Şirket özeti

| FX Broadnet İnceleme Özeti | |

| Kuruluş | 1993 |

| Kayıtlı Ülke/Bölge | Japonya |

| Düzenleme | Düzenlenmemiş |

| Hizmetler | Tezgahüstü Döviz/Click 365/İşlem Araçları |

| Demo Hesabı | ✅ |

| Spread | 0.2 sen (dolar-yen spread) |

| İşlem Araçları | FX BroadNe(Tarayıcı/Android/iPhone/Tablet/Mobil) |

| Müşteri Desteği | Hotline: 0120-997-867 |

| E-posta: support@fxbroadnet.com | |

| Sosyal Medya: Facebook, Twitter | |

FX Broadnet Bilgileri

FX Broadnet, 1993 yılında kurulan ve yirmi yılı aşkın süredir döviz piyasasıyla ilgili hizmetler sunan bir bilgi şirketi olarak kurulmuştur. Şirket, keskin IT teknolojisine dayalı olarak tezgahüstü döviz marjı (FX) işlemleri için düşük spreadli bir çevrimiçi hizmet olan "FX Broadnet" ve Tokyo Finansal Borsası'nda işlem gören bir döviz marjı işlem hizmeti olan "Click 365"i sunmaktadır. YouTube'da anlaşılır ve basit videolarla açıklanmıştır: https://www.youtube.com/watch?reload=9&v=vYHJCADGt5k

https://www.youtube.com/watch?v=2P1tX5SCdkg

https://www.youtube.com/watch?v=2P1tX5SCdkg

https://www.youtube.com/watch?v=2P1tX5SCdkg

FX Broadnet Güvenilir mi?

FX Broadnet, Finansal Hizmetler Ajansı (FSA) tarafından yetkilendirilmiş ve düzenlenmektedir. Lisans No. 関東財務局長(金商)第244号 olup, bu da düzenlenmiş aracılardan daha güvenli kılmaktadır.

FX Broadnet Hangi Hizmetleri Sunuyor?

FX Broadnet, üç temel alanda hizmet sunmaktadır: Tezgahüstü Döviz, Click 365 ve İşlem Araçları.

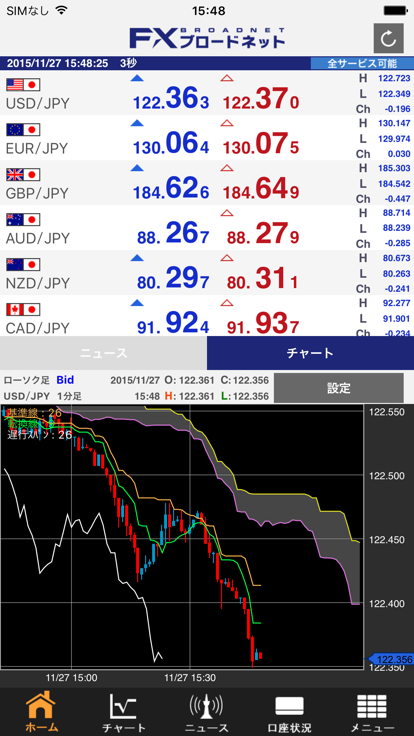

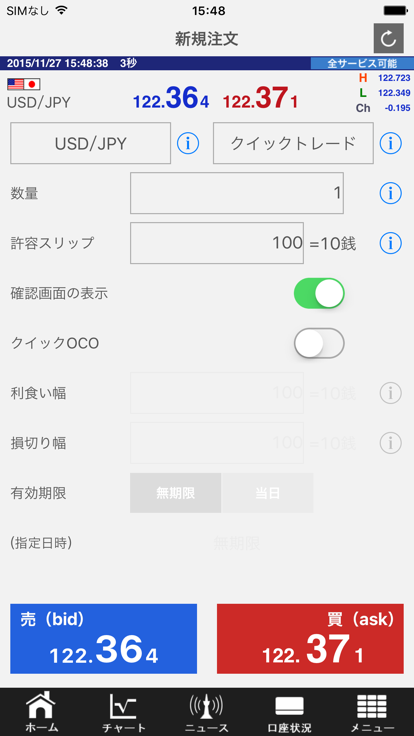

Tezgahüstü Döviz, düşük nokta farklılığı işlemleri sağlar. Bilgisayarlardan akıllı telefonlara kadar döviz ticareti için özel işlem araçlarıyla, işlemleri takip edebilir, 4.000 yen'den işlem yapabilir ve 10.000 çeşit işlem yapabilirsiniz. Bu nedenle, acemi olanlar ve riskleri azaltmak isteyen kişiler için uygundur.

"CLICK 365", müşterilere piyasa işlem yöntemleri mekanizması aracılığıyla tercihli fiyatlar sunan Japonya'nın ilk döviz yatırımı işlemidir (FX).

Hesap Türü

Tezgahüstü Döviz ticareti için canlı hesabın yanı sıra, FX Broadnet ayrıca platformlara aşina olmak ve öğrenme içeriğiyle ilgili olarak demo hesapları sunmaktadır.

FX Broadnet Ücretleri

FX Broadnet spreadlerinin gücü, dolar-yen spreadinin 0.2 sen olmasıdır. Spread ne kadar düşük olursa likidite o kadar hızlı olur. Click 365 LARGE, 100.000 para birimi birimi kullanır ve Al Swap'ı 0.08 düşer. Detaylar için lütfen https://www.fxbroadNet.com/click/composition/swap/ adresine bakın.

İşlem Araçları

Kullanıcılar, Tarayıcı, Android/iPhone, Tablet ve Mobil dahil olmak üzere FX BroadNet'in çeşitli sürümlerini indirebilirler.

| Platform | Desteklenen | Mevcut Cihazlar |

| FX BroadNet | ✔ | Tarayıcı/Android/iPhone/Tablet/Mobil |

Müşteri Destek Seçenekleri

Tüccarlar, platformu Facebook, Twitter ve daha fazlası üzerinden takip edebilir ve telefon ve e-posta aracılığıyla iletişim kurabilirler. Çalışma saatleri Pazartesi-Cuma günleri 9:00-17:00 arasıdır (Interbankmarket Tatilleri Hariç).

| İletişim Seçenekleri | Detaylar |

| Hotline | 0120-997-867 |

| E-posta | support@fxbroadnet.com |

| Sosyal Medya | Facebook, Twitter |

| Desteklenen Dil | Japonya |

| Web Sitesi Dili | Japonya |

| Fiziksel Adres | 〒100-6217 東京都千代田区丸の内1-11-1 |