Buod ng kumpanya

| Ichiyoshi Securities Buod ng Pagsusuri | |

| Itinatag | 1950 |

| Rehistradong Bansa/Rehiyon | Hapon |

| Regulasyon | FSA |

| Produktong Pangkalakalan | Mga Sekuridad |

| Platform ng Pangangalakal | / |

| Suporta sa Customer | Tel: 03-4346-4500 |

Impormasyon Tungkol sa Ichiyoshi Securities

Ichiyoshi Securities Co., Ltd., itinatag sa Hapon noong 1950 at nireregula ng FSA, gumagana sa isang triangular pyramid management structure at itinutok ang interes ng bawat indibidwal na customer sa pamamagitan ng kanilang "Seven Ichiyoshi Standards," na nakatuon sa mapagkakatiwalaan at hindi gaanong kumplikadong mga produkto.

Mga Kalamangan at Disadvantages

| Kalamangan | Disadvantages |

|

|

|

|

Tunay ba ang Ichiyoshi Securities?

Ichiyoshi Securities ay may Retail Forex License na nireregula ng Financial Services Agency (FSA) sa Japan na may lisensyang 関東財務局長(金商)第24号.

| Regulated Authority | Kasalukuyang Kalagayan | Pinagregulahang Bansa | Uri ng Lisensya | Numero ng Lisensya |

| Financial Services Agency (FSA) | Regulated | Japan | Retail Forex License | 関東財務局長(金商)第24号 |

Lakas ng Ichiyoshi Securities

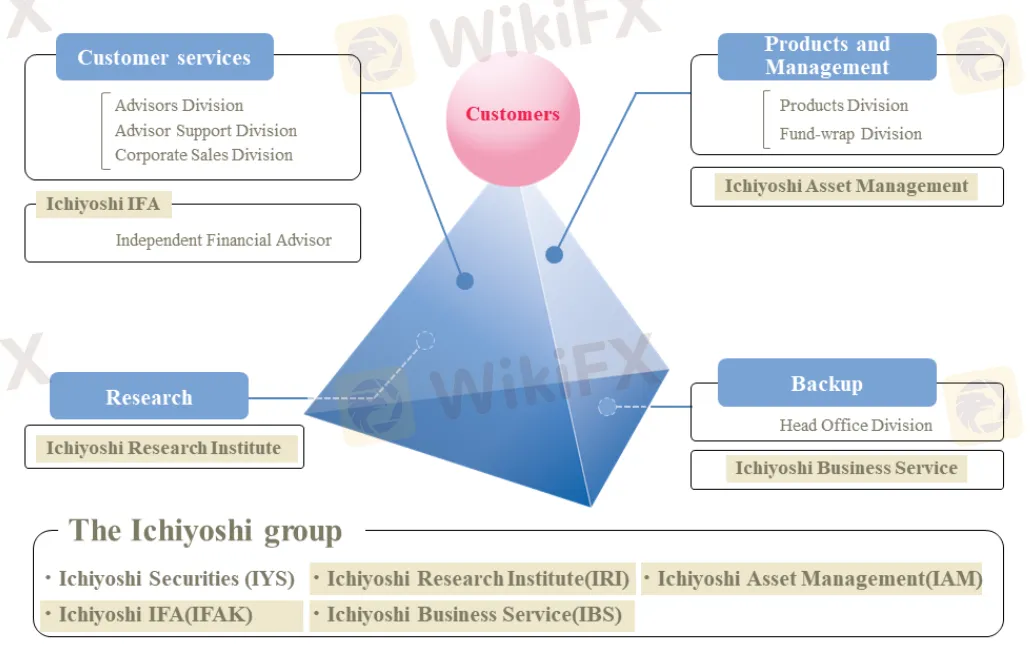

- Pamamahala ng Triangular Pyramid: Ang lakas ng Ichiyoshi Securities ay matatagpuan sa kanyang istrakturang pamamahala ng triangular pyramid na may magkakonektang mga dibisyon (Customer Services, Products & Management, Research, Backup) na nagtataguyod ng synergy upang mapataas ang bawat tungkulin ng bawat dibisyon, sa huli ay layuning magbigay ng superior na mga serbisyo, produkto, at impormasyon para sa pamamahala ng ari-arian at negosyo ng customer.

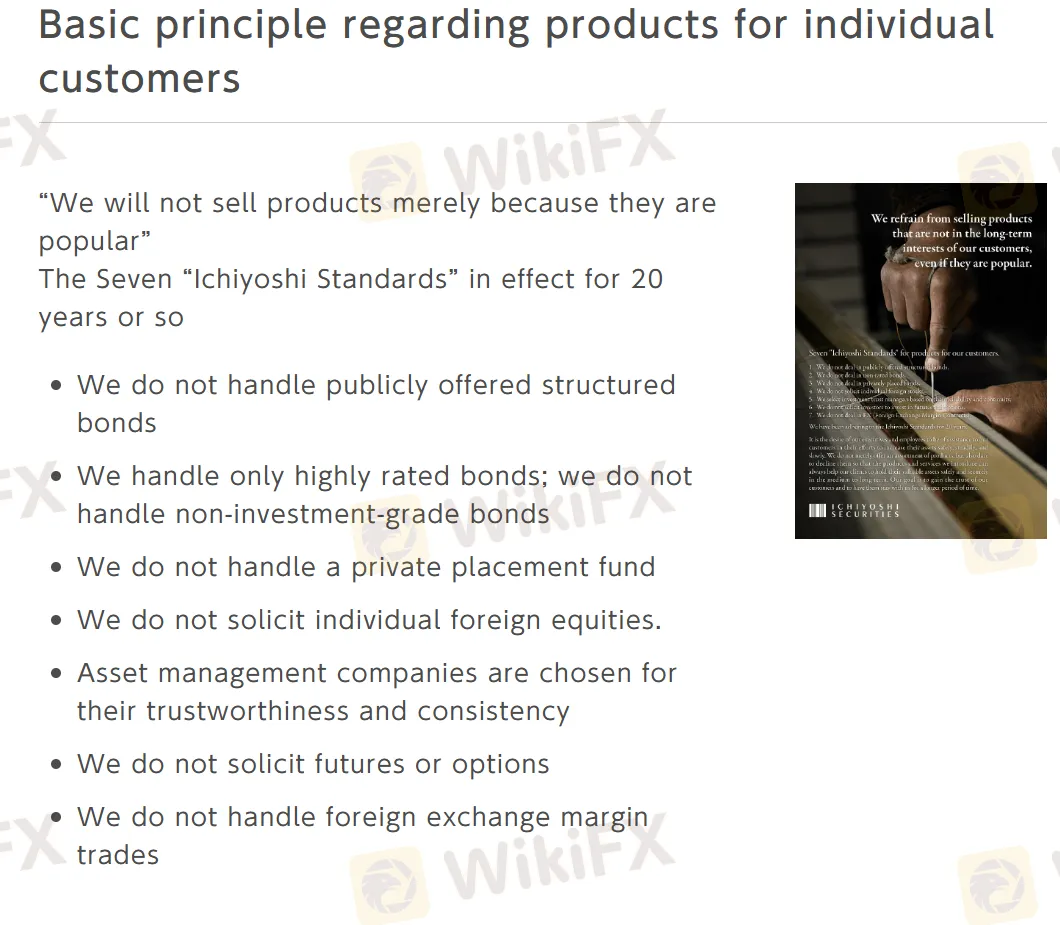

- Mga Batayang Prinsipyo Tungkol sa mga Produkto para sa Indibidwal na mga Customer: Inuuna ng Ichiyoshi Securities ang interes ng indibidwal na customer sa pamamagitan ng pagsunod sa "The Seven Ichiyoshi Standards" sa loob ng mga 20 taon, nakatuon sa mataas na kalidad, mapagkakatiwalaang mga produkto at pag-iwas sa mga komplikadong o mataas na panganib na alok tulad ng structured bonds, non-investment grade bonds, private placements, foreign equities, futures/options, at foreign exchange margin trades.

Mahahalagang Estadistikang Bilang

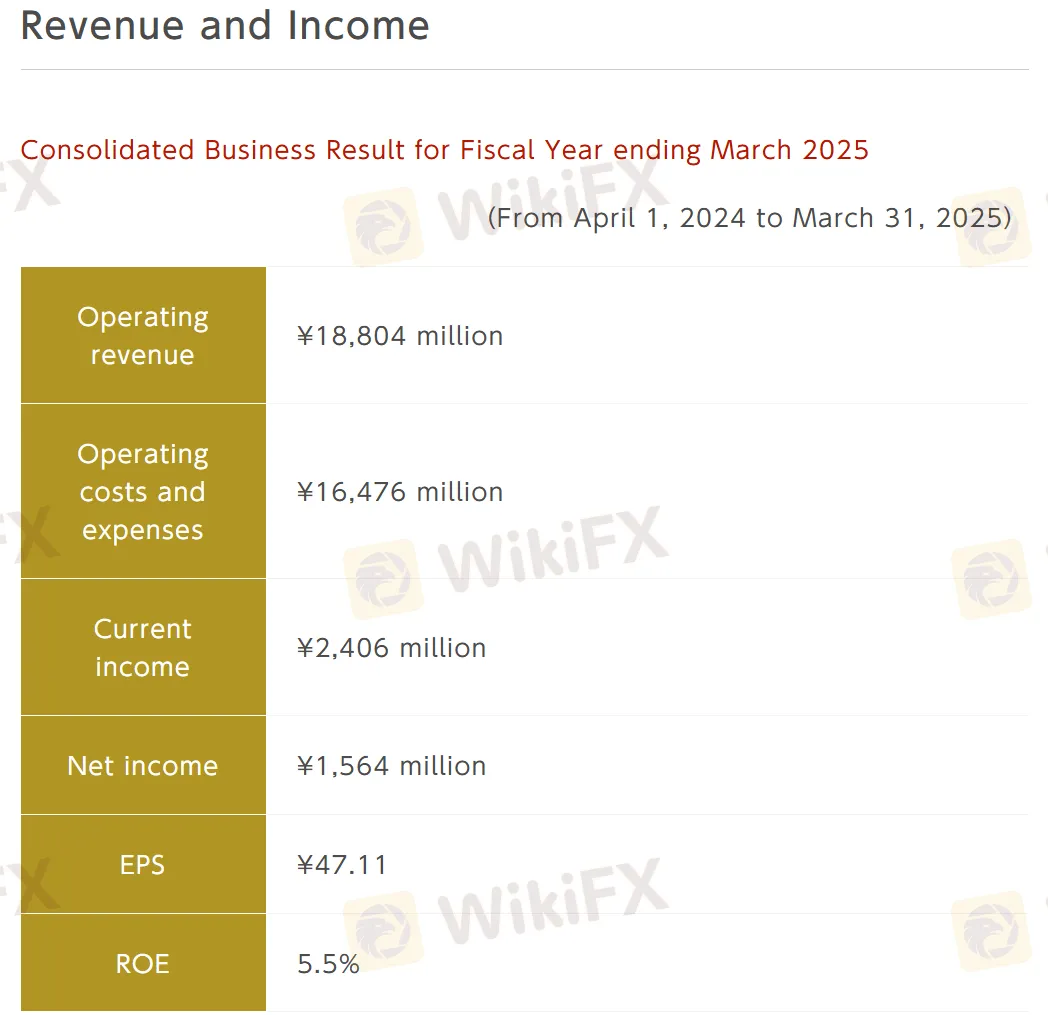

- Kita at Ikinabubuhay: Mula Abril 1, 2024, hanggang Marso 31, 2025

| Metric | Halaga |

| Operating Revenue | ¥18,804 milyon |

| Operating Costs and Expenses | ¥16,476 milyon |

| Kasalukuyang Kita | ¥2,406 milyon |

| Net Income | ¥1,564 milyon |

| EPS | ¥47.11 |

| ROE | 5.5% |

- Sa Buod ng Pananalapi: Sa Marso 31, 2025

| Metric | Halaga |

| Kabuuang Ari-arian | ¥41,900 milyon |

| Net Worth | ¥27,461 milyon |

| Ekwiti Rasyo | 65.4% |

| Net Assets per Share | ¥861.85 |

| Capital Adequacy Ratio | 448.0% |