公司簡介

| Jarden 檢討摘要 | |

| 成立年份 | 1961 |

| 註冊國家/地區 | 紐西蘭 |

| 監管 | 由ASIC(澳洲)監管 |

| 市場工具 | 股票、外匯、商品、期貨、期權 |

| 模擬帳戶 | ❌ |

| 槓桿 | / |

| 點差 | / |

| 交易平台 | Ranos、Commtrade、Market Trader |

| 最低存款 | / |

| 客戶支援 | 聯絡表格 |

| 電話:+61 2 8077 1300 | |

| 電郵:info@afca.org.au | |

| 地址:Level 54 Governor Phillip Tower 1 Farrer Place Sydney NSW 2000 | |

Jarden 資訊

Jarden 是一家成立於1961年的紐西蘭經紀商,受ASIC監管。它提供多元化的市場工具,例如:股票、外匯、商品、期貨和期權。

優缺點

| 優點 | 缺點 |

| 受ASIC監管 | 交易信息有限 |

| 多樣化的交易資產 | 不支援MT4和MT5 |

| 多種聯絡渠道 | 沒有模擬帳戶 |

| 實體辦公室證明 | |

| 長時間運作 |

Jarden 是否合法?

Jarden 受澳洲證券及投資委員會(ASIC)監管,由JARDEN AUSTRALIA PTY LTD持牌,牌照號碼為000485351。

| 監管狀態 | 監管機構 | 持牌機構 | 牌照類型 | 牌照號碼 |

| 受監管 | 澳洲證券及投資委員會(ASIC) | JARDEN AUSTRALIA PTY LTD | 市場製造商(MM) | 000485351 |

WikiFX 實地調查

WikiFX 地勘團隊訪問了 Jarden 的澳洲地址,我們在現場發現了該公司的辦公室,這意味著該公司設有實體辦公室。

我可以在 Jarden 交易什麼?

| 交易工具 | 支援 |

| 股票 | ✔ |

| 外匯 | ✔ |

| 商品 | ✔ |

| 期貨 | ✔ |

| 期權 | ✔ |

| 指數 | ❌ |

| 股票 | ❌ |

| 加密貨幣 | ❌ |

| 債券 | ❌ |

| ETF | ❌ |

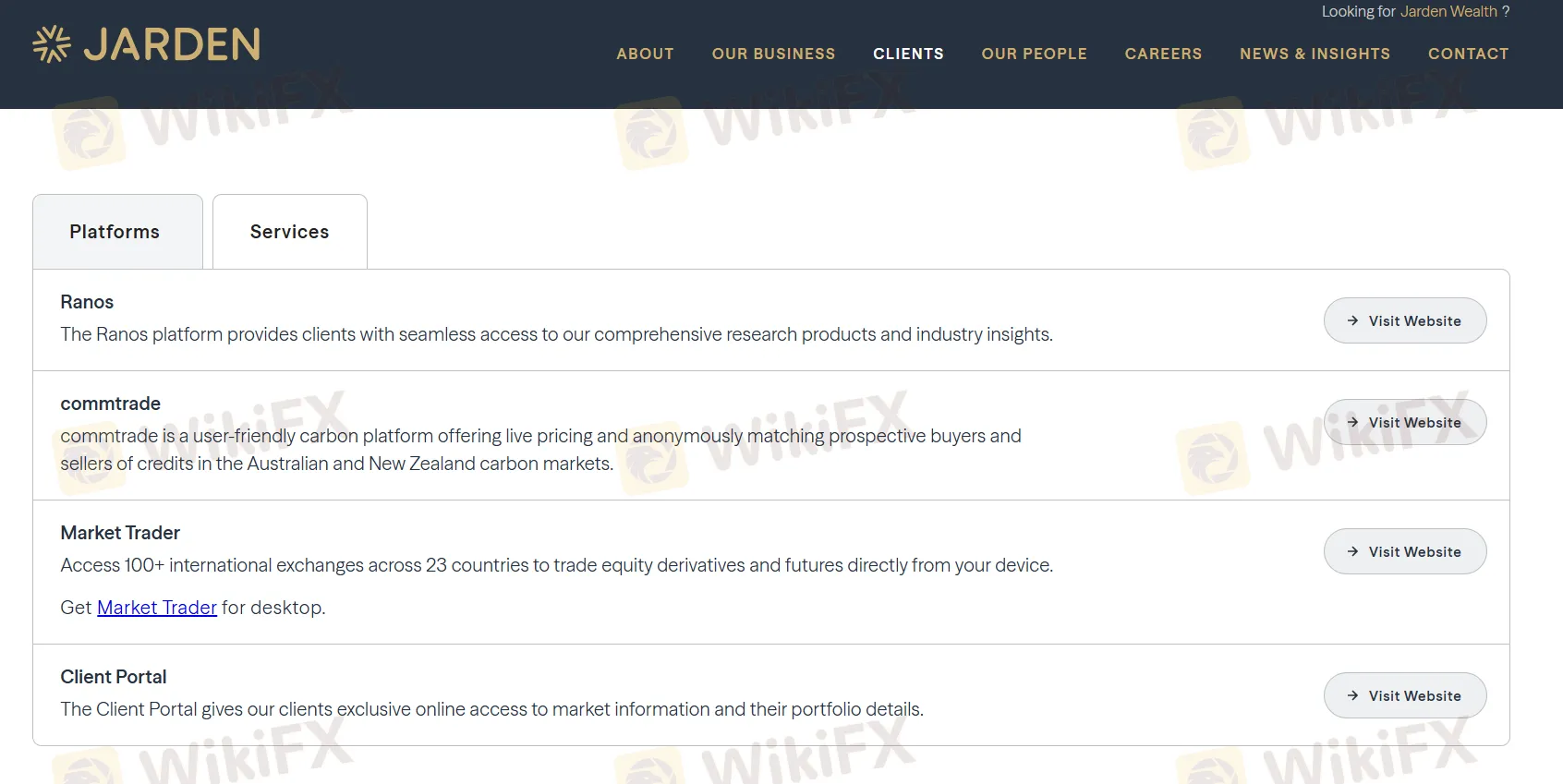

交易平台

| 交易平台 | 支援 | 可用設備 | 適合對象 |

| Ranos | ✔ | Web(基於瀏覽器) | / |

| Commtrade | ✔ | Web(基於瀏覽器) | / |

| Market Trader | ✔ | Windows | / |

| MT4 | ❌ | / | 初學者 |

| MT5 | ❌ | / | 經驗豐富的交易者 |