회사 소개

| Ichiyoshi Securities 리뷰 요약 | |

| 설립 연도 | 1950 |

| 등록 국가/지역 | 일본 |

| 규제 | FSA |

| 거래 상품 | 증권 |

| 거래 플랫폼 | / |

| 고객 지원 | 전화: 03-4346-4500 |

Ichiyoshi Securities 정보

Ichiyoshi Securities Co., Ltd., 1950년에 일본에서 설립되었으며 FSA의 규제를 받고 있으며 삼각 피라미드 관리 구조로 운영되며 "세븐 이치요시 표준"을 통해 개별 고객의 이익을 우선시하며 신뢰할 수 있고 복잡하지 않은 제품에 중점을 둡니다.

장단점

| 장점 | 단점 |

|

|

|

|

Ichiyoshi Securities 합법적인가요?

Ichiyoshi Securities은 일본의 금융 서비스 규제 기관인 금융 서비스 규제 기관 (FSA)에 의해 규제되는 소매 외환 라이센스를 소유하고 있으며, 라이센스 번호는 関東財務局長(金商)第24号입니다.

| 규제 기관 | 현재 상태 | 규제 국가 | 라이센스 유형 | 라이센스 번호 |

| 금융 서비스 규제 기관 (FSA) | 규제됨 | 일본 | 소매 외환 라이센스 | 関東財務局長(金商)第24号 |

Ichiyoshi Securities의 강점

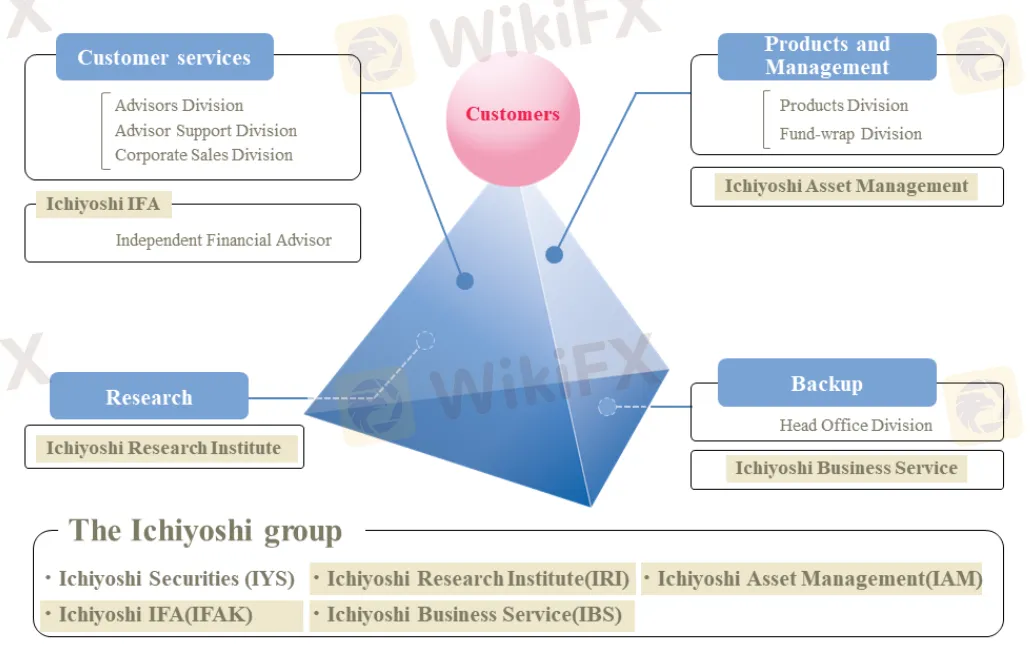

- 삼각 피라미드 관리: Ichiyoshi Securities의 강점은 상호 연결된 부문 (고객 서비스, 제품 및 관리, 연구, 백업)으로 이루어진 삼각 피라미드 관리 구조에 있으며, 각 부문의 기능을 극대화하기 위해 시너지를 육성하여 궁극적으로 고객 자산 및 비즈니스 관리에 우수한 서비스, 제품 및 정보를 제공하는 데 초점을 맞추고 있습니다.

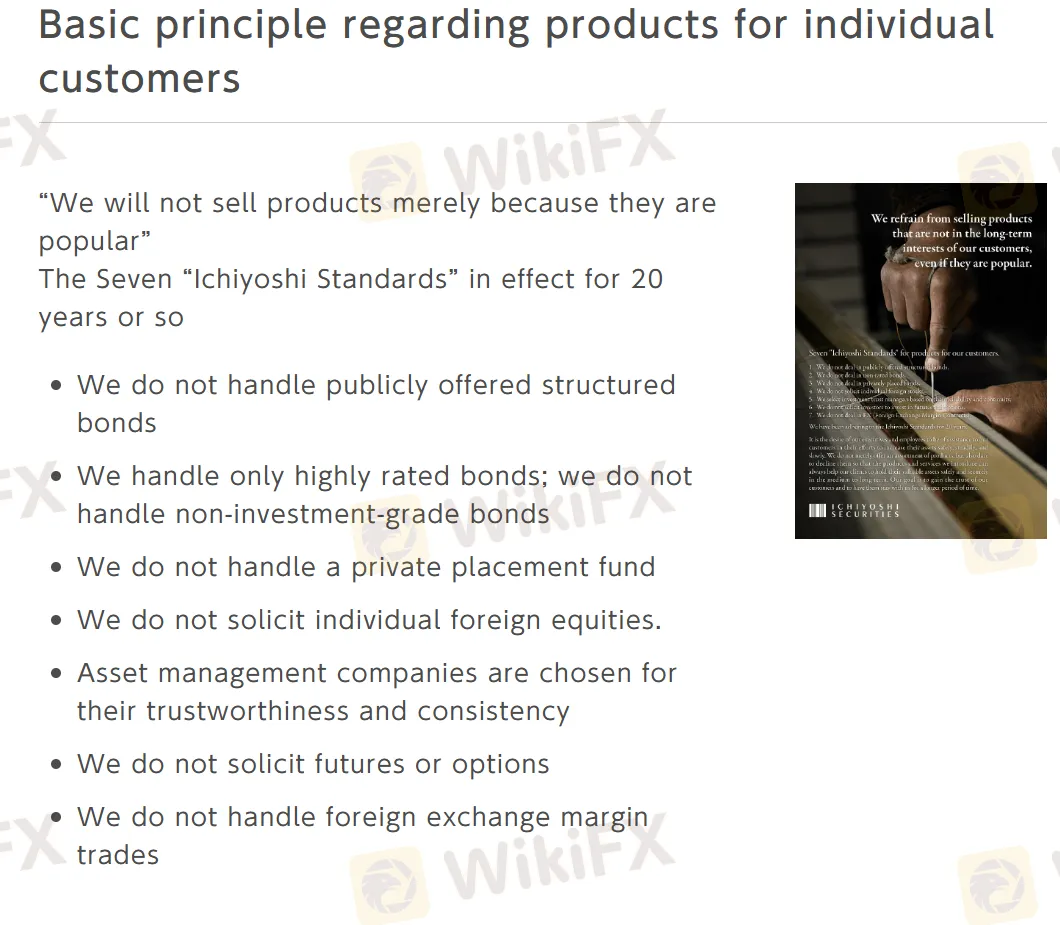

- 개별 고객을 위한 제품에 대한 기본 원칙: Ichiyoshi Securities은 약 20년 동안 "일요시 7대 기준"을 준수하여 고객의 이익을 우선시하며, 고품질이고 신뢰할 수 있는 제품에 중점을 두고 구조화된 채권, 비투자 등급 채권, 사모 펀드, 외국 주식, 선물/옵션 및 외환 마진 거래와 같은 복잡하거나 고위험 제공을 피하고 있습니다.

중요한 통계 수치

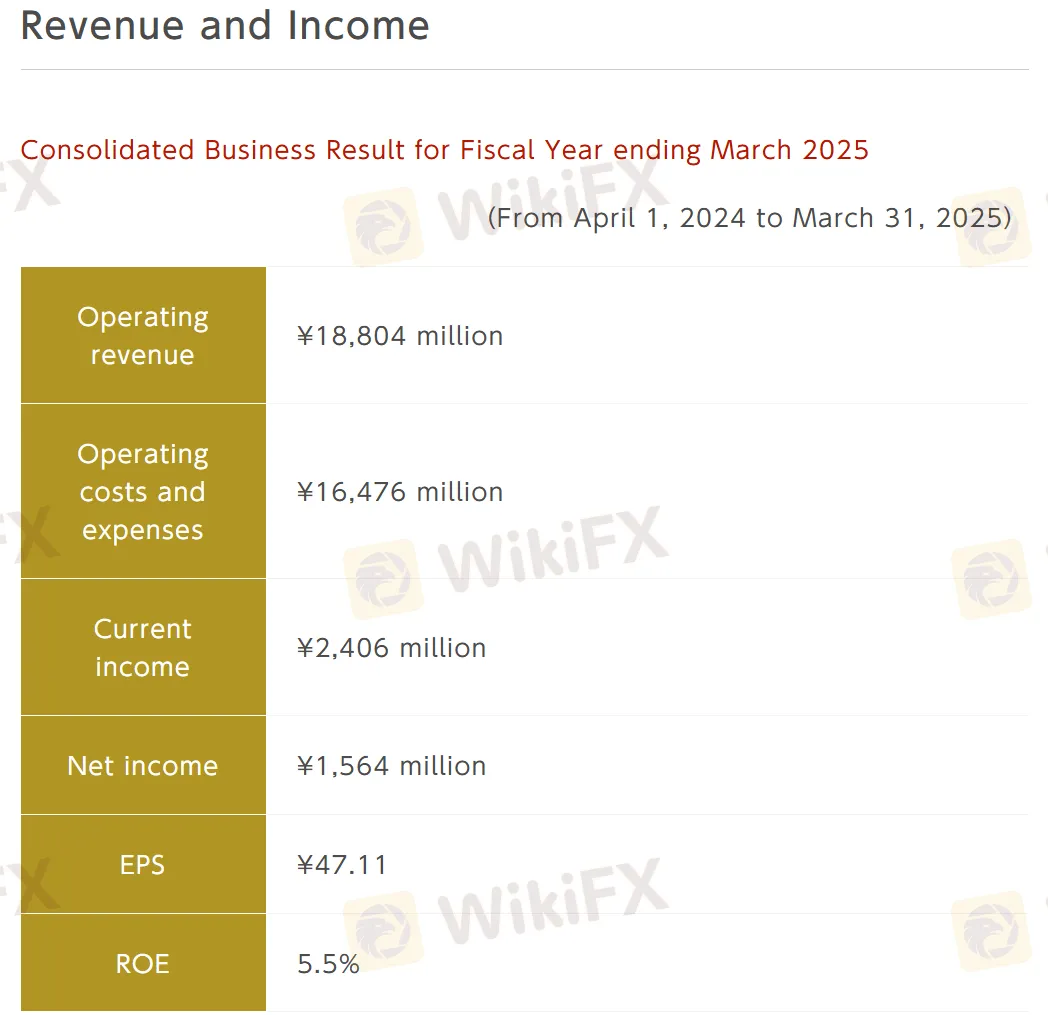

- 수익 및 소득: 2024년 4월 1일부터 2025년 3월 31일까지

| 지표 | 값 |

| 운영 수익 | ¥18,804 백만 |

| 운영 비용 및 비용 | ¥16,476 백만 |

| 현재 소득 | ¥2,406 백만 |

| 순 소득 | ¥1,564 백만 |

| 주당 순이익 | ¥47.11 |

| ROE | 5.5% |

- 재무 요약: 2025년 3월 31일 기준

| 지표 | 값 |

| 총 자산 | ¥41,900 백만 |

| 순 자산 | ¥27,461 백만 |

| 자본 비율 | 65.4% |

| 주당 순 자산 | ¥861.85 |

| 자본 적정성 비율 | 448.0% |