Riepilogo dell'azienda

Informazioni di base e regolamentazione dei titoli Huatai

Huatai Securities Co., Ltd. è stata ufficialmente aperta a Nanchino il 26 maggio 1991, precedentemente nota come Jiangsu Securities Company, ed è stata ribattezzata Huatai Securities Co. nel marzo 1999 con un capitale sociale aumentato di 850.320.000 RMB ed è stata approvata come società di titoli globale nello stesso anno. Il 30 novembre 2009, il Comitato di emissione ed esame della China Securities Regulatory Commission ha formalmente approvato la domanda di IPO di Huatai Securities. Il 17 giugno, le ricevute di deposito globali emesse da Huatai Securities Co. sono state quotate per la negoziazione sulla LSE. Huatai Securities è uno dei primi broker completi approvati dalla China Securities Regulatory Commission e uno dei primi broker in Cina ad essere qualificato come pilota di innovazione. Huatai Securities è ora una grande impresa gestita dalla Commissione statale per la supervisione e l'amministrazione dei beni del governo popolare della provincia di Jiangsu, con un patrimonio netto di oltre 10 miliardi di RMB. Huatai Securities possiede Southern Fund, Huatai Berry Fund, Huatai United Securities, Huatai Great Wall Futures, Huatai Financial Holdings (Hong Kong) Limited e Huatai Zijin Investment Company Limited, ed è anche il secondo maggiore azionista di Bank of Jiangsu.

Principali attività di Huatai Securities

I servizi di Huatai Securities coprono principalmente le parti principali della gestione patrimoniale, dei servizi istituzionali, della gestione degli investimenti, degli affari internazionali e dei servizi digitali. La gestione patrimoniale comprende principalmente la negoziazione di agenzie, l'asset allocation e la finanza di titoli. La gestione degli investimenti comprende principalmente la gestione di fondi di società di titoli, la gestione di fondi di private equity, la gestione patrimoniale di società di fondi e la gestione patrimoniale di società futures.

Problemi di apertura del conto di Huatai Securities

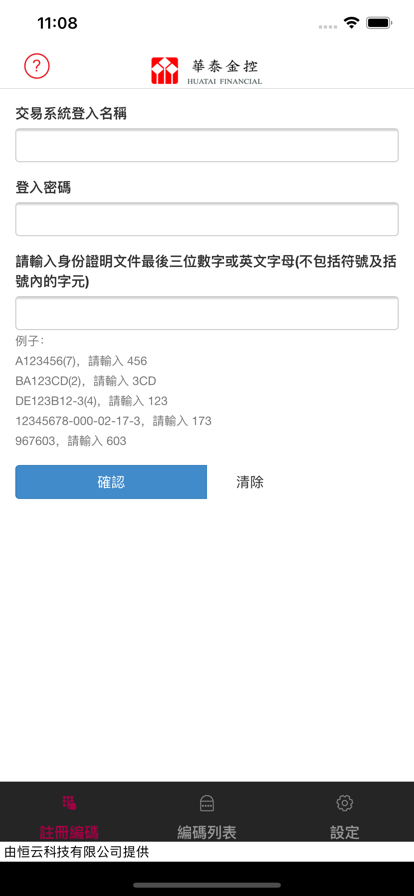

Huatai Securities supporta gli investitori nell'apertura di conti online, gli investitori (di età superiore ai 18 anni) devono preparare le loro carte d'identità, telefoni cellulari (telefoni cellulari comunemente usati), carte di debito bancarie (vedere il sito Web ufficiale di Huatai Securities per i dettagli delle banche supportate) in anticipo e attraverso le fasi di verifica dell'identità, apertura del conto, firma di accordi e restituzione dei questionari, possono aprire conti di fondi Huatai Securities, SSE A, conti SZSE A-share e conti di fondi online. L'applicazione di apertura del conto online può essere gestita 7 * 24 ore. I conti dormienti non sono disponibili per l'apertura di conti online.

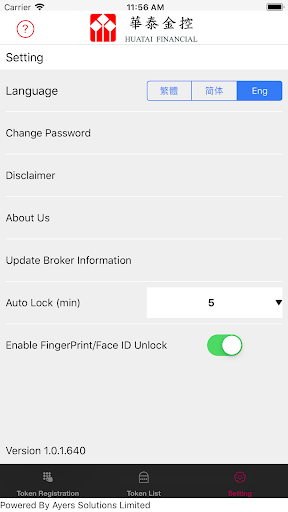

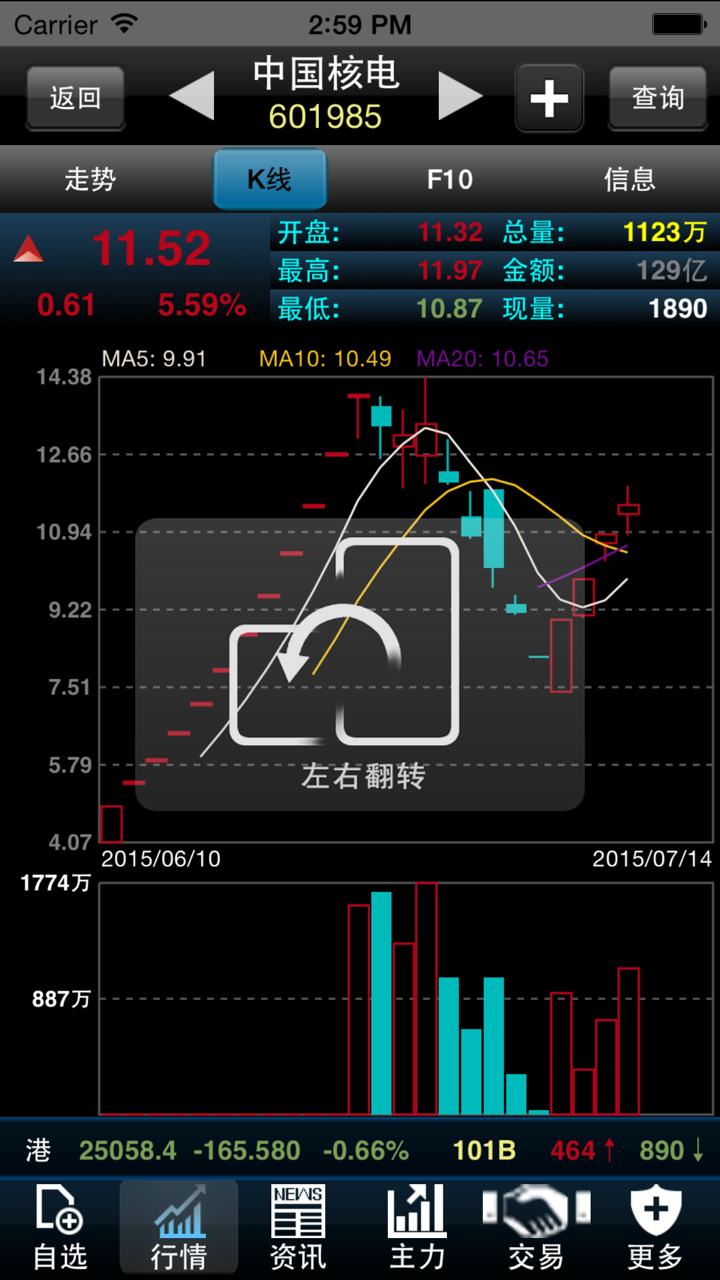

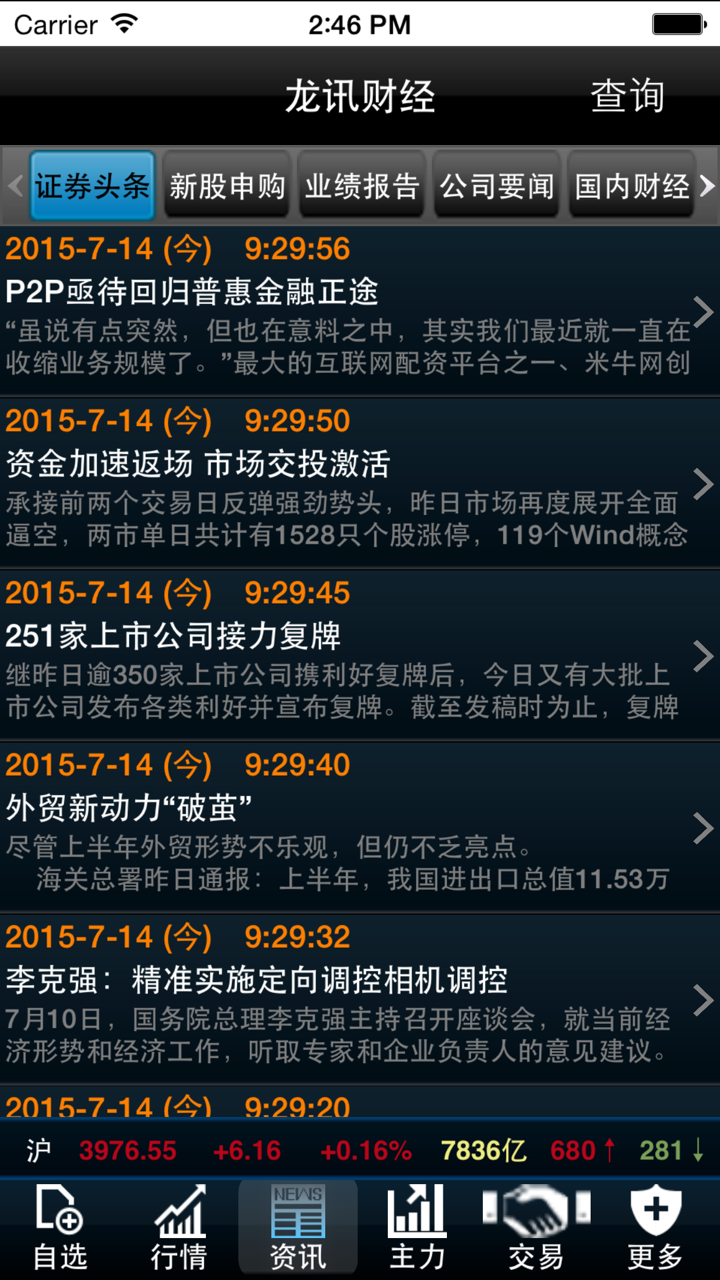

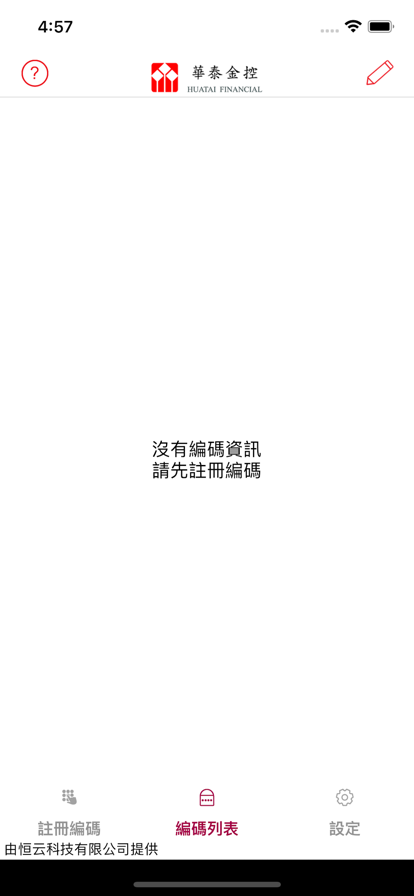

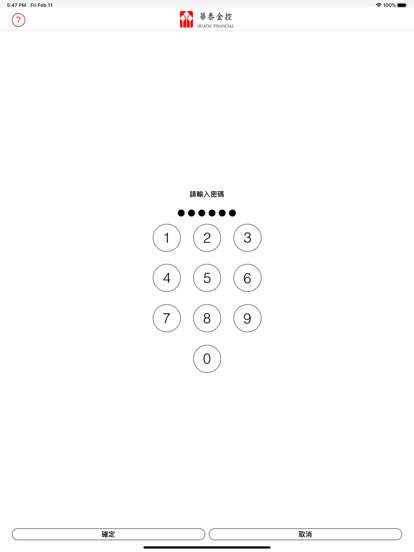

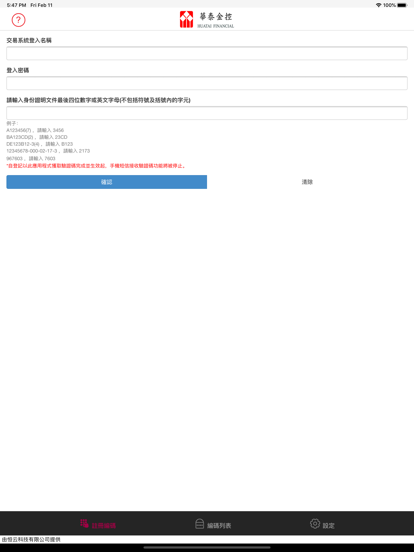

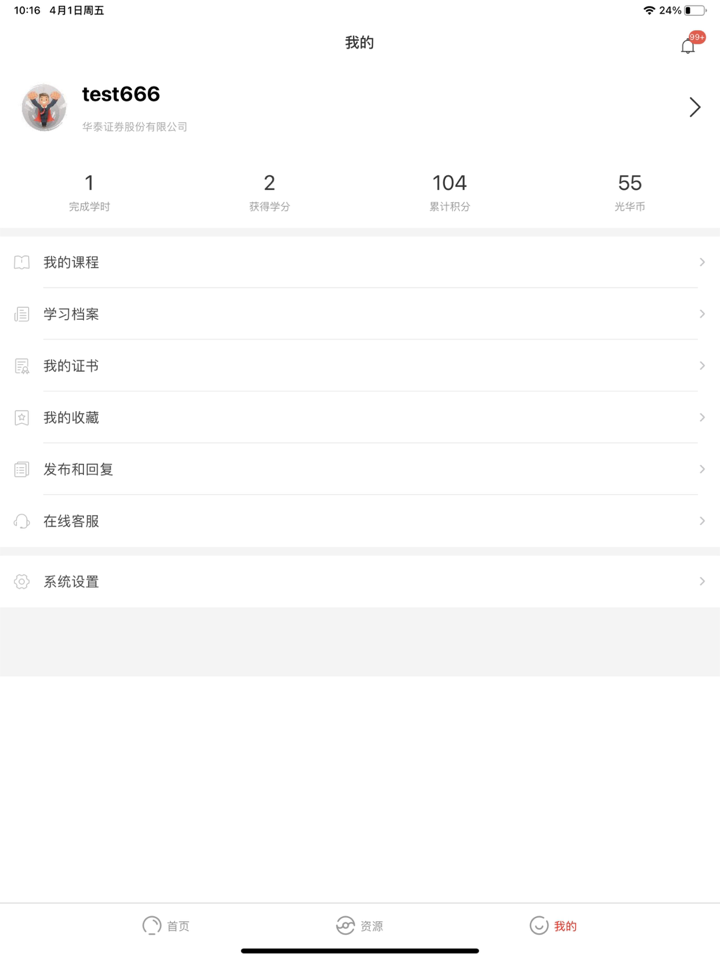

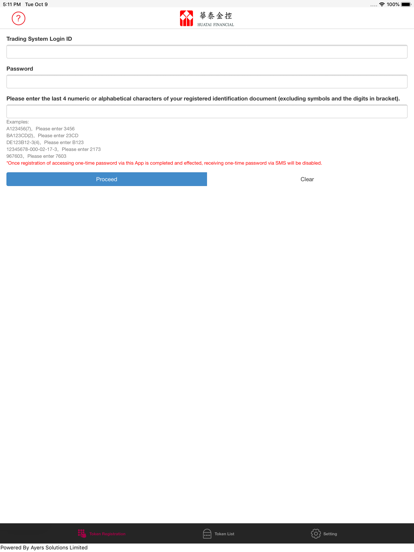

Software commerciale

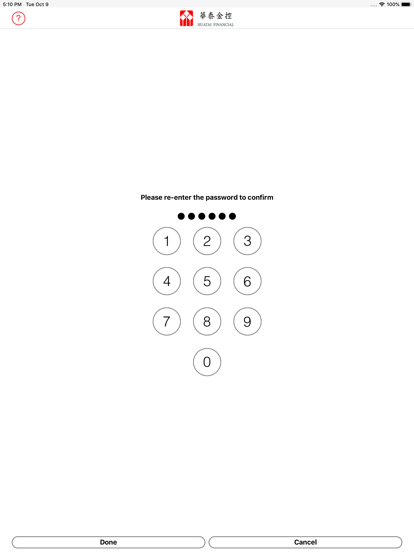

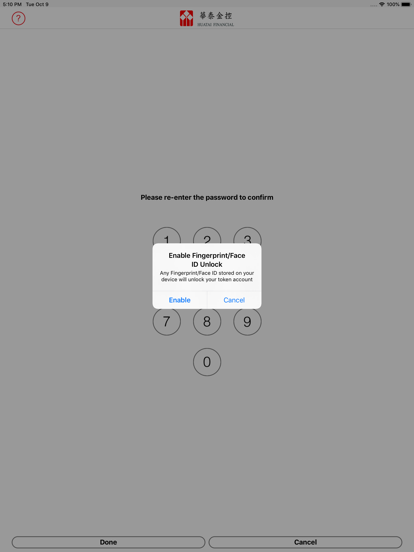

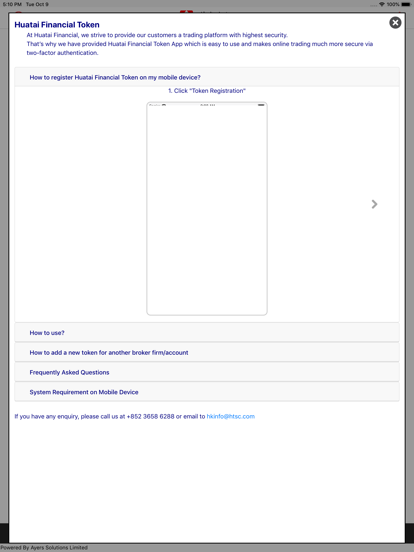

Huatai Securities offre diversi software per dispositivi mobili e software Windows. Informazioni dettagliate, consultare il sito Web ufficiale.

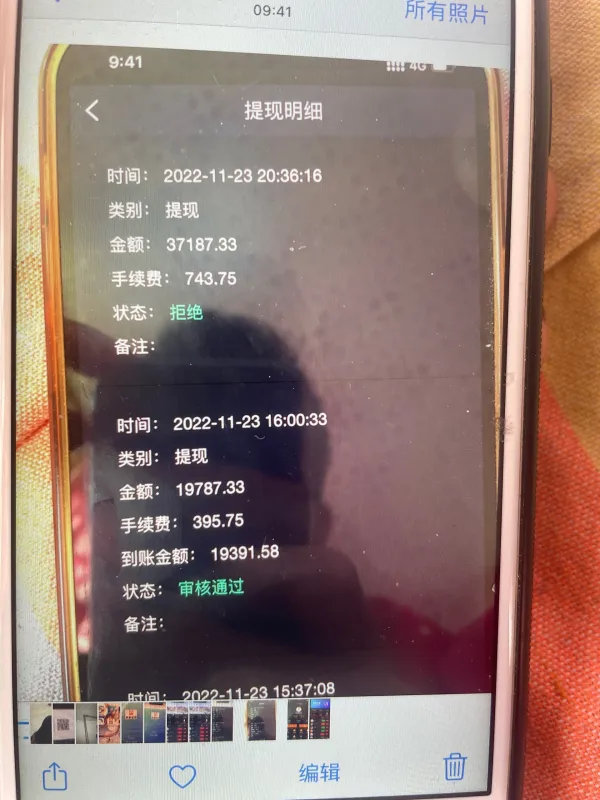

Trasferimento da banca a futures

Bank to futures time: 08:30-15:30 e 20:30-02:30 nei giorni di negoziazione, nessun importo e nessun limite al numero di volte. Futures to bank time: 09:30-15:30 nei giorni di trading; 3 volte al giorno, ogni singola transazione fino a 5 milioni, con un importo minimo di 1.000 yuan.