Şirket özeti

| Ichiyoshi Securities İnceleme Özeti | |

| Kuruluş | 1950 |

| Kayıtlı Ülke/Bölge | Japonya |

| Düzenleme | FSA |

| İşlem Ürünü | Menkul Kıymetler |

| İşlem Platformu | / |

| Müşteri Desteği | Tel: 03-4346-4500 |

Ichiyoshi Securities Bilgileri

Ichiyoshi Securities Co., Ltd., 1950 yılında Japonya'da kurulan ve FSA tarafından düzenlenen, üçgen piramit yönetim yapısı ile faaliyet gösteren ve güvenilir ve daha az karmaşık ürünlere odaklanarak "Yedi Ichiyoshi Standartları" ile bireysel müşteri çıkarlarını önceliklendiren bir kurumdur.

Artıları ve Eksileri

| Artıları | Eksileri |

|

|

|

|

Ichiyoshi Securities Güvenilir mi?

Ichiyoshi Securities Japonya'da Finansal Hizmetler Kurumu (FSA) tarafından düzenlenen bir Perakende Forex Lisansına sahiptir ve lisans numarası 関東財務局長(金商)第24号'dir.

| Düzenleyici Otorite | Mevcut Durum | Düzenlenen Ülke | Lisans Türü | Lisans No. |

| Finansal Hizmetler Kurumu (FSA) | Düzenlenmiş | Japonya | Perakende Forex Lisansı | 関東財務局長(金商)第24号 |

Ichiyoshi Securities Gücü

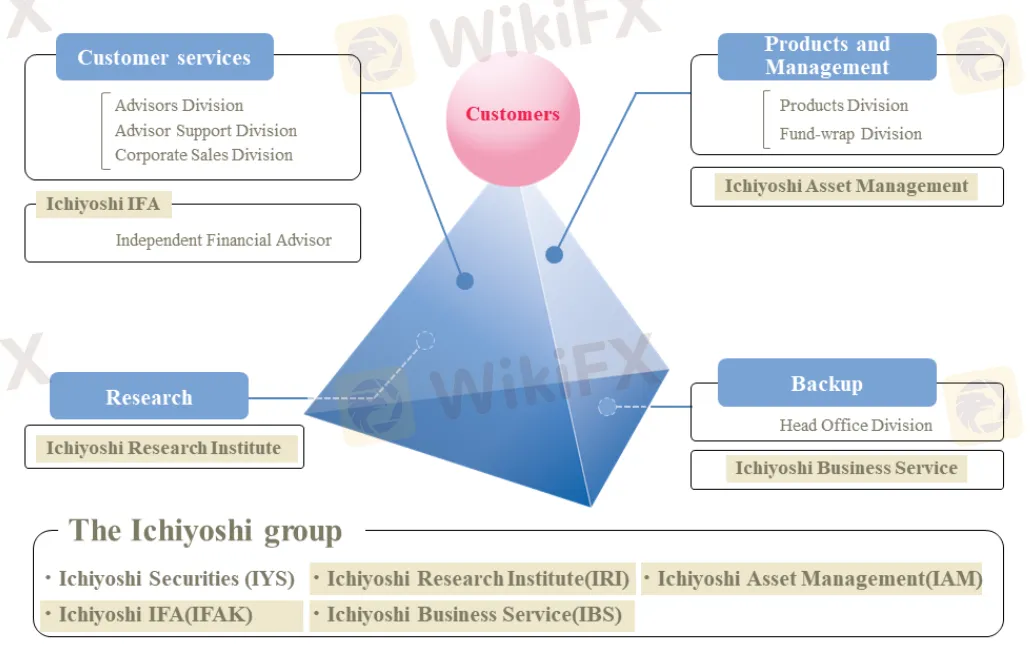

- Üçgen Piramit Yönetimi: Ichiyoshi Securities'nin gücü, müşteri hizmetleri, ürünler ve yönetim, araştırma, yedek gibi birbirine bağlı bölümleri olan üçgen piramit yönetim yapısında yatmaktadır. Bu yapı, her bölümün işlevini en üst düzeye çıkarmak için sinerji oluşturarak nihai olarak müşteri varlığı ve iş yönetimi için üstün hizmetler, ürünler ve bilgiler sağlamayı amaçlamaktadır.

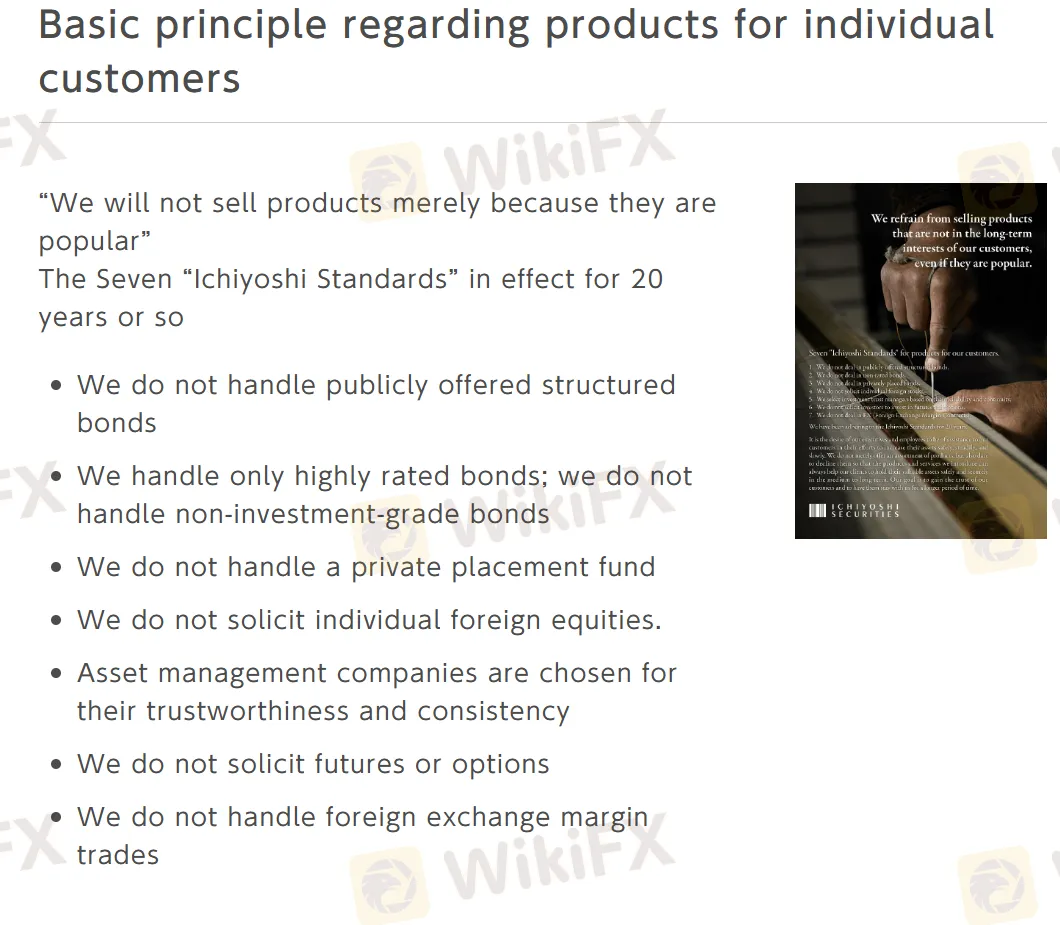

- Bireysel Müşteriler için Ürünlere İlişkin Temel İlkeler: Ichiyoshi Securities, yaklaşık 20 yıldır yüksek kaliteli, güvenilir ürünlere odaklanarak ve yapılandırılmış tahviller, yatırım yapılabilirlik derecesi düşük tahviller, özel yerleştirmeler, yabancı hisse senetleri, vadeli işlemler/opsiyonlar ve döviz kaldıraçlı işlemler gibi karmaşık veya yüksek riskli tekliflerden kaçınarak bireysel müşteri çıkarlarını önceliklendirir.

Önemli İstatistiksel Rakamlar

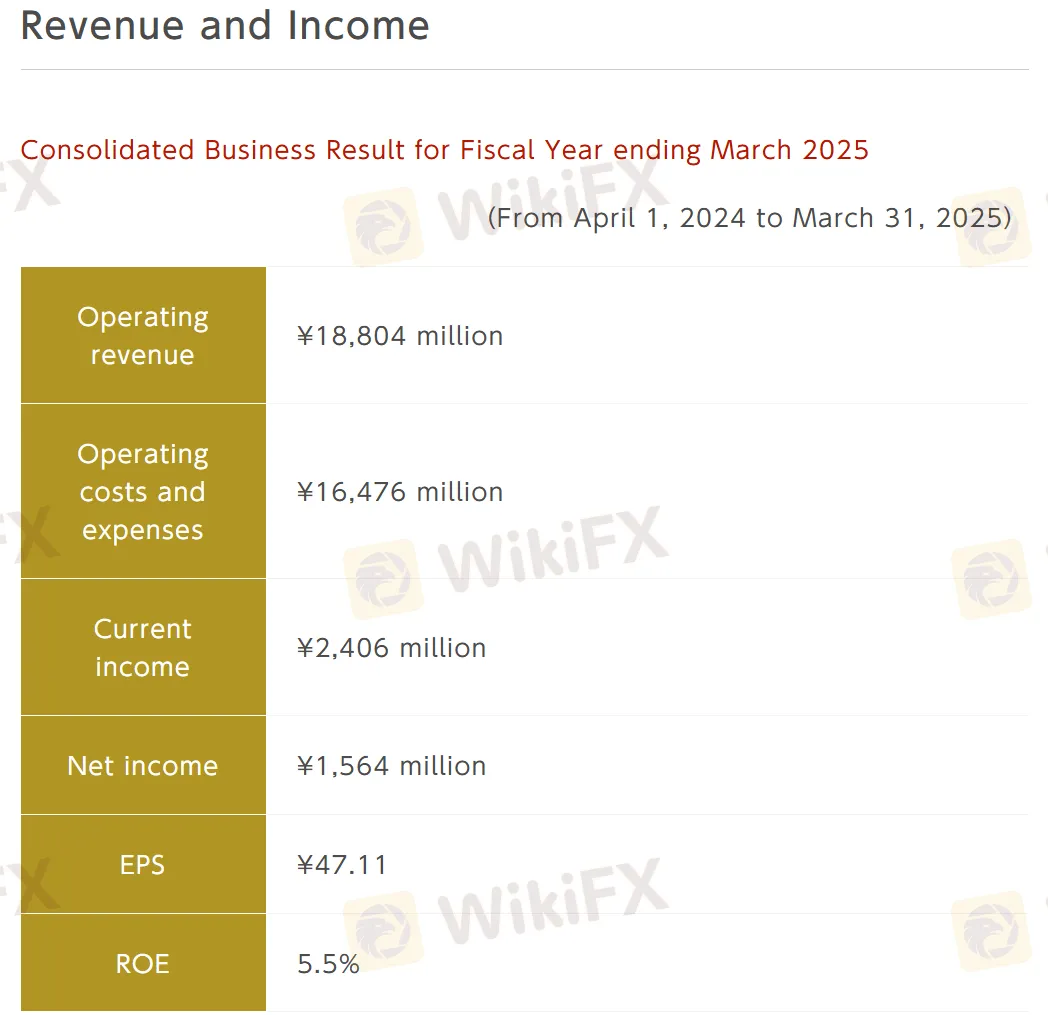

- Gelir ve Gelir: 1 Nisan 2024'ten 31 Mart 2025'e kadar

| Metrik | Değer |

| İşletme Geliri | ¥18,804 milyon |

| İşletme Maliyetleri ve Giderleri | ¥16,476 milyon |

| Mevcut Gelir | ¥2,406 milyon |

| Net Gelir | ¥1,564 milyon |

| EPS | ¥47,11 |

| ROE | 5,5% |

- Finansal Özet: 31 Mart 2025 itibarıyla

| Metrik | Değer |

| Toplam Varlıklar | ¥41,900 milyon |

| Net Değer | ¥27,461 milyon |

| Öz Sermaye Oranı | 65,4% |

| Hisse Başına Net Varlık | ¥861,85 |

| Sermaye Yeterlilik Oranı | 448,0% |