회사 소개

| FX Broadnet 리뷰 요약 | |

| 설립 | 1993년 |

| 등록 국가/지역 | 일본 |

| 규제 | 규제 없음 |

| 서비스 | OTC FX/Click 365/거래 도구 |

| 데모 계정 | ✅ |

| 스프레드 | 0.2센(달러-엔 스프레드) |

| 거래 도구 | FX BroadNe(브라우저/안드로이드/아이폰/태블릿/모바일) |

| 고객 지원 | 전화: 0120-997-867 |

| 이메일: support@fxbroadnet.com | |

| 소셜 미디어: Facebook, Twitter | |

FX Broadnet 정보

FX Broadnet은 1993년에 설립된 정보 회사로, 20년 이상 외환 시장과 관련된 서비스를 제공해왔습니다. 이 회사는 최첨단 IT 기술을 기반으로 한 OTC 외환 마진(FX) 거래를 위한 저스프레드 거래 온라인 서비스인 "FX Broadnet"와 도쿄 금융 거래소에서 제공하는 거래소 거래 외환 마진 거래 서비스인 "Click 365"를 처리합니다. 이에 대한 설명은 YouTube에서 쉽고 이해하기 쉬운 동영상으로 제공됩니다: https://www.youtube.com/watch?reload=9&v=vYHJCADGt5k

https://www.youtube.com/watch?v=2P1tX5SCdkg

https://www.youtube.com/watch?v=2P1tX5SCdkg

https://www.youtube.com/watch?v=2P1tX5SCdkg

FX Broadnet의 신뢰성

FX Broadnet은 금융 서비스 기관(FSA)에 의해 승인 및 규제를 받았습니다. 라이선스 번호는 関東財務局長(金商)第244号이며, 이는 규제된 브로커보다 안전합니다.

FX Broadnet가 제공하는 서비스

FX Broadnet은 세 가지 주요 측면에서 서비스를 제공합니다: OTC FX, Click 365 및 거래 도구.

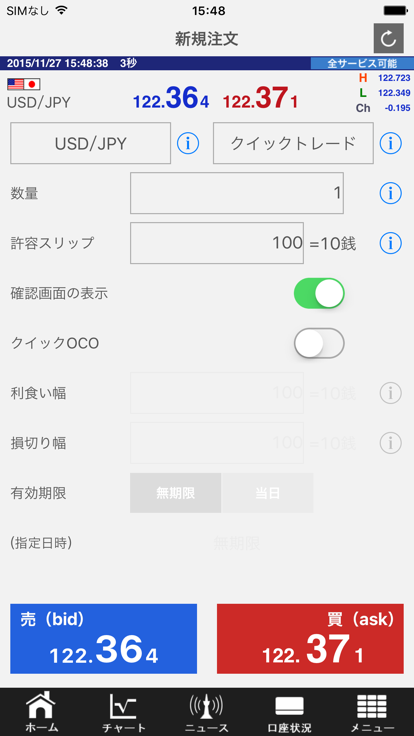

OTC FX는 저점 차이 거래를 제공합니다. 컴퓨터에서 외환 전용 거래 도구부터 컴퓨터에서 스마트폰까지 거래를 추적하고, 4,000엔부터 10,000종류의 거래를 허용하여 초보자와 리스크를 줄이고자 하는 사람들에게 적합합니다.

"CLICK 365"은 일본 최초의 외환 예치 거래(FX)로, 시장 업무 방식의 메커니즘을 통해 우대 가격을 제공합니다.

계정 유형

OTC FX 거래용 라이브 계정 외에도 FX Broadnet은 플랫폼에 익숙해지고 학습 관련 콘텐츠를 제공하기 위한 데모 계정도 제공합니다.

FX Broadnet 수수료

FX Broadnet의 스프레드 강점은 달러-엔 스프레드가 0.2센입니다. 스프레드가 낮을수록 유동성이 빨라집니다. Click 365 LARGE는 100,000통화 단위를 사용하며, 매수 스왑은 0.08으로 내려갑니다. 자세한 내용은 https://www.fxbroadNet.com/click/composition/swap/을 참조하십시오.

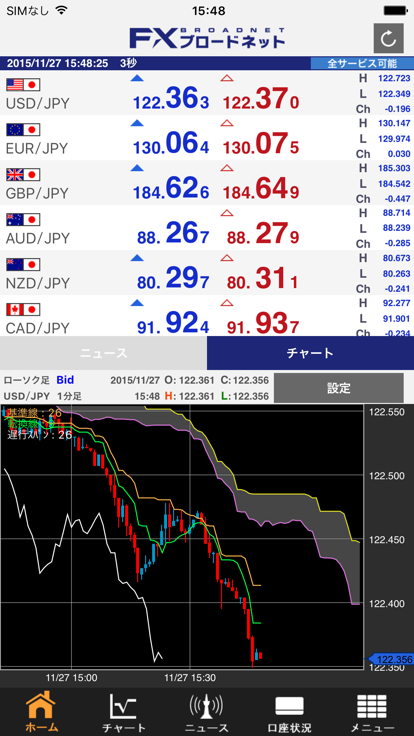

거래 도구

사용자는 브라우저, 안드로이드/아이폰, 태블릿 및 모바일을 포함한 FX BroadNet의 다양한 버전을 다운로드할 수 있습니다.

| 플랫폼 | 지원 | 사용 가능한 기기 |

| FX BroadNet | ✔ | 브라우저/안드로이드/아이폰/태블릿/모바일 |

고객 지원 옵션

트레이더는 페이스북, 트위터 등을 통해 플랫폼을 팔로우하고 전화 및 이메일로 연락할 수 있습니다. 근무 시간은 월요일부터 금요일까지 오전 9시부터 오후 5시까지입니다(은행 휴일 제외).

| 연락 옵션 | 세부 정보 |

| 핫라인 | 0120-997-867 |

| 이메일 | support@fxbroadnet.com |

| 소셜 미디어 | 페이스북, 트위터 |

| 지원되는 언어 | 일본어 |

| 웹사이트 언어 | 일본어 |

| 실제 주소 | 〒100-6217 東京都千代田区丸の内1-11-1 |