Resumo da empresa

| Gleneagle Resumo da Revisão | |

| Fundação | 2010 |

| País/Região Registrada | Austrália |

| Regulação | ASIC |

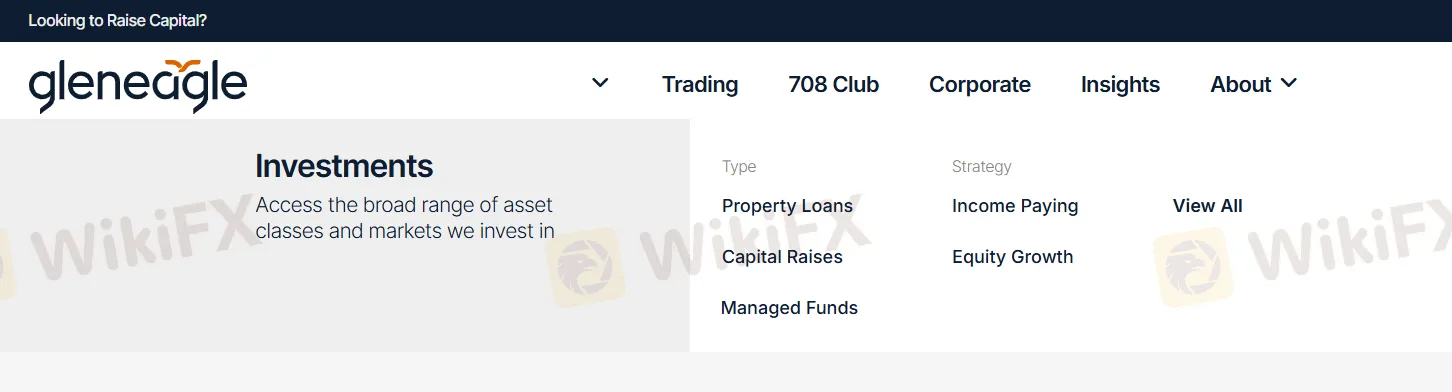

| Serviços | Empréstimos Imobiliários, Captação de Capital, Fundos Geridos, Estratégia, Pagamento de Rendimentos, Crescimento Patrimonial |

| Plataforma de Negociação | GleneagleWeb |

| Suporte ao Cliente | Formulário de Contato |

| Tel: 1300 123 345 | |

| Email: members@gleneagle.com.au | |

| Endereço: Level 27, 25 Bligh Street, Sydney NSW 2000 | |

| Facebook, LinkedIn | |

Informações sobre Gleneagle

Gleneagle é um provedor de serviços regulamentado de corretagem e serviços financeiros de primeira linha, fundado na Austrália em 2010. Oferece serviços de Empréstimos Imobiliários, Captação de Capital, Fundos Geridos, Estratégia, Pagamento de Rendimentos e Crescimento Patrimonial.

Prós e Contras

| Prós | Contras |

| Tempo de operação longo | Taxas de comissão cobradas |

| Vários canais de contato | |

| Vários serviços financeiros oferecidos |

Gleneagle é Legítimo?

Sim. Gleneagle é licenciado pela ASIC para oferecer serviços. Seu número de licença é 000337985. A Comissão Australiana de Valores Mobiliários e Investimentos (ASIC) é um órgão governamental independente da Austrália que atua como regulador corporativo da Austrália, estabelecido em 1º de julho de 1998, seguindo recomendações da Wallis Inquiry.

| País Regulamentado | Regulador | Status Atual | Entidade Regulamentada | Tipo de Licença | Número de Licença |

| Comissão Australiana de Valores Mobiliários e Investimentos (ASIC) | Regulamentado | GLENEAGLE SECURITIES (AUST) PTY LIMITED | Formador de Mercado (MM) | 000337985 |

Serviços Gleneagle

| Serviços | Suportado |

| Empréstimos Imobiliários | ✔ |

| Captação de Capital | ✔ |

| Fundos Geridos | ✔ |

| Estratégia | ✔ |

| Pagamento de Rendimentos | ✔ |

| Crescimento de Capital | ✔ |

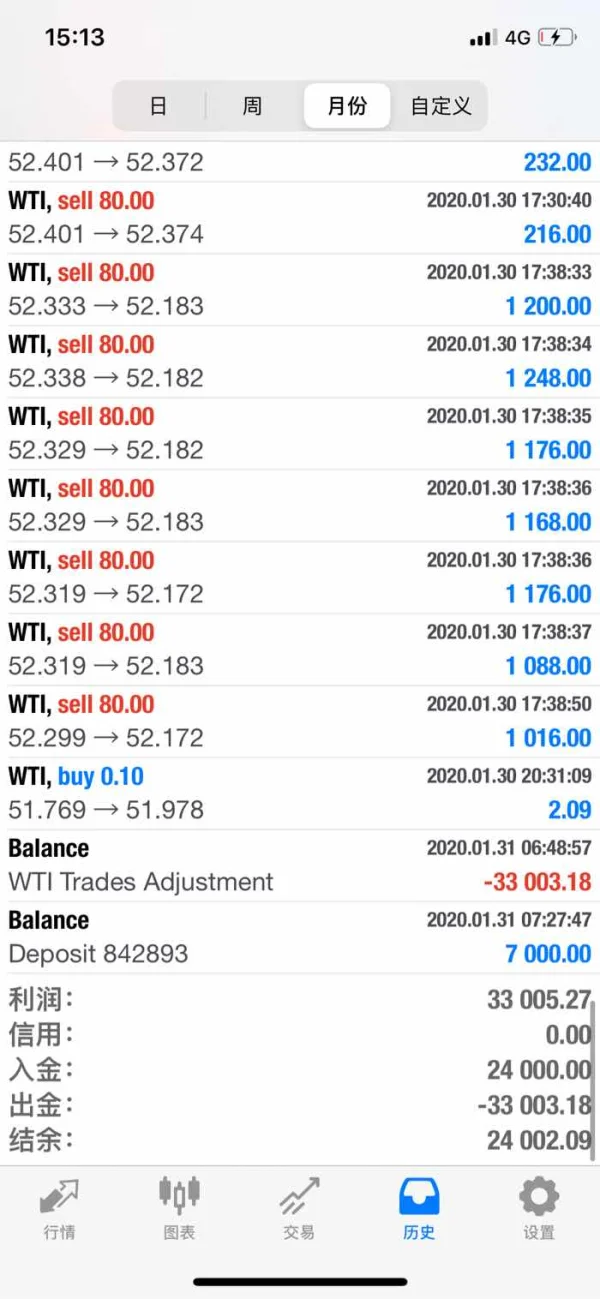

Taxas Gleneagle

Taxas e tarifas de ações

As taxas padrão que normalmente serão cobradas por transações em ações negociadas na ASX são de 1,1% (GST incluído) do valor da transação, sujeitas a um mínimo de $82,50, mas com um máximo de 1,65% e $150 (GST incluído).

Taxas de Derivativos ASX

As taxas padrão que normalmente serão cobradas por derivativos negociados em bolsa são de 1,1% (GST incluído) do valor do prêmio, sujeitas a um mínimo de $82,50 e um máximo de 1,65% e $150 (GST incluído).

Taxas de Transações OTC

As taxas, custos e encargos para Transações OTC são divulgados no PDS para esses produtos.

| Detalhes da Taxa | Valor |

| Taxa de Devolução Bancária | $82,50 |

| Taxa de Reserva Manual | $33,00 |

| Taxa de Reagendamento | $33,00 |

| Taxa de Rastreamento do Cliente | $30 |

| Compensação Bruta em Tempo Real (RTGS) (Doméstica) | $55 |

| Transferências Fora do Mercado | $55 por título |

| Solicitações SRN aos Registros de Ações | $27,50 por posição |

| Taxa de Empréstimo de Ações | $110 |

| Confirmação de Transação Enviada por Correio | $3,30 por confirmação |

Plataforma de Negociação

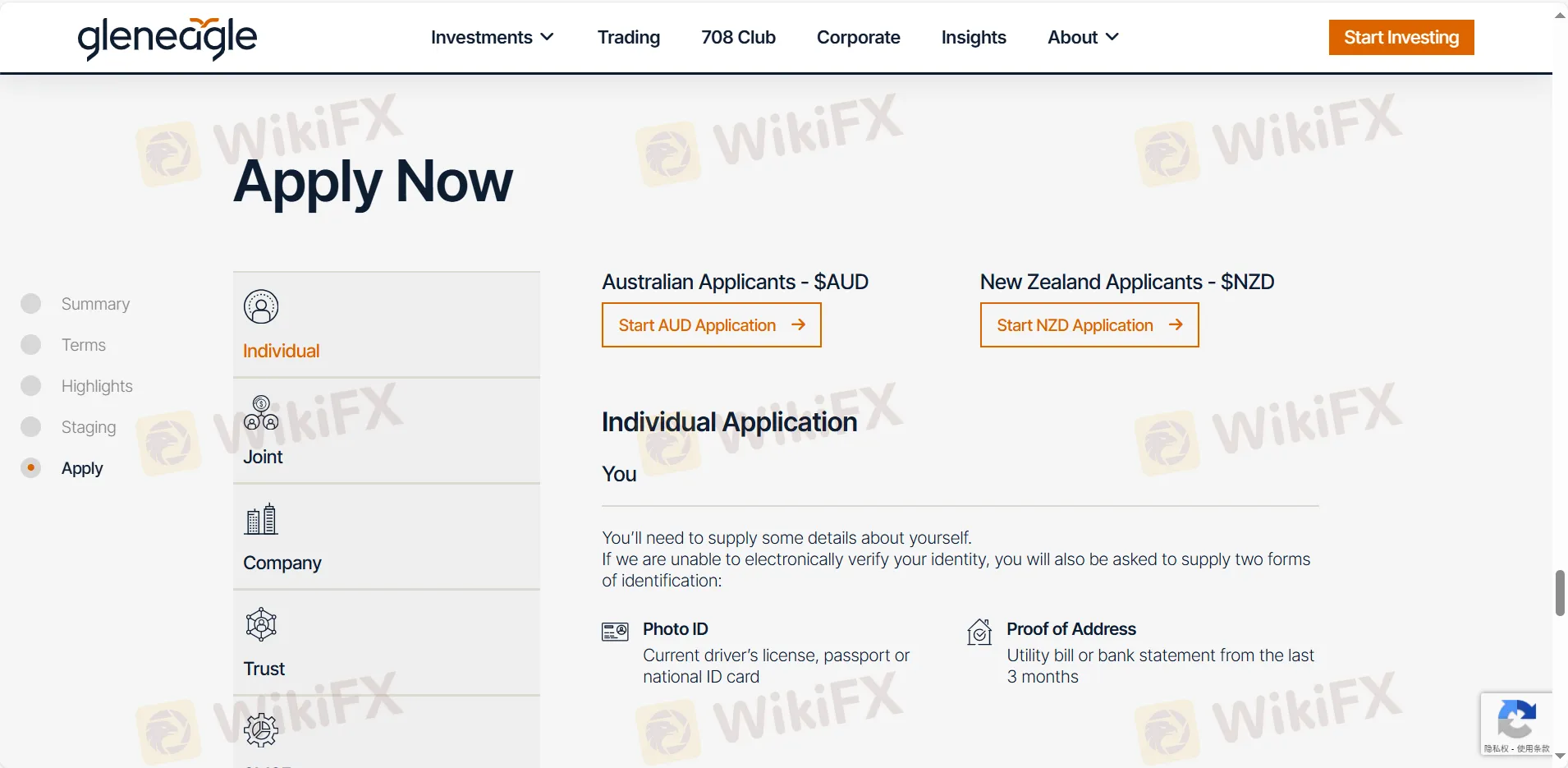

| Plataforma de Negociação | Suportado | Dispositivos Disponíveis |

| Gleneagle web | ✔ | PC, laptop, tablet |