Perfil de la compañía

| Ichiyoshi Securities Resumen de la reseña | |

| Fundación | 1950 |

| País/Región Registrada | Japón |

| Regulación | FSA |

| Producto de Trading | Valores |

| Plataforma de Trading | / |

| Soporte al Cliente | Tel: 03-4346-4500 |

Información de Ichiyoshi Securities

Ichiyoshi Securities Co., Ltd., fundada en Japón en 1950 y regulada por la FSA, opera con una estructura de gestión piramidal triangular y prioriza los intereses individuales de los clientes a través de sus "Siete Estándares Ichiyoshi", centrándose en productos confiables y menos complejos.

Pros y Contras

| Pros | Contras |

|

|

|

|

¿Es Ichiyoshi Securities Legítimo?

Ichiyoshi Securities tiene una Licencia de Forex Minorista regulada por la Agencia de Servicios Financieros (FSA) en Japón con un número de licencia 関東財務局長(金商)第24号.

| Autoridad Reguladora | Estado Actual | País Regulado | Tipo de Licencia | Número de Licencia |

| Agencia de Servicios Financieros (FSA) | Regulado | Japón | Licencia de Forex Minorista | 関東財務局長(金商)第24号 |

Fortalezas de Ichiyoshi Securities

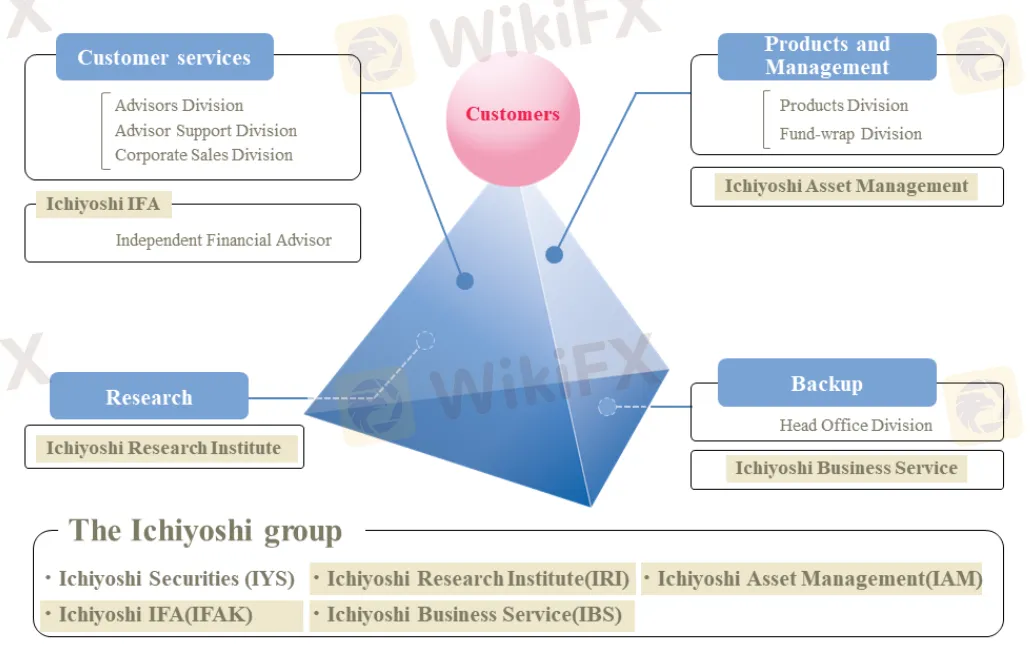

- Administración de Pirámide Triangular: La fortaleza de Ichiyoshi Securities radica en su estructura de administración de pirámide triangular con divisiones interconectadas (Servicio al Cliente, Productos y Gestión, Investigación, Respaldo) que fomentan la sinergia para maximizar la función de cada división, con el objetivo final de proporcionar servicios, productos e información superiores para la gestión de activos y negocios de los clientes.

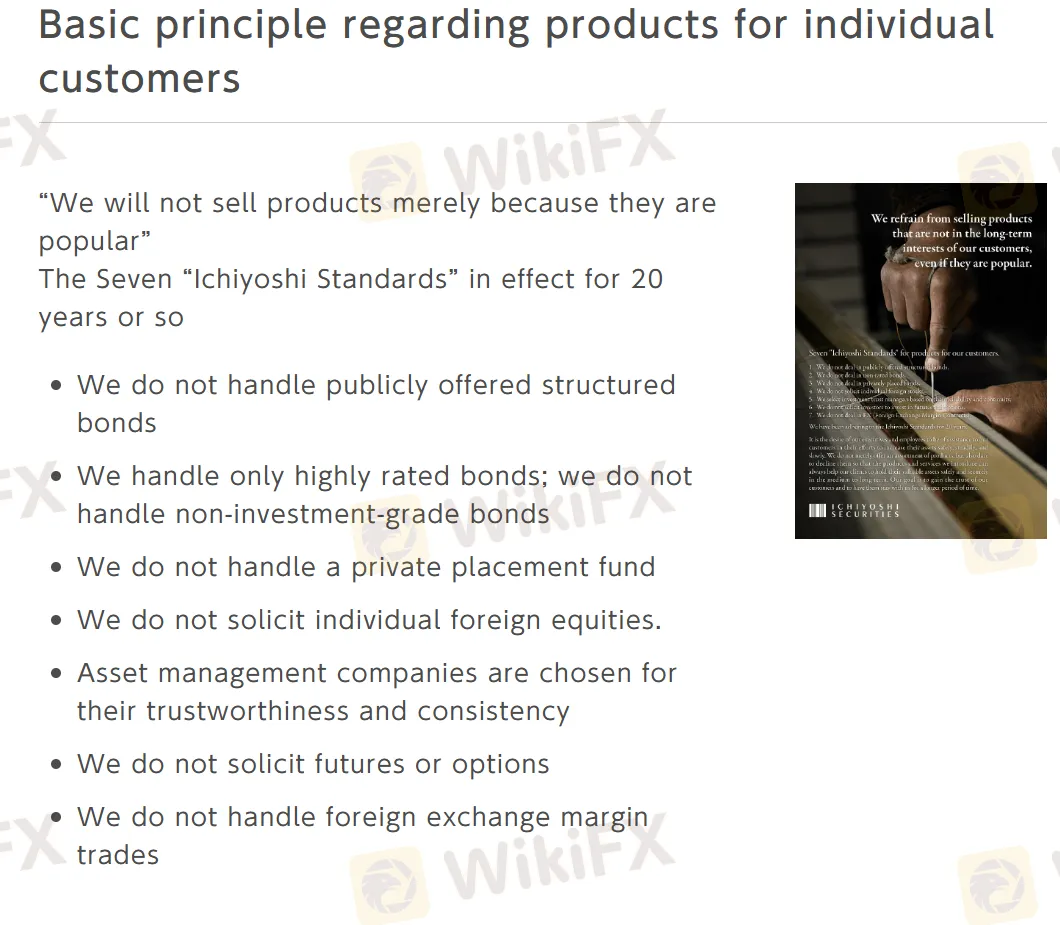

- Principios básicos sobre productos para clientes individuales: Ichiyoshi Securities prioriza los intereses de los clientes individuales al adherirse a "Los Siete Estándares Ichiyoshi" durante aproximadamente 20 años, centrándose en productos de alta calidad y confiables y evitando ofertas complejas o de alto riesgo como bonos estructurados, bonos de grado no inversión, colocaciones privadas, acciones extranjeras, futuros/opciones y operaciones de margen de divisas.

Cifras Estadísticas Importantes

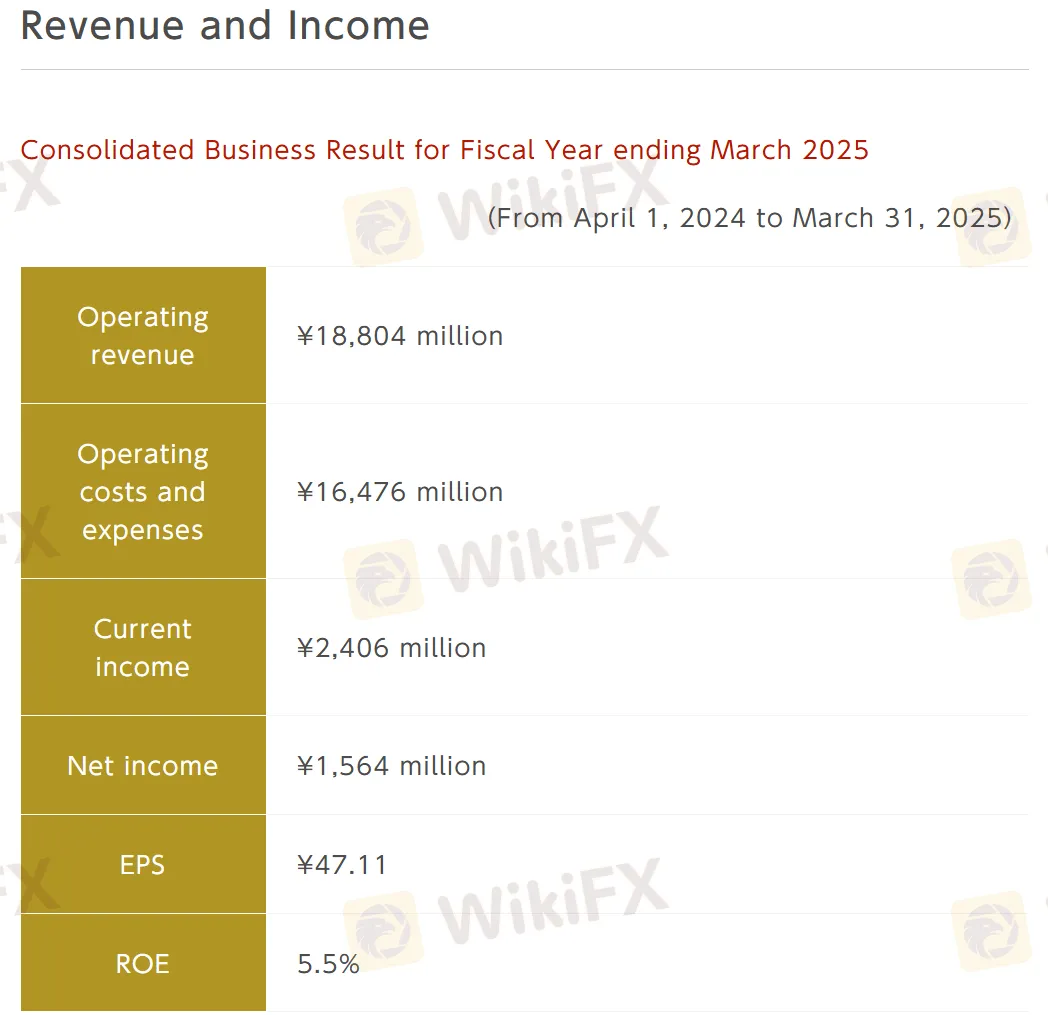

- Ingresos y Beneficios: Desde el 1 de abril de 2024 hasta el 31 de marzo de 2025

| Métrica | Valor |

| Ingresos Operativos | ¥18,804 millones |

| Costos y Gastos Operativos | ¥16,476 millones |

| Ingresos Actuales | ¥2,406 millones |

| Beneficio Neto | ¥1,564 millones |

| EPS | ¥47.11 |

| ROE | 5.5% |

- Resumen Financiero: Al 31 de marzo de 2025

| Métrica | Valor |

| Activos Totales | ¥41,900 millones |

| Valor Neto | ¥27,461 millones |

| Ratio de Capital Propio | 65.4% |

| Activos Netos por Acción | ¥861.85 |

| Ratio de Capital de Adecuación | 448.0% |