Présentation de l'entreprise

| IFX Résumé de l'examen | |

| Fondé | 2015 |

| Pays/Région d'enregistrement | Royaume-Uni |

| Régulation | FCA (dépassé), DFSA (dépassé) |

| Services | Solutions de paiement, change étranger |

| Compte de démonstration | ✅ |

| Support client | Téléphone : +4402074958888 |

| Email : private@ifxpayments.com | |

| Londres : 33 Cavendish Square Londres, W1G 0PW | |

| Dubaï : Unit 31-46 Central Park offices DIFC | |

| Amersham : Chalfont Court, 5 Hill Avenue Amersham, HP6 5BB | |

| Varsovie : WorkIN, ul. Senatorska 200‑075 Warszawa | |

Informations sur IFX

IFX est une entreprise qui se concentre sur la fourniture aux utilisateurs de solutions de paiement complètes et de services de change étranger. Elle a été enregistrée au Royaume-Uni, mais ses licences délivrées par la FCA et la DFSA sont dépassées, ce qui signifie que les risques potentiels ne peuvent être ignorés.

Avantages et Inconvénients

| Avantages | Inconvénients |

| Comptes de démonstration | Licences dépassées |

| Longue histoire |

IFX Est-il légitime ?

IFX a dépassé les réglementations actuellement. Veuillez être conscient du risque !

| Statut réglementaire | Dépassé |

| Réglementé par | Financial Conduct Authority (FCA) |

| Institution agréée | IFX (UK) Ltd |

| Type de licence | Licence de paiement |

| Numéro de licence | 900517 |

| Statut réglementaire | Dépassé |

| Réglementé par | Dubai Financial Services Authority(DFSA) |

| Institution agréée | IFX (UK) Ltd |

| Type de licence | Licence de services financiers communs |

| Numéro de licence | F001814 |

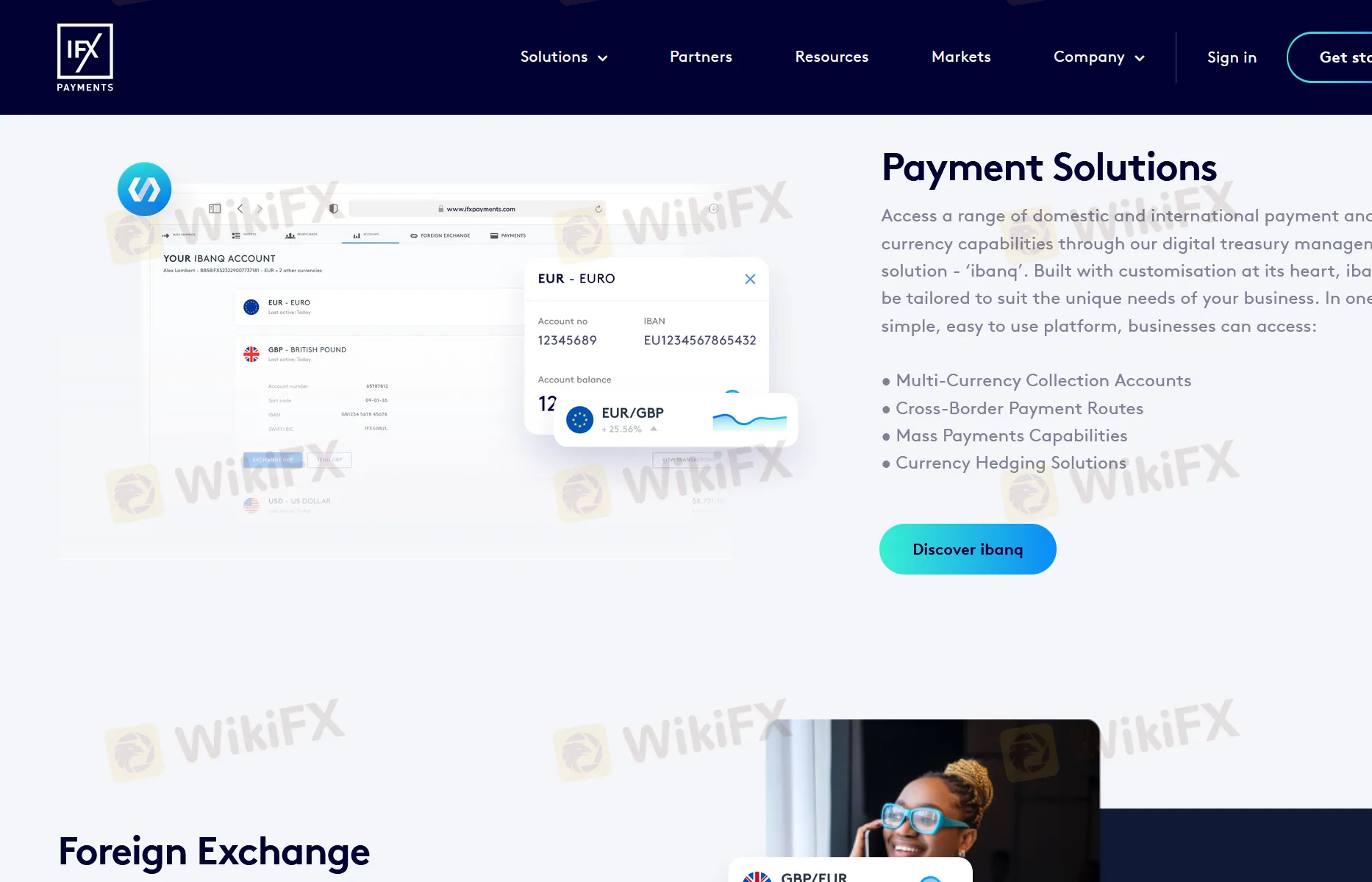

Services IFX

IFX propose des solutions de paiement et des services de change.

| Instruments négociables | Pris en charge |

| Solutions de paiement | ✔ |

| Change | ✔ |

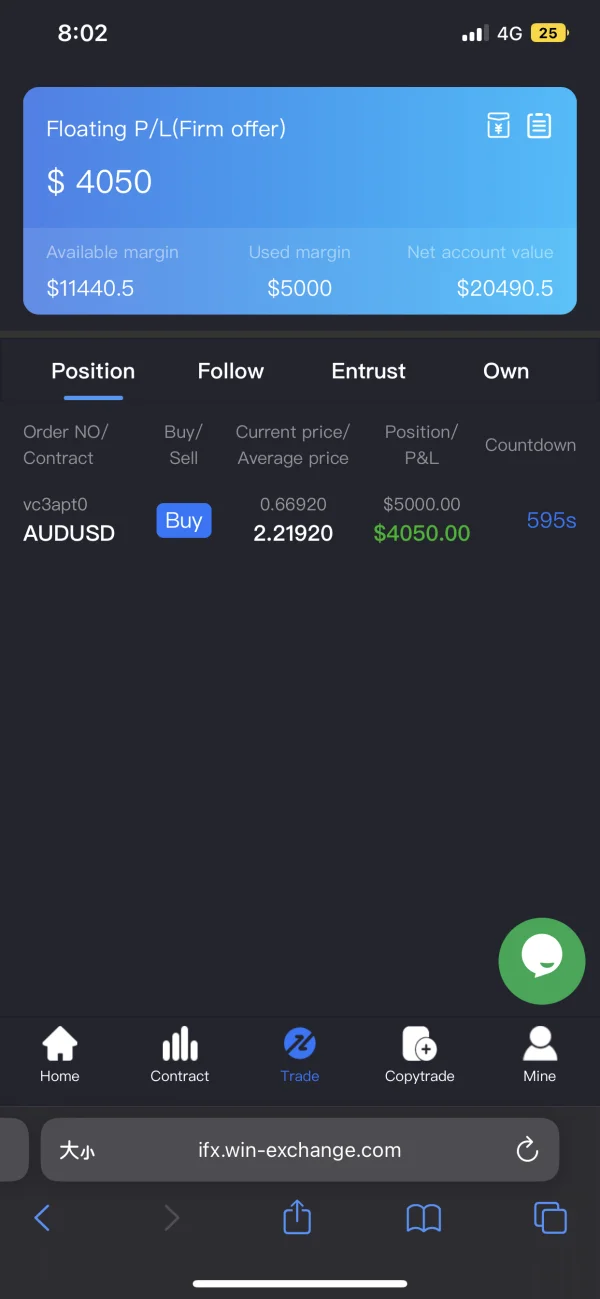

E1211

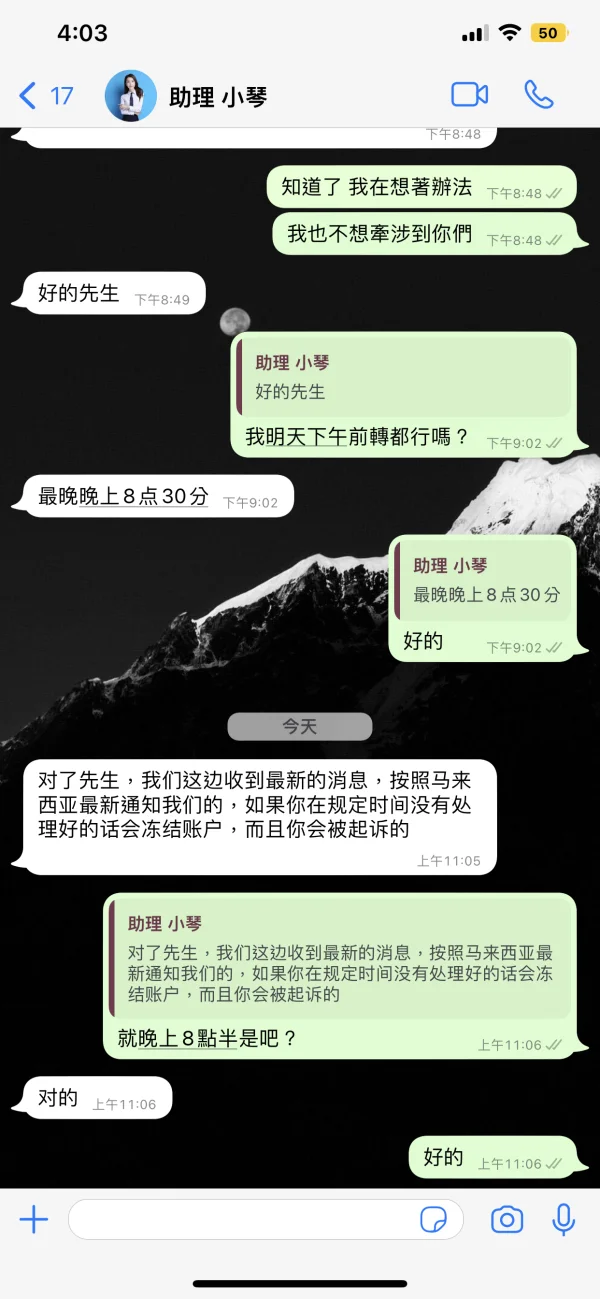

Malaisie

Les frais de traitement sont-ils vraiment de 3 000 RM et serai-je poursuivi si je ne les paie pas ? Ce site Web est-il vrai ?

Divulgation

Red Star

Hong Kong

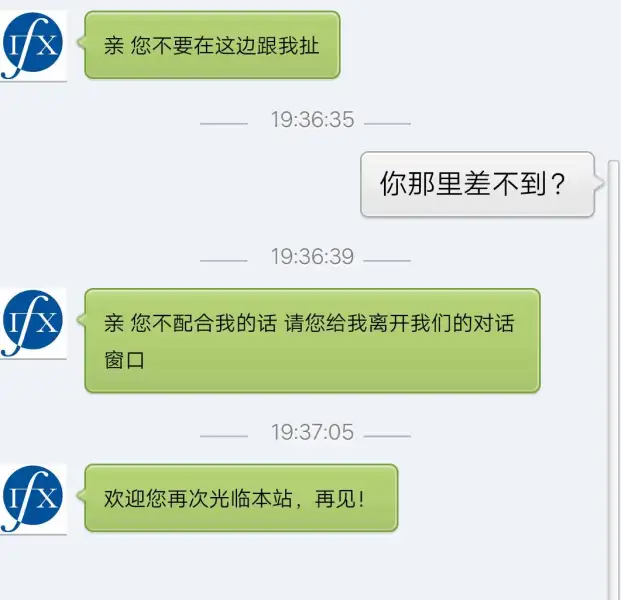

Le retrait n'est pas disponible dans IFX Après avoir appelé la police, mon compte a été annulé. Ne soyez pas trompé.

Divulgation

五四六一九一六六八

Hong Kong

Retrait impossible. La plate-forme a verrouillé les comptes des clients et n'a pas donné accès au retrait, indiquant que les informations d'identification étaient fausses.

Divulgation

FX1287225689

Maroc

Honnêtement, IFX est une bonne plateforme pour les services de transfert de paiement. J'ai utilisé ses services à plusieurs reprises et je reconnais son excellent service.

Positifs

A瞬间

Royaume-Uni

J'ai une très bonne expérience de trading avec IFX. Merci beaucoup pour le support client qui est super pour m'aider quand j'ai des questions et des problèmes. Je salue vos gars !

Positifs

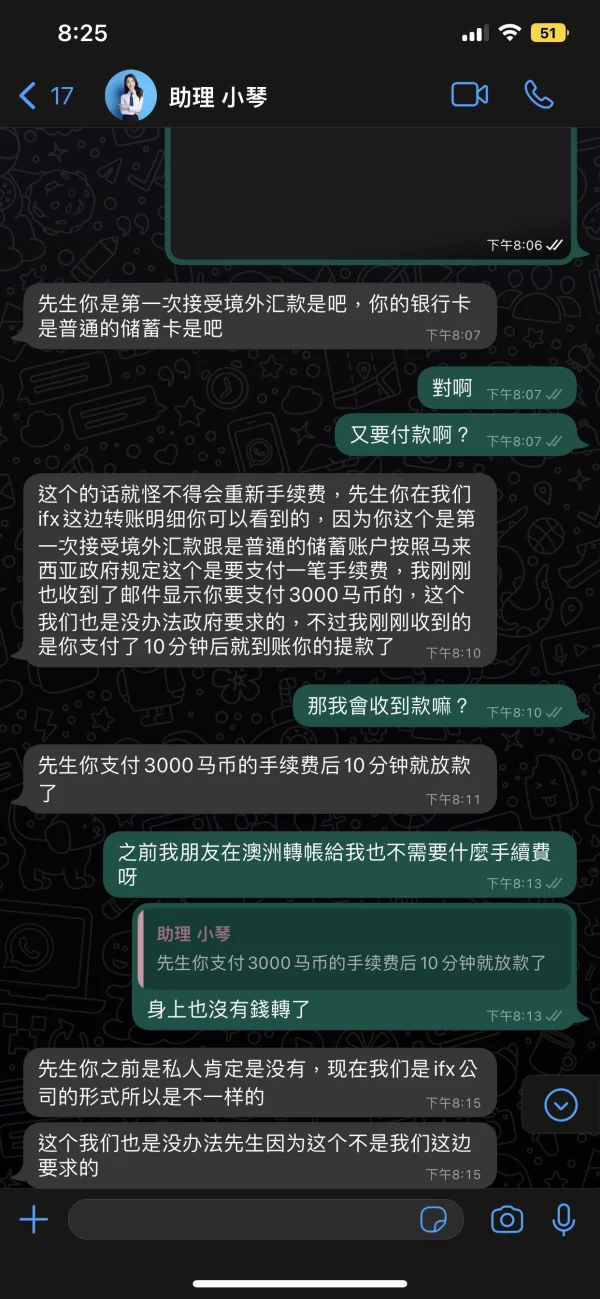

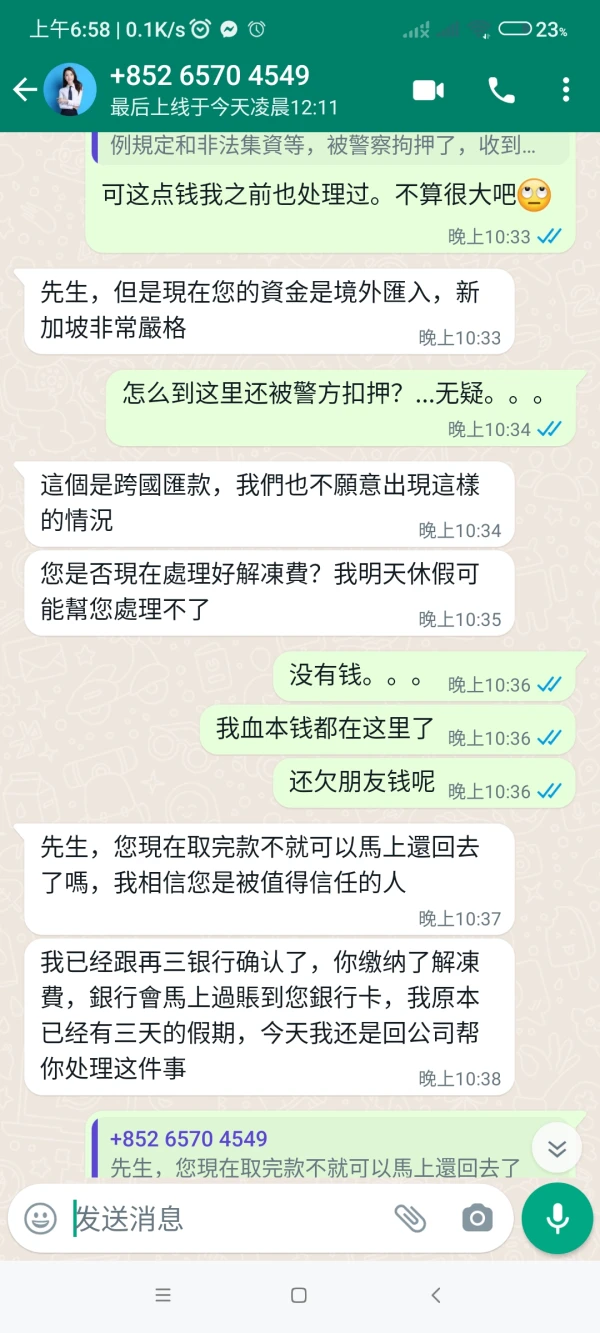

lee9022

Singapour

Fraude, le patron veut que vous payiez une commission, des frais de traitement, une marge, un impôt sur le revenu et des frais de déblocage. Il y a des frais sans fin

Divulgation

生死劫

Hong Kong

Oui, j'ai eu une expérience agréable avec les paiements IFX. Sunny a été très utile et a fait de son mieux pour me trouver le meilleur taux de change. Excellent service et merci.

Positifs

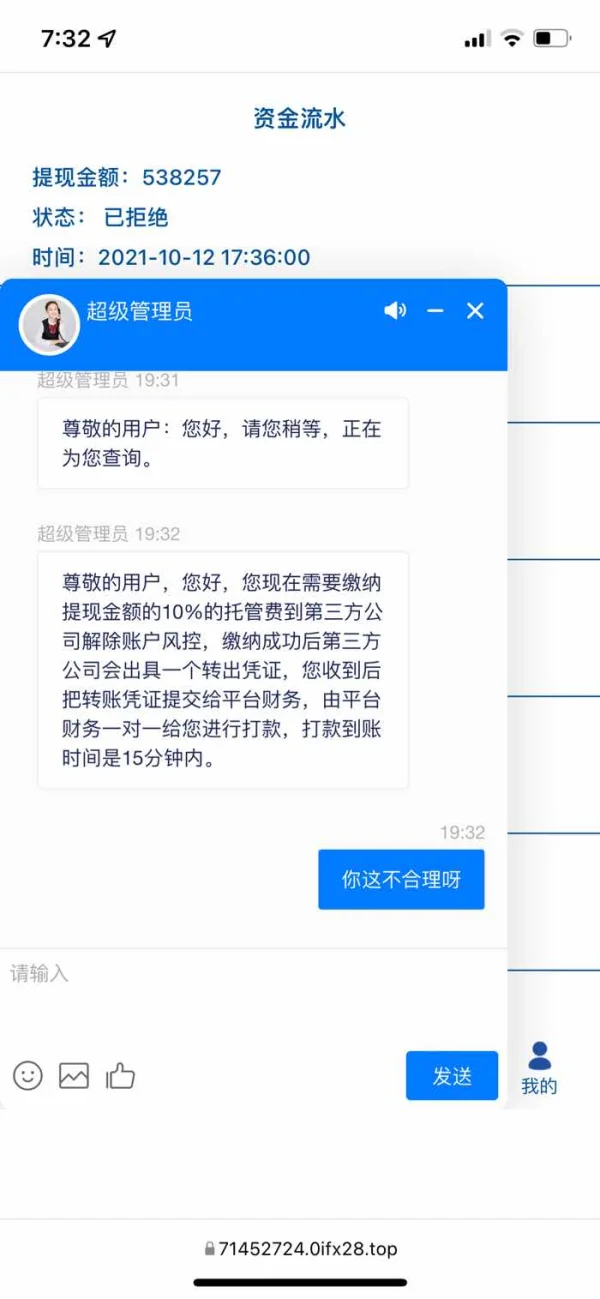

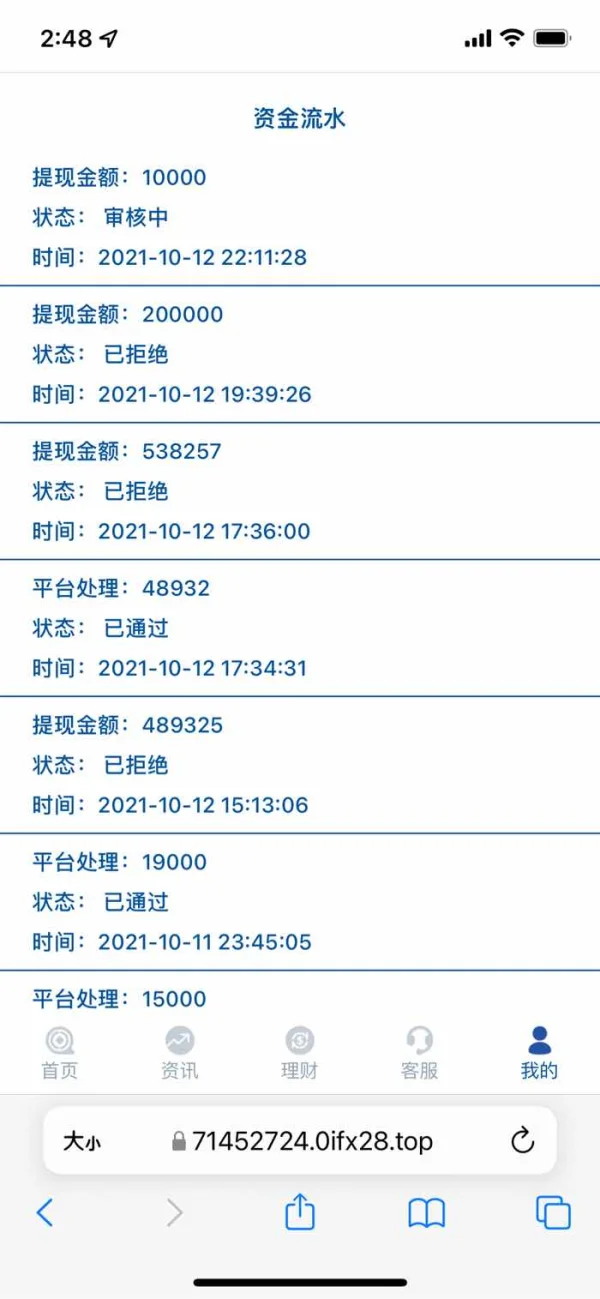

༺蜜糖༻

Hong Kong

Impossible de se retirer. Il m'a dit de déposer pour de nombreuses raisons. Était-ce une arnaque ?

Divulgation

FX4234736427

Hong Kong

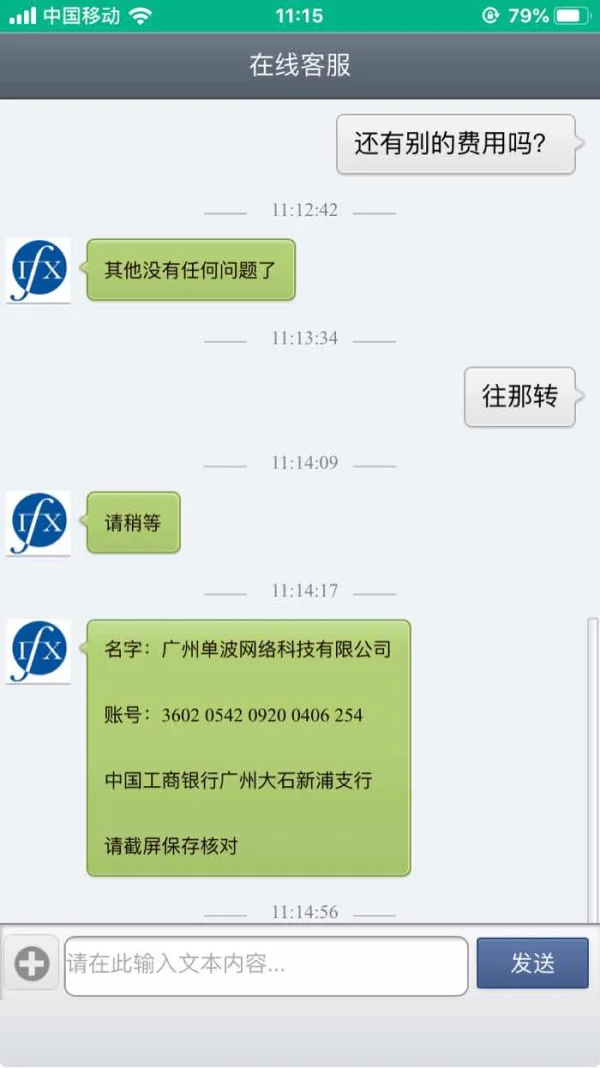

IFX aurait demandé une marge avec des excuses variées. Prétendant réparer le bogue, il n'a donné aucun accès et s'est enfui.

Divulgation

随风29414

Hong Kong

La plate-forme d'escroquerie n'a donné aucun accès au retrait et a demandé de l'argent pour débloquer le compte.

Divulgation

Red Star

Hong Kong

IFX est une plate-forme d'escroquerie qui m'a demandé de payer la marge dans un premier temps, et n'a donné aucun accès au retrait, continuant à demander divers frais. J'espère que le service de réglementation s'en chargera et récupérera les pertes pour nous.

Divulgation