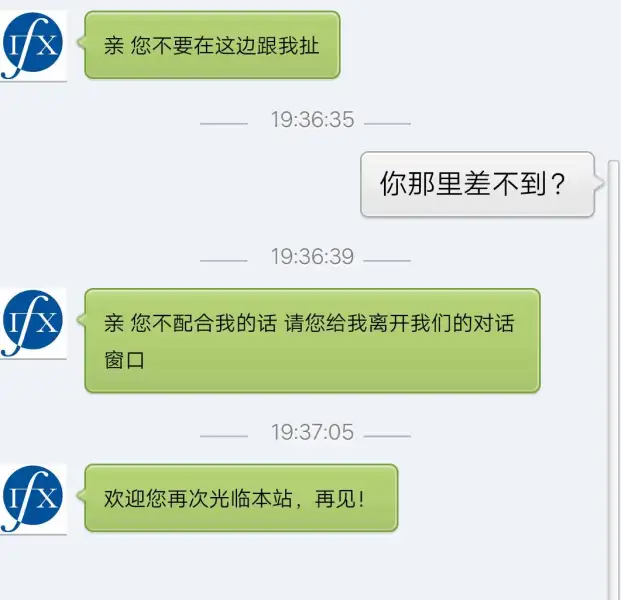

Unable to withdraw. It told me to deposit for many reasons. Was it a scam?

Exposure

FX4234736427

Hong Kong

IFX would asked for margin with varied excuses. Claiming to fix the bug, it gave no access and absconded.

Exposure

随风29414

Hong Kong

The scam platform gave no access to withdrawal and asked money to unfreeze the account.

Exposure

Red Star

Hong Kong

IFX is a scam platform which asked me to pay the margin at first,and gave no access to withdrawal,keeping asking for various fee.Hope the regulatory department see to this and recover losses for us.

Exposure