Perfil de la compañía

| Gleneagle Resumen de la reseña | |

| Establecido | 2010 |

| País/Región registrado | Australia |

| Regulación | ASIC |

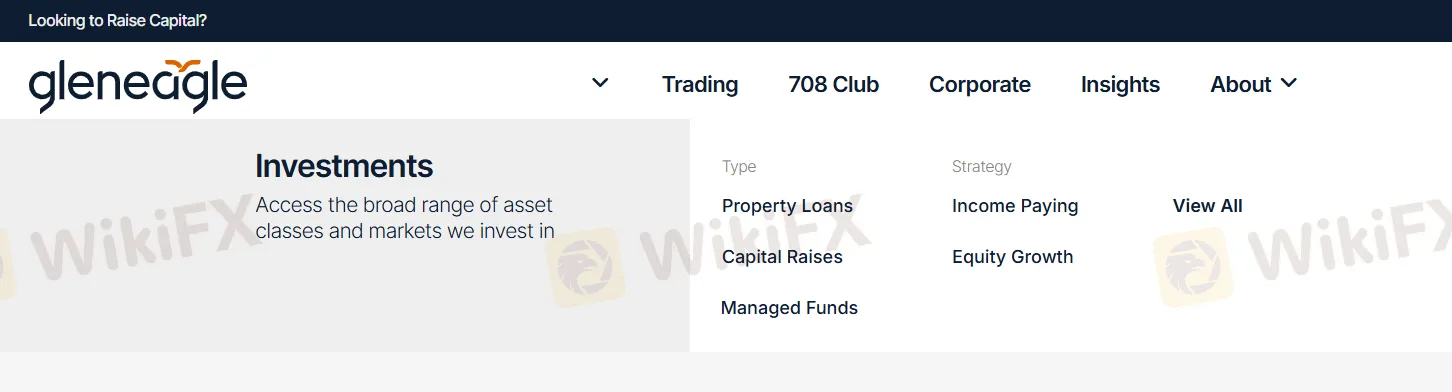

| Servicios | Préstamos hipotecarios, Captación de capital, Fondos gestionados, Estrategia, Pago de ingresos, Crecimiento patrimonial |

| Plataforma de trading | GleneagleWeb |

| Soporte al cliente | Formulario de contacto |

| Tel: 1300 123 345 | |

| Email: members@gleneagle.com.au | |

| Dirección: Nivel 27, 25 Bligh Street, Sydney NSW 2000 | |

| Facebook, LinkedIn | |

Información de Gleneagle

Gleneagle es un proveedor de servicios regulado de corretaje y servicios financieros de primera categoría, fundado en Australia en 2010. Ofrece servicios de Préstamos hipotecarios, Captación de capital, Fondos gestionados, Estrategia, Pago de ingresos y Crecimiento patrimonial.

Pros y contras

| Pros | Cons |

| Tiempo de operación prolongado | Se cobran comisiones |

| Varios canales de contacto | |

| Se ofrecen varios servicios financieros |

¿Es Gleneagle legítimo?

Sí. Gleneagle está licenciado por ASIC para ofrecer servicios. Su número de licencia es 000337985. La Comisión Australiana de Valores e Inversiones (ASIC) es un organismo gubernamental independiente de Australia que actúa como regulador corporativo de Australia, el cual fue establecido el 1 de julio de 1998 siguiendo las recomendaciones de la Investigación Wallis.

| País Regulado | Regulador | Estado Actual | Entidad Regulada | Tipo de Licencia | Número de Licencia |

| Comisión Australiana de Valores e Inversiones (ASIC) | Regulado | GLENEAGLE SECURITIES (AUST) PTY LIMITED | Creador de Mercado (MM) | 000337985 |

Servicios de Gleneagle

| Servicios | Soportado |

| Préstamos Hipotecarios | ✔ |

| Recaudación de Capital | ✔ |

| Fondos Administrados | ✔ |

| Estrategia | ✔ |

| Pago de Ingresos | ✔ |

| Crecimiento de Capital | ✔ |

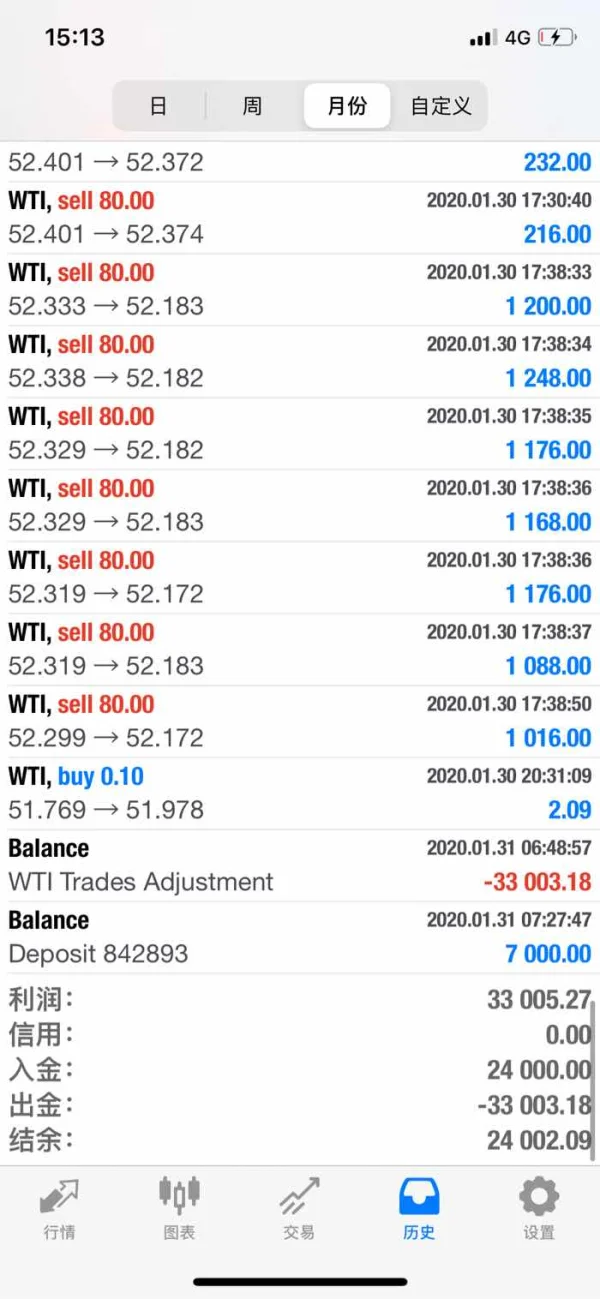

Tarifas de Gleneagle

Tarifas y tasas de acciones

Las tarifas estándar que normalmente se le cobrarán por transacciones en acciones negociadas en ASX son del 1.1% (IVA incluido) del valor de la transacción, sujeto a un mínimo de $82.50 pero con un máximo del 1.65% y $150 (IVA incluido).

Tarifas de Derivados de ASX

Las tarifas estándar que normalmente se le cobrarán por derivados negociados en bolsa son del 1.1% (IVA incluido) del monto del premio, sujeto a un mínimo de $82.50 y un máximo del 1.65% y $150 (IVA incluido).

Tarifas de Transacciones OTC

Las tarifas, costos y cargos por Transacciones OTC se detallan en el PDS de esos productos.

| Detalles de Tarifas | Cantidad |

| Tarifa por Devolución Bancaria | $82.50 |

| Tarifa de Reserva Manual | $33.00 |

| Tarifa de Re-reserva | $33.00 |

| Tarifa de Rastreo de Cliente | $30 |

| Compensación Bruta en Tiempo Real (RTGS) (Doméstica) | $55 |

| Transferencias Fuera de Mercado | $55 por valor |

| Solicitudes SRN a Registros de Acciones | $27.50 por tenencia |

| Tarifa de Préstamo de Acciones | $110 |

| Confirmación de Transacción por Correo | $3.30 por confirmación |

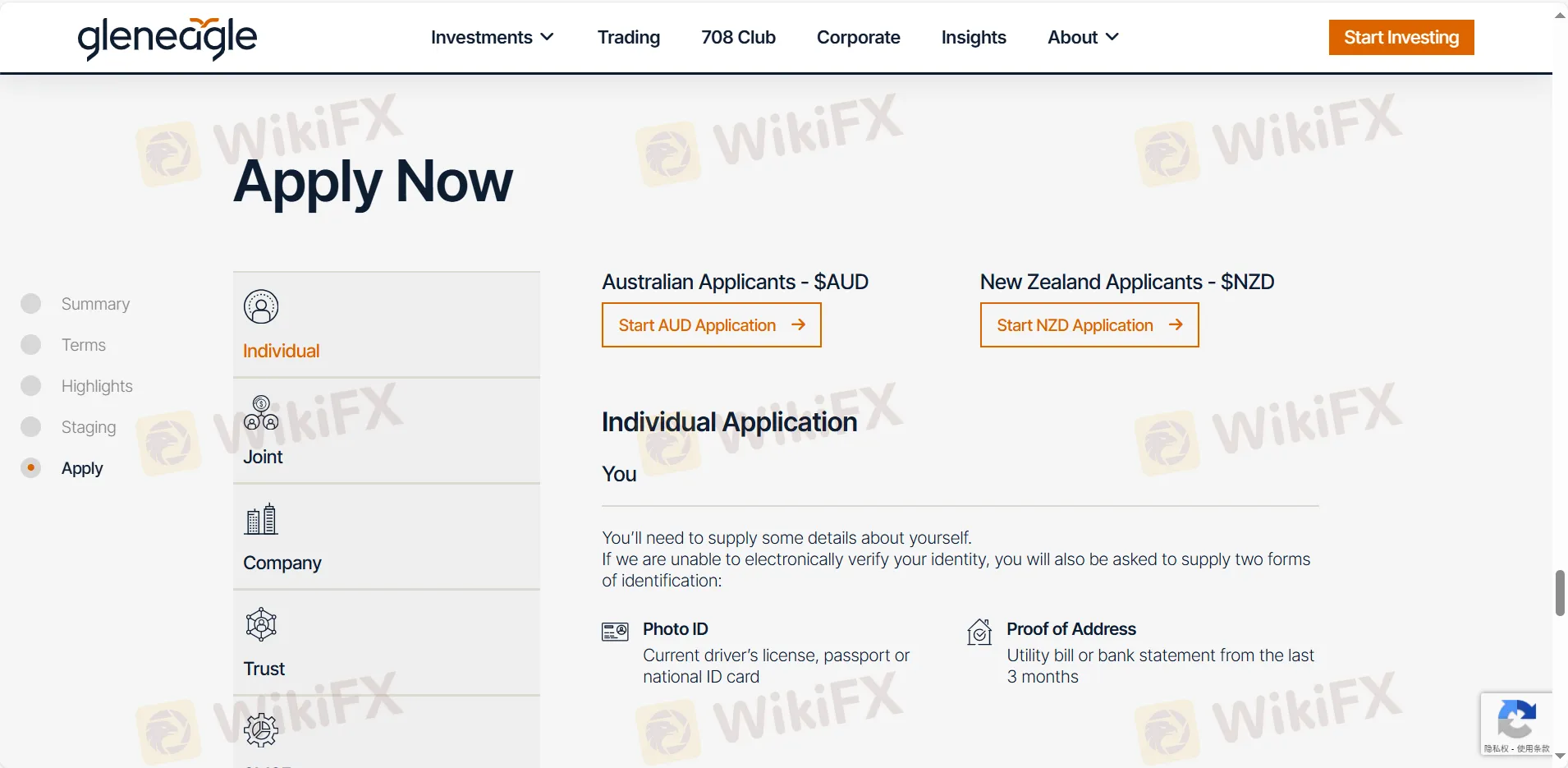

Plataforma de Trading

| Plataforma de Trading | Soportado | Dispositivos Disponibles |

| Gleneagle web | ✔ | PC, portátil, tablet |