Founded in 2005 and registered in Japan, Kotobuki Securities is a brokerage firm regulated by the Financial Services Agency (FSA). It offers an extensive array of market instruments, including featured mutual funds, domestic listed stocks for both spot and margin trading (restricted to institutional credit), IPOs, ETFs, REITs, convertible bonds, investment trusts, MRFs, foreign stocks and bonds, foreign currency-denominated MMFs, and market derivatives trading like futures and options.

Pros and Cons

Is Kotobuki Securities Legit?

Yes, Kotobuki Securities is currently regulated by FSA, holding a Retail Forex License.

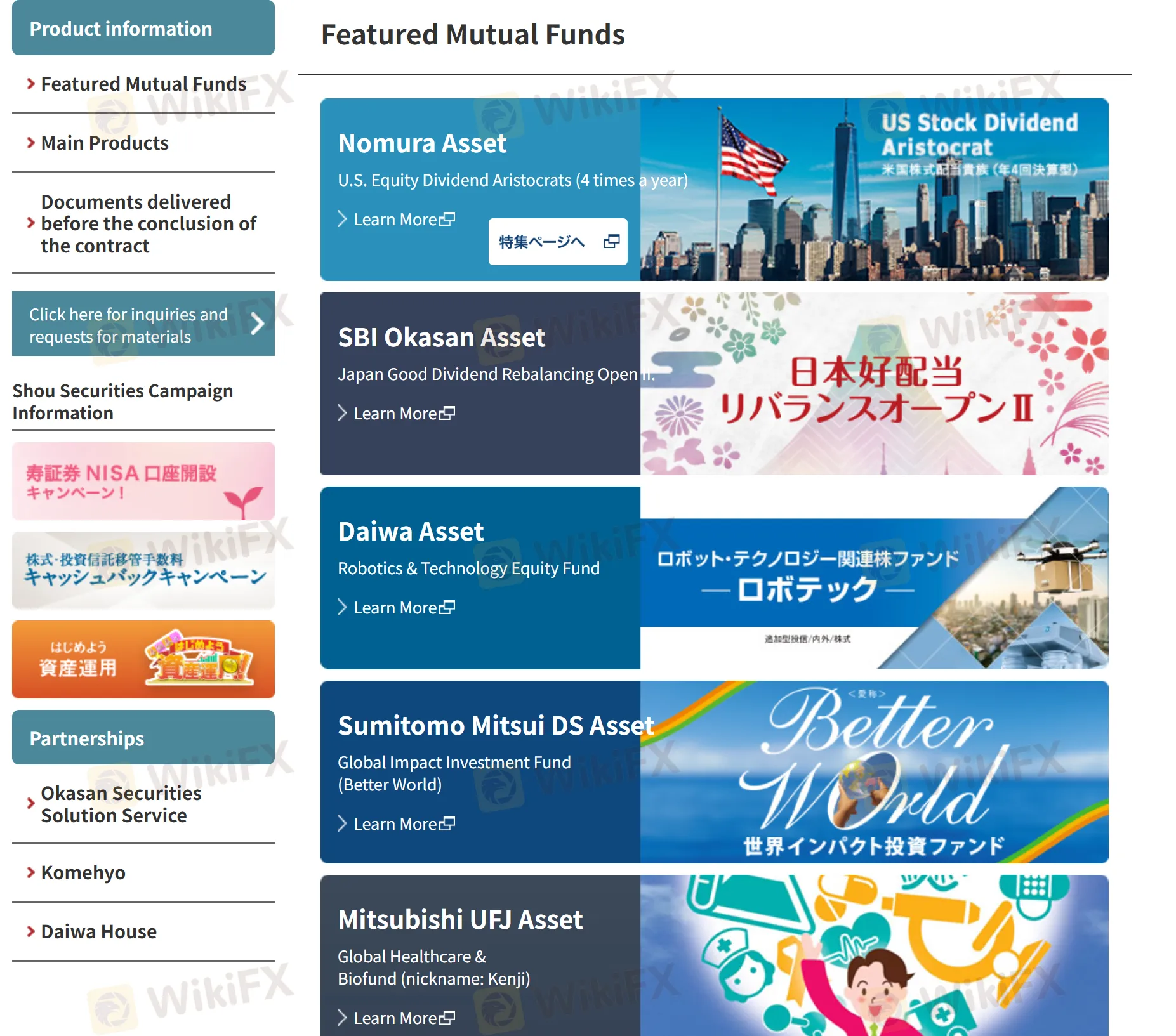

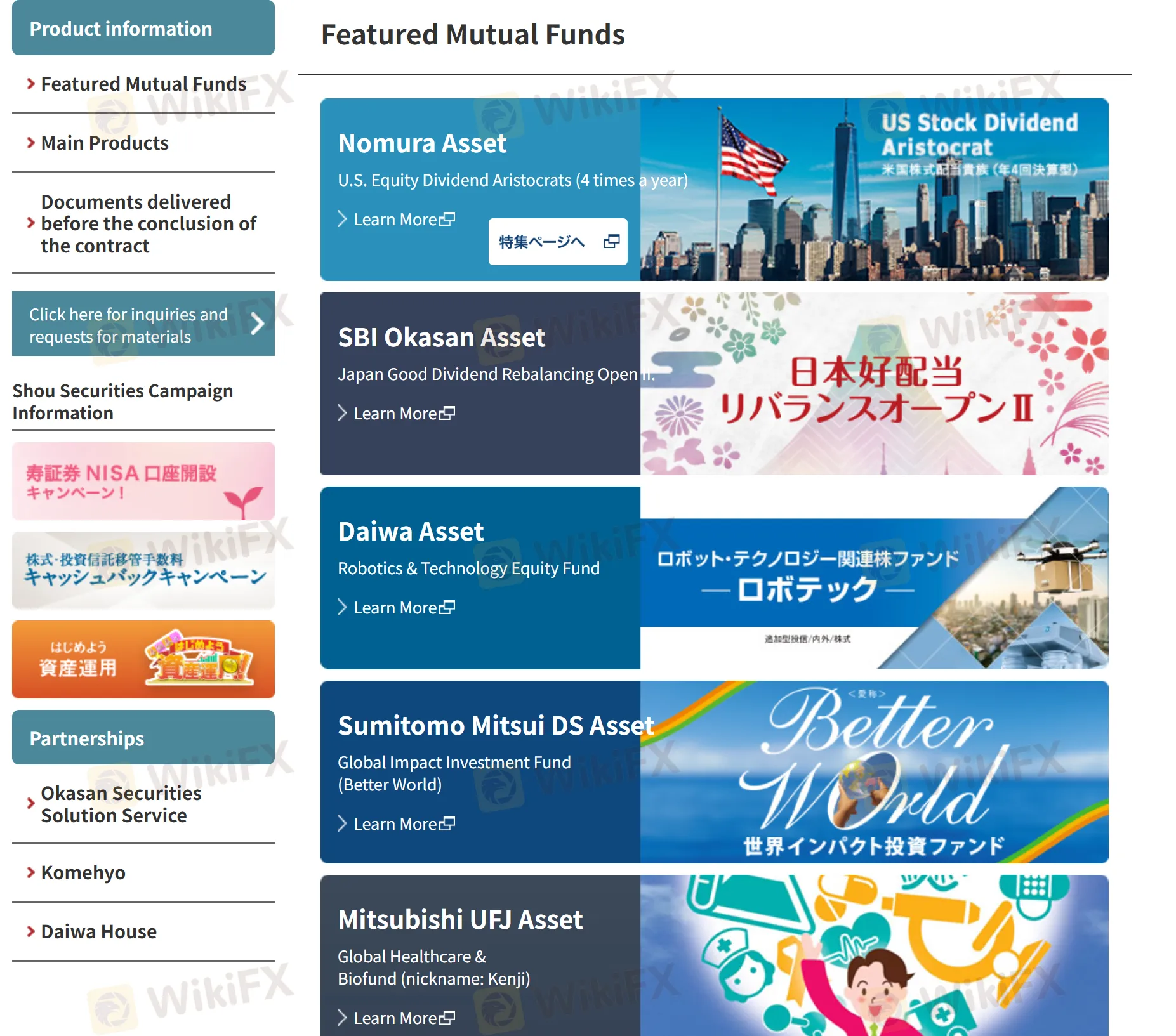

What Can I Trade on Kotobuki Securities?

On Kotobuki Securities, you can trade with Featured Mutual Funds, Domestic Listed Stocks Spot Trading, Domestic listed stocks margin trading (institutional credit only), IPO (Initial Public Offering), ETFs (Exchange Traded Funds), REITs (Real Estate Investment Trusts), CB (Convertible Bond), investment trust, MRF, Foreign Stocks, Foreign Bonds, Currency Denominated MMF, Market Derivatives Trading (Futures & Options).