Buod ng kumpanya

| FX Broadnet Buod ng Pagsusuri | |

| Itinatag | 1993 |

| Rehistradong Bansa/Rehiyon | Hapon |

| Regulasyon | Hindi Regulado |

| Mga Serbisyo | Over-the-Counter FX/Click 365/Mga Kasangkapan sa Pagkalakalan |

| Demo Account | ✅ |

| Spread | Sa 0.2 sen (dollar-yen spread) |

| Mga Kasangkapan sa Pagkalakalan | FX BroadNe (Browser/Android/iPhone/Tablet/Mobile) |

| Suporta sa Customer | Hotline: 0120-997-867 |

| Email: support@fxbroadnet.com | |

| Social Media: Facebook, Twitter | |

FX Broadnet Impormasyon

Ang FX Broadnet ay itinatag noong 1993 bilang isang kumpanya ng impormasyon na nagbibigay ng mga serbisyo kaugnay ng merkado ng palitan ng dayuhang salapi sa loob ng mahigit na dalawampung taon. Ang kumpanya ay nag-aalok ng " FX Broadnet," isang online na serbisyo na may mababang spread trading para sa over-the-counter na palitan ng dayuhang salapi (FX) trading na batay sa cutting-edge na teknolohiya ng IT, at namamahala ng "Click 365," isang serbisyong pangkalakalan ng palitan ng dayuhang salapi sa Tokyo Financial Exchange. Ipaliwanag ito sa mga simpleng at madaling maunawaan na mga video sa YouTube: https://www.youtube.com/watch?reload=9&v=vYHJCADGt5k

https://www.youtube.com/watch?v=2P1tX5SCdkg

https://www.youtube.com/watch?v=2P1tX5SCdkg

https://www.youtube.com/watch?v=2P1tX5SCdkg

Totoo ba ang FX Broadnet?

Ang FX Broadnet ay awtorisado at regulado ng Financial Services Agency (FSA). Ang lisensya No. ay 関東財務局長(金商)第244号, na ginagawang mas ligtas kaysa sa mga reguladong mga broker.

Ano ang mga serbisyo na inaalok ng FX Broadnet?

Ang FX Broadnet ay nagbibigay ng mga serbisyo sa tatlong pangunahing aspeto: Over-the-Counter FX, Click 365, at Mga Kasangkapan sa Pagkalakalan.

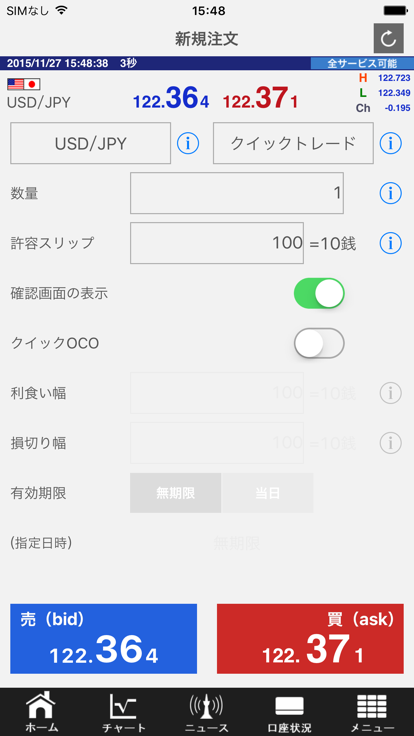

Ang Over-The-Counter FX ay nagbibigay ng mga transaksyon na may mababang pagkakaiba sa puntos. Mula sa mga computer na may mga espesyal na kasangkapan sa pagkalakalan ng dayuhang salapi hanggang sa mga smartphone, sinusundan ang mga transaksyon, mga transaksyon mula sa 4,000 yen, pinapayagan ang mga transaksyon sa 10,000 uri Kaya, ito ay para sa mga nagsisimula at mga taong nais na bawasan ang mga panganib.

"CLICK 365" ay ang unang depositong palitan ng dayuhang salapi (FX) sa Hapon na nagbibigay ng mga preferensyal na presyo sa mga customer sa pamamagitan ng mekanismo ng mga pamamaraan sa negosyo ng merkado.

Uri ng Account

Bukod sa live account para sa over-the-counterFX trading. Nagbibigay din ang FX Broadnet ng mga demo account upang maging pamilyar sa mga plataporma at mga kaugnay na nilalaman sa pag-aaral.

FX Broadnet Mga Bayarin

Ang lakas ng mga spread ng FX Broadnet ay ang dollar-yen spread ay sa 0.2 sen. Habang mas mababa ang spread, mas mabilis ang likidasyon. Ang Click 365 LARGE ay gumagamit ng 100,000 yunit ng salapi, at bumababa ang Buy Swap ng 0.08. Para sa mga detalye, mangyaring tingnan ang https://www.fxbroadNet.com/click/composition/swap/.

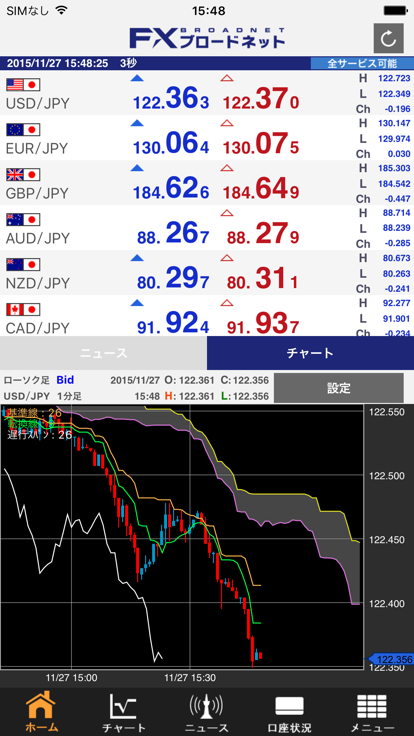

Mga Kasangkapan sa Pagkalakalan

Mga gumagamit ay maaaring mag-download ng iba't ibang bersyon ng FX BroadNet kabilang ang Browser, Android/iPhone, Tablet, at Mobile.

| Platform | Supported | Available Devices |

| FX BroadNe | ✔ | Browser/Android/iPhone/Tablet/Mobile |

Customer Support Options

Mga mangangalakal ay maaaring sundan ang platform sa Facebook, Twitter, at iba pa at makipag-ugnayan dito sa pamamagitan ng telepono at email. Ang oras ng trabaho ay mula 9:00 am-5:00 pm (Maliban sa mga Interbankmarket Holidays) mula Lunes hanggang Biyernes.

| Contact Options | Details |

| Hotline | 0120-997-867 |

| support@fxbroadnet.com | |

| Social Media | Facebook, Twitter |

| Supported Language | Japan |

| Website Language | Japan |

| Physical Address | 〒100-6217 東京都千代田区丸の内1-11-1 |