Buod ng kumpanya

| Gleneagle Buod ng Pagsusuri | |

| Itinatag | 2010 |

| Nakarehistrong Bansa/Rehiyon | Australia |

| Regulasyon | ASIC |

| Mga Serbisyo | Property Loans, Capital Raises, Managed Funds, Strategy, Income Paying, Equity Growth |

| Platform ng Pagtetrade | GleneagleWeb |

| Suporta sa Customer | Form ng Pakikipag-ugnayan |

| Tel: 1300 123 345 | |

| Email: members@gleneagle.com.au | |

| Address: Antas 27, 25 Bligh Street, Sydney NSW 2000 | |

| Facebook, LinkedIn | |

Impormasyon Tungkol sa Gleneagle

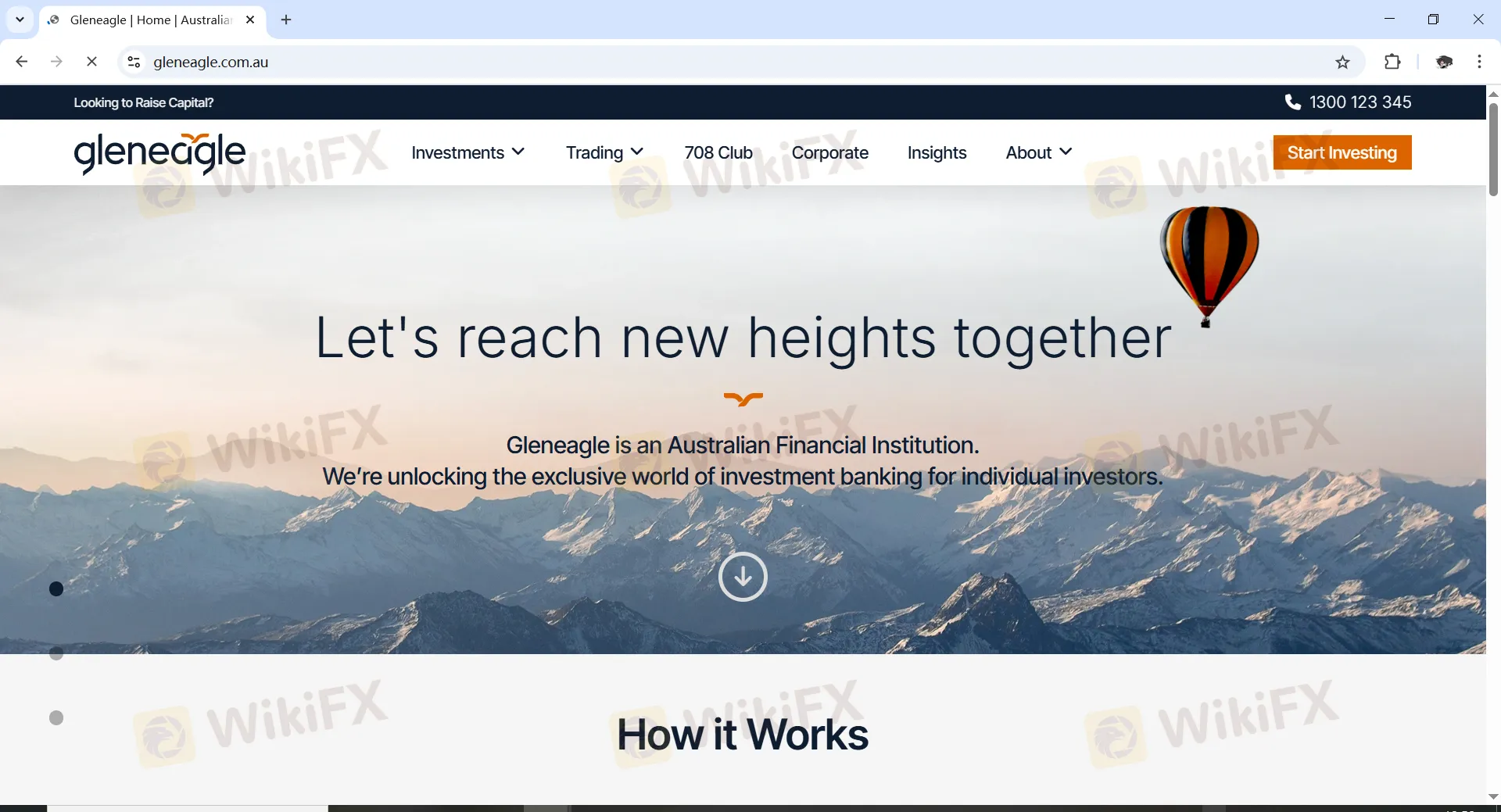

Ang Gleneagle ay isang reguladong tagapagbigay ng pangunahing brokerage at serbisyong pinansiyal, na itinatag sa Australia noong 2010. Nag-aalok ito ng mga serbisyo para sa Property Loans, Capital Raises, Managed Funds, Strategy, Income Paying at Equity Growth.

Mga Kalamangan at Disadvantages

| Mga Kalamangan | Mga Disadvantages |

| Mahabang oras ng operasyon | Nagpapataw ng bayad sa komisyon |

| Iba't ibang mga paraan ng pakikipag-ugnayan | |

| Iba't ibang mga serbisyong pinansiyal na inaalok |

Tunay ba ang Gleneagle?

Oo. Ang Gleneagle ay lisensyado ng ASIC upang mag-alok ng mga serbisyo. Ang numero ng lisensya nito ay 000337985. Ang Australian Securities and Investments Commission (ASIC) ay isang independiyenteng ahensya ng pamahalaan ng Australya na nagiging tagapamahala sa korporasyon ng Australya, na itinatag noong Hulyo 1, 1998, matapos ang mga rekomendasyon mula sa Wallis Inquiry.

| Regulated Country | Regulator | Current Status | Regulated Entity | License Type | License No. |

| Australian Securities and Investments Commission (ASIC) | Regulated | GLENEAGLE SECURITIES (AUST) PTY LIMITED | Market Maker (MM) | 000337985 |

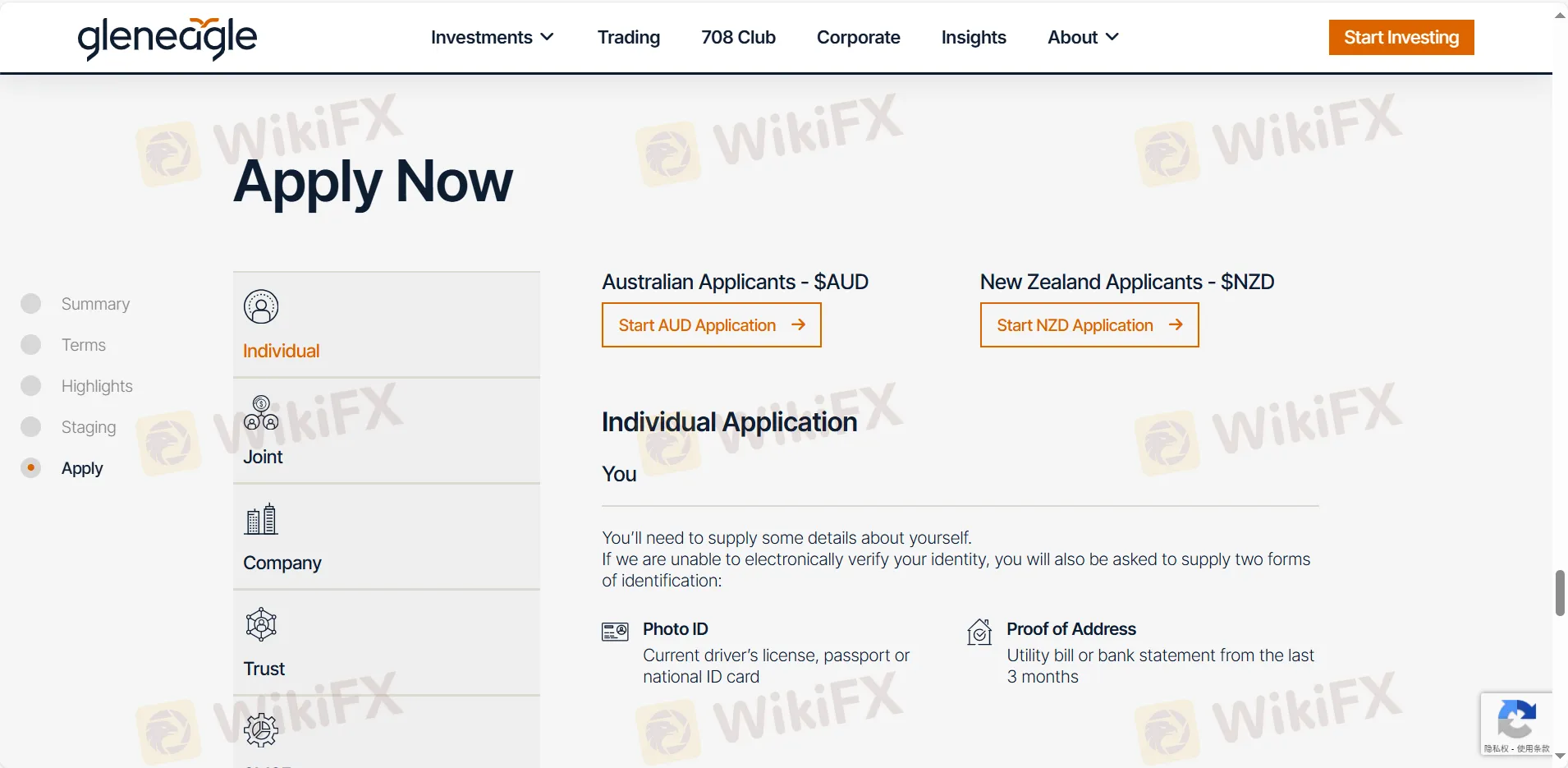

Mga Serbisyo ng Gleneagle

| Services | Supported |

| Property Loans | ✔ |

| Capital Raises | ✔ |

| Managed Funds | ✔ |

| Strategy | ✔ |

| Income Paying | ✔ |

| Equity Growth | ✔ |

Mga Bayad ng Gleneagle

Mga bayad at rate ng mga equities

Ang mga karaniwang bayad na karaniwang ipinapataw sa iyo para sa mga transaksyon sa mga equities na nakalista sa ASX ay 1.1% (kasama ang GST) ng halaga ng transaksyon na saklaw ng minimum na $82.50 ngunit saklaw ng maximum na 1.65% at $150 (kasama ang GST).

Mga bayad sa ASX Derivatives

Ang mga karaniwang bayad na karaniwang ipinapataw sa iyo para sa mga exchange-traded derivatives ay 1.1% (kasama ang GST) ng halagang premium na saklaw ng minimum na $82.50 na saklaw ng maximum na 1.65% at $150 (kasama ang GST).

Mga bayad sa OTC Transaction

Ang mga bayad, gastos at singil para sa OTC Transactions ay ipinapahayag sa PDS para sa mga produktong iyon.

| Mga Detalye ng Bayad | Halaga |

| Bayad sa Bank Dishonour | $82.50 |

| Bayad sa Manual booking | $33.00 |

| Bayad sa Re-booking | $33.00 |

| Bayad sa Customer Trace | $30 |

| Real Time Gross Settlement (RTGS) (Domestic) | $55 |

| Off Market Transfers | $55 bawat seguridad |

| SRN Requests sa Share Registries | $27.50 bawat holding |

| Bayad sa Stock borrow | $110 |

| Pinadalang kumpirmasyon ng transaksyon | $3.30 bawat kumpirmasyon |

Platform ng Pagtitingin

| Platform ng Pagtitingin | Supported | Available Devices |

| Gleneagle web | ✔ | PC, laptop, tablet |