公司简介

| 寿证券评论摘要 | |

| 成立时间 | 2005 |

| 注册国家/地区 | 日本 |

| 监管 | FSA |

| 市场工具 | 共同基金、股票、IPO、ETF、REITs、可转换债券、投资信托、MRF、债券、货币计价的MMF、衍生品(期货和期权) |

| 模拟账户 | ❌ |

| 杠杆 | / |

| 点差 | / |

| 交易平台 | / |

| 最低存款 | / |

| 客户支持 | 电话:+81 052-261-0211 |

| 邮箱:info@kotobuki-sec.co.jp | |

| 地址:名古屋市中区栄三丁目3番21号 セントライズ栄301 | |

成立于2005年,注册于日本的寿证券是一家由金融厅(FSA)监管的经纪公司。它提供广泛的市场工具,包括特色共同基金、国内上市股票用于现货和保证金交易(仅限机构信用),IPO、ETF、REITs、可转换债券、投资信托、MRF、外国股票和债券、以及以外币计价的MMFs,以及市场衍生品交易,如期货和期权。

优点和缺点

| 优点 | 缺点 |

| 受FSA监管 | 关于账户的信息有限 |

| 广泛的交易产品范围 | 关于交易手续费的信息有限 |

| 无演示账户 |

寿证券是否合法?

是的,寿证券目前受FSA监管,持有零售外汇牌照。

| 监管国家 | 监管机构 | 受监管实体 | 当前状态 | 许可证类型 | 许可证号码 |

| 金融厅(FSA) | 寿证券株式会社 | 受监管 | 零售外汇牌照 | 東海財務局長(金商)第7号 |

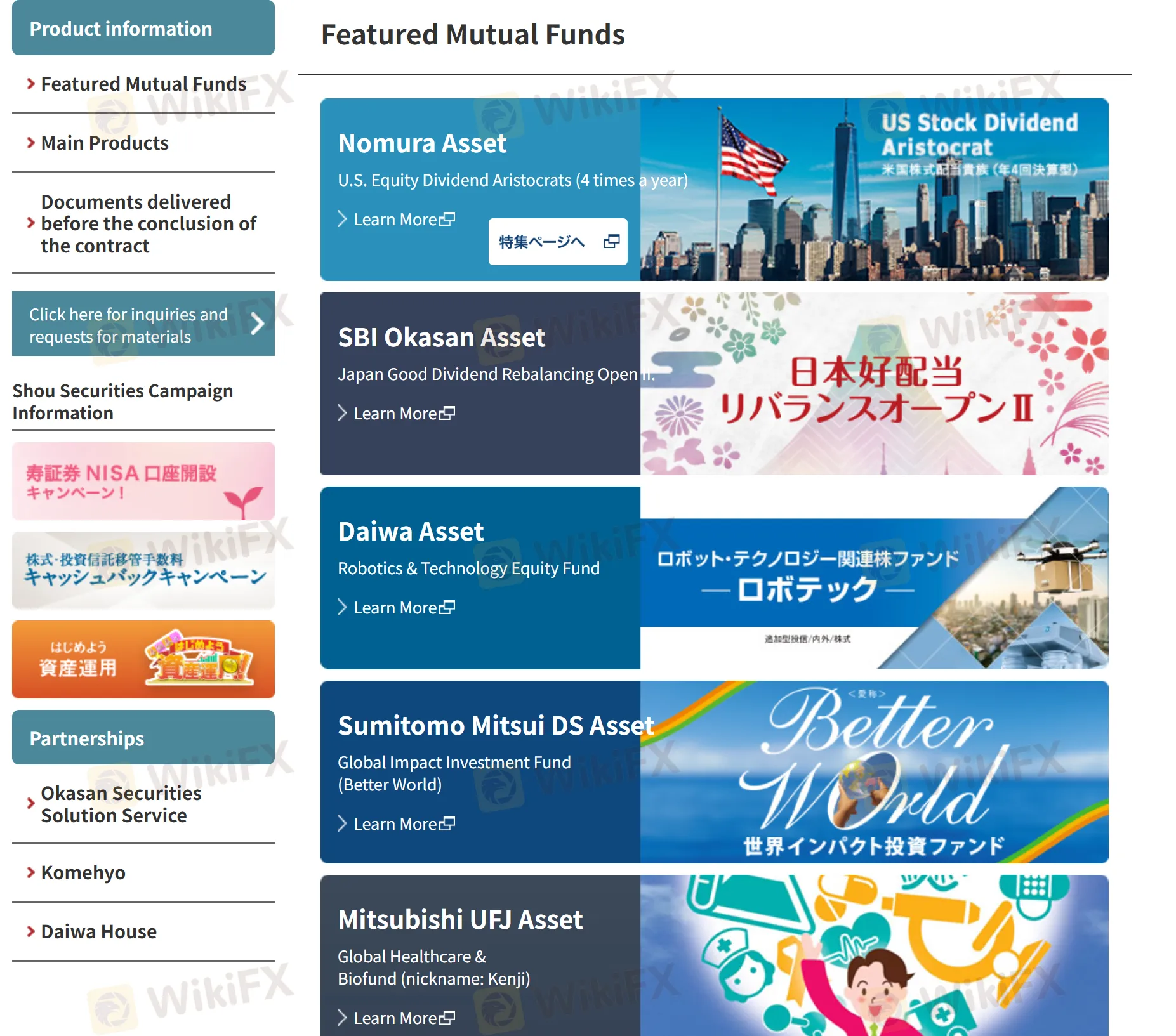

我可以在寿证券上交易什么?

在 寿证券,您可以交易特色互惠基金、国内上市股票现货交易、国内上市股票融资交易(仅限机构信用)、IPO(首次公开发行)、ETFs(交易所交易基金)、REITs(房地产投资信托)、CB(可转换债券)、投资信托、MRF、外国股票、外国债券、以货币计价的MMF、市场衍生品交易(期货与期权)。

| 可交易工具 | 支持 |

| 互惠基金 | ✔ |

| 股票 | ✔ |

| 债券 | ✔ |

| 衍生品(期货与期权) | ✔ |

| ETFs | ✔ |

| REITs | ✔ |

| 投资信托 | ✔ |

| IPO | ✔ |

| 以货币计价的MMF | ✔ |

| 外汇 | ❌ |

| 大宗商品 | ❌ |

| 指数 | ❌ |

| 加密货币 | ❌ |