Perfil de la compañía

| Jarden Resumen de la revisión | |

| Establecido | 1961 |

| País/Región Registrado | Nueva Zelanda |

| Regulación | Regulado por ASIC (Australia) |

| Instrumentos de Mercado | Acciones, Forex, Materias primas, Futuros, Opciones |

| Cuenta Demo | ❌ |

| Apalancamiento | / |

| Spread | / |

| Plataforma de Trading | Ranos, Commtrade, Market Trader |

| Depósito Mínimo | / |

| Soporte al Cliente | Formulario de Contacto |

| Tel: +61 2 8077 1300 | |

| Email: info@afca.org.au | |

| Dirección: Level 54 Governor Phillip Tower 1 Farrer Place Sydney NSW 2000 | |

Información de Jarden

Jarden es un corredor con sede en Nueva Zelanda fundado en 1961, regulado por ASIC. Ofrece una amplia gama de instrumentos de mercado, como: Acciones, Forex, Materias primas, Futuros y Opciones.

Pros y Contras

| Pros | Contras |

| Regulado por ASIC | Información limitada sobre operaciones |

| Varios activos de trading | Sin soporte para MT4 y MT5 |

| Múltiples canales de contacto | Sin cuentas demo |

| Oficina física comprobada | |

| Largo tiempo de operación |

¿Es Jarden Legítimo?

Jarden está regulado por la Comisión Australiana de Valores e Inversiones (ASIC), bajo JARDEN AUSTRALIA PTY LTD, con número de licencia 000485351.

| Estado Regulatorio | Regulado Por | Institución Licenciada | Tipo de Licencia | Número de Licencia |

| Regulado | Comisión Australiana de Valores e Inversiones (ASIC) | JARDEN AUSTRALIA PTY LTD | Creador de Mercado (MM) | 000485351 |

Encuesta de Campo de WikiFX

El equipo de investigación de campo de WikiFX visitó la dirección de Jarden en Australia y encontramos su oficina en el lugar, lo que significa que la empresa opera con una oficina física.

¿Qué puedo comerciar en Jarden?

| Instrumentos de Trading | Soportado |

| Acciones | ✔ |

| Forex | ✔ |

| Productos Básicos | ✔ |

| Futuros | ✔ |

| Opciones | ✔ |

| Índices | ❌ |

| Acciones | ❌ |

| Criptomonedas | ❌ |

| Bonos | ❌ |

| ETFs | ❌ |

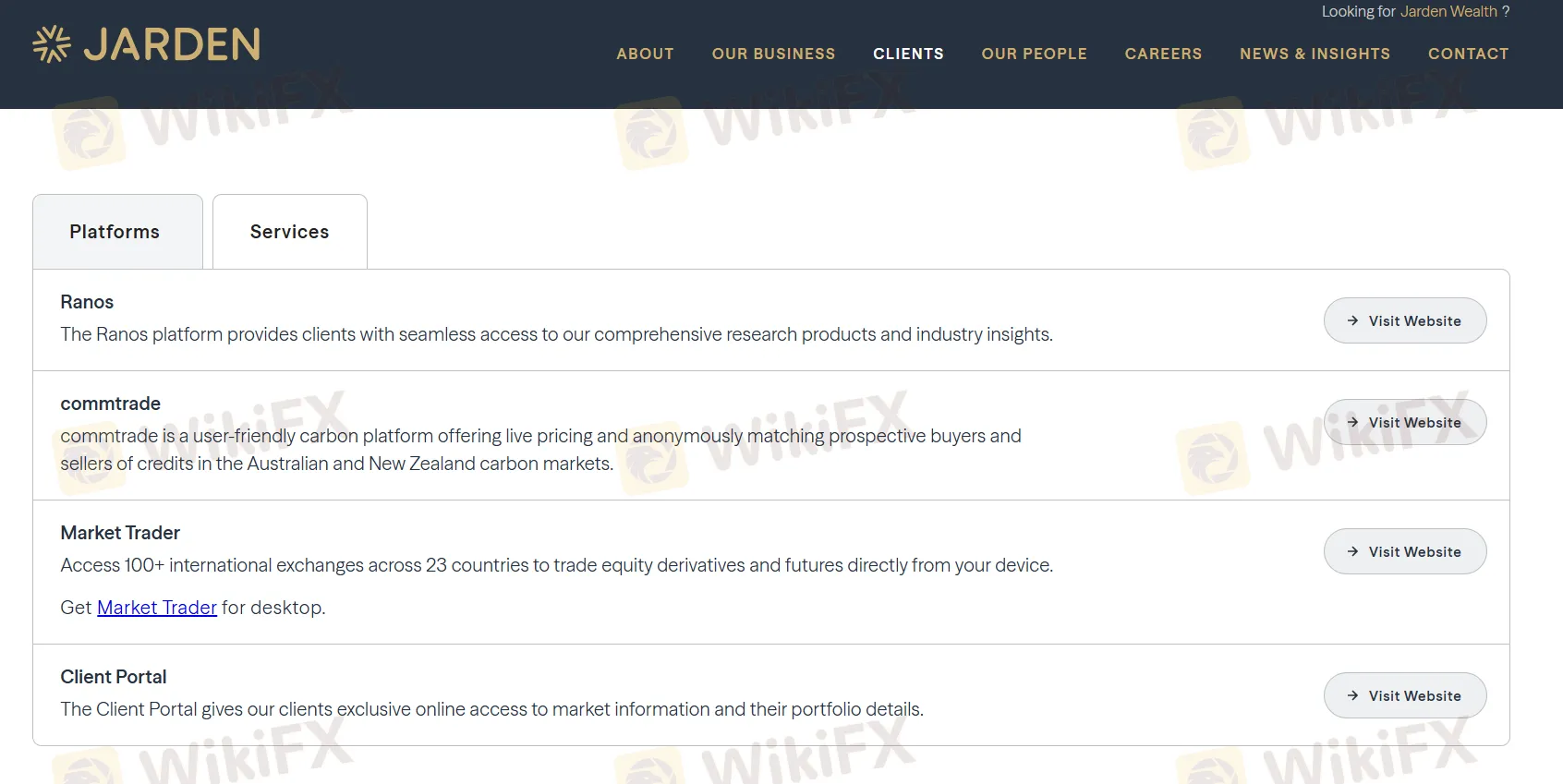

Plataforma de Trading

| Plataforma de Trading | Soportado | Dispositivos Disponibles | Adecuado para |

| Ranos | ✔ | Web (basada en navegador) | / |

| Commtrade | ✔ | Web (basada en navegador) | / |

| Market Trader | ✔ | Windows | / |

| MT4 | ❌ | / | Principiantes |

| MT5 | ❌ | / | Traders experimentados |