Perfil de la compañía

| FX Broadnet Resumen de revisión | |

| Fundado | 1993 |

| País/Región registrado | Japón |

| Regulación | No regulado |

| Servicios | FX de venta libre/Click 365/Herramientas de trading |

| Cuenta demo | ✅ |

| Spread | A 0.2 sen (spread dólar-yen) |

| Herramientas de trading | FX BroadNe (Navegador/Android/iPhone/Tablet/Móvil) |

| Soporte al cliente | Línea directa: 0120-997-867 |

| Correo electrónico: support@fxbroadnet.com | |

| Redes sociales: Facebook, Twitter | |

Información de FX Broadnet

FX Broadnet fue fundado en 1993 como una empresa de información que ha estado brindando servicios relacionados con el mercado de divisas durante más de veinte años. La empresa ofrece "FX Broadnet", un servicio en línea con operaciones de margen de divisas (FX) de venta libre con bajos spreads basado en tecnología de vanguardia en TI, y maneja "Click 365", un servicio de operaciones de margen de divisas negociadas en la Bolsa Financiera de Tokio. Explícalo con videos simples y fáciles de entender en YouTube: https://www.youtube.com/watch?reload=9&v=vYHJCADGt5k

https://www.youtube.com/watch?v=2P1tX5SCdkg

https://www.youtube.com/watch?v=2P1tX5SCdkg

https://www.youtube.com/watch?v=2P1tX5SCdkg

¿Es FX Broadnet legítimo?

FX Broadnet está autorizado y regulado por la Agencia de Servicios Financieros (FSA). El número de licencia es 関東財務局長(金商)第244号, lo que lo hace más seguro que los corredores regulados.

¿Qué servicios ofrece FX Broadnet?

FX Broadnet ofrece servicios en tres aspectos principales: FX de venta libre, Click 365 y Herramientas de trading.

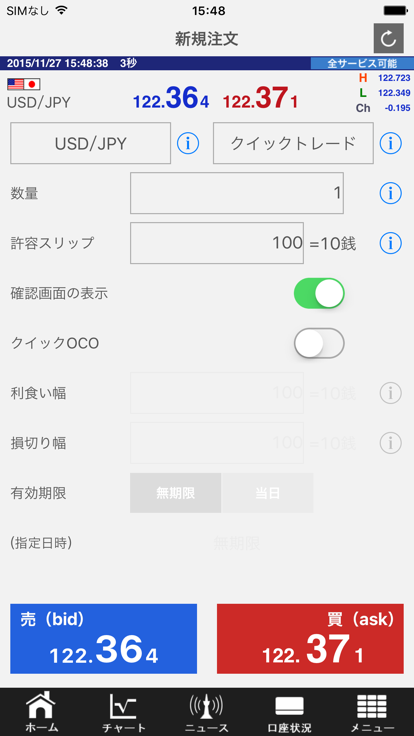

FX de venta libre ofrece transacciones con diferencias de puntos bajas. Desde computadoras hasta herramientas de trading dedicadas a divisas, desde computadoras hasta teléfonos inteligentes, rastreando transacciones, transacciones desde 4,000 yenes, permitiendo transacciones de 10,000 tipos. Por lo tanto, es adecuado para principiantes y personas que desean reducir riesgos.

"CLICK 365" es el primer servicio de operaciones de depósito de divisas (FX) de Japón que ofrece a los clientes precios preferenciales a través del mecanismo de métodos de negocios de mercado.

Tipo de cuenta

Además de la cuenta real para operaciones de FX de venta libre, FX Broadnet también ofrece cuentas demo para familiarizarse con las plataformas y el contenido relacionado con el aprendizaje.

Tarifas de FX Broadnet

La fortaleza de los spreads de FX Broadnet es que el spread dólar-yen es de 0.2 sen. Cuanto menor sea el spread, mayor será la liquidez. Click 365 LARGE utiliza 100,000 unidades de moneda y el Buy Swap disminuye 0.08. Para más detalles, consulta https://www.fxbroadNet.com/click/composition/swap/.

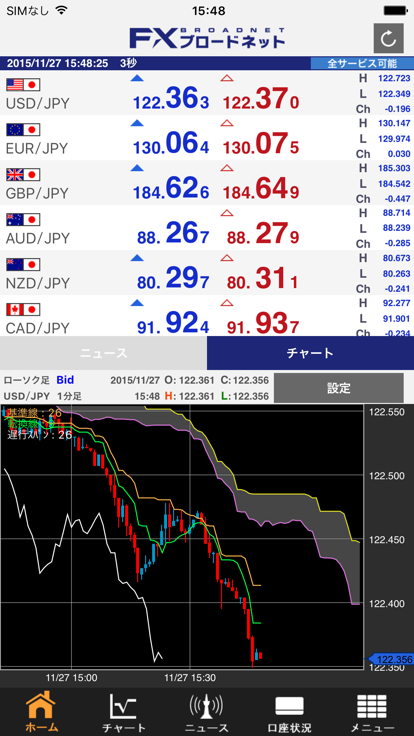

Herramientas de trading

Los usuarios pueden descargar múltiples versiones de FX BroadNet, incluyendo Navegador, Android/iPhone, Tablet y Móvil.

| Plataforma | Soportado | Dispositivos Disponibles |

| FX BroadNe | ✔ | Navegador/Android/iPhone/Tablet/Móvil |

Opciones de Soporte al Cliente

Los traders pueden seguir la plataforma en Facebook, Twitter y más y contactarla a través de teléfono y correo electrónico. El horario de trabajo es de 9:00 am a 5:00 pm (Excluyendo días festivos del mercado interbancario) de lunes a viernes.

| Opciones de Contacto | Detalles |

| Línea Directa | 0120-997-867 |

| Correo Electrónico | support@fxbroadnet.com |

| Redes Sociales | Facebook, Twitter |

| Idioma Soportado | Japón |

| Idioma del Sitio Web | Japón |

| Dirección Física | 〒100-6217 東京都千代田区丸の内1-11-1 |