Unternehmensprofil

| FX Broadnet Überprüfungszusammenfassung | |

| Gegründet | 1993 |

| Registriertes Land/Region | Japan |

| Regulierung | Unreguliert |

| Dienstleistungen | Over-the-Counter FX/Click 365/Handelstools |

| Demokonto | ✅ |

| Spread | Bei 0,2 Sen(Dollar-Yen-Spread) |

| Handelstools | FX BroadNe(Browser/Android/iPhone/Tablet/Mobile) |

| Kundensupport | Hotline: 0120-997-867 |

| E-Mail: support@fxbroadnet.com | |

| Soziale Medien: Facebook, Twitter | |

FX Broadnet Informationen

FX Broadnet wurde 1993 als ein Informationsunternehmen gegründet, das seit über zwanzig Jahren Dienstleistungen im Zusammenhang mit dem Devisenmarkt anbietet. Das Unternehmen bietet " FX Broadnet ", einen Online-Service mit geringem Spread-Handel für den außerbörslichen Devisenhandel (FX) auf Basis modernster IT-Technologie, und bearbeitet "Click 365", einen börsengehandelten Devisenhandel auf der Tokyo Financial Exchange. Erklären Sie es mit Videos einfach und verständlich auf YouTube: https://www.youtube.com/watch?reload=9&v=vYHJCADGt5k

https://www.youtube.com/watch?v=2P1tX5SCdkg

https://www.youtube.com/watch?v=2P1tX5SCdkg

https://www.youtube.com/watch?v=2P1tX5SCdkg

Ist FX Broadnet seriös?

FX Broadnet ist von der Financial Services Agency (FSA) autorisiert und reguliert. Die Lizenznummer lautet 関東財務局長(金商)第244号, was es sicherer macht als regulierte Broker.

Welche Dienstleistungen bietet FX Broadnet an?

FX Broadnet bietet Dienstleistungen in drei Hauptbereichen an: Over-the-Counter FX, Click 365 und Handelstools.

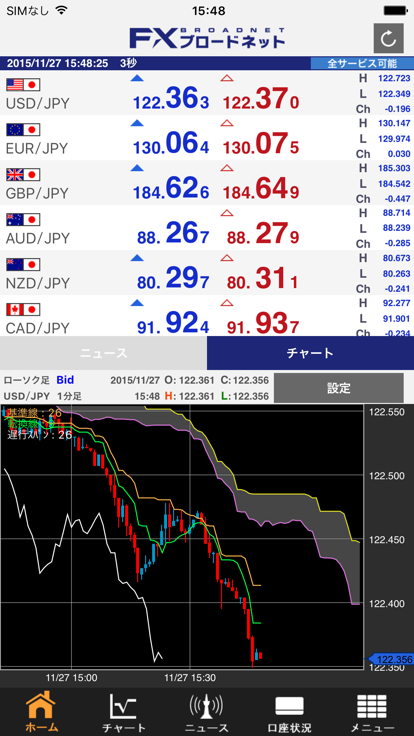

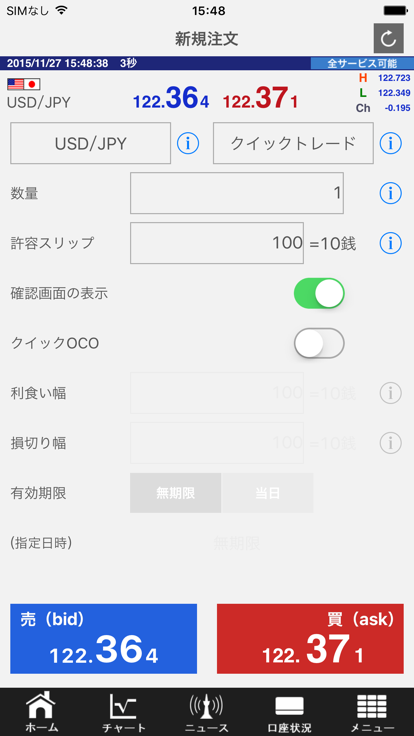

Over-The-Counter FX bietet Transaktionen mit geringem Punkteunterschied. Vom Computer bis zum Smartphone spezielle Handelstools für den Devisenhandel, Verfolgung von Transaktionen, Transaktionen ab 4.000 Yen, ermöglichen Transaktionen in 10.000 Varianten. Daher für Anfänger und Personen, die Risiken reduzieren möchten.

"CLICK 365" ist Japans erster Deviseneinlagenhandel (FX), der Kunden durch den Mechanismus der Marktbusinessmethoden bevorzugte Preise bietet.

Kontotyp

Neben dem Live-Konto für den außerbörslichen Devisenhandel bietet FX Broadnet auch Demokonten an, um sich mit Plattformen und lernbezogenen Inhalten vertraut zu machen.

FX Broadnet Gebühren

Die Stärke der FX Broadnet Spreads liegt darin, dass der Dollar-Yen-Spread bei 0,2 Sen liegt. Je niedriger der Spread, desto schneller die Liquidität. Click 365 LARGE verwendet 100.000 Währungseinheiten, und der Buy Swap sinkt um 0,08. Weitere Informationen finden Sie unter https://www.fxbroadNet.com/click/composition/swap/.

Handelstools

Benutzer können verschiedene Versionen von FX BroadNet herunterladen, einschließlich Browser, Android/iPhone, Tablet und Mobile.

| Plattform | Unterstützt | Verfügbare Geräte |

| FX BroadNet | ✔ | Browser/Android/iPhone/Tablet/Mobile |

Kundensupport-Optionen

Händler können die Plattform auf Facebook, Twitter und mehr verfolgen und über Telefon und E-Mail kontaktieren. Die Arbeitszeiten sind von Montag bis Freitag von 9:00 bis 17:00 Uhr (außer an Interbankmarktfeiertagen).

| Kontaktmöglichkeiten | Details |

| Hotline | 0120-997-867 |

| support@fxbroadnet.com | |

| Soziale Medien | Facebook, Twitter |

| Unterstützte Sprache | Japanisch |

| Websprache | Japanisch |

| Physische Adresse | 〒100-6217 東京都千代田区丸の内1-11-1 |