Unternehmensprofil

| Gleneagle Überprüfungszusammenfassung | |

| Gegründet | 2010 |

| Registriertes Land/Region | Australien |

| Regulierung | ASIC |

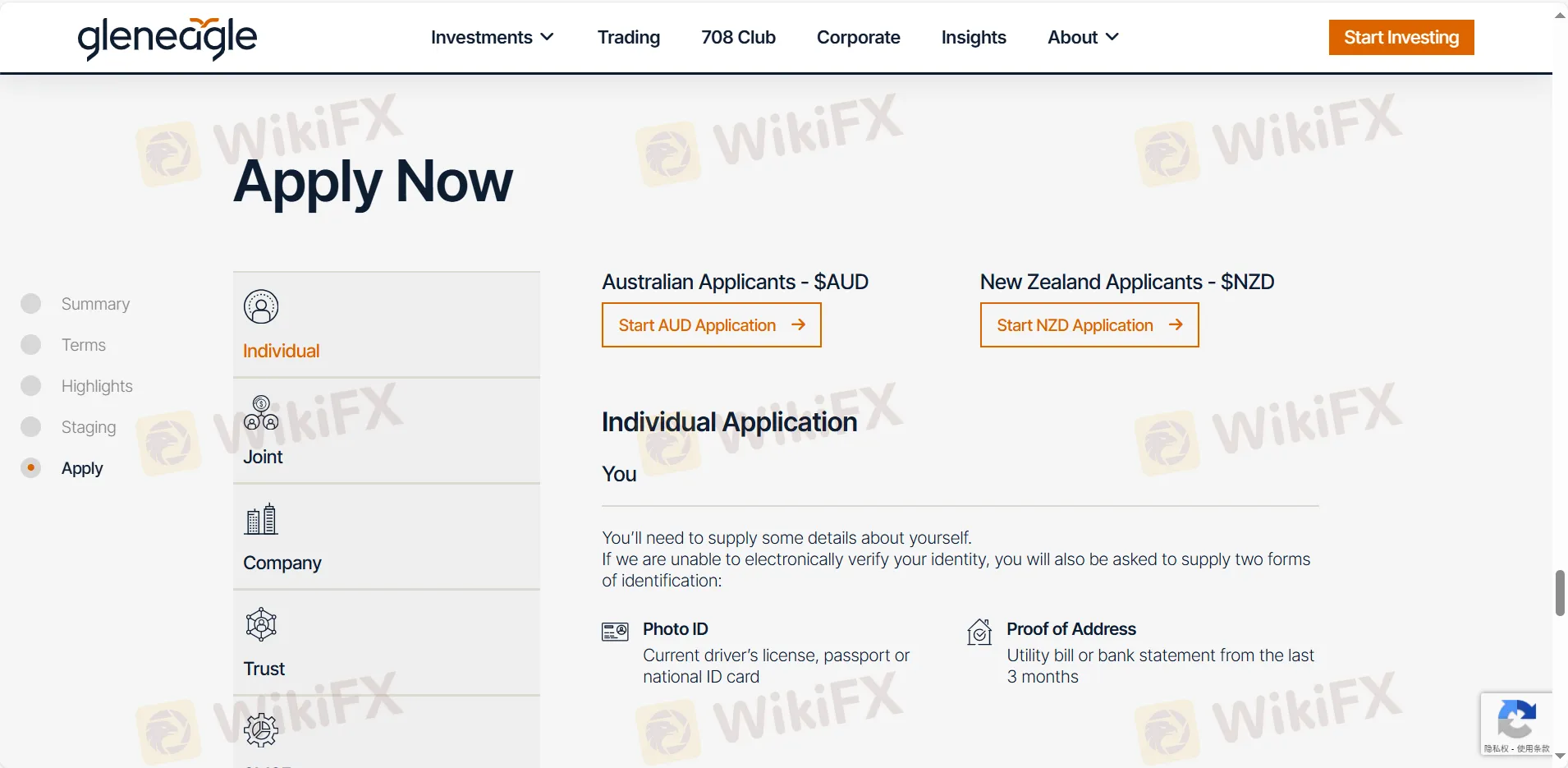

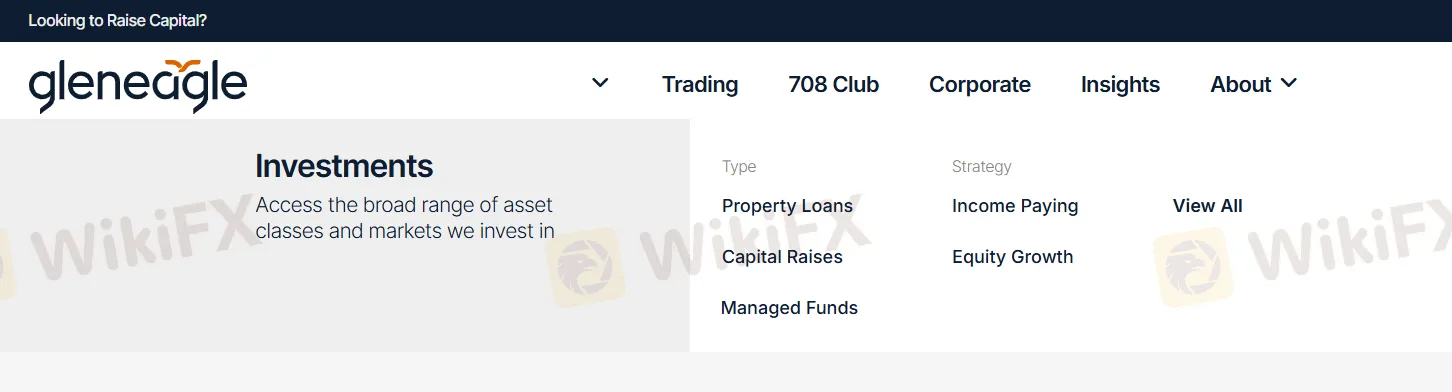

| Dienstleistungen | Immobilienkredite, Eigenkapitalerhöhungen, verwaltete Fonds, Strategie, Einkommenszahlung, Eigenkapitalwachstum |

| Handelsplattform | GleneagleWeb |

| Kundenbetreuung | Kontaktformular |

| Tel: 1300 123 345 | |

| E-Mail: members@gleneagle.com.au | |

| Adresse: Level 27, 25 Bligh Street, Sydney NSW 2000 | |

| Facebook, LinkedIn | |

Gleneagle Informationen

Gleneagle ist ein regulierter Dienstleister für erstklassige Makler- und Finanzdienstleistungen, der 2010 in Australien gegründet wurde. Er bietet Dienstleistungen für Immobilienkredite, Eigenkapitalerhöhungen, verwaltete Fonds, Strategie, Einkommenszahlung und Eigenkapitalwachstum an.

Vor- und Nachteile

| Vorteile | Nachteile |

| Lange Betriebszeiten | Provisionen werden erhoben |

| Verschiedene Kontaktmöglichkeiten | |

| Verschiedene Finanzdienstleistungen angeboten |

Ist Gleneagle legitim?

Ja. Gleneagle ist von der ASIC lizenziert, um Dienstleistungen anzubieten. Die Lizenznummer lautet 000337985. Die Australian Securities and Investments Commission (ASIC) ist eine unabhängige australische Regierungsbehörde, die als Unternehmensregulierungsbehörde Australiens fungiert und am 1. Juli 1998 gegründet wurde, nach Empfehlungen der Wallis Inquiry.

| Reguliertes Land | Regulierungsbehörde | Aktueller Status | Reguliertes Unternehmen | Lizenztyp | Lizenznummer |

| Australian Securities and Investments Commission (ASIC) | Reguliert | GLENEAGLE SECURITIES (AUST) PTY LIMITED | Market Maker (MM) | 000337985 |

Gleneagle Dienstleistungen

| Dienstleistungen | Unterstützt |

| Immobilienkredite | ✔ |

| Kapitalerhöhungen | ✔ |

| Verwaltete Fonds | ✔ |

| Strategie | ✔ |

| Einkommenszahlung | ✔ |

| Eigenkapitalwachstum | ✔ |

Gleneagle Gebühren

Aktiengebühren und -sätze

Die Standardgebühren, die Ihnen in der Regel für Transaktionen mit an der ASX gehandelten Aktien berechnet werden, betragen 1,1% (einschließlich GST) des Transaktionswerts, mindestens jedoch 82,50 $, jedoch maximal 1,65% und 150 $ (einschließlich GST).

ASX-Derivategebühren

Die Standardgebühren, die Ihnen in der Regel für an der Börse gehandelte Derivate berechnet werden, betragen 1,1% (einschließlich GST) des Prämienbetrags, mindestens jedoch 82,50 $, jedoch maximal 1,65% und 150 $ (einschließlich GST).

OTC-Transaktionsgebühren

Die Gebühren, Kosten und Aufwendungen für OTC-Transaktionen sind im PDS für diese Produkte aufgeführt.

| Gebührendetails | Betrag |

| Bankrücklastgebühr | 82,50 $ |

| Manuelle Buchungsgebühr | 33,00 $ |

| Neubuchungsgebühr | 33,00 $ |

| Kunden-Trace-Gebühr | 30 $ |

| Echtzeit-Bruttosiedlung (RTGS) (Inland) | 55 $ |

| Off-Market-Überweisungen | 55 $ pro Wertpapier |

| SRN-Anfragen an Aktienregistrierungen | 27,50 $ pro Position |

| Leihgebühr für Aktien | 110 $ |

| Per Post versandte Transaktionsbestätigung | 3,30 $ pro Bestätigung |

Handelsplattform

| Handelsplattform | Unterstützt | Verfügbare Geräte |

| Gleneagle Web | ✔ | PC, Laptop, Tablet |