Profil perusahaan

| IFX Ringkasan Ulasan | |

| Dibentuk | 2015 |

| Negara/Daerah Terdaftar | Inggris Raya |

| Regulasi | FCA (melebihi), DFSA (melebihi) |

| Layanan | Solusi pembayaran, valuta asing |

| Akun Demo | ✅ |

| Dukungan Pelanggan | Telepon: +4402074958888 |

| Email: private@ifxpayments.com | |

| London: 33 Cavendish Square London, W1G 0PW | |

| Dubai: Unit 31-46 Central Park offices DIFC | |

| Amersham: Chalfont Court, 5 Hill Avenue Amersham, HP6 5BB | |

| Warsaw: WorkIN, ul. Senatorska 200‑075 Warszawa | |

Informasi IFX

IFX adalah perusahaan yang berfokus pada menyediakan pengguna dengan Solusi Pembayaran dan layanan Valuta Asing yang komprehensif. Perusahaan ini terdaftar di Inggris Raya, tetapi lisensinya yang dikeluarkan oleh FCA dan DFSA melebihi, yang berarti risiko potensial tidak dapat diabaikan.

Pro dan Kontra

| Pro | Kontra |

| Akun demo | Lisensi melebihi |

| Sejarah panjang |

Apakah IFX Legal?

IFX telah melebihi regulasi saat ini. Harap waspada terhadap risiko!

| Status Regulasi | Melebihi |

| Diatur oleh | Otoritas Jasa Keuangan (FCA) |

| Institusi Berlisensi | IFX (UK) Ltd |

| Jenis Lisensi | Lisensi Pembayaran |

| Nomor Lisensi | 900517 |

| Status Regulasi | Melebihi |

| Diatur oleh | Otoritas Jasa Keuangan Dubai(DFSA) |

| Institusi Berlisensi | IFX (UK) Ltd |

| Jenis Lisensi | Lisensi Layanan Keuangan Umum |

| Nomor Lisensi | F001814 |

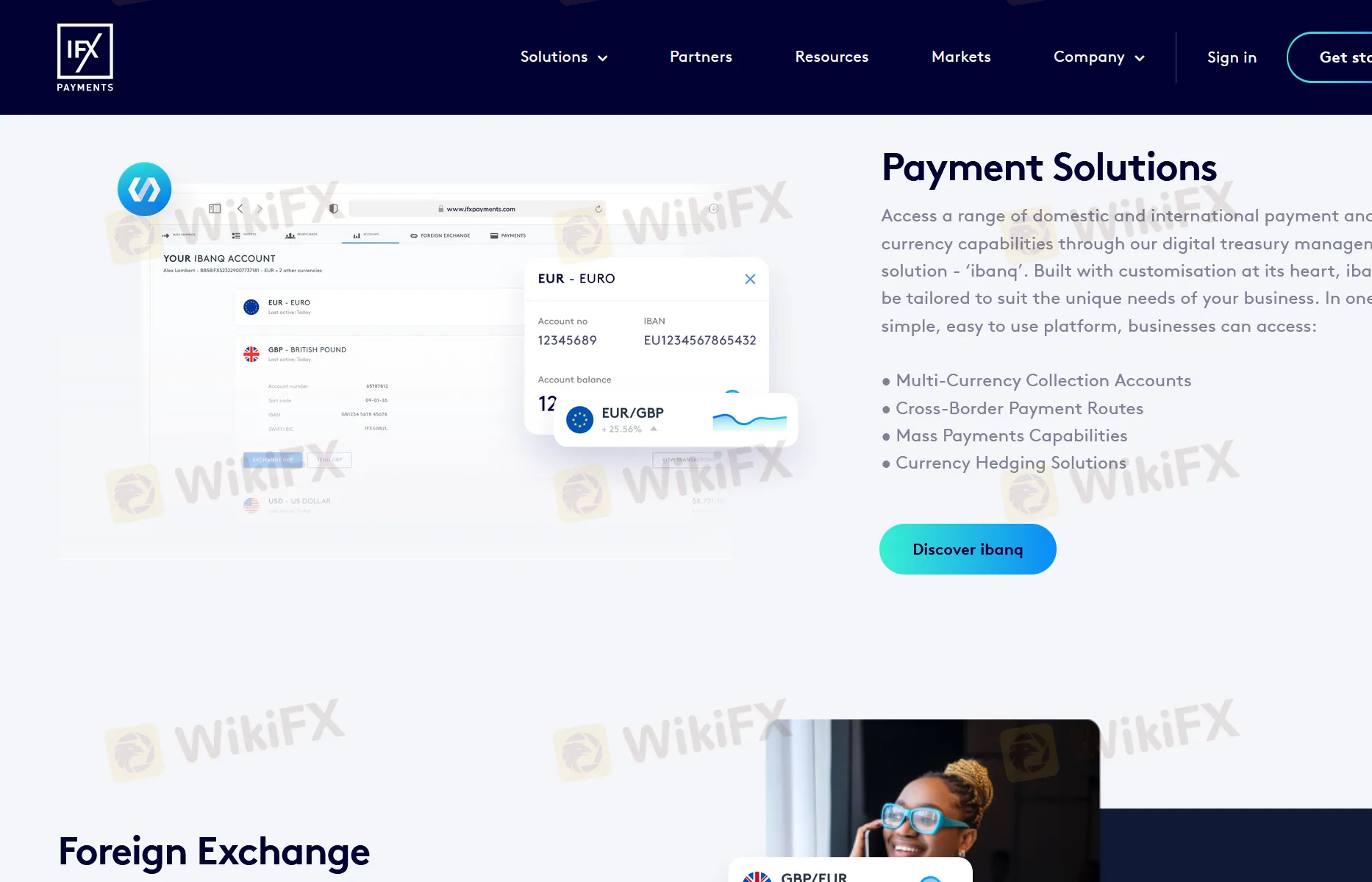

Layanan IFX

IFX menawarkan Solusi Pembayaran dan layanan Pertukaran Valuta Asing

| Instrumen yang Dapat Diperdagangkan | Didukung |

| Solusi Pembayaran | ✔ |

| Pertukaran Valuta Asing | ✔ |

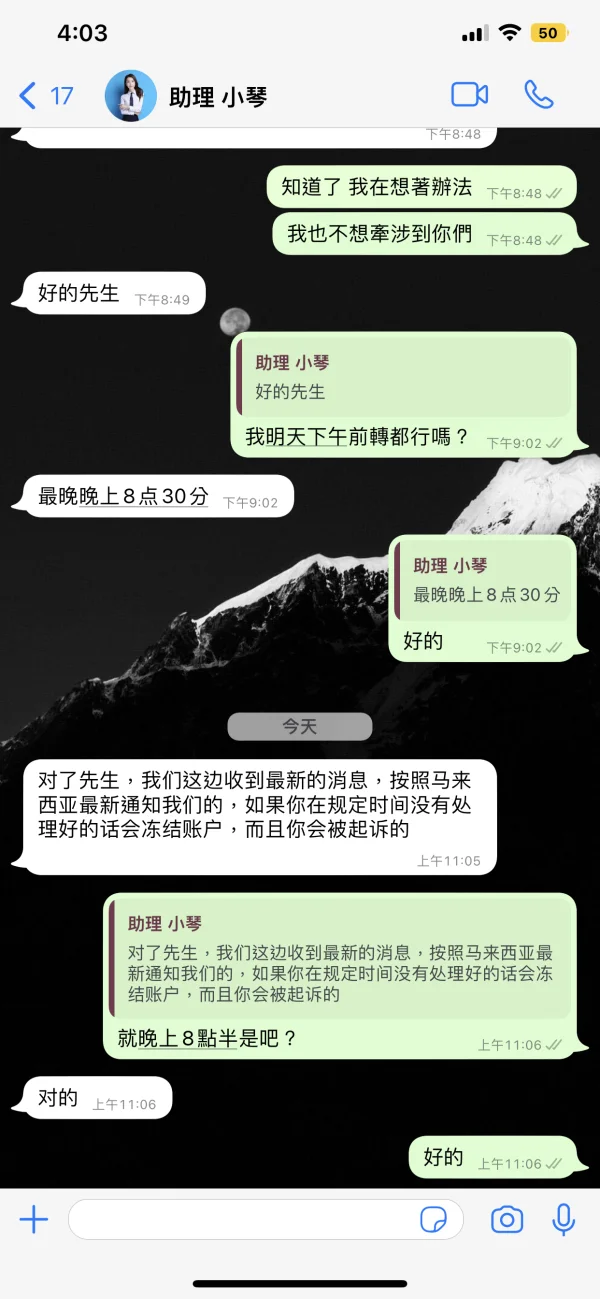

E1211

Malaysia

Apakah biaya penanganan benar-benar RM3000 dan apakah saya akan dituntut jika saya tidak membayarnya? Apakah situs web ini benar?

Paparan

Red Star

Hong Kong

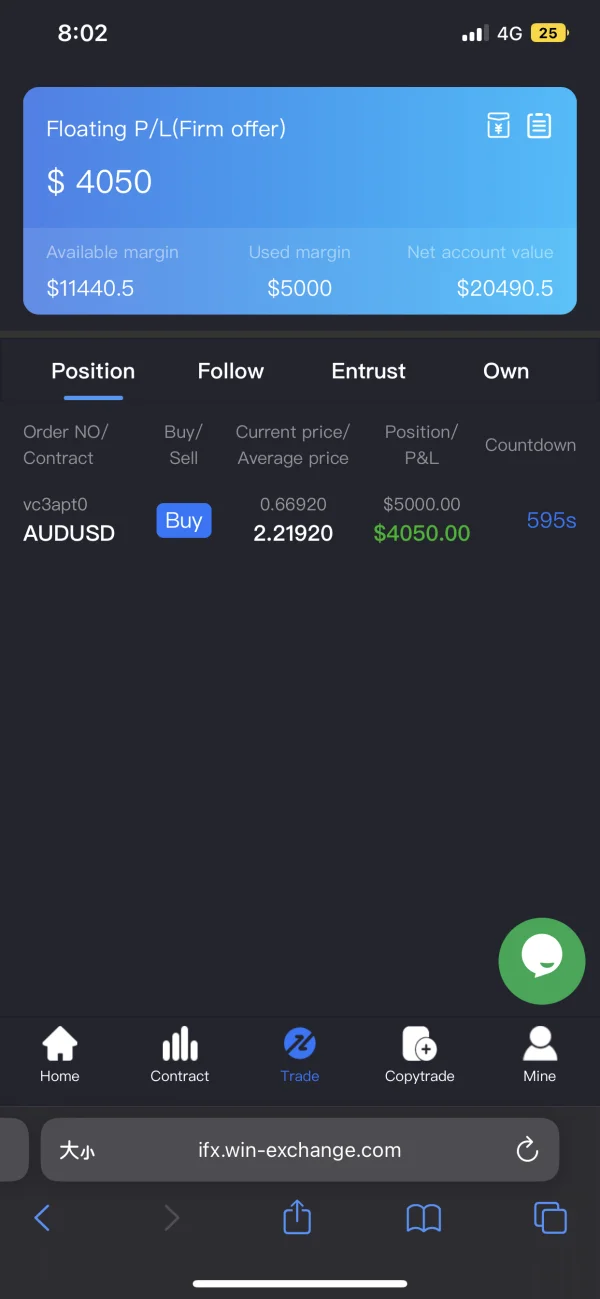

Penarikan tidak tersedia di IFX .Setelah menelepon polisi, akun saya dibatalkan. Jangan ditipu.

Paparan

五四六一九一六六八

Hong Kong

Tidak dapat menarik. Platform mengunci akun klien dan tidak memberikan akses ke penarikan, dengan mengatakan bahwa informasi ID salah.

Paparan

FX1287225689

Maroko

Sejujurnya, IFX adalah platform yang bagus untuk layanan transfer pembayaran. Saya telah menggunakan layanannya beberapa kali dan saya mengenali layanannya yang luar biasa.

Baik

A瞬间

Kerajaan Inggris

Saya memiliki pengalaman perdagangan yang sangat baik dengan IFX. Terima kasih banyak atas dukungan pelanggan yang sangat membantu saya ketika saya memiliki pertanyaan dan masalah. Saya salut dengan kalian!

Baik

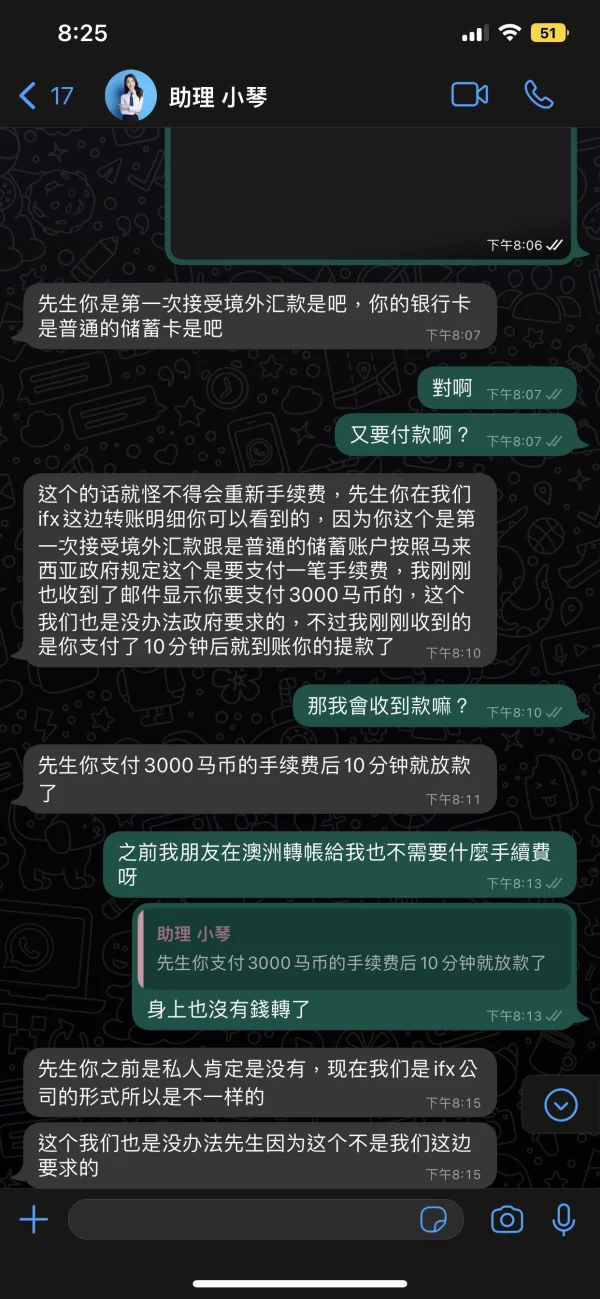

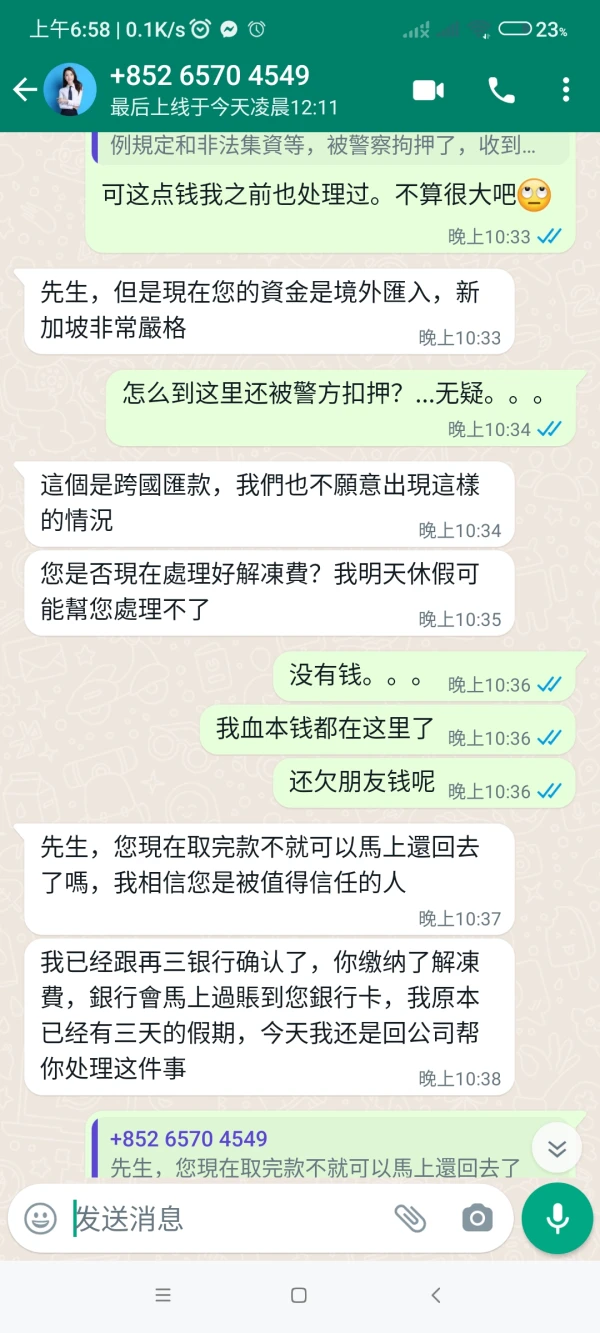

lee9022

Singapura

Penipuan, bos ingin Anda membayar komisi, biaya pemrosesan, margin, pajak penghasilan, dan biaya pencairan. Ada biaya tak berujung

Paparan

生死劫

Hong Kong

Ya, saya memiliki pengalaman yang menyenangkan dengan pembayaran IFX. Sunny sangat membantu dan mencoba yang terbaik untuk menemukan saya nilai tukar terbaik. Layanan hebat dan terima kasih.

Baik

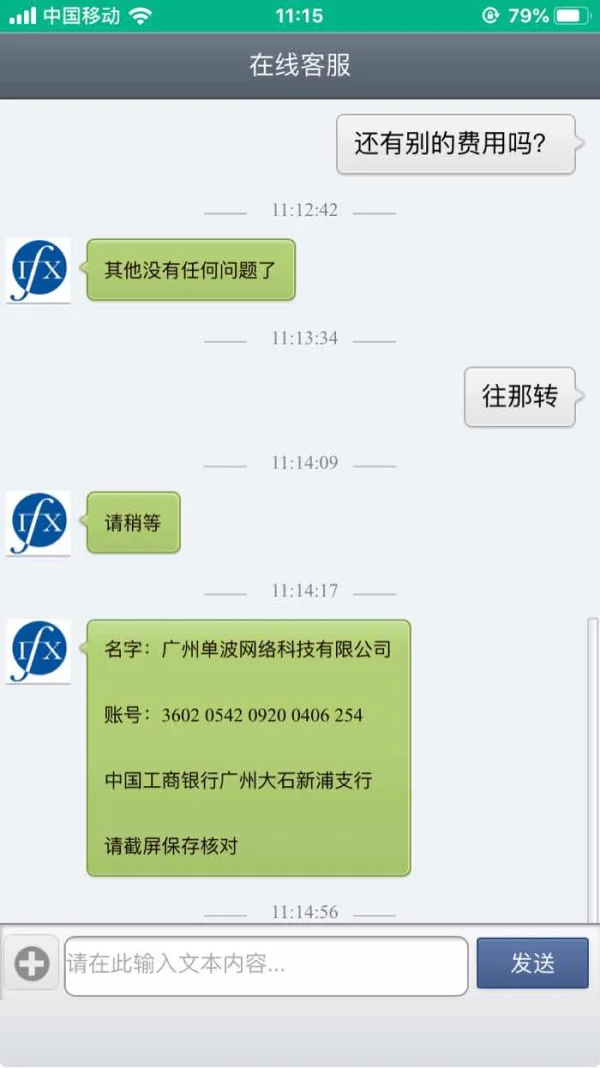

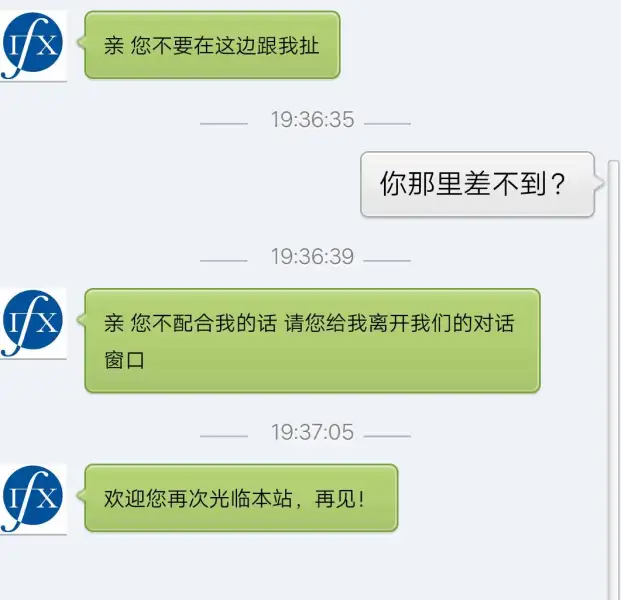

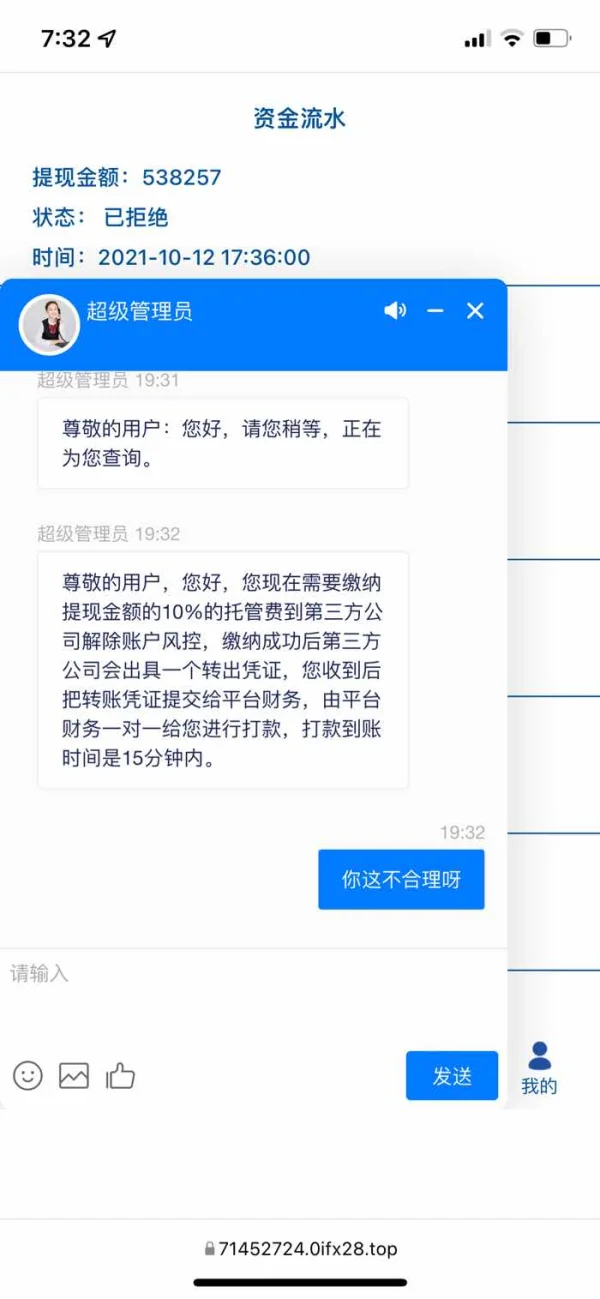

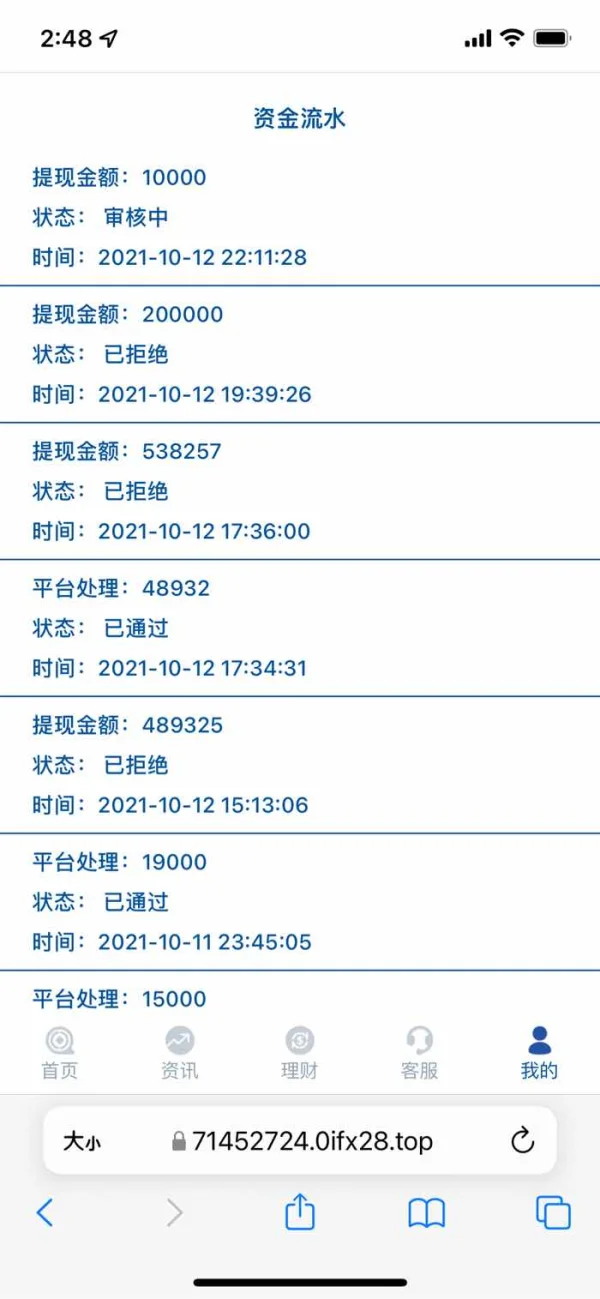

༺蜜糖༻

Hong Kong

Tidak dapat menarik. Itu mengatakan kepada saya untuk menyetor karena berbagai alasan. Apakah itu penipuan?

Paparan

FX4234736427

Hong Kong

IFX akan meminta margin dengan beragam alasan. Mengklaim untuk memperbaiki bug, itu tidak memberikan akses dan melarikan diri.

Paparan

随风29414

Hong Kong

Platform penipuan tidak memberikan akses ke penarikan dan meminta uang untuk mencairkan akun.

Paparan

Red Star

Hong Kong

IFX adalah platform penipuan yang meminta saya untuk membayar margin pada awalnya, dan tidak memberikan akses ke penarikan, terus meminta berbagai biaya. Semoga departemen pengawas melihat ini dan memulihkan kerugian bagi kami.

Paparan