公司简介

| Jarden 评论摘要 | |

| 成立时间 | 1961 |

| 注册国家/地区 | 新西兰 |

| 监管 | 由ASIC(澳大利亚)监管 |

| 市场工具 | 股票、外汇、大宗商品、期货、期权 |

| 模拟账户 | ❌ |

| 杠杆 | / |

| 点差 | / |

| 交易平台 | Ranos、Commtrade、Market Trader |

| 最低存款 | / |

| 客户支持 | 联系表单 |

| 电话:+61 2 8077 1300 | |

| 电子邮件:info@afca.org.au | |

| 地址:Level 54 Governor Phillip Tower 1 Farrer Place Sydney NSW 2000 | |

Jarden 信息

Jarden 是一家成立于1961年的总部位于新西兰的经纪商,受ASIC监管。它提供多样化的市场工具,例如:股票、外汇、大宗商品、期货和期权。

优缺点

| 优点 | 缺点 |

| 受ASIC监管 | 交易信息有限 |

| 多样的交易资产 | 不支持MT4和MT5 |

| 多种联系渠道 | 无演示 账户 |

| 实体办公室验证 | |

| 长时间运营 |

Jarden 是否合法?

Jarden 受澳大利亚证券与投资委员会(ASIC)监管,隶属于JARDEN AUSTRALIA PTY LTD,许可证号为000485351。

| 监管状态 | 监管机构 | 许可机构 | 许可类型 | 许可证号 |

| 受监管 | 澳大利亚证券与投资委员会(ASIC) | JARDEN AUSTRALIA PTY LTD | 做市商(MM) | 000485351 |

WikiFX 实地调查

WikiFX 实地调查团队访问了 Jarden 的地址在澳大利亚,我们在现场发现了他们的办公室,这意味着该公司有实体办公室在运营。

我可以在 Jarden 上交易什么?

| 交易工具 | 支持 |

| 股票 | ✔ |

| 外汇 | ✔ |

| 大宗商品 | ✔ |

| 期货 | ✔ |

| 期权 | ✔ |

| 指数 | ❌ |

| 股票 | ❌ |

| 加密货币 | ❌ |

| 债券 | ❌ |

| 交易所交易基金 | ❌ |

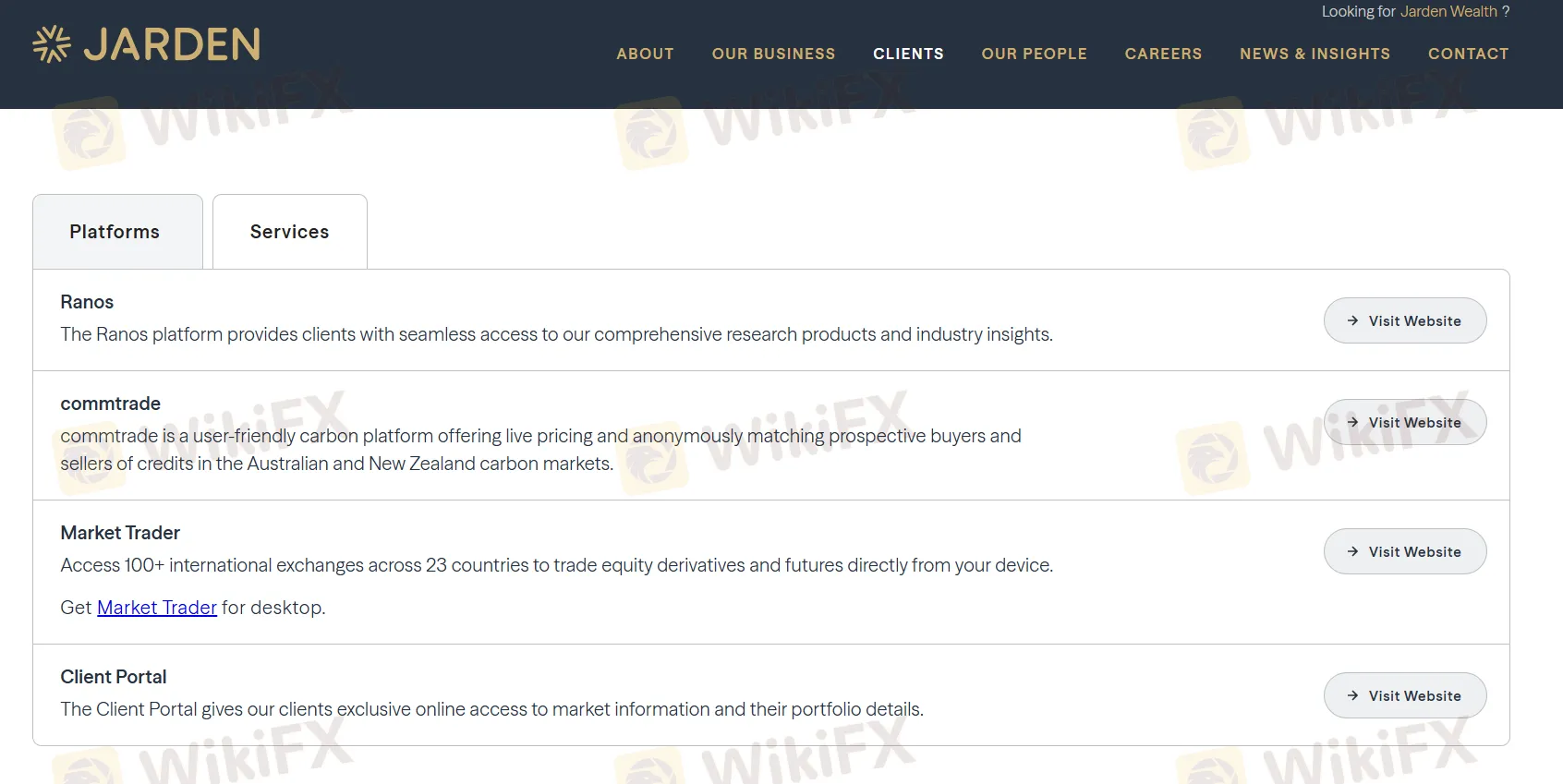

交易平台

| 交易平台 | 支持 | 可用设备 | 适合人群 |

| Ranos | ✔ | Web(基于浏览器) | / |

| Commtrade | ✔ | Web(基于浏览器) | / |

| Market Trader | ✔ | Windows | / |

| MT4 | ❌ | / | 初学者 |

| MT5 | ❌ | / | 有经验的交易者 |