Profil perusahaan

| Gleneagle Ringkasan Ulasan | |

| Didirikan | 2010 |

| Negara/Daerah Terdaftar | Australia |

| Regulasi | ASIC |

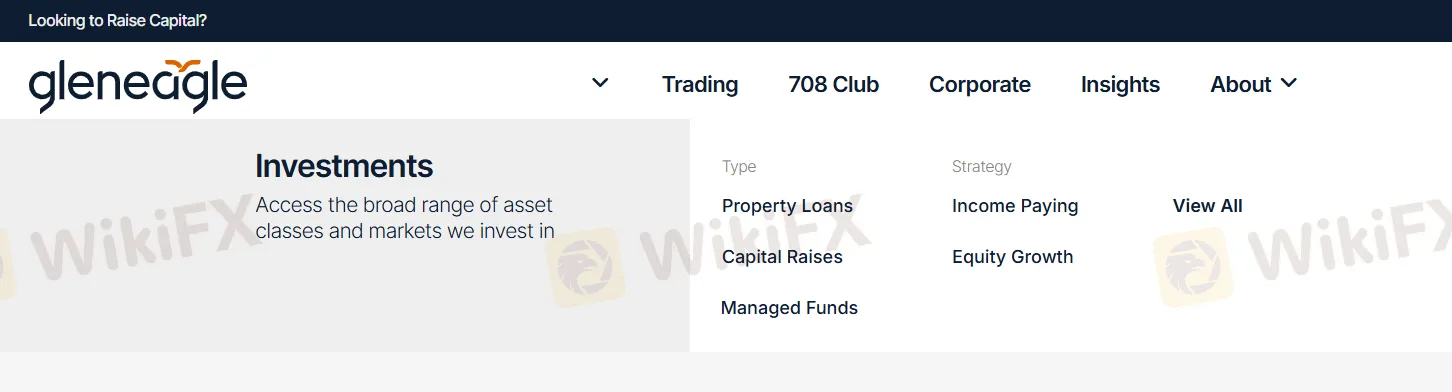

| Layanan | Pinjaman Properti, Peningkatan Modal, Dana Dikelola, Strategi, Pembayaran Pendapatan, Pertumbuhan Ekuitas |

| Platform Perdagangan | GleneagleWeb |

| Dukungan Pelanggan | Formulir kontak |

| Tel: 1300 123 345 | |

| Email: members@gleneagle.com.au | |

| Alamat: Level 27, 25 Bligh Street, Sydney NSW 2000 | |

| Facebook, LinkedIn | |

Informasi Gleneagle

Gleneagle adalah penyedia layanan yang diatur untuk pialang dan layanan keuangan utama, yang didirikan di Australia pada tahun 2010. Ini menawarkan layanan untuk Pinjaman Properti, Peningkatan Modal, Dana Dikelola, Strategi, Pembayaran Pendapatan, dan Pertumbuhan Ekuitas.

Pro dan Kontra

| Pro | Kontra |

| Waktu operasi yang panjang | Biaya komisi dibebankan |

| Berbagai saluran kontak | |

| Berbagai layanan keuangan yang ditawarkan |

Apakah Gleneagle Legal?

Ya. Gleneagle memiliki lisensi dari ASIC untuk menawarkan layanan. Nomor lisensinya adalah 000337985. Australian Securities and Investments Commission (ASIC) adalah badan pemerintah Australia independen yang bertindak sebagai regulator korporat Australia, yang didirikan pada 1 Juli 1998 setelah rekomendasi dari Wallis Inquiry.

| Negara yang Diatur | Regulator | Status Saat Ini | Entitas yang Diatur | Jenis Lisensi | No. Lisensi |

| Australian Securities and Investments Commission (ASIC) | Diatur | GLENEAGLE SECURITIES (AUST) PTY LIMITED | Market Maker (MM) | 000337985 |

Layanan Gleneagle

| Layanan | Didukung |

| Pinjaman Properti | ✔ |

| Pengumpulan Modal | ✔ |

| Dana Dikelola | ✔ |

| Strategi | ✔ |

| Pembayaran Pendapatan | ✔ |

| Pertumbuhan Ekuitas | ✔ |

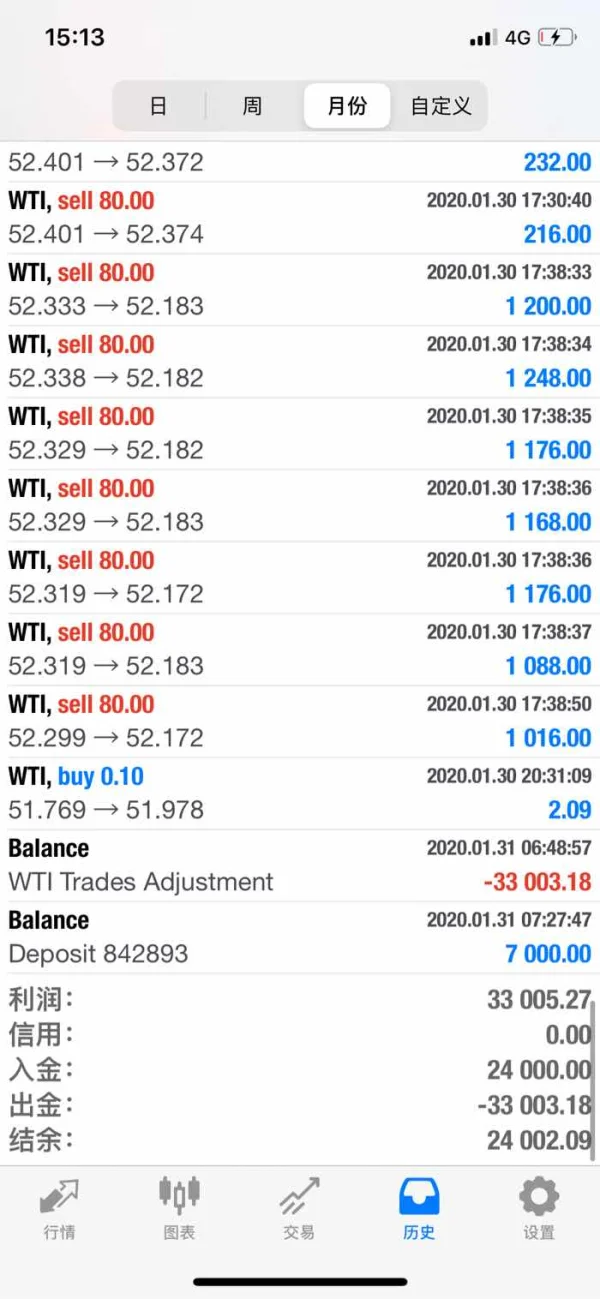

Biaya Gleneagle

Biaya dan Tarif Ekuitas

Biaya standar yang biasanya akan dikenakan untuk transaksi ekuitas yang diperdagangkan di ASX adalah 1,1% (termasuk GST) dari nilai transaksi dengan minimum $82,50 tetapi maksimum 1,65% dan $150 (termasuk GST).

Biaya Derivatif ASX

Biaya standar yang biasanya akan dikenakan untuk derivatif yang diperdagangkan di bursa adalah 1,1% (termasuk GST) dari jumlah premi dengan minimum $82,50 tetapi maksimum 1,65% dan $150 (termasuk GST).

Biaya Transaksi OTC

Biaya, biaya, dan biaya untuk Transaksi OTC diungkapkan dalam PDS untuk produk-produk tersebut.

| Detail Biaya | Jumlah |

| Biaya Penolakan Bank | $82,50 |

| Biaya Pemesanan Manual | $33,00 |

| Biaya Pemesanan Ulang | $33,00 |

| Biaya Pelacakan Pelanggan | $30 |

| Penyelesaian Bruto Real Time (RTGS) (Domestik) | $55 |

| Transfer Off Market | $55 per sekuritas |

| Permintaan SRN ke Registri Saham | $27,50 per kepemilikan |

| Biaya Pinjaman Saham | $110 |

| Konfirmasi Transaksi yang Dikirim melalui Surat | $3,30 per konfirmasi |

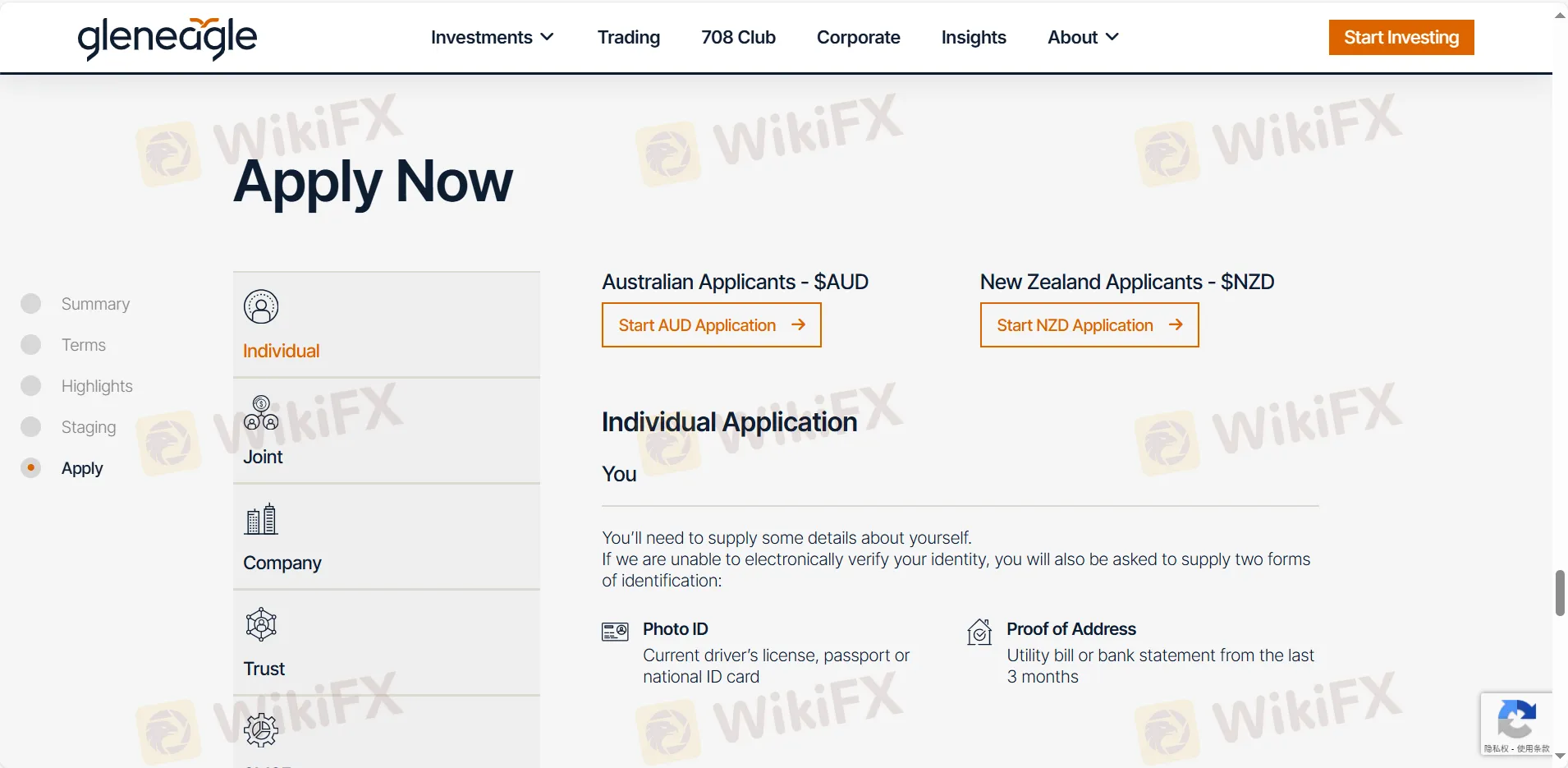

Platform Perdagangan

| Platform Perdagangan | Didukung | Perangkat Tersedia |

| Gleneagle web | ✔ | PC, laptop, tablet |