Didirikan pada tahun 2005 dan terdaftar di Jepang, Kotobuki Securities adalah perusahaan pialang yang diatur oleh Otoritas Jasa Keuangan (FSA). Perusahaan ini menawarkan beragam instrumen pasar, termasuk reksa dana unggulan, saham domestik yang terdaftar untuk perdagangan spot dan margin (terbatas pada kredit institusi), IPO, ETF, REIT, obligasi konversi, trust investasi, MRF, saham dan obligasi asing, MMF denominasi mata uang asing, dan perdagangan derivatif pasar seperti futures dan options.

Kelebihan dan Kekurangan

Apakah Kotobuki Securities Legal?

Ya, Kotobuki Securities saat ini diatur oleh FSA, memegang Izin Forex Ritel.

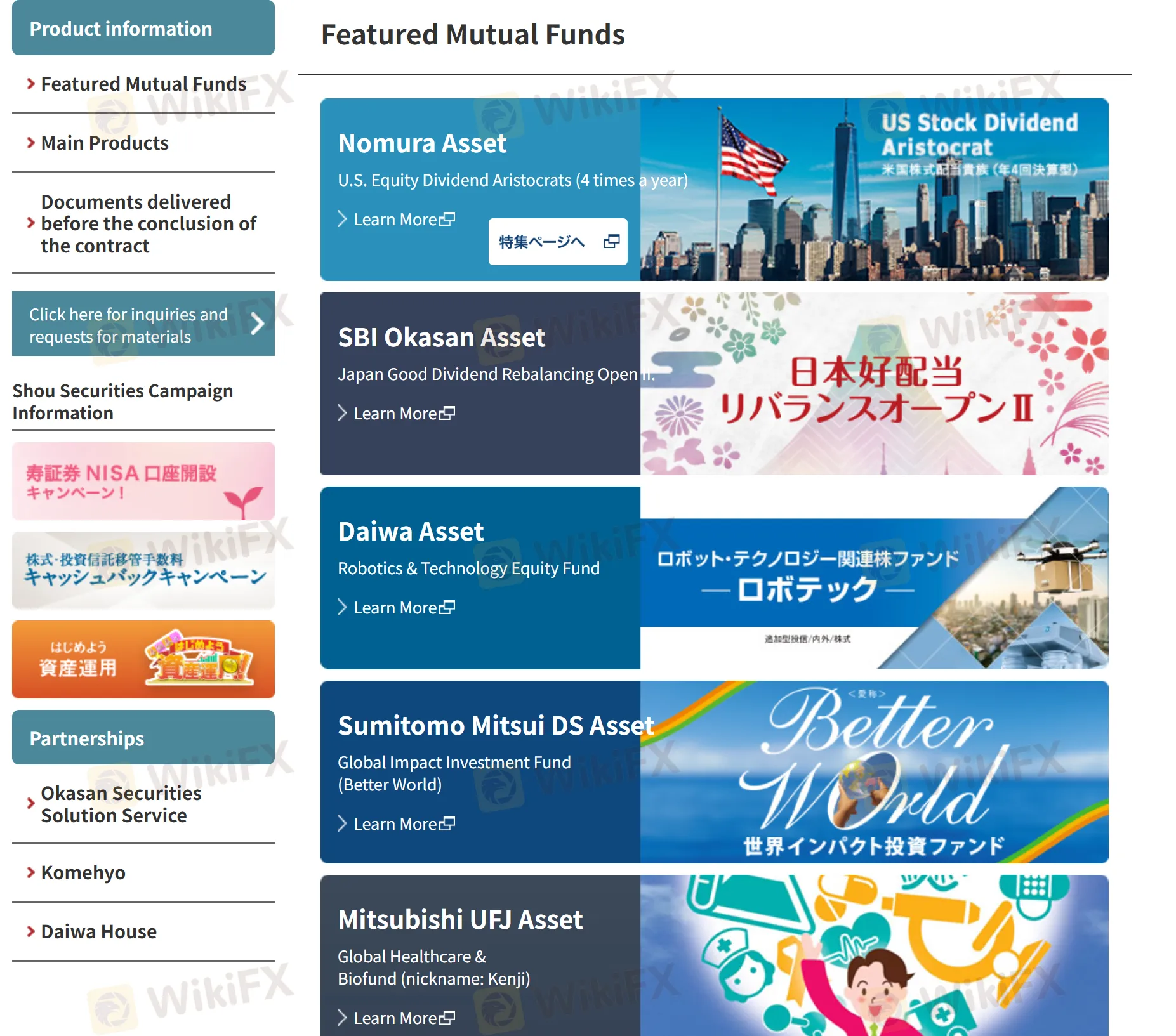

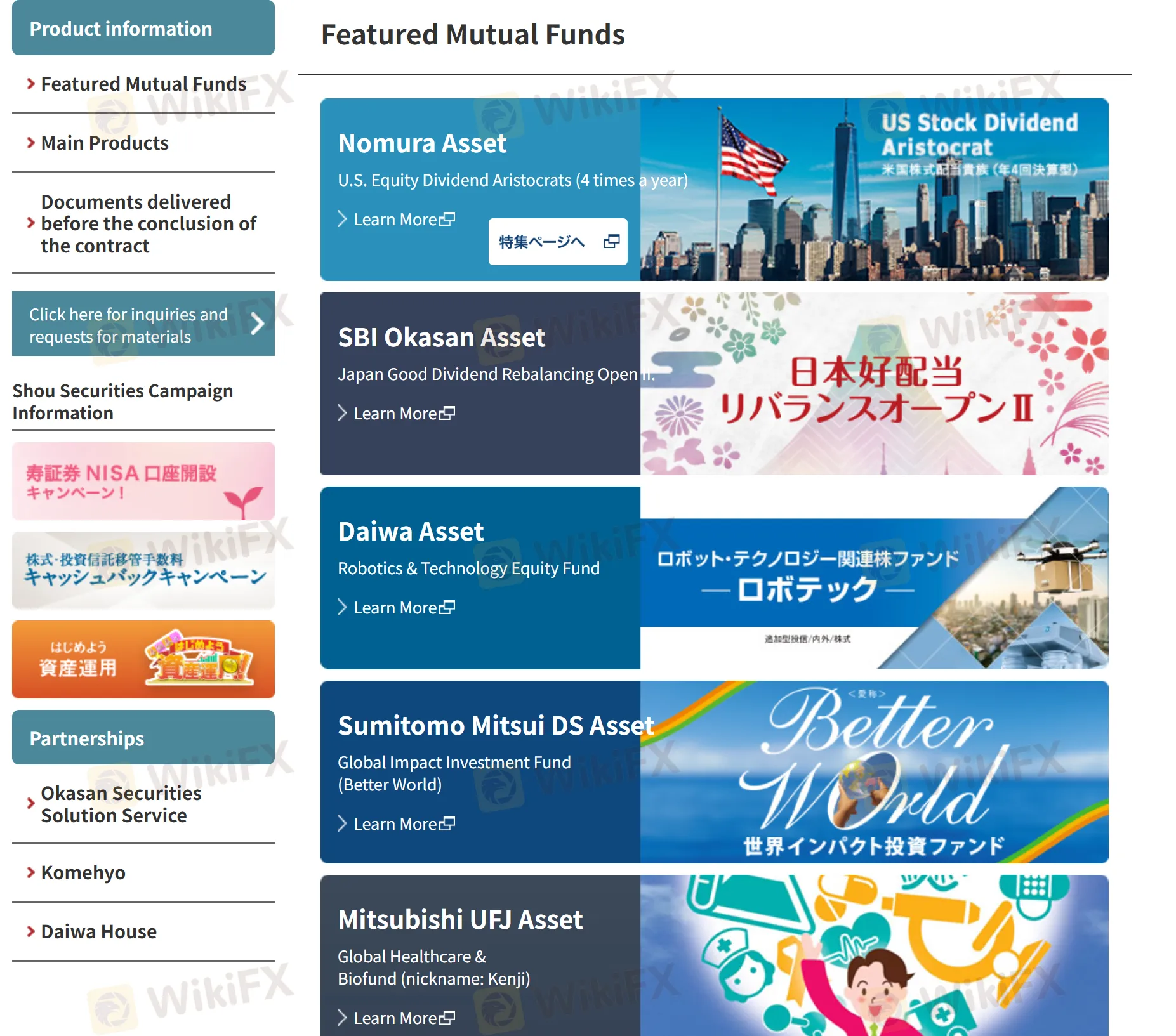

Apa yang Dapat Saya Perdagangkan di Kotobuki Securities?

Pada Kotobuki Securities, Anda dapat melakukan perdagangan dengan Dana Investasi Unggulan, Perdagangan Spot Saham Terdaftar Domestik, Perdagangan Marjin Saham Terdaftar Domestik (hanya kredit institusi), IPO (Penawaran Saham Perdana), ETF (Dana yang Diperdagangkan di Bursa), REIT (Real Estate Investment Trust), CB (Obligasi Konversi), trust investasi, MRF, Saham Asing, Obligasi Asing, MMF Berdenominasi Mata Uang, Perdagangan Derivatif Pasar (Futures & Options).